Sula Vineyards is launching an IPO worth Rs 960 crore, consisting solely of an offer for sale by investors including a 1% stake sale by the promoter. The offer for sale will result in approximately 32% of equity being sold by the selling shareholders with the promoter stake at ~28% post-issue. The issue opens on December 12 and closes on December 14. Shares are being offered at a price band of Rs.340-Rs.357 per share of face value Rs 2. This being an offer for sale, the company will not receive any funds from the issue.

Sula Vineyards was founded by a first-generation entrepreneur Rajeev Samant in 1999 and has since scaled up to become the largest player in domestically produced wines, controlling over half the market. Educated abroad and working in the technology sector, Samant returned to India to pursue farming. After few experiments, he discovered the opportunity of wine making, with Maharashtra proving to be an ideal region for wine grape cultivation and thus, the journey of Sula began.

Business

Sula Vineyards (Sula) produces and sells wines under various brands including Sula, RASA, Dindori, The Source, Satori, Mosaic, Madera, Samara, York and Dia, with Sula being its flagship brand. The company is the market leader in domestically produced wines with a market share of 52% spanning all price segments from mass market to premium. It has six wine making facilities in the States of Maharashtra and Karnataka with a capacity of 145 lakh litres and has 2,521 acres of grapes under contract cultivation.

Sula is also a pioneer of wine tourism in India and owns and operates two vineyard resorts located adjacent to its winery in Nashik, Maharashtra, under “The Source at Sula” and “Beyond by Sula” brand names, having 67 rooms. About 3.68 lakh people visited its vineyards in FY20.

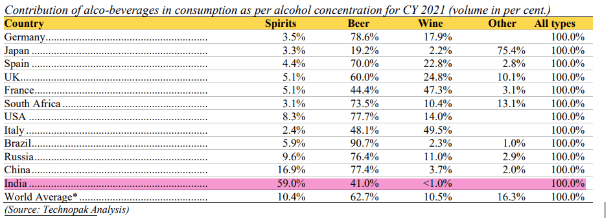

Wine is the smallest category in the alcoholic beverages market in India with a share of ~1% and Sula will be a small-cap company upon listing. Here is a snapshot of its key financials.

As a well-known brand which also offers a proxy for upmarket discretionary consumption, the Sula Vineyards IPO is likely to generate a lot of interest among investors. Here’s our take on the IPO.

Positives

#1 Leadership in a niche segment

The Indian wine market is concentrated with the top three players dominating the market, Sula being the leader with 52% market share. The two other major players are Grover Vineyards and Fratelli Wines. The top three players control close to 80% by value of the domestic 100% grape wine market. Even in spirits and beer, the top three players control close to 70-80% in value terms with two MNCs in each category holding a lion’s share.

The regulatory issues around the production and sale of liquor and the need for extensive distribution and sourcing tie-ups renders the Indian liquor space an oligopolistic market, with a few players dominating each segment.

Sula has the largest area under contract cultivation of grapes at 2,521 acres as compared to 410 acres for Grover Vineyards and 240 acres for Fratelli Wines, mainly in Nashik region of Maharashtra. It also has 4 owned and 2 leased wine making facilities with 4 in Maharashtra and two in Karnataka with a total capacity of 145 lakh litres.

What differentiates wine from other kinds of spirits are the sourcing and production methods. On the supply side, there is an annual harvesting season that runs between December and March, and the requirement for prolonged storage and ageing, which leads to a high inventory business model as compared to other alcoholic beverages. A few states, including Maharashtra, Karnataka and Tamil Nadu, have introduced policies to encourage wine production, including excise duty concessions.

Sula also has built a robust distribution over the years, a source of moat in the alcoholic beverages market. The distribution chain comprises of State-run corporations, wholesalers and independent distributors who purchase its products for resale to retail outlets, restaurants, hotels and clubs. This extensive sales and distribution network comprises of 50 distributors, 11 corporations, 14 licensed resellers, 7 company depots and 3 defense units and over 23,000 points of sale (13,500 retail touchpoints and over 9,000 hotels, restaurants and caterers).

These factors create strong barriers to entry into wine making as it involves deep involvement and investment in production as well as distribution.

#2 Opportunity size, contingent on market-take off

The Indian wine market is relatively young, taking shape only in the 1990s and its size is still small compared to other major markets. India also does not have a strong wine drinking culture unlike in European countries where it is paired with meals. The bulk of the spirits market in India is dominated by beverages with high alcohol content such as whisky, rum, brandy etc. The wine drinking culture in India is mostly occasion-led driven by parties, social gatherings and events. While a large part of the affluent class may try wine, wine loyalists are limited in number and seem to favour it only occasionally, while opting for whisky, rum or cocktails for regular consumption.

