There is excitement around the IPO of Bajaj Housing Finance for two reasons: one, it comes from the house of Bajaj, a group that has proven that it can generate stupendous wealth for investors. Two, institutional investors seem to be looking at it as an alternative to HDFC, that got recently merged into HDFC Bank.

Bajaj Housing Finance (BHF) is a 100% subsidiary of Bajaj Finance. Being the 2nd largest standalone housing finance company (HFC) by AUM it is considered as upper layer NBFC (Upper layer NBFCs are NBFCs which have large potential of systemic spill-over of risks and have the ability to impact financial stability.

They hence invite a higher regulatory superstructure) by RBI. This regulation makes it mandatory for them to go public and list in the exchanges as well, before September 2025. At a time when market is able to absorb multiple new offerings and offer for sale, Bajaj Housing Finance is also tapping the market for its Rs.6,560 crore IPO, comprising fresh issue of Rs.3,560 crore and offer for sale of Rs.3,000 crore by Bajaj Finance.

The IPO will open on September 9th and close on 11th at a price band of Rs.66-70 per share of Rs.10 each. Post the IPO, Bajaj Finance will continue to own 95% of Bajaj Housing Finance with further requirement to bring it down to 75% over a period of 3 Years (SEBI requirement)

The offer price will lead to its share capital ballooning to ~Rs.8,300 crore post IPO. Will the sheer size of this capital make this elephant difficult to dance? Read our take on the IPO.

Business

BHF primarily caters to the housing needs of prime borrowers with average ticket size of close to Rs50 lakh, largely in the urban centres. Its AUM is concentrated in Maharashtra, Karnataka, Telangana, Gujarat and New Delhi, contributing to 32%, 22.7%, 14.8%, 8.1%, and 7.6% respectively of the total AUM at the end of June 2024.

This apart, it has been aggressively growing in related urban segments such as lease rental discounting and developer financing as well. This contributes to a third of AUM. The table below gives the breakup.

HDFC was the stalwart in the prime lending space, followed by LIC Housing. With HDFC vacating this space, BHF has taken LIC Housing’s number 2 position in this space.

BHF has grown its AUM aggressively over the last 3 years, primarily led by boom in urban housing in the aftermath of Covid and also driven by its thrust to grow its housing finance book aggressively.

Let’s look at where BHF stands in terms of key financial metrics Vs other HFCs

Comparison with other HFCs on key financial metrics

HFCs primarily fall into two categories, ones that cater to “prime” borrowers and the rest that cater to low ticket “affordable” home loan segment.

The affordable housing finance (AHFC) is one where banks don’t operate because of the complexities involved in credit assessment, need for deeper penetration, low ticket size and higher cost of servicing (considering the high-cost structure of banks).

This is where AHFCs have carved out a niche to do business profitably.

Here’s a quick glimpse into the key financial parameters of HFCs belonging to both the categories at the end of FY24.

One can clearly note that the yield for Prime lenders is ~2-4% lower Vs AHFCs. It is to be noted that the primary driver of RoA and RoE is cost of funds and leverage. LIC Housing Finance is operating at 9X leverage to generate 1.7% RoA and 16% RoE while PNB Housing is generating sub-par RoA due to huge capitalisation it has undertaken in FY24. Fortunately for BHF, lower credit cost is driving its RoA and RoE at this point, with an acceptable leverage of 6.7X.

Canfin homes has been a major success story in the long-term and it appears like it has significant access to low-cost funds from its parent, as reflected in its cost of funds being lower than even BHF and LIC Housing Finance. This is the story of of the first category we mentioned – viz. prime lending HFCs

On the other hand, AHFCs have been generating superior RoA and RoE, with far less leverage (4-4.5X), driven by their ability to generate higher yields. Though their cost of operations (opex) is relatively higher, it is being largely compensated by their lending yields.

This has resulted in market giving better valuation to AHFCs Vs the prime lending HFCs so far while BHF is pitching its IPO at a valuation comparable to AHFCs.

Is the IPO offer attractive?

In our opinion, the offer price of this IPO is not attractive for following reasons:

#1 Remaining lucrative standalone as a prime lending HFC – a challenge

The “prime” borrower category is the forte of banks as prime retail mortgage is the most lucrative secured asset class leading to cut-throat competition. Banks have access to low-cost deposits and the pricing comes under the RBI’s external benchmark linked pricing (EBLR) as well, which curbs the available yields at 9-10%.

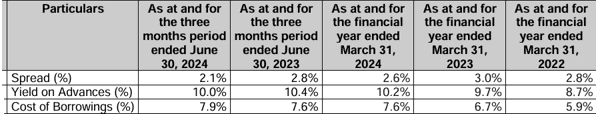

For HFCs, this makes it tough to generate adequate spreads, lending at this yield by accessing money from the market or by depending on bank borrowing. At this point of time, we are looking at data for last 3 years in the case of BHF and this is also a period where the funding environment has been benign for high credit rated borrowers. If we look at the latest June quarter, there has been a visible compression in spreads to 2.1% Vs the 2.8% it used to enjoy for the last 3 years.

Meanwhile, BHF has also aggressively grown its lease rental discounting and developer finance books as explained in the beginning, This can offer tad better yields (HFCs are required to maintain 60% of their book in residential mortgage while they can maintain 40% of their book in other segments).

The very fact that HDFC was merged with HDFC Bank is an indicator that the opportunity for a standalone HFC to make a lucrative business out of catering to prime borrowers may be limited.

#2 High relative valuation

As discussed earlier, the IPO is priced at high relative valuation versus other prime lending HFCs like LIC Housing, PNB Housing and Canfin homes and much closer to that of AHFCs.

Meanwhile, if we look at the core valuation of Private Sector banks at this point of time, it falls between 2 to 3 times book for the ones like HDFC Bank, Axis Bank and Kotak Mahindra Bank. And these banks also operate at ~2% RoA and 15%+ RoE.

For BHF, its lower credit cost is also allowing it to generate RoA just upwards of 2% and RoE of 15% at this point of time. Its Gross and Net NPAs are very low at <0.75% and 0.25% respectively at this point of time, which could potentially go up as the books season out. Its rapid pace of growth in the last 3 years (>30% CAGR) on a favorable real estate upcycle hides potential risks to asset quality at this point of time.

HDFC too had close to 1% NPA on its retail mortgage book and much higher on developer finance book. HDFC’s valuations were also far lower than 3 times book (~2.7X) at the time of its merger with HDFC bank.Hence, relative to leading private sector banks, the valuation is unattractive at 3.2 times price to book.

What can make the company attractive

Post listing, BHF can well pursue M&A opportunities, especially in the AHFC space. The 5 listed AHFCs are largely regional players with significant PE ownership as well. So, there is a significant opportunity ahead for BHF to drive consolidation and build a sizable AHFC book through M&A.

This will also help BHF to bring down promoter stake from 95% to 75% over 3 years if it executes these M&A through share swaps. BHFs current valuation of 3.2 times book, closer to AHFCs, also makes it a probable scenario, later.

If that happens, BHF can build a better yielding book comprising prime home loans, AHFC, LAP, lease rental discounting and developer finance and sustain 2% RoA and 15%+RoE with a reasonable leverage of 6-7 times. This can support premium valuations as well, if that happens.

As we write this, there is no clear visibility that this can happen. So, the IPO can be given a PASS for now in our opinion.