As part of our high-risk bond coverage in Prime Bonds, we look for bonds that provide superior yields for the risk entailed. We seek to take calculated risks if the bond issuers are backed by sound book or a sound parent or both. In this report, we have a bond review of a secured, listed, redeemable non-convertible debenture (NCD) of a micro-finance company with a yield of 11.28% at the time of covering this bond.

Muthoot Microfin, a Microfinance Institution (MFI) promoted by Muthoot Pappachan Group (blue Muthoot) is one of the top 5 MFI in India with an AUM of Rs.9,200 crore. The company did a private placement of Rs 150 crore of secured listed NCDs, in early July 2023. The same is now available through SEBI-registered online bond platform provider (OBPP) IndiaBonds. (It may be available in other places too. We happened to find it here. You will need to check its availability elsewhere). The details of the bond is available in the platform here: Muthoot Microfin listed, secured NCD. If you haven’t invested in privately placed bonds, you must read our article about the risks in these bonds and how we choose them.

Important disclosure – please read

- In an endeavour to provide you with select recommendations of privately placed bonds, we look at various bond platforms to handpick a few and review them here. We have already provided such recommendations from PhillipCapital (India) Private Limited and this one is from Indiabonds. We may look at other bond platforms too if we find suitable products listed there.

- We do not have any kind of commercial agreement with the bond issuers nor bond platforms nor the vendors of these bonds.

- We are not operationally involved with any of the platforms in any way. You will need to have an account or get in touch with the respective bond platforms yourself.

- This is a review/recommendation of the product based on the risk-return pay off of the bond and should not in any way be construed as an advice on your portfolio. The suitability of this product for your portfolio would be based on your own risk appetite, goal, income need and time frame. You should consider these factors or consult a registered advisor before investing.

- Since this is a secondary sale of a privately placed bond through a platform, there is no guarantee on how long it will be available. It might last a few days to a couple of weeks. You will need to check the bond website or check with the broker on its availability.

- The yields mentioned in the report are tentative and subject to changes based on the availability, time and demand of the bond at the time of your purchase. This should not be construed as the final yield.

- Although the bonds are listed and will be credited to your demat, there is no guarantee on its liquidity. You may check with the broker/platform if you wish to sell them.

- Unless otherwise mentioned, our call on the product would be a buy and hold.

- In the case of coverage of perpetual bonds, the yield to call would be the yield mentioned and the assumption is that the bond can be sold on such call date.

- We do not guarantee any safety of principal or safety of transaction in the platform that you operate in. You will need to do your own due diligence before opening an account with any of the platforms. We have merely taken information of the bond availability on such platform and our review is restricted to the bond sale and its risk-return payoff.

About Muthoot Microfin

Muthoot Microfin is the fourth largest NBFC-MFI in India in terms of gross loan portfolio as of December 31, 2022 (Source: CRISIL Report). It is part of Muthoot Pappachan Group (Blue Muthoot) which is one of India’s leading NBFCs in the gold loan space. The unlisted gold loan NBFC, Muthoot Fincorp, holds 54% of the share capital of Muthoot Microfin. Two private equity players hold a third of the stake in the company.

We had reviewed an NCD issue of parent company a year ago. Read the report, to know the background of the parent.

Muthoot Microfin is not a listed company. But it has recently filed its DRHP with SEBI for an IPO, to the extent of Rs.1,350 crore comprising of fresh issue of Rs.950 crore.

Details of the bond sale

After a recent private placement, the NCD of Muthoot Microfin (see details in the table below) are now available for secondary market sale through the IndiaBonds platform. Please note that it provides only a monthly interest payout option with periodic payout of principal. You can check the platform for the cash flow illustration.

Do check the illustration on the platform to see the principal repayment schedule. Broadly the principal would be repaid in the proportion mentioned in the below table.

