- The imposition of tax on stock dividends is positive for low taxpayers and negative for those in 30% tax bracket.

- Dividend on equity funds will turn unattractive.

- The dividend reinvestment option in liquid ETFs will be bothersome.

- Debt funds investors looking for income are better off doing systematic withdrawals (SWP).

When the Finance Act in 2003 brought back the divided distribution tax (DDT), the idea was simple. It is hard to keep tab of individual taxpayers’ dividend income. Let companies deduct it. This was convenient both for the government and for you. The government did not have to go behind tax evaders, and you did not feel the pain (directly) nor the hassle of filing and paying tax on the dividend income.

The Budget proposal 10 days ago that gets rid of DDT, however, changes things for you. You must now take stock of whether it makes sense for you to continue the dividend option in mutual funds and how else to plan for dividends from stocks.

Please note that the discussion in this article is restricted to impact on individual investors and not institutions.

Impact of tax on your stock dividends

Currently, for stocks, a DDT of 20.56% (15% on gross dividend plus surcharge of 12% plus cess of 4%) is deducted. So, if a company had a surplus of Rs 100, you got 100 minus 20.56, that is, Rs 79.44 in your hands. If you were in the 30% tax bracket, then the DDT was lesser than your own tax slab. But if you had been in the 5% tax bracket, the DDT was not beneficial.

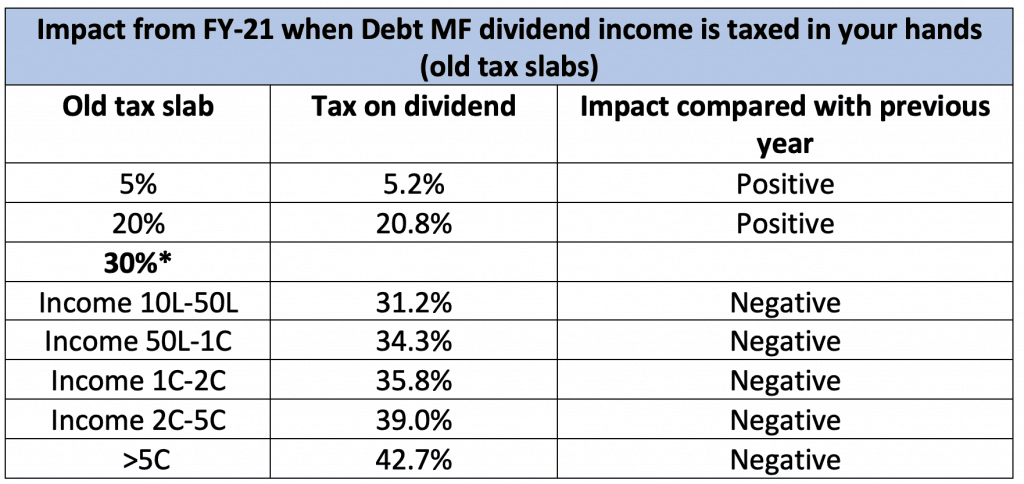

The above is flipped now with the new budget proposal. The imposition of tax on your dividend income is positive for low taxpayers (see table below) and negative for those in 30% tax bracket.

Impact from FY-21 when dividend income is taxed in your hands (old tax slabs)

| Old tax slab | Tax on dividend | Impact compared with previous year |

|---|---|---|

| 5% | 5.20% | Positive |

| 20% | 20.80% | Neutral |

| 30%* | ||

| Income 10L-50L | 31.20% | Negative |

| Income 50L-1C | 34.30% | Negative |

| Income 1C-2C | 35.80% | Negative |

| Income 2C-5C | 39.00% | Negative |

| >5C | 42.70% | Negative |

*30% tax slab split into various income buckets

Note that the dividend tax of 10% if your dividend income exceeds Rs 10 lakh a year has been removed under the proposed dividend taxation rules.

Under the new tax slab proposed, those earning income up to Rs 12.5 lakh (slab up to 15%) will still benefit if their dividend income is taxed in their hands, compared with DDT earlier.

