Toyota Motor Corp. Airbus. LVMH, owner of luxury brands such as Louis Vuitton, Dior, and Givenchy. Astrazeneca and Novartis. If owning global majors such as these interest you, the ongoing NFO from Motilal Oswal AMC might just have you hooked.

This is the Motilal Oswal MSCI EAFE Top 100 Select Index Fund (yes, one long fund name!), a passive fund that will track the MSCI EAFE Top 100 Select Index. This index represents the largest stocks in developed markets in Europe, Australasia and the Far East. That means the US, the key global market, is not part of this index.

To this extent, therefore, this NFO offers a different opportunity in global investing in the passive space. So, does the index make for a good diversifier? Here’s a review.

The MSCI EAFE Top 100 Select Index

MSCI is a dominant global presence in index construction across asset classes and data analytics, and has been involved in index building for over 50 years now. There are over 1300 equity ETFs alone based on MSCI’s indices, with about $13.6 trillion in assets benchmarked to its indices.

Therefore, MSCI indices are more than capable of being good representatives of a wide variety of investment opportunities. Domestic MFs hopping onto the international bandwagon are starting to choose MSCI indices; a few months ago, saw HDFC AMC launch an index fund tracking the MSCI World Index.

The Motilal Oswal MSCI EAFE Top 100 Select Index is targeted to capture the largest stocks in the larger developed markets outside the US. It is derived from a parent index called the MSCI EAFE Index. This parent index houses stocks across market capitalisations, covering 21 developed markets excluding the US. It includes countries across the globe, ranging from France, Germany, and other European markets, to the UK, to Hong Kong, Japan, Singapore and so on. The index aims at capturing about 85% of the free-float market cap of each country. That makes it a massive index, housing about 843 stocks (as of October 2021).

The MSCI EAFE Top 100 Select Index draws from this MSCI EAFE index. The index has been specifically constructed for Motilal Oswal AMC, and is built as follows:

- The top 10 countries are selected based on their weight in the MSCI EAFE index

- From the stocks in these markets, the 100 largest by marketcap form the index, weighted by marketcap.

- A country’s weight is capped at 40% and the index is rebalanced quarterly.

Whittling down the MSCI EAFE index to half the countries and an eighth of the stock list makes this fund a more concentrated play on developed markets, covering only the largest markets and stocks instead of every single one. For example, the top 10 stocks in the MSCI EAFE Top 100 account for 27% of the index weight compared to the parent’s 13%. The top stock weight stood 4.1% against the parent’s 2%. The biggest country weights – the UK and Japan – will account for around 20% of this index fund against the parent’s 14.5% and 22.9%, respectively.

The MSCI EAFE Top 100 index’s region break-up and the top holdings are given below. The top stocks, as you can see, are a motley mix of established companies across countries.

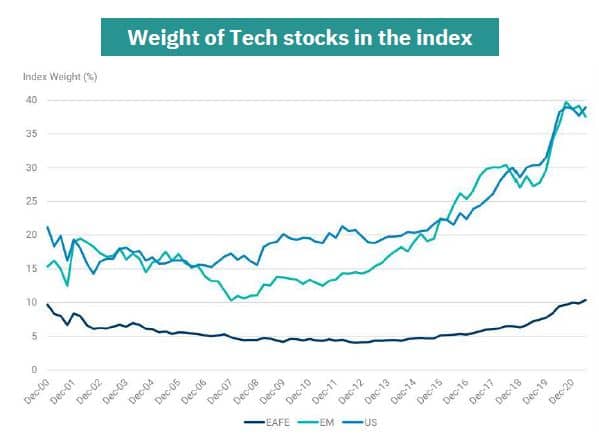

The exclusion of the US in the MSCI EAFE Top 100 makes it very different from the global index funds/ETFs available currently, which are either US-focused or are skewed towards the market. Two, it also means that the index does not heavily feature tech stocks but still offers access to giant, global companies.

But does the differentiation make the MSCI EAFE Top 100 worth an investment? There are two aspects to consider here. The first is how the index performs in relation to the other indices and the second is how the returns themselves are.

Comparing performance

Because the MSCI EAFE Top 100 index has been expressly designed for this index fund, there is limited data on performance. But from the diversification lens, it is well possible to draw some inferences measuring the parent index against other indices.

#1 Low correlation with our markets

When opting for diversification in global markets, an index (or a fund) needs to perform differently from our own. So, consider correlation, which measures how closely two indices perform. On this count, the parent index, MSCI EAFE, ticks the box. The correlation between the MSCI EAFE and the MSCI India index has a low correlation of 0.44 over the past 20 years, although it has moved up marginally to 0.51 over the past 5 years (using the USD indices for both).

