SBI Banking and PSU Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 3309.7766 2.844(0.086 %) NAV as on 19 May 2025

Scheme Objective: The scheme seeks to generate regular income through a judicious mix of portfolio comprising predominantly debt and money market securities of Banks, Public Sector Undertakings, Public Financial Institutions and Municipal bodies.

Performance (As on 19 May 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.83 % | 3.67 % | 5.52 % | 10.01 % | 7.81 % | 6.52 % | 8.06 % | >

Portfolio

Banking and PSU debt funds invest in instruments issued by banks, such as bonds and certificate of deposits and debt papers of PSU companies. These funds make returns from the interest accrued on papers as well as price appreciation on the PSU bonds during downward rate cycles. Average maturities for these funds change based on interest rate cycles. These funds typically carry low credit risk as they restrict themselves to PSU companies and banks.

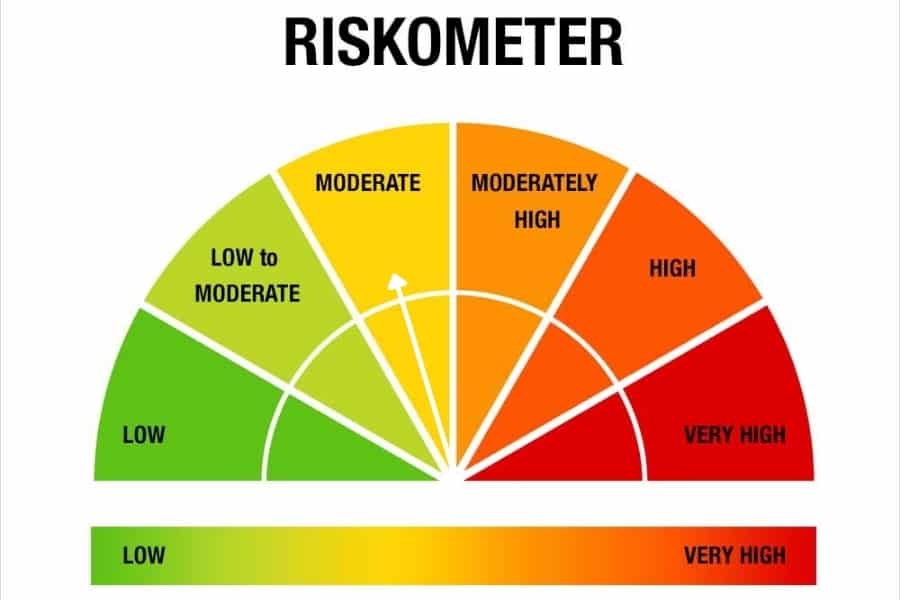

These funds suit any investor with investment horizons above 3 years. Some funds may be riskier than others, so a check on portfolio will be prudent.