Stocks from commodity sectors tend to be tactical bets rather than secular ones. However, this very attribute makes many investors shun them, making for good tactical buying opportunities. Two large commodity sectors in India that offer many listed opportunities are metals and cement. Out these, cement is a non-traded commodity with minimal import competition.

Fortunes of companies in cement sector are linked to domestic demand-supply dynamics, input and freight costs, geographical presence and most importantly, timely capital allocation decisions by the management. Managements capable of navigating cycles with prudent capital allocation decisions have been the hallmark of wealth creators.

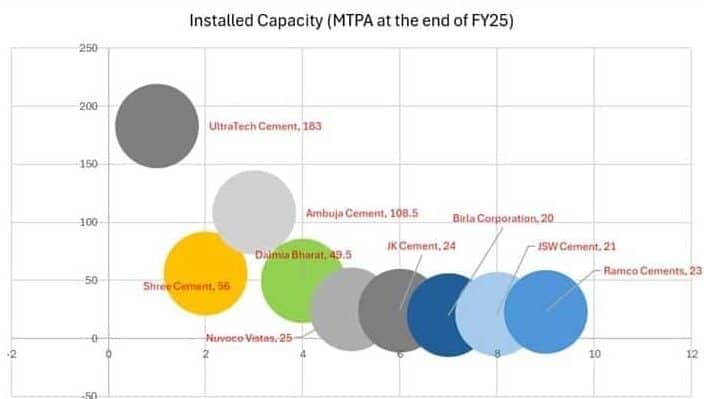

India’s cement industry has been left with a few larger players after the recent wave of consolidation kicked off by the Adani Group’s acquisition of Ambuja and ACC Cements. There is the behemoth Ultratech nearing a 200 Million Tonne (MTPA) capacity, followed by Ambuja and ACC at just over 100 MTPA, followed by two players around 50 MTPA and a bunch of regional players with 20-25 MTPA.

Meanwhile, the key factors that drive earnings such as demand, pricing, input cost and utilisation are looking upwards for the sector at this point of time. FY26 could turn out to be best year for earnings after a gap of 3 years.

This is also one of the sectors that can outperform index-level earnings in FY26.

At this point in time therefore, this is a sector one needs to own in the portfolio.

In this article, we will look at how the dynamics of the sector are evolving at this point of time along with investment opportunities within the top 8 companies with a capacity of over 20 MTPA. In commodity sectors, owning the leaders delivers better risk-adjusted performance.

#1 A good start to FY26 in Q1 earnings

The sector has started on a strong note in Q1FY26 on the back of a favourable base effect, strong pricing environment and benign costs. The quarter is usually seasonally a weak one with monsoons setting in, leading to a lull in construction activity. However, Q1 FY26 has kicked off on a robust note with strong profit growth from cement companies.

Helped by a favourable base effect as Q1FY25 was muted ahead of the general elections last year, cement players could deliver topline growth despite early onset of the 2025 monsoon. This favourable base effect will continue in coming quarters as well as government capex stayed muted throughout last year before picking up in Q4FY25.

Here’s a glimpse into Q1FY26 performance of top cement players

What aided this stellar performance was a recovery in cement prices combined with benign input costs as well as low freight costs.

For many of the players, EBIDTA margin performance is also the best since FY22. If the favourable conditions sustain throughout the year, there is likely to be a 2-4% boost on margins itself (15-25% EBIDTA expansion)

This earnings growth is expected to sustain on the back of key structural factors discussed below and could start a strong earnings recovery cycle for the sector from FY26.

#2 Consolidation done, Utilisation and Growth to play out

Cement is a sector where geographical presence plays a significant role in growth , profitability and in turn valuations. This is because cement is expensive to transport, resulting in regional demand-supply imbalances driving up prices.

Ultratech and Ambuja Cements (Incl. its subsidiary ACC) are the two large pan-India players followed by some strong regional players with a focus on North, East, Central and South India.