Additionally, the MSCI EAFE is lower on volatility compared to our own. Using the same two indices above for an even comparison, the MSCI EAFE return deviation across periods is lower than the MSCI India, and average downsides are lower as well. The table below shows how the MSCI EAFE and MSCI India indices compare on these metrics across timeframes, based on returns rolled over the past 10 years.

While the MSCI EAFE Top 100 Select Index is more concentrated, it can behave in a similar manner in terms of downsides and volatility. Data provided by the AMC indicate lower volatility across periods.

But then, the US market also has lower correlation with our own markets. The MSCI India’s correlation with the MSCI US index is, in fact, lower than the MSCI EAFE. For instance, correlation over the past five years is 0.31 and over the past 20 years is 0.23. On the volatility front as well, the US is in step with the EAFE.

#2 Returns don’t stack up well

That leaves the actual returns the different markets delivered. From this aspect, the MSCI EAFE Top 100 (and indeed the MSCI EAFE itself) is lacking compared to the US market. On a 5-year rolling return over the past 10 years, the MSCI EAFE averaged 2.5% compared to the MSCI US’s 11.1%. The MSCI World is also a superior performer, thanks to the heavy weight of the US markets in the index. The MSCI EAFE fails to beat the US index with any degree of consistency in this period as well.

While it is true that the US outperformance could be in part to the tech-heavy US indices that has done exceptionally well in the past few years, the picture still does not change much going even further back.

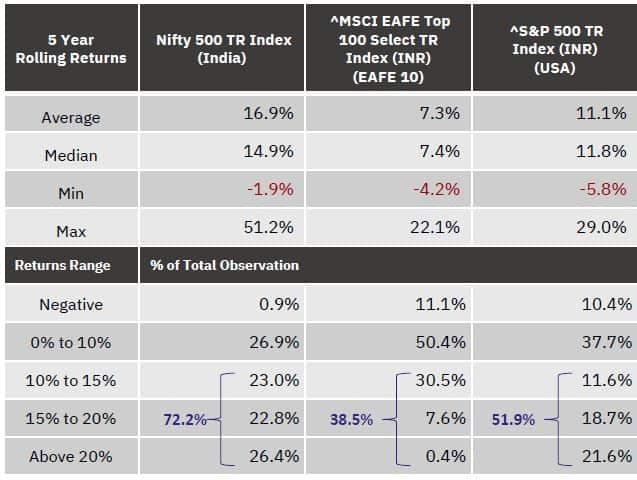

The more focused nature of the MSCI EAFE Top 100 index can afford it better returns than the parent index. But data provided in the AMC’s fund presentation does not indicate a very different return profile. The image below, taken from the presentation, shows the distribution of the 5-year rolling return from December 1999 to September 2021 between the Nifty 500, the MSCI EAFE Top 100 and the US S&P 500. As you will observe, the MSCI EAFE Top 100 is far more moderate in return generation over the years. The same holds for shorter 3-year rolling periods as well.

Is it a diversifier?

To summarize, the MSCI EAFE Top 100 provides access to global giants across countries and industries, which are not available domestically. It has low correlation with our domestic markets and is less volatile. Therefore, including the EAFE index in a portfolio can help contain downsides. But given that the index also doesn’t rally as well, a significant inclusion can weigh on long-term returns.

The AMC has undertaken a rolling return analysis over different periods, assuming varying weights of domestic markets, the US, EAFE Top 100, and World. This analysis suggests that a small inclusion of the EAFE index to the extent of up to 10% in a portfolio offers marginally higher risk-adjusted portfolio return. Higher allocations to the EAFE index weigh on overall returns.

Of course, the return profile of the US or EAFE markets may change over the coming years. We don’t know. But if we go by on historical trends, here are the points to note about the MSCI EAFE Top 100 index fund:

- If you already hold 10-15% of your portfolio in US-based funds, skip the MSCI EAFE Top 100 index. The allocation gives you adequate international diversification in a market that has low correlation and healthy returns. Going by past performance, it’s not really beneficial to reduce domestic market exposure by big margins.

- Similarly, if you hold US-based funds plus the recent HDFC Developed World Index fund, then the Motilal Oswal MSCI EAFE Top 100 can be ignored. The combination of the US and Developed World will be somewhat similar to a combination of the US and the EAFE index, though with a heavier US tilt.

