With inputs from Chandrachoodamani N V

With almost three-quarters of the calendar year 2024 behind us, the stock market shows no signs of a deep correction. When we presented our Equity Outlook for 2024, the Nifty 50 stood at 21,500. We anticipated gains to be frontloaded with uncertainty in the second half; we predicted that the second half would be influenced by the performance of the US economy, interest rate cuts in both the US and India, and the contents of Budget 2024.

In this report, we assess where markets stand vis-à-vis what we expected and our present view on the Nifty 50.

Where Nifty 50 earnings stand

In our original outlook, we had anticipated some correction in the second half by the following considerations:

- Widening gap between expected and realized interest rates, both globally and in India

- The deceleration of government capital expenditure and its consequent effect on manufacturing and capital goods sectors reliant on government spending

- Slowdown in earnings and valuation excesses, especially in mid-cap and small-cap companies, and investment themes driven by narratives.

On point 1, the Fed rate cut has not transpired yet, nor has the RBI showed indications of imminent rate cuts. Despite this, markets held steadfastly to cut expectations, which has helped prevent a market correction. Going forward, the US Fed’s rate cut fate will be known on September 18, with significant consensus building for at least a 25-basis point rate cut considering the present inflation scenario. A deeper cut would spell stress on the US economy and could trigger other fears. In general, rate cuts in the US are expected to cause cheaper money to flow into emerging markets, depending on which ones seem more attractive.

On point 2, India’s GDP growth hit a 15-month low of 6.7%, due to decreased government spending and subsidies. So, the growth rate did see a moderation since December 2023.

While the government's capital outlay was maintained at 3.4% of projected FY-25 GDP in Budget 2024, there is indication that it may decrease in the coming years. This is due to a shift in priorities towards fiscal consolidation and populist measures such as job creation, agricultural revitalization, and other economic measures. Capital outlay for FY 24 was 27% up from the previous year while it was just 11% more in FY25. According to media reports and CMIE data, value of new projects (both government and private) was at its lowest in June 2024 quarter in over 8 quarters, though the elections could be a cause.

On point 3, earnings have moderated overall for the Nifty 50 and valuations have moved up, reaching premium levels in mid and small-cap segments. Let’s start with the Nifty 50 earnings. The data below will show you the growth of the total revenue and profits (not weighted) of the Nifty 50 companies over the past 4 quarters.

As the data shows, there is a significant moderation in earnings growth caused by the energy basket (primarily hit by oil & gas marketing companies). Even if we remove this sector or weight the earnings based on market cap, the moderation in earnings is visible (although profit growth improves to low double digits).

One reason is margins coming off. While it can be argued that an election quarter caused a dent (lower capex spends), that the revenue growth has largely held steady suggests that the growth rate moderation is driven more by operating margins coming off their highs. This is visible when we take the ex-financials Nifty 50 basket to study margins. EBITDA margins declined from a peak of 19.7% (last 8 quarters) to 18.5%.

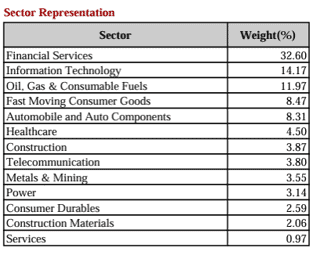

Two, the composition of the Nifty 50 basket is important. The top 5 sectors (financial services, IT, oil & gas and consumable fuels, FMCG, auto & auto components in that order) account for 75% of the basket. Of this, oil & gas as a whole (barring Reliance Industries) saw a dip in earnings, while IT and FMCG remained muted. It is only the rest of the pack (essentially financials and auto) that drove the index.

The trend, therefore, is suggestive of a growth moderation underway, but not a slowdown. The latest June quarter earnings definitely seem a one-off hit than any real fall.

If this is the story for the Nifty 50, the Nifty 500 is not far behind. The Nifty 500’s earnings growth also shows a similar trend; the June quarter earnings growth is only a tad better than the Nifty 50 at 7.4%. However, we will stick to Nifty 50 in this discussion as our estimates are focused on the bellwether index.

With the earnings picture now drawn, let us come to valuations. From a time (2 years ago) when the Smallcap 250 was trading at a discount to the Nifty 50, we now have a situation of the mid and small-cap indices trading at a significant premium to not only the large cap but at an over 20-30% premium to their own historical valuations.

Another way of looking at the premium is as follows: In the past one year, the Nifty 50’s earnings expanded 21.5% (earnings calculated based on niftyindices.com data on PE; do not confuse it with the total profits of the Nifty basket presented earlier, which is not weighted) as opposed to the Nifty 50 returns of 25%. Not a bad deal considering that the market factors forward earnings in its returns. On the other hand, for the Smallcap 250 index, the earnings expanded by 16.1% while the index returned 47%. That means the markets expectations of earnings in the small-cap segment has gotten too challenging.