Shree Cement and JK Cement have North as their predominant region while Nuvoco Vistas and Dalmia Bharat have East as their predominant region. Central India is the predominant region for Birla Corp while it is South for JSW Cement.

Ramco is a purely a South based player.

Here’s a glimpse into the region-wise total capacity and that of individual players in Million Tonnes Per Annum (MTPA)

Source: Company Presentation, JSW Cements RHP

Ultratech is the behemoth at 183 MTPA or 28% of the industry followed by Ambuja at 15%.

Consolidation drive

The overarching theme of the industry in the last two years was consolidation with the Adani Group acquiring Ambuja and ACC in the middle of FY23.

This marked a major change for the sector, pushing for aggressive consolidation form the leader, Ultratech as well. Thanks to the ownership of Ambuja and ACC by MNC Holcim for a while that allowed players like Shree Cement, and Dalmia Bharat to aggressively expand in the last decade while giving birth to other large new players like Nuvoco Vistas in the East.

(Nuvoco Vistas is owned by Nirma Group and has been formed out of acquisition of another MNC, Lafarge India, and the cement assets of Emami group in the East)

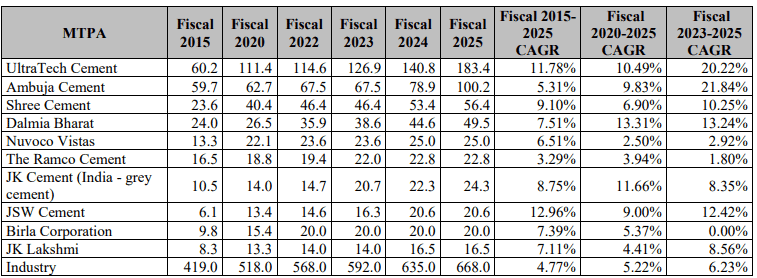

Here’s a glimpse into how capacity expansion for players have played out in the last decade (Ref: Fiscal 2014-25 CAGR. ACC is a subsidiary of Ambuja)

Source: JSW Cements RHP

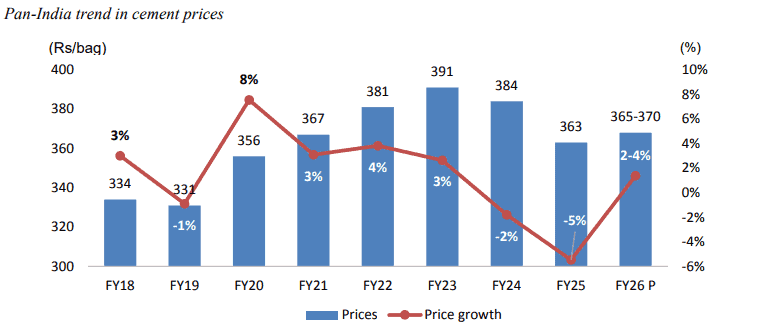

Meanwhile, cement prices hit multi-year low in the middle of FY25 as a combination of subdued demand and aggression from top players to acquire capacity at supressed prices/valuations weighed on the sector. Ultratech acquired majority stake in south- based India Cements and a significant minority stake (8.9%) in North-East based Star Cements (only major player) while Ambuja lapped up stakes in Orient Cement (8.5 MTPA) and Penna Cement (14 MTPA).

Nuvoco has just acquired Vadraj Cements in Gujarat from NCLT, which will take its capacity past 30 MTPA from 25 MTPA now.