- If your allocation to international funds is low and you already own US-based funds, then you can consider small allocations to the MSCI EAFE Top 100, if you prefer it as a diversifier. It would also be lower-cost than other active European-based or global market funds. But phase any such investments over a period of time and not all at one go. This apart, be aware that there is no data on tracking error of the Motilal Oswal EAFE index as yet. Tracking can be judged only over a period of at least a year or more and that too based on data disclosed by AMC, since the global index will be in USD.

We are not adding this fund to our list of Prime Funds now.

Do note that you will need to have an investment horizon of at least 5-7 years if you intend to invest in the fund, now or at any other time. Because it is an international fund, it will be taxed similar to debt funds. The NFO closes on 25th November and will reopen for subscription after that.

14 thoughts on “NFO Review: Motilal Oswal MSCI EAFE Top 100 Select Index Fund”

Can you compare HDFC Developed world index fund and this fund MO MSCI EAFE Top 100

Hi, how can the MSCI India have an average loss of -196.8% in 5 years?

Sorry! Error when copying into our table-designing software 🙂 I’ve corrected and updated the table. Thank you for pointing it out. – regards, Bhavana

Thank you Bhavana for this article. Since you mentioned in above answers about continuing Nasdaq 100 allocation, I have a specific question relating to Nasdaq 100. Between Motilal Oswal Nasdaq 100 and recently launched ICICI Nasdaq fund, which one is preferable? The N100 shows a different price than its actual NAV. do you think it is better to invest in Index fund instead…or would the tracking error be higher there?

Thanks

Yogesh Namjoshi

We’ve responded on the ticket you raised. Apologies for the delay in response. thanks, Bhavana

Hello!

I would like to throw more light on this issue….

There are 2 notable ETFs available in USA which tracks “MSCI EAFE Index” The ticker symbols are “IEFA” & “EFG”

1) IEFA = iShares Core MSCI EAFE ETF which started trading there on Nov 30, 2012 and the Annualized Returns till date is only 7.95%. Its holds about 3024 different Stocks in 10 different developed countries ex-US.

2) EFG = iShares MSCI EAFE Growth ETF which started trading there on Sept 30, 2005 and the Annualized Returns till date is only 6.53%. It holds about 484 different Stocks in in 10 different developed countries ex-US.

In overall it is felt that the ‘Returns’ as seen from the track record of either ETFs mentioned above are NOT attractive. If any one is interested in investing in ‘Index’ ETFs then the better choice will be ….

1) ONEQ = Fidelity NASDAQ Composite ETF which since its inception trading day(Nov 28, 2003) till date has given 13.33% AR

2) VONG = Vanguard Russell 1000 Growth ETF which since its inception trading day (Oct 29, 2010) till date has given 18.59% AR.

Sadly, Till date no AMC in India has so far offered a matching ‘product’ (MF / ETF) here in India.

This is just FYI without prejudice.

Thanks & Regards!

Prakash Joshi

Mumbai, India.

Nasdaq vs S&P 500 which is better for long run ?

If you do not mind higher volatility, go for the Nasdaq 100. – thanks, Bhavana

If you are going for NASDAQ 100 benchmark ETF then the ticker symbol is “QQQ” and its 3X Bull Leveraged version is “TQQQ” . You will be able to invest in these ETFs from India.

BEST LUCK

Prakash Joshi

Mumbai, India.

Hello Bhavana

Fantastic article. Very timely as I was about to ask your opinion on it. I was thinking and tempted to invest in MO EAFE Top 100 fund. I have about 30% of equity invested in US based fund. I have started investing in HDFC Developed world index fund recently. Now I see that you recommend to skip EAFE Top 100, since I have combination of US funds and HDFC developed world index fund.

My other question for further investment is HDFC Developed world index fund sufficent as one stop shop for international fund exposure. Can I stop investing in MO Nasdaq 100 + S&P 500 and use only HDFC fund.

Looking forward to your thoughts on the above.

Thanks

Kind Regards

Vittal

No, don’t rely on the Developed World index alone. While it is influenced by the US, you will be able to earn better with a higher allocation to the US markets. If you’re keen on reducing the number of funds in your portfolio, retain at least the Nasdaq 100. – thanks, Bhavana

Thanks for your reply. All well noted.

Hi,

Is the tax treatment like any other debt fund?

It’s mentioned at the end of the article 🙂 Yes, the tax treatment is that of a debt fund. – thanks, Bhavana

Comments are closed.