₹ 11,500 + Cr worth portfolios reviewed

Portfolio Review

Review your live stock & mutual fund portfolio in minutes! Spot risks, get clear buy/sell/hold calls & boost your returns.

What You Get with Portfolio Review

From review to action—your portfolio, perfected.

01

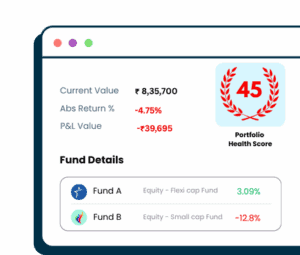

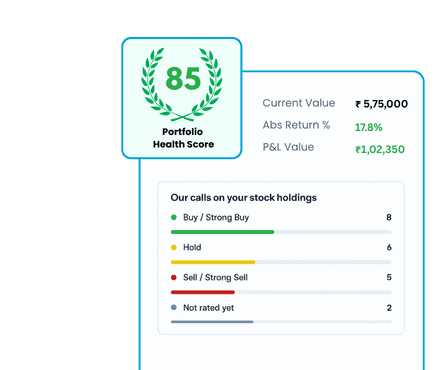

Portfolio Health Score

A complete portfolio analysis to assess how well it is built. Know at a glance if your portfolio is on the right track or if you need to make big changes.

02

Allocation insights

See your exposure by asset class, marketcap size, sector & more. Spot hidden concentration risks before they hurt your portfolio.

03

Easy holdings import

Import all your mutual funds, stocks, and ETFs in seconds with just your PAN and mobile number. Keep your portfolio updated with easy refreshes.

PrimeInvestor is 100% safe & secure

Your security and privacy are our top priority!

We value your privacy. Your data is protected with industry-leading safeguards.

SEBI Reg No: INH200008653

Numbers

That Matter

Your portfolio review is powered by our comprehensive research. From dissecting hundreds of mutual funds & ETFs to analyzing company fundamentals, our analysis goes deep so your review is built on substance, not surface. With years of data and thousands of investment decisions studied, you get insights you can trust.

₹11,500 Cr +

Portfolio Value Reviewed

800 +

Mutual Funds Analysed

160 +

ETF Analysed

900 +

Stocks Researched

2500 +

Researched Hours

Review your portfolio

Review your stock or mutual fund portfolio for actionable insights.

Mutual Fund Review

Comprehensive analysis of your portfolio allocations, risks, expense ratios, and optimization opportunities.

Stock Review

Deep dive into individual stock calls, sector allocation, marketcap break-ups and growth scenario analysis

Frequently asked

Questions

What is Portfolio Review?

Portfolio Review is a comprehensive investment check-up tool that helps you analyse your mutual fund, stock, and ETF holdings. Instead of merely tracking returns, it goes deeper to uncover:

- Performance gaps – Identify underperforming funds or weak stocks

- Cost leaks – Flag high-expense funds and avoidable regular-plan costs

- Risk balance – Assess whether your portfolio matches your goals and risk tolerance

- Diversification issues – Highlight concentration across sectors, market caps, or holdings

- Actionable insights – Clear Buy / Hold / Sell calls and portfolio optimisation cues

It works like a diagnostic report for your investments — giving you a clear picture of portfolio health and areas that need attention.

For investors seeking continuous oversight beyond periodic reviews, these same evaluation principles are applied within PrimeInvestor’s managed portfolio offering, where portfolios are actively managed and rebalanced by an experienced investment team.

What kind of investments can be reviewed?

The Portfolio Review tool is designed to cover the primary investments in every investor's portfolio. You can review:

Mutual funds – All funds across equity, debt, hybrid, or international

Stocks – Stocks across sectors and market capitalisations that are NSE listed

ETFs – Across asset classes including equity, debt, and gold

How does Portfolio Review work?

The Portfolio Review tool imports your holding data. It provides insights on your portfolio based on research-built metrics.

Mutual Funds – Enter your PAN & mobile number, verify via OTP, and your entire mutual fund portfolio is automatically fetched no matter where you hold those funds. The tool then analyzes each fund across performance, risk, costs, and concentration.

Stocks & ETFs – Enter your PAN & mobile number and select your broker, and you can directly import stocks held through that broker. Alternatively, you can upload your holdings manually. The tool checks provides insights on valuation and diversification. Importantly, it gives Buy/Sell/Hold calls on your stocks.

What can I review under mutual funds?

Mutual fund portfolio review provides a 360° analysis. It provides insights on your portfolio including:

Portfolio snapshot (invested value, gains, XIRR, and allocation to sectors, credit rating, maturity & more)

Portfolio risk based on fund categories held, to help you understand if you have taken too much or too little risk

Buy / Hold / Sell calls on funds, for easy remedial action or to know where to make fresh investments

Concentration and ideal fund count

Cost comparisons (regular vs direct plans)

What can I review under stocks?

You get a detailed analysis of your stock portfolio, including:

Stock selection score – Whether you have picked the right stocks.

Expert Calls – Buy/Hold/Sell ratings backed by research models.

Portfolio snapshot – Value, returns, portfolio PE valuation compared with the Nifty PE ratio

Sector Allocation – Visual view of exposure to different industries.

Projected Returns – Scenario-based forecasts you can make to gauge portfolio value.

Do I need to monitor and review my portfolio often?

Yes. Regular monitoring helps ensure your portfolio remains aligned with your goals, risk tolerance, and changing market conditions. For investors who prefer not to track and review portfolios frequently, PrimeInvestor offers a managed approach through its mutual fund and stock PMS strategies where an expert investment team monitors and manages the portfolio on an ongoing basis.

What makes a Portfolio Review tool unique compared to other tools?

Most portfolio tools only track NAVs or returns. Portfolio Review goes much deeper by:

Giving Buy/Hold/Sell calls on mutual funds and stocks based on comprehensive research.

Highlighting hidden costs (like high expense ratio funds or regular plan drag).

Checking risk–return balance and telling you if you're over-invested or under-invested in high-risk investments.

Providing valuation insights like your portfolio PE against the Nifty PE & helping you judge how much your portfolio can grow to.

In short, it’s not just a tracker—it’s an action-oriented review tool built to help you optimize, and not just monitor, your mutual fund, ETF and stock investments.