How your net income reduces: For those slabs where we have mentioned it is negative, what we mean is that you will have less net income in hand than you had under the DDT regime. The table below will tell you how you will get to keep less.

| DDT | No DDT | |

|---|---|---|

| Dividend available for distribution | 100 | 100 |

| DDT | 20.35 | Nil |

| Dividend in your hands | 79.65 | 100 |

| Tax in your hands* | Nil | 31.2 |

| Net dividend income | 79.65 | 68.8 |

For those in the Rs 10-50 lakh bracket. For those over Rs 50 lakh, the income further reduces. We have not considered TDS for simplicity sake. TDS will be deducted at 10% for dividend in excess of Rs 5,000.

What can stock dividend earners do

- For those who are going to pay marginally higher tax (say those in the Rs 10 lakh to Rs 1 crore of total income) on their dividend income, there is not much of a choice. It simply becomes necessary for you to keep tab of the dividend income (possibly by maintaining a separate account), adjusting TDS deducted (for dividend exceeding Rs 5,000) and paying your taxes. However, if your dividend income is a large chunk of your other income, consider the option mentioned in the next point.

- For HNIs earning over Rs 1 crore income, if your dividend income is a large chunk of your other income, it is perhaps time to relook at deploying some amount through the mutual fund route or increase exposure to MFs, if the taxes are indeed denting you big time. This is because when mutual funds earn dividends from the portfolio holdings, they do not have to pay tax on it given the way they are structured (pass through vehicles). So, the dividend on the underlying portfolio essentially gets redeployed without being taxed.

Also, remember, with mutual funds, you have a choice not to opt for dividend and go for growth option. This lever is not available in stocks as you do not have control over companies’ dividend declaration.

Impact for mutual fund investors

Mutual funds up until now have 2 DDT structures separately for equity and debt funds. For equity funds it is 10% plus surcharge plus cess – effectively a charge of 11.65%. For debt funds it is 25% plus surcharge plus cess – 29.12%.

Equity funds: For equity fund investors who used options such as balanced advantage or equity savings or arbitrage to generate dividend, only those in the tax brackets up to 10% will stand to benefit. The rest, whether under the old or new tax slab, stand to lose. While dividend was never a sustainable option for equity funds, they will turn completely unattractive now, tax-wise as well.

Debt funds: With debt funds, the impact is felt if you are in the 30% tax bracket or above in the current tax slab.

In the new tax slab regime, those up to 25% tax bracket (or income up to Rs 15 lakh) will not be impacted – that is, they do not stand to fork over more tax. However, there were and are far more tax-efficient options than dividend.

The following points will tell you what to do with your investments.

What you can do

- If you are using the dividend option in debt funds to generate income, move for the growth option with systematic withdrawal plan (SWP) as they are far more tax efficient for any tax bracket. This is simply because every time you withdraw (automated withdrawal), only a small part is considered as gain and taxed. The rest is considered as capital. However, with dividends, the entire amount will be taxable.

- If you were using the daily dividend option for STPs or dividend reinvestment options, it is going to be a big hassle henceforth. The hassle comes from maintaining a record of dividend received, which is tough to compile in the reinvestment option. This is true of many HNIs who were using this route, given their high tax bracket of over 30%. You will be better off doing systematic withdrawal plan or switching to growth.

- Think before using liquid ETFs in India as they may have (like the most liquid one, Nippon Liquid BeES does) a dividend reinvestment option and you must therefore keep tab of the dividends received and pay the tax on it.

- Even if you are in the low tax bracket, the hassle of having to pay tax on dividends (especially if the dividend is frequent) is best avoided by opting for growth or SWP.

6 thoughts on “No DDT – the impact on your dividend income”

Liquid bees income taxable ?

Dividend is taxable, yes.

Very well explained. I have one doubt though – the 10% TDS on dividend is for mutual funds and stocks both OR only for mutual funds?

Hi Ajish, It is for both. Vidya

Thanks Vidya. Your analysis is very comprehensive and you have explained the impact very well.

Thanks, Bhavik!

Vidya

Comments are closed.