But cement prices have strongly recovered in the last two quarters with leaders withdrawing from price suppression earlier than expected. That is what has aided strong performance from players in Q1FY26. The trend is expected to continue post-monsoon with a pricing environment that is expected to trend higher

Source: JSW Cements RHP

Utilisations to move higher

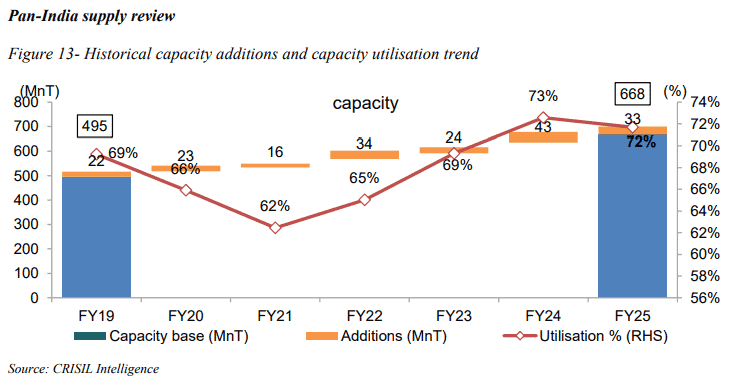

Capacity utilisation is another key determinant of profitability for the sector. Healthy utilisation levels, a tad over 70%, also seem to be aiding profitability. This should go up further with larger players lapping up smaller players across regions.

Sweating of the acquired assets will be the primary focus of the acquirers, which are operating at significantly lower capacity be it India Cements or Penna Cement.

A few large assets landing in NCLT such as the Jaypee Group which is undergoing resolution, will also take utilisation levels upwards.

Source: JSW Cement RHP

With cement demand expected to grow 7-9% on the existing capacity of 668 MTPA, the additional capacity of 75 MTPA is coming in stream in FY26 is also likely to get absorbed in the coming years, leading to a healthy earnings cycle for cement players.

Growth to return

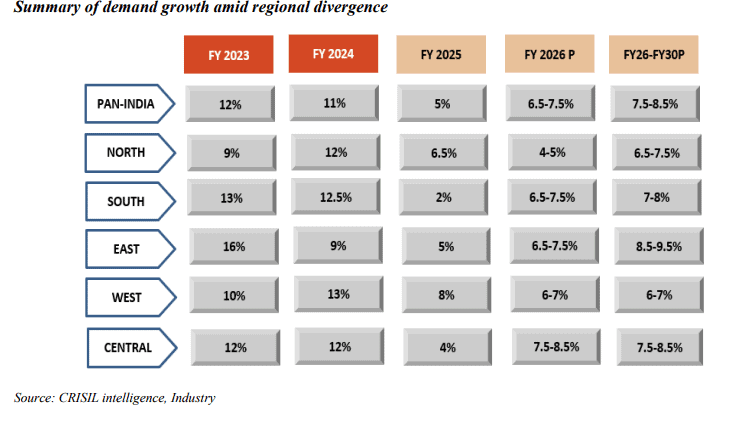

CRISIL expects cement demand to log a slightly higher 7.5-8.5% CAGR between FY26-30. This was prior to GST cuts. During this period, the Eastern (including North-east) and Central regions, which have a higher housing shortage and lower per capita cement consumption, are expected to exhibit robust growth, followed by the South and North.

Demand in the Southern region will be supported by real estate and urban housing projects, and road and irrigation infrastructure projects.

The Western region is expected to witness moderate growth on a high base. This region has high-budget infrastructure projects under execution (Mumbai-Ahmedabad bullet train, multiple expressways and metro projects in Mumbai) but already has the highest per capita cement consumption, which will limit the demand growth potential.

Source: JSW Cements RHP

This paints a robust growth picture for the sector across regions, with profit growth likely to outpace revenue growth in FY26 and through FY27.

#3 Playing the earnings up-cycle

If we take stock of the sector for last 5 years, FY21 and FY22 were strong years for earnings, followed by a weak FY23 and subdued FY24 and FY25.

FY22 was a year of pent-up demand post Covid, combined with massive government spending. On the other hand, earnings were hit by higher costs (raw material, freight) in FY23 due to commodity inflation led by the Russia-Ukraine Crisis.

FY24 and FY25 saw muted realisation/cement price for players which dragged their earnings. Volume growth was supportive for earnings in FY24 despite muted realisations. However, volumes faltered in FY25 as government capex took a backseat due to elections. This proved a double whammy to performance.

