Consumer durables is a category that stands between staples and lifestyle goods. This category has been hit on one hand by Covid-led lockdowns, and on the other by inflation eating into margins and hurting demand. The category has seen a more severe impact as it is neither buoyed by the non-discretionary nature of staples nor by the quick demand rebound that lifestyle consumption tends to see.

A look at the Nifty Consumer Durables index, however, doesn’t show the troubles that the sector faced. The index has nearly doubled from pre-Covid levels. But the bulk of the index is represented by only two stocks – Titan and Havells. Another significant representation is from electronics contract manufacturer Dixon Technologies.

Titan is a luxury goods retailer. Havells gained traction from real estate recovery. Dixon rode on import substitution of electronics and PLIs. Outside of these, though, categories such as white goods and appliances have been ailing.

This segment, though, is now placed at an interesting position. A series of factors can change the scenario and help companies in this space improve toplines and margins, both in the near term and over a longer period. Here’s deep-diving into these factors. For this analysis, we are broadly looking at the white goods, electrical and non-electrical appliances space while excluding companies that are largely focused on wires and cables. We have selected companies with market cap of above Rs 5, 000 crore, with a 3-year average RoE and RoCE above 10%, filtered using our Stock Screener.

#1 Good times coming back after a double whammy

Consumer durables companies lost two consecutive April-June seasons in both FY-21 and FY-22 owing to Covid-related lockdowns. The season makes up 30-35% of their sales. Though pent-up demand aided some recovery in subsequent quarters, it has not resulted in any meaningful growth for these companies on a full year basis. In the last three years, most of them have grown their revenues only in single digits.

Just as the lockdown impact began to recede and companies started the June 22 quarter on a better note, companies were knocked out by inflation – which led to both weaker demand and significant compression in margins.

Below is a glimpse of performance of companies for Q1FY23, and growth and margins on a 3-year CAGR basis.

While the headline growth in revenues for Q1FY23 look spectacular on a year-on-year basis, this has come on a low base of Q1FY22. An ideal comparison would be to look at their pre-Covid revenues (Q1FY20) and vouch for the growth over that base.

Below is a comparison of how some key consumer durable companies have performed compared to the same quarter pre-Covid (only comparable companies taken).

Here, it is clear that companies just managed to cover their pre-Covid sales in Q1FY23. An important point to note is that some of this growth comes from product price increases of up to 20%, which companies undertook to combat raw material price inflation. The underlying volume growth, a measure of underlying strength in demand, is not robust.

But this bleak demand and margin scenario looks set to change. Going into the festival season, there is a lot of optimism among the companies and retailers. While companies are back with new products, retailers are back with promotional campaigns. There are more trade fairs as the pandemic fears recede and physical store visits are also on the rise. There is the anticipation of festival bonuses for employees.

Equally importantly, credit has started rolling back to the sector. NBFCs that predominantly finance purchases have come out of asset quality woes and are looking at the festival season with optimism. So, companies are eyeing broad based recovery in sales and focusing on premium products.

On the margin front, companies can see better quarters on the back of a cool-off in commodity prices and earlier calibrated price increases.

However, note that the effect of the demand and margin recovery will begin to play out only gradually on the growth numbers. For instance, pent-up demand from the June 21 quarter spilling into the subsequent September 2021 quarter makes it a high base to grow from, for companies, in the ongoing September 2022 quarter. Essentially, the overall sentiment on growth looks upbeat and the demand squeeze appears to be dissipating.

#2 Significant opportunity with increase in per-capita income

If the near-term looks positive, the medium to long-term outlook for the durables segment also holds immense potential. This stems from the fact that our per-capita income is still very low (averaging about Rs 150,000 based on government data on 2021-22 estimates). A rising per-capita income will lead to increase in discretionary consumption as families spend a lower proportion of their income on necessities. This apart, there is wide disparity between states.

Currently, lifestyle consumption including modern retailing is concentrated in few high per-capita income States (>$3,000), especially in the West and South (largely the top 10 major States in the above list excluding Union Territories). However, it is slowly expanding to other geographies with rise in income levels. While the trend has been disturbed by Covid, it is clearly the path forward. As lower income states with huge populations join the consumption bandwagon, it can open up significant growth opportunities for categories like consumer durables as compared to staples.

The consumer durables sector, therefore, can see generally sustained demand over the medium-to-long-term owing to the following factors:

- Expanding consumer base with rising per-capita income

- Significantly lower penetration compared to staples

- Premiumisation opportunities as existing high-income consumers move to premium products

The potential in the durables sector owing to these factors can be seen in the way the staples sector has played out. Over the past decade, companies have focused on expansion and premiumisation of their product lines as consumers started looking for choices. Their margin profile saw a shift upwards, a key factor that pushed markets into taking strong notice of the FMCG sector.

