Mirae Asset has come out with a NFO of NYSE FANG+ ETF and a fund of fund (FOF) with the same underlying ETF. This ETF closes on April 30th while the FoF offer closes on May 3. Both will be available for investing afresh later.

We’re writing this note on the NFO following queries from some of you on whether to invest in one of these.

The index

The NYSE FANG+™ Index is an equal-dollar weighted index listed in the NYSE. It is a portfolio comprising of stocks of 10 high-growth companies in the technology and tech-enabled sectors, media & communications and consumer discretionary sectors that are highly traded. The ‘plus’ FANG+ indicates that it has 5 additional stocks other than the classic FAANG combo of Facebook, Apple, Amazon, Netflix, and Alphabet’s Google. The portfolio details are given below.

The index is rebalanced quarterly for the constituents and weights (as weights tend to move away from their equal weight positioning with stock moves).

Factors determining returns

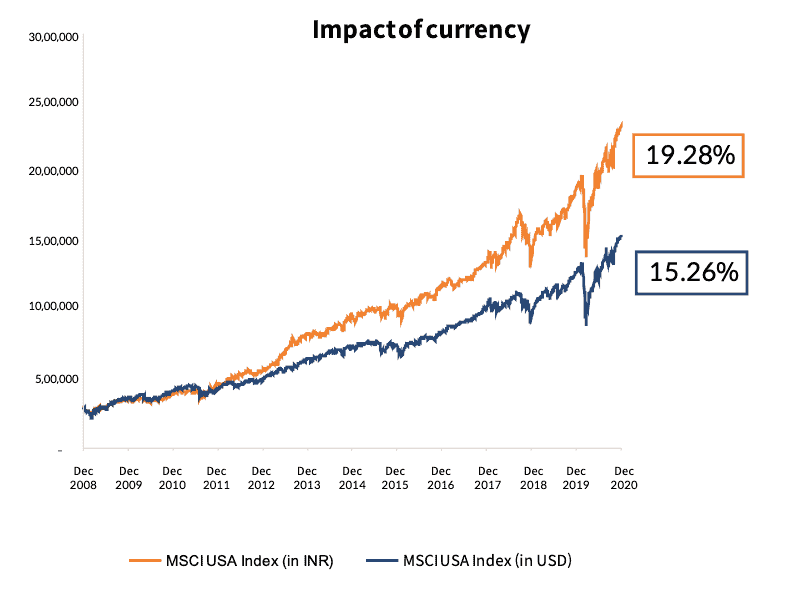

There are broadly two factors that drive your returns in any foreign equity investment. One, the risks relating to the market in which you invest (US in this case) and two, currency fluctuation. The former is true of any market you invest in, including the local market. However, currency fluctuation adds another layer to this risk. Fortunately, for Indian investors, as the rupee has traditionally depreciated against the dollar, global equity investment has largely worked in their favour.

Data below (source: AMC presentation) will tell you the superior returns delivered by investing in MSCI USA index in Indian rupees as opposed to MSCI USA dollar index. This is because every dollar invested there would have returned more rupees as rupee value depreciated over this period. The rupee’s depreciation against the dollar is higher than the former’s slide against a currency like the Euro.

Your choices and how NYSE FANG+ index compares

We’ll not get into the benefits of investing in global markets as we have already discussed about it in this article by Aarati.

We have also stated in our earlier reports that our preferred market is the US for the following reasons:

- global giants are listed there even if they have presence in other countries

- it has companies that are unique and innovative – options that are not available in India.

- the market has depth and unique options in the passive space

- It has lower correlation with our market. Given below is some data from the AMC on correlation. You will see that Indian has a lower correlation with the US market.

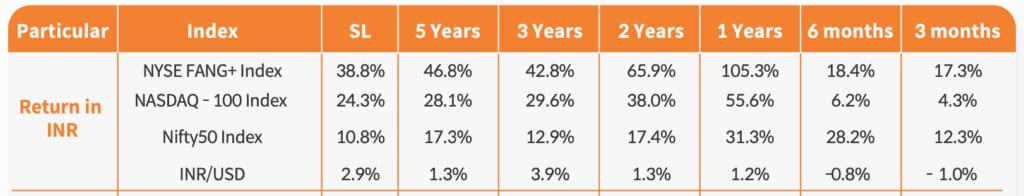

At present, Indian investors wanting to invest in US indices through local ETF/FoF route have the Nasdaq 100 and S&P 500 options. We are not getting into the active US fund options in India simply because they haven’t beaten the indices consistently and are relatively higher on cost. While those options may seem to have ‘returned well’ (as many of you stated in the case of Franklin US Opportunities fund) most of you would not have compared them with broad index returns in rupee terms to know if they are your best choices.

