Chances are that at some point in your investing journey, you have been sold an endowment plan. Maybe you even got a call asking you to buy one before April 1, 2023. You know, the ones that usually come with a happy looking family on the brochure promising you your money back with returns and an insurance cover? Maybe you managed to ward off that pushy insurance agent ‘uncle’ but maybe you bought it believing you were killing two birds with one stone and saving on tax to boot!

At PrimeInvestor, we have always been vocal about keeping your insurance and investments separate. But with the tax treatment of endowment plans changing, we take a look at whether there is any merit at all left in buying one of these plans anymore.

What an endowment plan is

IRDAI says that an endowment policy ‘is a savings linked insurance policy with a specific maturity date. Should an unfortunate event by way of death or disability occur to you during the period, the Sum Assured will be paid to your beneficiaries. On your surviving the term, the maturity proceeds on the policy become payable.’

Endowment plans come in various shapes and forms (with profit, non-profit, unitized, participating / non-participating) but at the core, they basically combine a life cover and savings and mature usually after several years which classifies them as ‘long-term’. So every time you pay a premium, part of it will go toward securing your life insurance cover and the other toward savings.

You will find that most endowment plans are marketed with three primary benefits:

- One is that you get your money back with some returns if you survive

- Two, they give you insurance cover so if something untoward were to happen, your dependents are provided for and

- Three, payouts are tax-free

Let’s examine if these commonly promoted selling points hold water.

#1 Returns don’t quite measure up

Endowment plans usually offer you a fixed payout at the maturity of the policy. There could also be a variable component in addition to this. The Jeevan Anand, one of the most beloved endowment plans out there for instance, provides you with one, a lump sum payout on maturity, two, some variable bonus and three, also keeps your life insurance in place after maturity. So whenever the insured passes away, even after maturity of the policy, the family gets a payout of the sum assured.

Sounds idyllic! But when you look at a product in terms of returns, it’s important to get an idea of what those returns could be. That’s where endowment plans falter. Most plan illustrations give you the bonus and maturity benefits in rupee terms. When you view these through the XIRR lens, the picture gets a lot sharper!

Consider the Jeevan Anand mentioned above. Some time ago, we had done a detailed analysis of this policy. According to this, assuming a 15-year policy taken by a 30-year-old with a sum assured of Rs 50 lakh, the net IRR was just about 3.11% (extrapolating the historical bonus component). Even changing the age to a 20-year-old would peg the IRR to around 3.6%. Extending the policy period to 25 years would likely earn about 4.9% in IRR.

Clearly, the returns aren’t really attractive! While the return for each policy from other insurers would vary based on the bonus and maturity component, and the calculations in the analysis linked above are older, returns are still likely to be around similar levels.

# 2 Life cover

The argument will then turn focus to the insurance component of endowment policies – since returns, after all, aren’t the only aspect.

One of the main reasons people opt for endowment plans is that they believe that they are getting two birds with one stone – saving for a goal and getting life insurance. But in life cover, it is very important to get the amount right if it is to take care of your family’s financial needs.

Ideally, the insurance cover should be enough to replace your income for the rest of your working years, meet all contributions remaining towards a goal, and cover any big outstanding liabilities. You can read this article as a guide and use this insurance calculator to see how much life insurance you will need.

To help you get an idea, PrimeInvestor’s term insurance calculator puts the amount of life cover needed by a 35-year old (single income, no kids) at close to Rs. 2-3 crore (based on assumptions of income, financial goals, lifestyle etc.). Try out the term insurance calculator yourself to see how much life insurance you will need based on your age, income, lifestyle, financial goals etc.

Adequate cover aside, you also need to take into account the premium you will be paying. The higher the insurance premium paid, the lesser you would have to allocate to other investments and goals. Therefore, you need to be smart about maximizing the benefit you get from your insurance premium.

