Invesco India Balanced Advantage Fund(G)

View the direct plan of this scheme

Rs 53.11 -0.02(-0.038 %) NAV as on 16 May 2025

Scheme Objective: To generate capital appreciation / income from a mix of equity and debt securities which are managed dynamically.

Performance (As on 16 May 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 2.39 % | 8.65 % | 15.54 % | 15.05 % | 9.94 % |

Portfolio

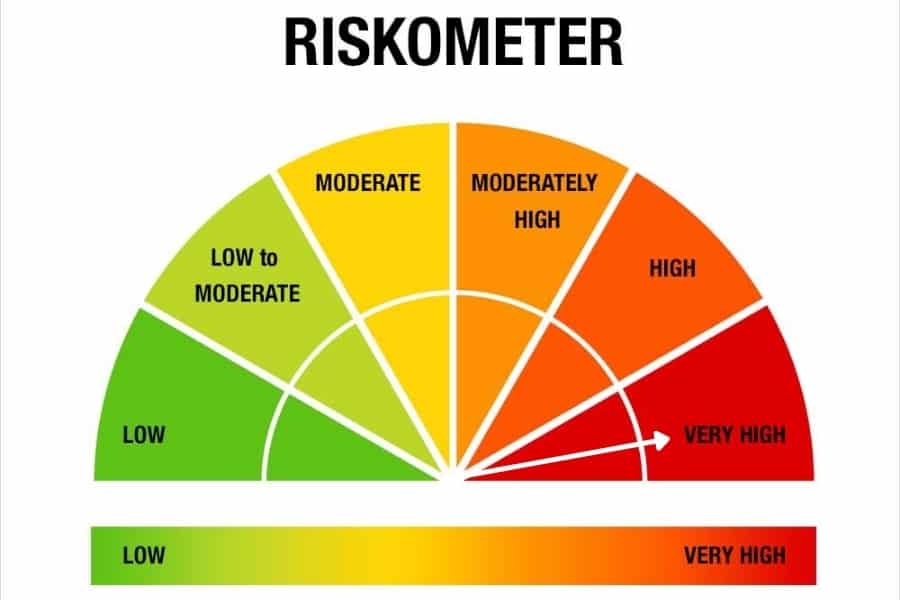

Dynamic asset allocation funds invest in both debt and equity. Allocations are decided on a valuation-based model. Funds define the ranges of allocation to equity and debt, and they can invest even their entire portfolio in equity or debt. These funds are lower volatile than pure equity funds, but have a lower return potential due to debt exposure. Taxation is based on the average equity exposure of the 12 months preceding the date of redemption. If it is 65% or higher, it is taxed like an equity fund and as a debt fund if not.

These funds suit investors who would like their funds to take cash and debt calls when equity is expensive or volatile.