Consequently, the earnings cycle for the sector has been weak for the last 3 years, as seen below. A new earnings cycle is kick-starting form this low base.

Further, EBIDTA per tonne for most players peaked out during FY22 with stability returning in FY25, followed by a strong recovery in Q1FY26

Apart from cement prices, geographical presence and capacity utilisation rates also play a meaningful role in driving earnings.

Players in the North, West, East and Central regions have operated at 75-85% capacity utilisation rates with the North being the highest. This explains the performance of North based players like Shree Cement and JK Cement.

Capacity utilisation has been a concern for long in the South, at 60-65% and has dragged overall financial performance of players like India Cements and Ramco. But this is now expected to change with Ultratech and Ambuja going for asset- sweating post acquisitions. Over-capacity was created in the past as each player added capacity to protect their own market shares without a big-picture view. This is likely to change now. Going forward, the top 5 players are adding bulk of the capacities (72-74%) in the next 5 years. This points out to earnings cycle (growth) concentration among these players.

GST cut, a welcome trigger

The recent GST cut on cement to 18% from 28% is also a welcome trigger for the sector.

This will bring down the prices of cement by Rs 30-35 per 50 kg bag and lower the cost of construction for infrastructure and housing projects. This could lift volume off-take.

Larger Pan India players will be the obvious beneficiary of this earnings up-cycle followed by strong regional players, especially in the north, east and southern regions.

#4 Valuation and Preference

Here’s how the valuations stack up for top cement players on EV/EBIDTA

On a forward basis, the valuation appears significantly lower with growth and margin expansion playing out for most of the players in FY26. For most players, the valuation could converge to the median-5 year EV/EBIDTA.

But Ultratech and JK Cements could end up with higher valuations.

Debt is expected to stay elevated for JSW Cement (recent IPO) due to its aggressive expansion plan while debt will go up for Nuvoco also due to its recent acquisition.

Key success factors Investors eyeing the sector need to consider the following factors, in this sequence in stock selection.

- Growth rate and region to which each player belongs

- Companies leading capacity expansion in next 5 years

- Size and balance sheet strength

- Valuations

- Stock price rally, in last 6 months

First preference on all parameters: Ultratech and Ambuja

Pan India players generally showcase resilience on growth and margins across cycles and show less volatility in their earnings even during demand slumps when smaller players land in losses.

Ambuja Cements’ capital raising of Rs.20,000 crore through warrants and previous investments of Rs.8,339 crore in April 2024 has pushed its equity share capital by ~25% and that has led to subdued returns from the stock since the time of acquisition by Adani Group.

The majority stake acquisition of Orient Cement is completed in June 2025 while that of Penna Cements happened in FY25. These assets would be contributing to revenue and profits in FY26. But they would be inferior to Ambuja’s own performance on margins until scale, integration and cost rationalisation efforts play out.

Second preference: Shree Cement, Dalmia Bharat

We have a buy recommendation on Dalmia Bharat in Prime Stocks at this point of time.

(Please read our rationale and Q1FY26 result update for the stock for more info).

High-risk plays: Nuvoco and Ramco

(This is contingent of the strong cement cycle playing out for next 3-5 years)

Nuvoco is planning an acquisition and its debt levels may stay elevated.

For Ramco, a stronger cycle with cement pricing sustaining in south will be the key.

We earlier had a buy recommendation on Nuvoco Vistas as well as we were expecting the recovery cycle to play out in FY25. But as environment turned adverse post elections, the recovery fizzled out. The aggression from Ultratech and Amubja raised risks for for smaller and leveraged players. We reversed our buy call on it and the stock is up 30% from that price.

The securities quoted are for illustration purposes only and are not recommendatory.

11 thoughts on “Cement Sector: On the cusp of earnings recovery”

Hi. It’s a very well written data rich article. Really appreciate!