This table shows consumption trend of alcoholic beverages in major markets.

Source: RHPEven if we go by the sales numbers of top alcoholic beverages makers including beer and spirits, the wine industry at ~Rs.1,000 crore in value terms would not be more than 2.5% of the overall Indian liquor market (Refer peer comparison table at the end).

Unlike other spirits, wine is also largely an urban consumption item with Mumbai, Bengaluru (Karnataka), Delhi NCR, Pune and Hyderabad together contributing to 70% of the overall demand. Sula aims to increase its focus on the under-penetrated metros like Chennai and Kolkata, the tourist markets of Kerala, Rajasthan and Goa, and other Tier-1 and 2 cities.

The Indian wine segment is estimated at just 2.6 million cases in volume terms in FY22 (as compared to 684 million cases for spirits and 300 million cases for beer) and is projected to grow to 3.9 million cases by FY25 at a CAGR of about 14% in volumes. This would compare with a similar projected growth for beer and far higher than the 4.5% growth for stronger alcoholic spirits, according to Technopak Advisors.

The niche status of the wine market in India makes for a dilemma for investors in Sula Vineyards. If you believe that wine will remain a marginal category with stronger spirits continue to make up the bulk of consumption, the prospects for Sula to scale up, even as the market leader, could be limited. But if you expect wine consumption to scale up in India, driven by aspirational demand, a shift towards low-alcohol content drinks or the differing preferences of first-time or young alcohol drinkers, then Sula would appear to be sitting pretty on a market with high growth potential.

Given that changes in consumer habits often take many years, this IPO would thus be rewarding only for investors who do believe in the market potential for wine and are willing to hold on to the stock for several years until an inflexion point is reached.

#3 Focus on profitable growth

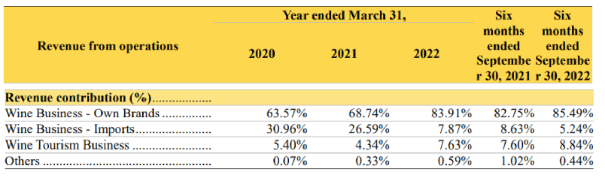

Sula has recently taken a strategic decision to improve its EBIDTA margins by focusing on its own brands while significantly bringing down the sale of imported wines, reducing the trading component in turnover. This significant shift in business mix is shown below.

The purchase of traded goods has declined from Rs.132 crore in FY20 to Rs. 12 crore in H1FY23 for Sula. This strategic decision combined with de-leveraging initiatives have led to significant improvement in financial performance in FY22 and H1FY23, driven by EBIDTA margin gains. The management has guided that this will continue to be the strategy going forward.

Net profits also got a boost with reduction in interest costs and calibrated spending on distribution and marketing. If we go through 5-year financial performance, as publicly available, the EBIDTA margin band has been in the range of 14-16%. While exiting the trading business should give a permanent leg up to EBIDTA margins, the improvement in Sula’s financials is of too recent a vintage to take a decisive view.

#4 Wine tourism adding to its niche

Sula is also a pioneer in wine tourism in India and owns and operates two vineyard resorts located adjacent to its winery in Nashik, Maharashtra, under “The Source at Sula” and “Beyond by Sula” brand names, having 67 rooms together with 3.68 lakh people visiting its vineyards in FY20. This gives it the advantage of introducing the category to a large set of new customers while enabling direct sales as well as brand-building. In FY20, it sold ~2,30,000 bottles directly to consumers.

Sula has also acquired York Winery, near its existing facilities which would augment its wine making capacity while allowing it to expand the wine tourism business. The business has been contributing in high single digits to Sula’s revenues.

Key risks

#1 Free Trade Agreement (FTA) with Australia

India has recently inked a FTA with Australia which is expected to come into effect soon. Australia is one of the largest wine makers in the world and duty reduction on imported wines is one of the key items in the FTA. Tariffs on wines with a minimum import price of US$5 per bottle (~Rs.400) will be reduced from 150% to 100% and subsequently to 50% over 10 years while the duty on bottles with a minimum import price of US$15 (~Rs.1,200) will be reduced from 150% to 75%, and subsequently to 25% over 10 years.

