DSP Regular Savings Fund-Reg(G)

View the direct plan of this scheme

Rs 58.4458 0.058(0.099 %) NAV as on 16 May 2025

Scheme Objective: The objective of the Scheme is to seek to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities.It will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of the 100 largest corporates.The Scheme will also invest a certain portion of its corpus in money market securities, in order to meet liquidity requirements.

Performance (As on 16 May 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 5.34 % | 11.48 % | 10.83 % | 10.57 % | 8.80 % |

Portfolio

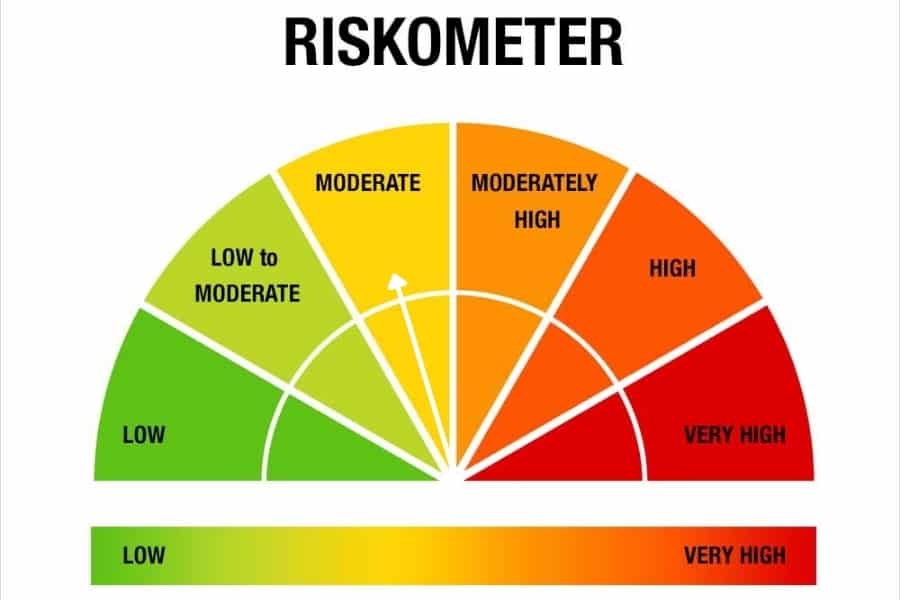

Conservative hybrid funds invest 75-90% of their portfolio in debt instruments with the remaining in equity. These funds aim to generate returns higher than pure debt funds through the equity allocation. In their debt investments, funds can change strategies based on market movements and don't have to follow a steady strategy. They can, for instance, go in for low-rated debt to earn higher coupon.

These funds suit investors who wish for debt-plus returns without taking on high equity exposure. These funds need to be held for at least 2 years.