There is something that bugs me. Cement Sector has hardly ever been at these valuations. I can understand that it might be because of a long bull market.

During last bull market, despite much better growth, it used to look cheap. Can’t understand why a slow and steady sector is valued at unprecedented premium.

Please shed some light if possible.

Welcome your query sir,

If we look at FY26 as a growth year combined with margin recovery, then Ultratech tops on valuation at 22 times EV/EBIDTA and everything else below it. Only other player above 20x is JK Cement.

Even for Shree, it is in a capex cycle and additional capacity is coming on stream in next 2 Years.

Cement being a non-tradeable commodity, prices and in turn growth and profitability are purely decided by domestic factors.

Further, the industry has seen major consolidation in last many years and so all the incremental capacity is coming from top 5 players. Which in turn means the earnings is going to be captured by them only.

Like Steel Cos where Tata Steel or JSW had 2 or 3 Cos inside them (acquired from NCLT) when the steel cycle turned up after Covid.

As of now market is pricing few things; 1) strong demand recovery 2) profit/margin recovery as costs stay benign 3) earnings momentum for top players as they are also putting all incremental capacity (previous cycle was about fragmentation with smaller players putting capacity during 2007-2012)

So, earnings momentum is going to be there in favour of top 5 players.

On valuations, cement has never traded cheap like steel as it has no link to global prices or demand-supply pressures. It is a non-tradeable commodity even within the country.

One way to look at valuation is to assign a base case valuation and then look at how much premium we are paying.

Say 10X EV/EBIDTA for the 4th or 5th player at the turn of cycle and look at how much premium is paid and whether it is justified.

(Not an easy exercise as up-cycle assumptions are currently factored by market in valuations. We have to model at least 3 years of growth + incremental capacity led growth + debt reduction/cash accretion and then calculate EV/EBIDTA 3 year forward to see whether valuations are expensive or not – Valuations will suddenly moderate in an upcycle for commodities)

Promoters are also holding their ownership firm and scaling up, not even selling minority stakes in this bull market to take money home.

Hope this provides some clarification

Thank you

Hello PI Team,

Thanks for the write up , list of stocks has been provided in the order of precedence, is there a fund which leverages cement industry ? Fund will be simpler as there is no handling required to exit or switch in the holding period.

Less preferred but a small case based on the theme will be helpful

Welcome your query sir,

We have a reco. on ICICI Prudential Commodities fund, that has high exposure to Cement & Steel

The fund may have done very well of late as both the sectors have seen a spike in last 3-6 months

The other “category” or “thematic” funds that may have high exposure to Cement are “infrastructure” funds. We don’t have any specific recommendation there.

Hope this helps

Thank you

Please inform top Mutual Funds investing in cement stocks.

N.M.Khambhati

Welcome your query sir,

We have a reco. on ICICI Prudential Commodities fund, that has high exposure to Cement & Steel

The fund may have done very well of late as both the sectors have seen a spike in last 3-6 months

The other “category” or “thematic” funds that may have high exposure to Cement are “infrastructure” funds. We don’t have any specific recommendation there.

Hope this helps

Thank you

Hi Chandra, PI has suggested a stock and a fund with exposure to the sector as part of Prime Stocks/Funds. Is there any other way we can consider or increase the exposure.

Welcome your query sir,

Yes, those are the two available options. We are also evaluating if we can add one more stock reco. to play the uptrend.

Thank you

Thank you, Chandra

Could you please share the link to the fund recommendation with exposure to this sector?

Welcome your query sir,

We have a reco. on ICICI Prudential Commodities fund, that has high exposure to Cement & Steel

The fund may have done very well of late as both the sectors have seen a spike in last 3-6 months

You can see that under Prime Funds recommendations – thematic

https://primeinvestor.in/prime-funds/

The other “category” or “thematic” funds that may have high exposure to Cement are “infrastructure” funds. We don’t have any specific recommendation there.

Hope this helps

Thank you