Business positives

#1 Heightened prospects for MFI

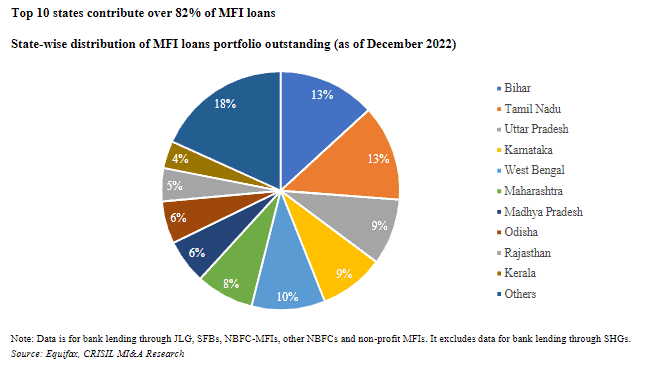

After being one of the worst hit segments in the financial space during the pandemic, the MFI industry is back in the limelight with record high disbursements in FY23 combined with high collection efficiency. Although India’s household credit penetration on MFI loans has increased in the last decade, it is still on the lower side. There is a huge untapped market available for MFI players. Ten States account for 82% of the all India Micro-finance loans and here’s a break up of that.

Source: Muthoot Microfin DRHP, Page 139

With economic revival and unmet demand in rural regions, CRISIL MI&A Research expects the overall portfolio size to reach Rs.4.9 lakh crores by the end of the financial year 2025 from Rs.3.5 lac crores at present.

During the period, NBFC-MFIs are expected to grow at a much faster rate of 25-30% compared with the MFI industry. The RBI’s new regulatory regime for microfinance loans effective April 2022 has done away with the interest rate cap applicable on loans given by NBFC-MFIs and supports growth by enabling players to calibrate pricing in line with customer risk.

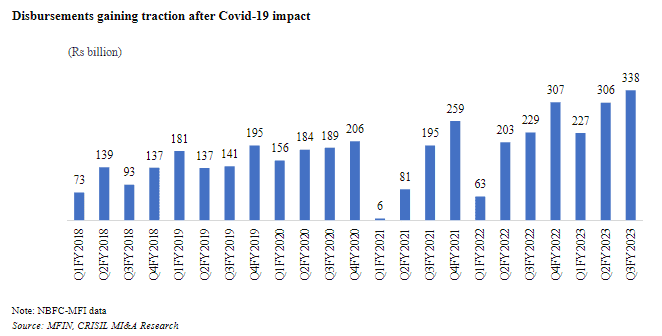

Here's how the disbursements have shaped up in the last 5 years – Prior to Covid and post Covid. The industry has not only come back strongly, but disbursements have also reached new highs in FY23.

Source: Muthoot Microfin DRHP, Page 132

Collection efficiency of micro finance players has also significantly improved from 67.5% in FY21 (when hit by Covid) to 95.84% in FY23 with most states moving above the 90% mark. Barring Maharashtra and Rajasthan, 8 out of the top 10 States for Micro Finance loans have moved past the 95% mark in collection efficiency at the end of FY23.

All the above factors augur well for Muthoot Microfin to use its fund effectively for growth thus enhancing its capability to repay its debt commitments.

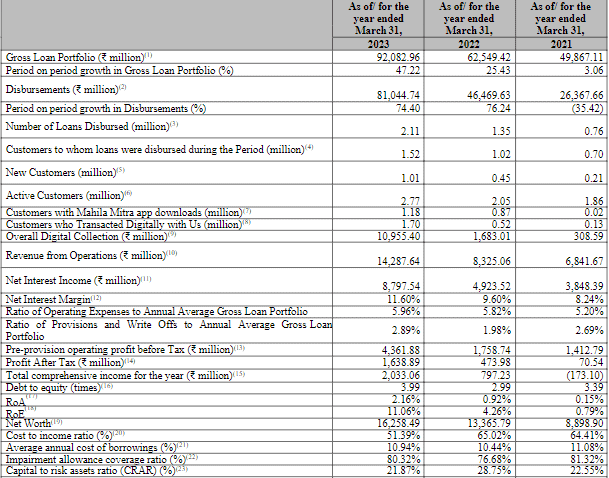

After being hit by Covid, the MFI sector has come back strongly in the last 2 years. Muthoot Microfin too, sailed this trend. Its loan portfolio has grown at a faster clip post Covid, at 25% in FY22 and 47% in FY23 while significantly improving on asset quality and profitability. Below is a glimpse in to the 5-year financial performance of Muthoot Microfin.