To summarize, what we expected in terms of interest rate action in reality, capex slowdown and earnings growth moderation have all more or less played out. The Nifty 50, though, has not corrected despite these factors the has been comfortably perched above 25,000. So, what are the reasons for markets to remain upbeat?

What could be holding the Nifty 50 up?

To answer this, it is important to understand that the Nifty index has been performing with limited weightlifting by its large tenants. Of the top 5 sectors that accounted for 75% of the performance, 12% is energy, where the oil marketers dragged the basket’s performance (though Reliance saved the day a bit). The 14% from IT and 8.5% from FMCG did nothing much to push growth while the 33% from financials did a mediocre job. Only the auto and component pack (8.3%) did some lifting.

But the scenario is now set up that the three main sectors – IT, financials and FMCG may see better days ahead. These expectations are helping sustain the Nifty 50 even as the earnings paint a bleaker picture.

#1 IT and FMCG expected to provide support

We are once again seeing the IT and FMCG space garner market interest. This is not without reason as earnings improvement is being expected in these sectors. For IT, If the US Fed starts cutting rates and the macro holds up, a lot of discretionary spends that were absent can revive, thus improving prospects for the top Tier IT companies.

With consumer goods too, management commentaries suggest better revenue aided by recovery in rural demand, expanding distribution and pricing growth in second half of the fiscal, further buttressed by government’s thrust on rural and social spending.

In the broader picture, it is noteworthy that private consumption growth was at 7.45%, contributing positively to the GDP growth for the first time in 7 quarters, besides outpacing the GDP growth itself. Both these sectors can provide adequate support to the Nifty’s earnings, countering the tepid growth in the June 2024 quarter.

#2 Financials attractive

The gorilla in the Nifty pack – banking and financial sector (specifically banking) has been a primary reason for Nifty’s tepid performance last year. The market’s activity suggests that this sentiment is set to change. Let us split this into near- and medium-term activity.

First, in the near term, there is high consensus that the bank valuations (financials are best valued based on book than earnings) is turning attractive, providing good entry points for investors. The data below will show you the underperformance of the Nifty Bank and Nifty Financial Services index in 2023 and year-to-date in 2024. A rally in banking stocks can push, or at least hold up, the Nifty.

Second is the earnings growth expected over the medium term. With the debate over lower deposit growth all over the place, our stance is simple: it is credit growth that has to and will drive deposit growth. With the government still anchored to the bitter experience of asset quality in the past, it is our opinion that credit growth is being curtailed rather than not being present. What could change these?

- One, the government cannot deny credit growth when the economy shows signs of moderation and when inflation is under check. So, it could be a time-wait rather than absence of growth in the sector.

- Two, rate cuts or simply the moderation of yields (especially with the inclusion of government bonds in the global index and release of liquidity for credit) would likely be the other trigger for credit growth.

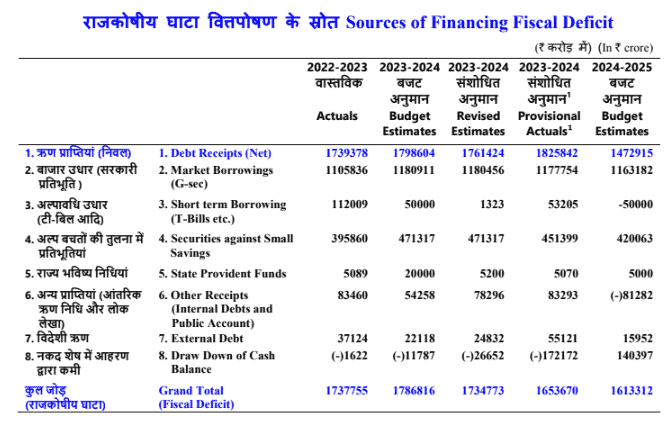

- Three and a more subtle one, lies in the data released by the government itself in the Budget. First, India’s primary deficit has declined from 3% in FY-23 to a provisional 2% in FY24 and estimated at 1.4% in FY25. Primary deficit is the excess of expenses over revenue, before interest payments. As primary deficit reduces, it means the need to borrow reduces – releasing more money for private credit.

Let us see how this is happening: See the data in the image below. For FY-25 the issuances of treasury bills are estimated at a negative Rs 50,000 crore. That means the government is not issuing, it is buying back.

The other data is the draw down on cash – at a whopping Rs 1.4 lakh crore for FY25. The negative figure in the previous fiscal suggests that the government was only adding net cash (thanks to massive dividend receipts from RBI) rather than drawing it down. Remember that holding cash by the government does not help liquidity. Cash withdrawal not only goes to finance the fiscal deficit but also ensures that funding sources are left free for the rest of nation to borrow. Now, these are but cues that credit growth ought to happen in the medium term for banks, expanding their earnings growth.