In endowment plans, the life cover is likely to fall short of how much insurance you actually need. To illustrate, we’ll continue with LIC’s New Jeevan Anand. If the policy holder dies during the policy term,

‘Provided all due premiums have been paid, the following death benefit shall be paid: • On Death during the policy term i.e. before the stipulated Date of Maturity: Death benefit, equal to “Sum Assured on Death” alongwith vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable; where, “Sum Assured on Death” is defined as higher of 125% of Basic Sum Assured or 7 times of annualised premium. This death benefit shall not be less than 105% of total premiums paid upto date of death. The premiums mentioned above exclude taxes, extra premium and rider premium(s), if any. • On death after expiry of the policy term i.e. from the stipulated Date of Maturity: Basic Sum Assured shall be payable.’

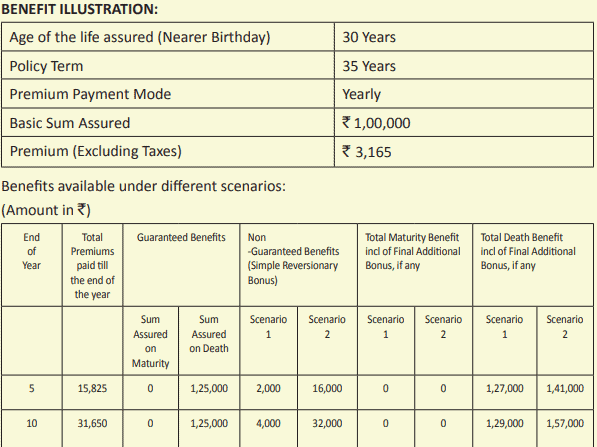

Now take the example below:

Source: LIC New Jeevan Anand brochure

Effectively, under this policy, for every Rs 1.25-Rs 1.5 lakh in life cover, you would have to shell out about Rs 3,165. So, if one were to try to get a cover of say Rs. 10 lakhs, one would have to shell out a little over Rs 31,000 a year. Would Rs 10 lakh be adequate to meet what you really need? In the intervening years – from the start to the end of the 35-year plan in this case – your life insurance needs are likely to have changed and a cover of Rs. 10 lakhs may be insufficient.

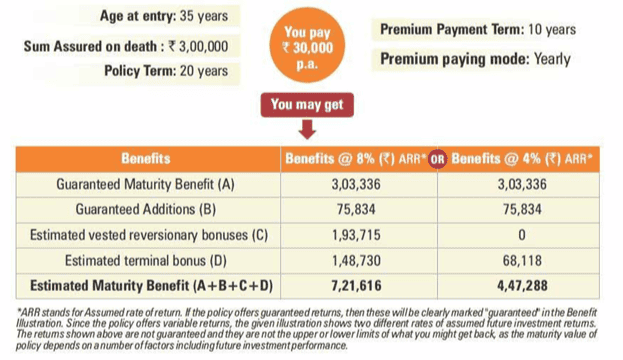

This apart, for the investment component, one would have to stay invested till the maturity of the plan in order to get their money back with any returns.It’s not very different with other endowment plans too. Take another example (below) – the ICICI Savings Suraksha Endowment plan. Here again, going by the illustration that talks about a 35-year old healthy male, he would have to pay a premium of Rs. 30,000 per annum. This plan will only fetch him Rs. 3 lakhs as sum assured on death (plus some bonus) – not even close to the sum assured that a 35-year old might need.

Source: ICICI Savings Suraksha

To put the balance between premiums and insurance cover in better perspective, let’s head to PrimeInvestor’s term insurance comparison tool. A pure term cover of Rs. 1 crore for a 35-year old male would cost a premium of between ~Rs. 14,400 and Rs. 27,000 per annum; meaning, a Rs 10 lakh term cover would cost a fraction of the Rs. 31,000, leaving the rest to be invested.