Source: Muthoot Microfin DRHP, Page 146

#2 Attempting to diversify geographically

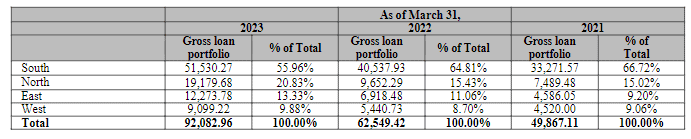

Muthoot Microfin has 2.77 million active customers, who are served by its network of 1,172 branches across 321 districts in 18 states and union territories in India, as of March 31, 2023. Born South, its loan book is more skewed towards South, with Kerala, Karnataka and Tamil Nadu, together accounting for 56% of its total gross loan portfolio. Over the past five years, Muthoot Microfin has expanded operations in North, East and West India, which has allowed it to achieve more geographical diversification. It has opened 596 branches across North, West and East India as of March 31, 2023, representing 51% of its branch count as of March 31, 2023.

The table below sets forth a detailed break-up of geography-wise loan portfolio. The data suggests that the company has been attempting to diversify with the non-southern states now accounting for 44% of the loan portfolio from 33% 2 years ago.

Source: Muthoot Microfin DRHP, Page 148; Rs. in million

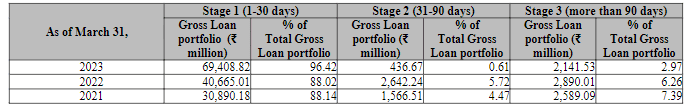

#3 NPAs under check

The table below sets forth the stage-wise movement in NPA in the last three years. Gross NPA peaked out at 7.39% in FY21 (Covid year) and recovered to 2.97% at the end of FY23. In other words, NPAs are well-contained now.

Source: Muthoot Microfin DRHP, Page 150; Rs. in million

#4 Credit rating

Muthoot Microfin has a CRISIL A+/Stable rating for its market linked and non-convertible debentures. Its long-term bank loan facilities also carry similar ratings. It is noteworthy that a large player such as Credit Access Grameen has a CRISIL A+/Positive rating. In general, microfinance companies do not have high credit ratings like other NBFCs, given the very nature of their business risk.

CRISIL is primarily banking on the ownership, common corporate identity and support from the parent, Muthoot Fincorp, for its rating. It also accords strategic importance of this business to the group by virtue of the size it has achieved. Parent Company Muthoot Fincorp has a better credit rating, a notch above the MFI at AA- from CRISIL itself.

The rating also takes in to account of the above average earnings profile of the MFI business historically. Though hit by pandemic, CRISIL expects NBFC-MFIs to do well, post RBI regulations of 2022 that allows for risk based pricing, and benefit ones like Muthoot Microfin.

Separately, as stated earlier in this article, Muthoot Microfin has recently filed DRHP with SEBI for an IPO. If the IPO happens as planned, it could augment its capital base, improve its credit rating, and lend more visibility in the market.