#1 High performance index but volatile

Now, coming back to the latest offering – the FANG+ index is a powerful portfolio of high growth stocks. So, it should hardly come as a surprise to you that it outperformed a broader high-growth index the Nasdaq 100 (data below gives the comparison of returns in rupee terms over shorter and longer time frames. Source AMC presentation).

We tried rolling the returns (dollar terms) of the 3 indices, NYSE FANG+, Nasdaq 100 and S&P 500. The data below will tell you that while NYSE FANG+ beats its peers by a mile, the volatility, measured by standard deviation, is also quite high. Over rolling 1-year return periods, while the NYSE FANG+ beat the Nasdaq 100 over 80% of the time, in the 20% period it underperformed, it lagged Nasdaq 100 by a good 11 percentage points on an average. In other words, when it falls, it can fall hard.

#2 Expensive basket

The Nasdaq 100, which is considered as an expensive growth index, trades at about 40.4 times trailing earnings while the broader S&P 500 is at 32.5 times. The FANG+ index beats them both with an expensive P/E of 54 times (source: Bloomberg). Of course, when a stock like Tesla or Twitter do not have any meaningful PE, this metric may not provide much light. But suffice to note that it is the more expensive than the expensive Nasdaq stock portfolio. Much of the valuation is afforded to the earnings potential arising from newer lines of business and services for most of these companies, capacity for geographic expansion, and potential disruption in technology.

#3 High Concentration & risks

While the FANG+ is equal weighted, it is concentrated to just 10 stocks. This makes it a very volatile play, subject to sharp hits. There are many potential regulatory and industry-specific risks for most of these companies. Companies like Google and Twitter (and to a lesser extent Netflix) face risks regarding content regulations. Facebook also faces content regulation and may additionally face headwinds in the form of Google’s (and Apple’s) privacy policy changes (cramping ad revenue).

Amazon is under scrutiny for labour practices and monopolistic behaviour. Alibaba may face domestic issues in China. All these can either impact the fortunes of these companies or cause sharp swings in the stock prices, reacting to negative news now and then. That these companies try to reinvent themselves every time these risks materialise, is where the story may ultimately lie.

8 out of the 10 stocks in FANG+ (Twitter and Alibaba are not in Nasdaq 100) are available in the Nasdaq 100. These stocks account for about 80% of FANG+ but just 38% of Nasdaq 100.

The FANG+ has index futures precisely for this reason of being a high volatile/concentrated portfolio. In fact, the index is popular for taking trading positions and hedging risks.

Should you invest?

The performance of FANG+ cannot be ignored, risks notwithstanding. But what you need to be aware is that the index has been built to capture a rising theme. The index was launched only in 2017 (with back tested data since 2014) and is built to primarily trade on the FAANG stocks as a basket. It therefore appears that the index is best used as a trading opportunity for traders than an option for only long-term investment. How long this theme will last in the way it does is too early to assess. That the theme holds potential is undeniable.

The offering from Mirae therefore needs to be treated like a high-risk thematic fund if you have very high-risk profile – and only if you are particularly enamoured by the FAANG theme. Periodic profit booking will also be necessary.

For those of you who already use a US stock trading platform, this can be skipped. If your objective is diversification of markets and hedging your portfolio from rupee depreciation, then we think the other 2 passive US index funds work better with lower risks. Our choice, for diversification, would be the less volatile passive options. Our recommendations are available in Prime Funds under thematic/strategic investing.

Please note that as an international fund, this ETF/FoF will be treated like a debt fund for tax purposes.

21 thoughts on “NFO Review: Mirae Asset NYSE FANG+ ETF & Fund of Fund”

Awesome post!! I will stay away from this one for now.