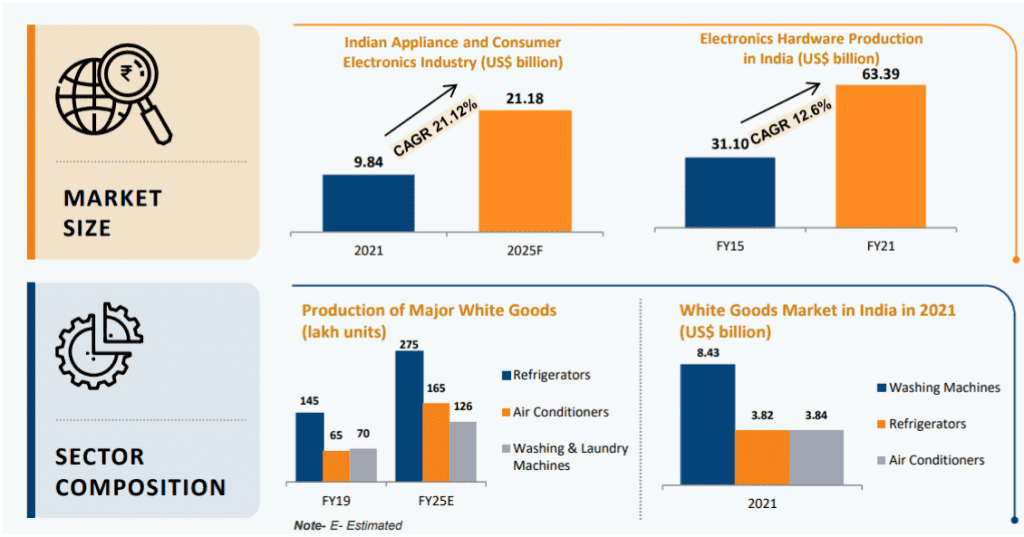

Below is a glimpse into the projected growth of the consumer durable segment for the next few years on the major categories.

Source: Growth of Consumer Durables Industry in India - Infographic (ibef.org)

This can translate into demand for other smaller categories as well including in electrical and non-electrical appliances. It is a strong double-digit growth projection for most of the categories aided by factors we have discussed above and the growth tailwinds can last much longer.

#3 Consolidation and manufacturing to aid growth

Of late, the industry has been going through some consolidation as well with smaller brands finding homes in larger ones. For example, Havells acquired Lloyd Electric, Whirlpool acquired Elica PB India's business to foray into kitchen segment, and Crompton Consumer has recently acquired small appliances player Gandhimathi Appliances that owns the Butterfly brand. This will help companies build up brand and product portfolio, gain market share and tap newer segments.

Companies are also increasing domestic manufacturing either through owned facilities or through outsourcing to contract manufacturers to focus on quality and to avail lower corporate tax advantage (new manufacturing companies that start production before March 2023 will attract corporate tax of only 15%). While many of the companies used the import route to expand their product range and enter new categories pre-Covid, they are now shifting towards domestic manufacturing to increase premiumisation, customisation and inducting new technologies (such as IoT) in their products. This can translate into improved margins and sustained demand and topline.

The move to domestic manufacturing as well as the PLI scheme can help companies engaged in manufacture of durables – a play similar to that in the auto sector, where the auto ancillary route is a good way to gain from demand uptick especially as many of the MNC auto companies were unlisted. However, in terms of scale, Dixon remains the sole large-scale player at this time that does the manufacturing for Xiaomi (LED TV), Samsung, Bosch, Panasonic, Lloyd, Croma, Reliance JIO, Motorola, Nokia, Acer, Boat, etc.

As a whole, the consumer durables sector is shaping up to have a few large players leading market share gains in each category while those engaged in contract manufacturing are going beyond domestic opportunities to exports as well as they gain scale in manufacturing.

#4 Rich valuations, but priced for growth with quality

Companies in this sector are known for their asset light nature, low debt, strong cash flows, healthy return ratios and robust cash conversion cycle - translating into healthy ratios in their Return on Capital Employed (RoCE) and Return on Equity (RoE). This places them on good footing for investors to gain from the improvement in potential.

Below table will give a glimpse into the key metrics of these companies :

(We have written in detail about these ratios and how to interpret them in our article: 3 ratios to pick winning stocks in manufacturing space.)

On the valuations front, most companies have traded upwards of 35-40 times earnings and over 5-7 times book value in the past. markets have tended to accord many stocks the sector higher valuations, possibly due to the consumption tag and their superior return ratios.

Current PE multiples for many companies, though, hold well above this, as can be seen from the table below.

But looking at current PE alone can be misleading as the companies have gone through earnings compression in the last few years. They have also started Q1FY23 on a weak note.

So, one should look at normalised earnings. This can be done by using the PAT margins of these companies during good years like FY18 and FY19 and applying that to future earnings to arrive at normalised EPS and PE ratio. Further, valuations have to be looked into in conjunction with future growth prospects rather than in absolute terms. A price earnings to growth ratio (PEG) of 2X appear reasonable for this sector.

Where to invest

We have recently added a stock from this space to Prime Stocks. We have looked at growth prospects, management quality, capital allocation, return ratios and valuation to zero in on it. But if you want to do your own exploring of this sector, you can use both our Stock Screener and our Stock Ranking tool to create a watchlist and dig deeper. Given the changing prospects in the consumer durables space, there may be other stocks as well that provide attractive opportunities to investors at this point of time.

4 thoughts on “Consumer durables: On the comeback trail”

Hello,

You had indicated that a “Consumer durable” stock has been added recently to your prime stocks list..

I did not find any

You can find the rationale of the stock recommended here. – thanks, Bhavana

Thank you. Is there an ETF or a recommendation for MF from this space

Regards

Madhavan

No, there is not ETF or fund that specifically plays this opportunity. Consumer-themed funds will have some allocation to the sector along with other consumption-oriented ones. – thanks, Bhavana

Comments are closed.