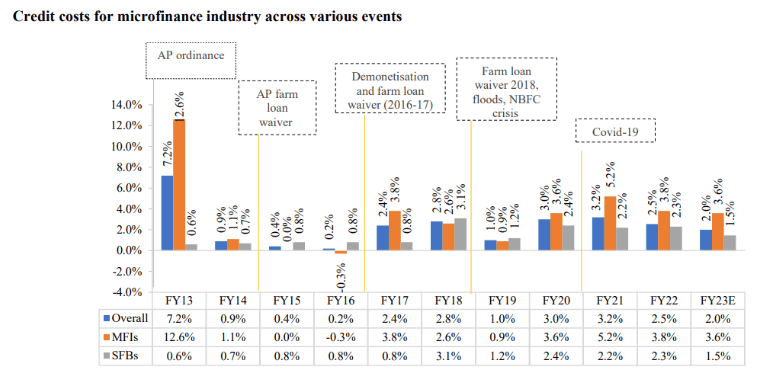

Business Risks

The microfinance industry has faced various headwinds in the past decade, such as the national farm loan waivers (2008), the Andhra Pradesh crisis (2010), Andhra Pradesh farm loan waiver (2014), demonetisation (2016), and farm loan waiver across some more states (2017 and 2018) and risk from Covid (2021 and 2022). Of these events, the Andhra Pradesh crisis of 2010 had a lasting impact on the industry. At the same time, the industry made a self-recovery from Covid. While things are looking bright for the MFI sector now, it has been caught by some credit events every now and then.

There is also an ongoing flood situation in the North states at this point of time and this could turn out to be minor credit event for the sector. There are also upcoming State elections in the later part of 2023 and general elections in early 2024 to take note of, for any potential credit events for the sector.

Here's a glimpse (see image below) into the credit cost for the sector during various the credit events that have played out. You will see a spike in credit cost of MFIs after such events.

Source: Muthoot Microfin DRHP, Page 130

Given that micro financing is essentially unsecured lending, there is no means to recover the money if unpaid. It will eventually be written-off. On that count, MFIs stand higher on risk classification for NCD investors as compared to banks or secured lending NBFCs or even the small finance banks.

Having said, the MFI model has also proved to be very successful save in periods of any major credit fallout. That most of the MFIs survived a crisis like Covid, even as its target borrowers’ incomes were severely hit, is telling of the resilience of the MFI model.

Our take on the bond

While industry leading financial performance is always considered key determinant to premium equity valuation of MFI stocks, other factors such as promoters, ownership, liquidity, and capital adequacy take precedence when it comes to assessing credit risk.

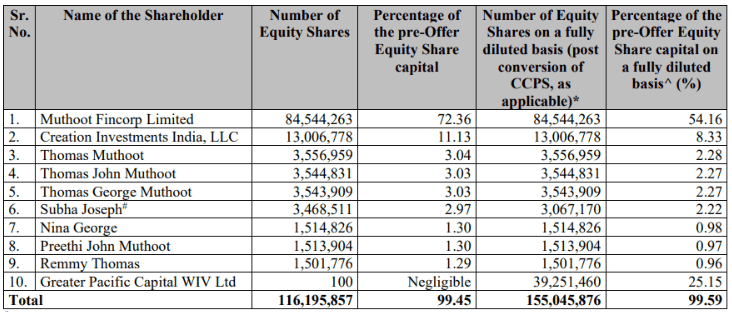

As far as the NCD investors are concerned, the backing of Muthoot Pappachan Group lends significant comfort in this. This apart, the listing of the company’s shares through IPO (when it happens) is likely to improve its Tier 1 capital adequacy significantly above the current 21.87% while lending more visibility for public investors. Here’s the shareholding pattern of Muthoot Microfin

Source: Muthoot Microfin DRHP, Page 84.

Note: Post the proposed share IPO, the shareholding of Muthoot Fincorp may drop below 50% based on the dilution through fresh issue proceeds. But it is still likely to hover around 40-44%. The total promoter stake including family members may hover close to 50%

Further, the MFI space has come back strongly in FY23 and is growing at a fast pace. Unless hit by some specific credit events, the companies in this space has a track record of strong financial performance as well.

A combination of all these factors makes the risk-reward equation for the NCDs favourable for a medium-term investment horizon.

Suitability

- This issuance is suitable only for very high-risk investors given the business risk that micro finance institutions carry. The bond is listed in the Wholesale debt market (WDM) of BSE but may suffer from lack of liquidity.

- The bond has only an interest payout option and will therefore entail reinvestment of the cash flow if you do not need income.