Vidya, thanks for the review. Really appreciated. So it seems okay to give low exposure to it and periodically book profits. I agree, that NASDAQ 100 and S&P 500 are better indices for the long term.

On a related note, I wanted to understand the behaviour of indices more. For eg, they say it is rebalanced quarterly. So how vulnerable it is if 1 or 2 stocks go down completely? Any other material online or in your website will be helpful to better understand the behaviour of various indices. Thanks in advance.

Hello Sir, Thanks! If a stock falls, it is the same like it falls in an active fund – afetr all an active fund too is a constructed portfolio. In an index, depending on the weight of the stock in the portfolio, the hit can be more or less. In an equal weight index, if a stock that has low weights in a marktcap-based index falls, then the equal weight index can suffer more because if it has the same stock and vice versa. check niftyindices.com for methdology for each index. thanks Vidya

Good article, but I have some points:

1.Don’t you think that the risk-reward ratio is favorable? They are glowing globally, hyperscaling.

2.They are still cheaper than 12 months forward PE of the top10 expensive Nifty 50 stock

3. They are not unicorn bubbles but monopolistic/moat companies generating an income of 180 Bn USD which exceeds the combined net income of all Indian equities.

4. They have cash-in books of USD 500 Bn which is 85% of India’s forex reserves

1. The reward is as good as its theme. If the theme lives and kicks yes 🙂

2. Not really. The PE is average. For some of these FAANG+, the PE is almost meaningless 🙂

3 and 4 – yes good data observations.

thanks

Vidya

Do you still think it is ok to invest in US Market after US Market Cap to GDP is more than 200 % . What is your thoughts on this. Thanks.

When the purpose of an asset class is to diversify, we don’t look at market timing. We look at averaging. From that perspective, US investing is a diversifier and need not be timed. it can be averaged. And in general, we do think with pandemic fear receding there, money could flow more there while countries liek India struggle to cope. thanks, Vidya

For subscribing to the IPO can I switch funds from another Mirae fund into FAANG Fund?

Hello Sir, Not a good idea. The former will be a core fund in your portfolio, the FAANG is a thematic one. thanks, Vidya

i read your mirae fang+ fof review. awesome. i have few doubts

(1) if we invest in FOF means will it buy the from the open market or directly from the fund house, if it directly buy in open markets the nav-price deviation will be there ( etfs have low volume india) which will impact the returns.

(2) what is the expense ratio for this fund?

could you write a article about different types of international funds ( feeder fund, FOF…..)

We will know the exact expense ratio once it is live. Won’t be high since it is a passive fof.FOF is bought from AMC..so no deviaton of NAV. There may be deviations in the underlying ETF that will indirectly of course impact FoF too. But because the FOF will feed into the ETF, the liquidity can be expected to normalise with time. thanks, Vidya

If the correlation with the Dow/ S&P500 is only 16%, then why do we check US markets overnight to start trade on the Nifty the next day? Near term – Post pandemic correlation (say last 12 months or even 18) would be a lot higher.

Secondly what do we know about the expense structure right now?

Global events tie all markets and that too to the US – simply because US is the funder to the world 🙂 (FPI money predominantly comes from there). But on a daily basis, it is the Asian markets (that opens ahead of us) that usually is looked up to. Not so much US. thanks Vidya

Any reason why Microsoft does not feature in this Index?

they’ve taken the most highly traded withing the sectors. If the others outdo, then that could be the reason. Vidya

Thanks Vidya. I want to subscribe to the NFO. Should we participate on the ETF or FOF?

Given that we don’t know how the ETF volume will be, FOF may be a betetr route right now. Vidya

Thank you for the review. Appreciate the advice. One question on the FANG+ index. Will this index go through change in constituents like how Nifty 50 changes over a period of time?

Hello sir, Yes, indeed. Rebalancing in an index (quarterly as mentioned) also means change in constituents. If newer FAANGS come, and theya re highly traded, they will get into this index. thnaks, Vidya

HI Vidya, If newer companies replace FANG stocks, then will the index still be called FANG?

It is FAANG Plus another 5 stocks..so..unless the top 5 change, there is no need 🙂 And in any case, what’s in a name? 😊 Vidya

Comments are closed.