In a term plan, obviously, there’s no return of the amount which is why premiums are that low. But as we can see from point #1 above, returns in an endowment plan are not high either. The more you shell out for endowment plans, the less savings you may have to allocate to higher-returning options.

In the analysis linked in point #1 above, Bipin Ramachandran had compared replicating the cover provided by the New Jeevan Anand and an investment in debt funds plus a term insurance plan. While the analysis is old and debt fund taxation has become less efficient, the verdict is quite clear. The debt funds-plus-term insurance combination delivered much more than the endowment plan. The margin by which this combination did better in terms of end-corpus and returns is quite wide. Therefore, even if you were to find endowment policies with better IRR than the New Jeevan Anand, it may still fall short.

This, therefore, weakens the case for endowment plans. A pure term cover would also let you ramp up your cover as and when your life circumstances change.

#3 Tax-free no-more

Debt funds saw a change in capital gains taxation from April 1, 2023 onwards where the indexation benefit on long-term capital gains was removed. In contrast, the tax-free status of payouts is one of the most advertised features of endowment plans!

But endowment plans have also had tax changes. Until Budget 2023, any payout you would have received under an insurance policy including an endowment policy would have been tax-free and this was a big plus for these plans. One could get both a deduction under section 80C of the Income Tax Act on the premium paid (subject to an overall cap of Rs. 1.5 lakhs) and get a tax-free payout.

Latest tax regulations however, are putting a stop to this.

For life insurance policies issued on or after April 1, 2023 payouts (of any nature including bonus) will be tax exempt only if the premium payable in any year does not exceed Rs. 5 lakhs. In case there is more than one policy, then this limit would apply to the aggregate of the premium payable in any year. This of course does not apply to payouts made on the death of the insured in which case payouts are always tax-free.

With this change in taxation, the motivation to go in for a high value endowment policy with the objective of getting tax free payouts has been wiped out. For policies where premiums are less than this limit, the same question of the balance between premiums paid and insurance cover, as well as return, comes into play.

Remember that term insurance premiums enjoy tax deductions as well, so by opting for this over endowment plans, you will not be missing that opportunity.

#4 Flexibility to surrender

Endowment plans usually score low on flexibility. If you were to keep your life insurance and investments separate, you have easier and better access to both your investment and your life cover. Should you at any time find yourself in need of money for any reason, you can simply exit your investments, get the amount you need, and do this without disrupting your life cover – for which you are already paying a comparatively smaller premium.

For example, if you had invested in fixed deposits, you could close these if needed, subject to any premature closure penalties, if any – and several deposits these days allow you to withdraw without penalties. If you had invested in debt mutual funds (or any other mutual funds, for that matter), you could redeem funds to the extent needed (the Franklin saga notwithstanding).

In an endowment plan however, it’s not so straightforward. You must be tired of LIC’s New Jeevan Anand by now, but let’s take it to illustrate anyway.