- While the platform may provide some means to offload, you should primarily view this as a buy and hold option.

- You can consider about 5-10% of your bond portfolio in this option, if you decide to invest. Overall, such bonds should not account for a majority of your portfolio. You should exhaust safe investment options before exploring these. Ensure you do not depend on this for your primary income stream and have other safer options.

- This issue requires a minimum investment of Rs 2 lakh (Rs 1 lakh face value) and therefore not meant for very small investments.

- There is only a monthly pay out option. Interest will be taxed at your slab rate and is subject to TDS.

- You need to ensure that you spread your bond holdings and not restrict it to one instrument.

Taxation

Interest income on NCDs is taxable at your slab rate whether on pay out or under the cumulative option (if you hold till maturity). If you sell the bond in the exchanges in less than a year, short-term capital gains, at your tax slab, will be applicable. If you sell after a year of holding, then long-term capital gains tax of 10% without indexation will apply.

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (hereinafter referred to as the Regulations).

1. PrimeInvestor Financial Research Pvt Ltd is a SEBI-Registered Research Analyst having SEBI registration number INH200008653. PrimeInvestor Financial Research Pvt Ltd, the research entity, is engaged in providing research services and information on personal financial products. This Research Report (called Report) is prepared and distributed by PrimeInvestor Financial Research Pvt Ltd with brand name PrimeInvestor.

2. PrimeInvestor Financial Research Pvt Ltd, its partners, employees, directors or agents, do not have any material adverse disciplinary history as on the date of publication of this report.

3. I, N V Chandrachoodamani, author/s and the name/s in this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any financial interest in the subject company.

I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period.

4. I, N V Chandrachoodamani, do not hold this bond as part of my investment portfolio. I/analysts in the Company have not traded in the subject bond thirty days preceding this research report and will not trade within five days of publication of the research report as required by regulations.

5. PrimeInvestor Financial Research Pvt Ltd has not received any compensation from the subject company in the past twelve months. PrimeInvestor Financial Research Pvt Ltd has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, PrimeInvestor Financial Research Pvt Ltd has not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report.

9 thoughts on “Prime Bonds: A 11% yielding NCD from a micro finance player”

hi team

https://goldenpi.com/bonds/INE046W07263/muthoot-microfin-limited-1075-bond-yield?src=view_details

is it the same , if not does it look good to invest. i am confused between the different bonds of muthoot-microfin.. does different platform can provide different versions of the NCD

Thanks

Sudipta

Yes, same issuer can come up with different bonds. That is why we give the ISIN. please always check for ISIN. As for this query –

We have responded through the ticket now. In general, the blog is not a support channel. it is meant for comments and discussions. When you raise a ticket (through contact us) please be assured we usually attend within a TAT of 48 hours on working days. if you raise a support ticket, kindly refrain from also raising on the blog. thanks, Vidya

Hi, Would the recommendation apply for MUTHOOT MICROFIN LIMITED 10.75 NCD 01AG26 FVRS1LAC also, as-is? Pls advise.

If the maturity tenure (3 yrs) and coupon rate are the same, it is fine. Please know that these can be highly illiquid instruments. Don’t expect easy sale in open market. You might need to approach the platform for any takers. Our call is a buy and hold to maturity. Vidya

Hi,

Thank you for sharing this.

These NCDs will be credited in demat account right and can be sold on open market?

Also can these securities be pledged for margin?

Yes it will be but please read the article fully. These instruments are HIGHLY ILLIQUID. You will unlikely be able to sell them easily and may need to approach the bond platform to see if they can. Our call is for a buy and hold only. Vidya

Considering that interest rates would go down in the near future and so i presume yields will go down, so in general is it advisable to invest in Bonds at this point of time? Please suggest

Yes, this is a good time for lock-in. Our friday’s article will have more details about locking in for the long term. Vidya

Considering that interest rates would go down in the near future and so i presume yields will go down, so in general is it advisable to invest in Bonds at this point of time? Please suggest

Comments are closed.