Image source: Indiabudget

#3 Tail remains resilient

If we leave out the top 5 sectors, the rest still seem to provide support to Nifty earnings as of now. Telecom, construction, healthcare, consumer durables are some of the sectors that have kept up their performance at 15% or much more, even if they had moderated from the high-power growth of earlier quarters. This trend is true of not only the Nifty but the broader market (Nifty 500) earnings as well.

We believe as far as the Nifty 50 is concerned the above reasons could be the most plausible factors that has kept the index ticking.

#4 Domestic inflow support

Apart from earnings, liquidity has also kept the market chugging. DIIs recorded their ninth consecutive month of inflows into Indian equities in August 2024 at $5.8 billion while FIIs saw outflows of $2.5 billion. Interestingly, September numbers thus far show FIIs pumping higher net inflows than DIIs into India. Liquidity is a primary factor to fuel the market and with an expectation of US rate cut, this factor can play a larger role in holding up the Nifty 50.

Where is the Nifty 50 headed?

When we wrote our equity outlook in January 2024 we had given the below scenario for the Nifty 50 with an 18-20 times forward 1 year PE.

However, as things stand, the Nifty 50 having crossed 25,000 is factoring a 15 percent plus growth (22 times forward PE).

We are revising our estimates with the following probable scenarios (the ones shaded are the more likely scenarios in our view):

- The Nifty is already trading at upper end of the valuation. Despite the weak June quarter earnings, we believe a 12-15% growth is achievable if the sectors we discussed in the earlier section (Bank, IT, FMCG) provide support and the long tail continues to hold strength.

- A 15% growth means there isn’t much room for upside in the near to medium term. This can be negated only if the heavy weight banking sector bounces bank in style in terms of earnings growth.

- On the other hand, if banking is average and IT or FMCG does not play out as expected, then a 12% earnings growth is still a more probable outcome. In that case, a shallow correction may happen, other things remaining the same.

Broad themes to play

As mentioned in our original outlook in January 2024, the themes we believed would hold potential and those that you needed to stay clear remain the same. They are as follows:

- Taking shelter in large caps and turn discreet in the choice of mid and small cap stocks (check our Prime Stocks)

- Play the capex recovery indirectly through banks (check our Finance squared smallcase)

- Turn valuation conscious over defence and industrials

- Give preference to consumption (check our Consumption smallcase)

- Look for unambiguous evidence in narrative led themes like China + 1

- Approach order book stories with caution

- Stay clear of turnarounds, penny stocks and SME counters

For individual portfolios, basic hygiene of rebalancing, taking heavy profits in mid and small-cap segments, and diversification into lower risk classes are a must in these times.

And finally, a sanity check. While many an analyst who tried to call the market top may have cut a sorry figure, no investor who has been prudent by diversifying or profit booking can be called a fool in the long run 😊 And if you have been very successful in equity investing in the past few years post Covid, it might help if you know that this is not a market to truly assess your investing skills! This might sound like a bruise to your ego, but trust me, this is the best message you can give yourselves in these times.

10 thoughts on “Nifty 50 fundamental outlook for 2024 – a revisit”

Excellent Article.

Few pointers towards this ” Look for unambiguous evidence in narrative led themes like China + 1″ or even recommendations ( Smallcase or Stocks ) will be highly appreciated

Thanks for writing, sir

Sometimes, narrative deceive by not translating to numbers. When market values Cos based on narrative and numbers don’t turn up as expected, the disappointment is huge. A classic case was the chemical sector

Likewise, textiles suddenly took off, then faded away. It is extremely impt. for Cos in this space to forge relationships with brands on a long-term basis and do end to end job for them from designing to finished products (garmenting) to make decent RoCE in this business. So, it’s about simultaneously building customer relationships, capabilities and scale

Now, with US Biosecure Act, a new space is getting attention – the CRO/CDMO in pharmaceutical space – but we need to see Cos sharing details on new contracts/relationships to get clear evidence of the shift. Some Cos are extremely well positioned to obviously benefit, but not all the Cos that are rallying on the news

So, the larger idea is to look beyond the narrative and see evidence in individual Cos and go with those Cos so that the chance of getting deceived by narratives is reduced

Hope this clarifies

Thank you

Excellent report analysis in depth detailed !!

Thanks!

Hello Ma’am,

Will the larger PSU banks will also be the beneficiaries of the credit growth offtake ( because they might get impacted by stricter RBI project financing norms ) or the private banks will benefit more.

Private Banks with their strong capital, cost of funds will definitely be better placed. Valuation wise too they are relatively better.

Superbly written article.

Thanks!

Hello Ma’am,

Is the froth more in midcap stocks or the small caps are equally expensive considering their low liquidity.

Cannot generalise but the midcap valuaution is more elevated than smallcap due to outliers. Also, the smallcap rally began a bit later and therefore seems less in premium than midcap. That does not make these better.Also, one has to be careful with smallcap considering the liquidity issue. Vidya

Comments are closed.