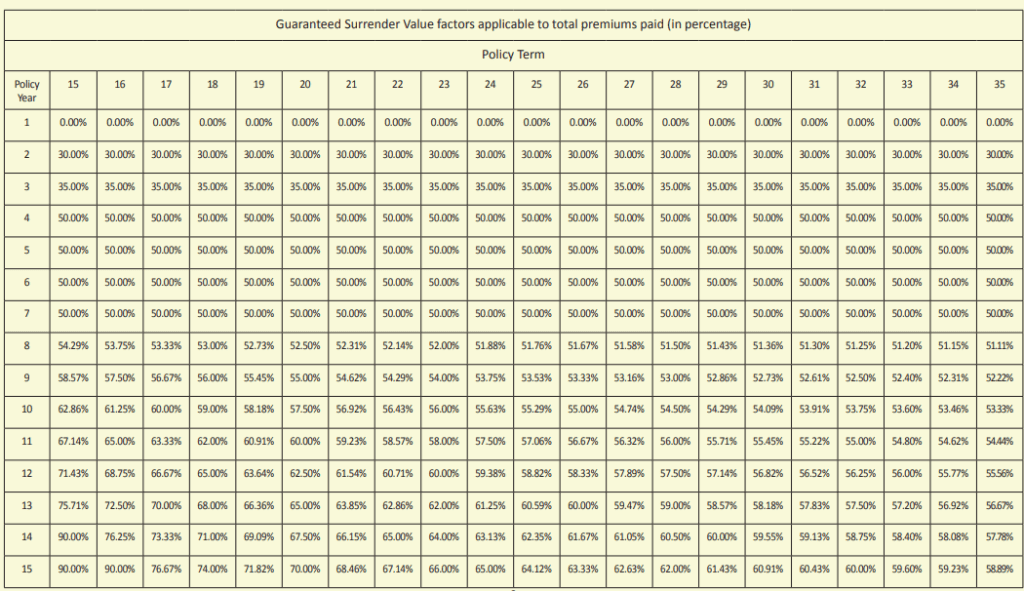

‘The policy can be surrendered at any time provided two full years’ premiums have been paid. On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value or Special Surrender Value. The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI. Guaranteed Surrender value payable during the policy term shall be equal to the total premiums paid (excluding extra premiums, taxes and premiums for riders, if opted for) multiplied by the Guaranteed Surrender Value factors applicable to total premiums paid. These Guaranteed Surrender Value factors expressed as percentages will depend on the policy term and policy year in which the policy is surrendered and are as specified’ below:

Here, once you complete the first two years of paying premium, you don’t get back all of the money you’ve paid so far as premiums but a percentage of it calculated in accordance with the surrender value chart. A quick scan will tell you that if you want to exit at any time before 7 years, you stand to lose half of the money that you have ‘invested so far’. Things start to look better only the closer you are to the maturity of the policy.

Source: LIC New Jeevan Anand brochure

While this varies from policy to policy, the general theme across endowment policies is that you will find it not viable to surrender your policy for a big chunk of the policy period. If you do surrender before time because you need the liquidity, remember that you will lose your insurance cover as well.

These plans are essentially for the long term and leave you little wiggle room once you buy one to make changes should you want to modify your investments and insurance.

Bottomline

So what does an endowment plan offer?

- Some life cover which can be secured more effectively and cost efficiently by sticking to a pure term plan.

- Safety and certainty of returns that are modest at best and can be replicated and even outmatched by other safe debt investments such as PPF and carefully selected debt mutual funds. Further, since an endowment plan is anyway a long term financial commitment, including equity mutual funds as an investment too should not be ruled out.

- Tax free payouts if annual premiums don’t cross the limits.

At PrimeInvestor, our view is that it is best to keep insurance and investments separate so both can be done in the most effective and efficient way – you get the biggest bang for your buck, so to speak! Further, term insurance cannot be considered an investment but a necessary expense.

You can use our Term insurance recommendations if you need help picking the best plan for you. Alternatively, if you want to do some evaluating yourself, then our Term Insurance Selection tool will be the assistant you need.

You can also get our recommendations on how to deploy the amount you want to toward investing through Prime Funds, our curated list of mutual funds that we have researched and shortlisted. We have also constructed ready-to-use portfolios that you can easily replicate based on your needs and life situation.

3 thoughts on “Is there still a case for buying an endowment plan?”

Good article Ms Pavithra,

True, it is always better to keep INSURANCE & INVESTMENTS seperate, but major mis-selling happens from all insurance companies due to which people loosing the opportunity to create wealth.

Also one point, which i may suggest here is, do share more thoughts on, low income people does not get to apply for the Term plan as they are unable to provide their ITR returns, which is an inhedrance here in going for TERM PLAN

Thank you Sir.

Noted.

Illustrations clearly underline the strategy that investment and insurance need to be kept separate. Hope more youngsters get to see this and invest prudently and not just fall for what agents peddle without making a proper study on their own.

Comments are closed.