For Sula, Elite (Rs.950+) and Premium (Rs. 700-950) contributed 61% of sales in FY22 and the relaxation on import duty on Australian wines can pose stiff competition to domestic wine-makers such as Sula. If Sula re-establishes tie-ups with overseas players and resumes the sale of imported wines, this can have adverse margin implications though it can boost growth.

India is also pursuing a FTA with the EU, which may expose Sula to similar risks as EU is a large wine market globally with many established brands. MNC liquor majors such as Diageo and Pernod Ricard, who rule the premium liquor market, have launched wines in India in the past and later withdrawn because of the limited market size. Their strategy also needs to be watched in the wake of the newly inked FTAs.

Peer Comparison

Sula has no comparable peer in the wine market. While comparisons are possible with firms operating in the branded liquor market, wine making tends to require more involvement from the grape cultivation stage. Wine is also a niche category addressing the creamy layer of urban consumers that may fetch higher margins as well.

For Sula, high EBIDTA margin is the key driver of RoCE and so sustaining these margins holds the key for valuations going forward. Liquor companies in the Indian listed space have tended to trade at very high valuations, often out of sync with their growth prospects. The regulatory barriers and high moats to this business which offer players with established brands strong pricing power, and scarcity premium arising from very few listed plays in this luxury consumption category, seem to be the key drivers of high valuation.

Below is a brief comparison with top liquor companies on key financial and valuation parameters

Valuation

At the upper end of the IPO price band at Rs 357, Sula would be valued at a PE of about 45-50 times based on an estimated Rs.550 crore of net sales and Rs.60-66 crore PAT in FY23 - a growth of ~20% over FY22.

While the Sula IPO is attractive from a promoter and market potential perspective, the high valuation based on its recent improvement in financials make us a bit wary. The low promoter stake of 28% may create a sizable float in the market over time. About 22% of the promoter holding is also pledged to a lender.

The stock may command the valuation it demands if it continues to deliver on growth and margins going forward, being the sole listed player in a niche industry. Its competitors in the wine segment may not make it to the public markets anytime soon. There was a listed player in champagne a decade back called Champagne Indage that caught market fancy, but went downhill after an inorganic and overseas expansion spree prior to the 2008 financial crisis caught it on the wrong foot.

Suitability

Long term investors may bid in the retail category to add Sula as a small part of their overall portfolio, with limited exposure to begin with. Further positions in the stock can be built based on the evolution of the market for wines and stability in financial performance. Do not expect any short to medium term gains. This call does not take into account any gains or otherwise on listing.

4 thoughts on “IPO Review: Should you take a sip of the Sula Vineyards IPO?”

thankyou, again as always very comprehensive analysis.

just sharing observation

sula might be story stock vs of value. Pure wine stocks including australia treasury wines ( penfolds), duckhorn ( napa valley) even with stand out brands didnt deliver good returns. And Business subject to high volatility- climate / trade arrangements btwn country / economic prospects. Specific to Sula

– Sula distribution skewed to high end bars / restraunts, as more people travel and try multiple cusines ( wine consumption growing , all may not ONLY favour sula, might favour other brands including imported). Thus they might need to also spend on brand advertising online distributions etc, might lower the margin.

– Every one loves wine from sources – given scarce supply and very very high demand , old / new world wines etc. not sure currently thats the case in india. lots of places newly wine can still be grown and industry doesnt have barriers other than distribution.

– yes it very niche in consumption… to make that 2x, 3x might require lots of bullets .

Welcome your observations sir, also insights on overseas stocks

You are clearly spot-on with respect to where the consumption is coming from. The headache of dealing with this distribution network creates a bit of entry barrier in this industry

Eventually it boils down to 2 things for investors to make good returns as mentioned in the IPO review;

1. a real take-off of this category beyond this 14-15% growth rate forecast

2. a sustainable financial performance from Co despite higher investment needed for growth (some trade-off is ok)

As we put in the conclusion, one will have to continuously monitor, and build based on the merits of how 1 & 2 shapes up

Need to be mindful of this FTA impact too in medium to long run.

Thank you

thankyou, very clear now.

have a 2 request , last year you did score card tally of hits and misses of prime investor stock reco (which is quiet honest and accountable one ) . Hope this year as well you are coming with one . In addition can you also do a IPO hits and misses, since you also covered major IPOs. And some of the stocks are proces have dropped significantly, thus many readers would be keen to hear your views !

Yes we will soon. Vidya

Comments are closed.