Mankind Pharma, which operates in the domestic pharmaceuticals space, opens its Rs 4300 core IPO today. The issue is priced at a band of Rs 1,026 – Rs 1,080 per share of face value Re.1/-.

The IPO is entirely an offer for sale by the promoters and existing investors; no part of the issue proceeds will flow to the company. The selling entities will offload 40,058,844 equity shares or 10% of the total equity. Post issue, promoters will hold 79% equity.

The IPO is open for subscription until April 27.

Mankind Pharma – Business

Mankind Pharma is a family-owned business built over the last 3 decades and is focused solely on the domestic pharmaceutical market. Over the years, it has become the 4th largest domestic pharmaceutical company in sales and 3rd largest in volume. Its business is a mix of prescription medicines and OTC consumer health products with leadership in some segments. It is present in several acute and chronic therapeutic areas, which addresses 69% of the therapy areas by classification. Mankind’s focus over the years centred on building and scaling up brands for the domestic market, akin to that of consumer companies. And much like consumer companies, Mankind spends heavily on advertisement using leading film personalities to push its products and brands.

Here’s a brief history of its financial performance.

Domestic-only, domestic-plus-exports, MNC pharma companies – how they differ

Once in the limelight, the pharmaceutical sector has now become one where investors see mixed results and fund managers make polarised bets. The risk-return nature of the different categories of pharma players thus becomes important.

It is the exports of generics, especially to US, that made the pharma sector what it is today and led to strong wealth creators for investors. The top 5 companies by market cap are still export heavy players. But since 2016, the US exports business has been hit by US FDA compliance issues and price collapse for generic drugs. This made domestic-focused players more attractive as they demonstrated a track record of steady earnings growth.

For MNC pharma companies (Indian subsidiaries that solely focus on Indian market), growth seems to have tapered off going by sales growth over the last decade. At the same time, many Indian-born companies with domestic focus gained size, surpassing MNC players by a wide margin, through product acquisitions and collaborations.

The domestic-focused players (including MNCs) also have a cost and profit structure akin to FMCG companies, with a bigger thrust on manufacturing and distribution rather than R&D and compliance - unlike the export focused players. That is, these companies are oriented towards sales with their portfolio tilted towards a mix of OTC and prescription products.

From an investor’s point of view:

- Export-focused players offer opportunities for disproportionate returns due to high volatility and upside from their R&D efforts. But it requires significant industry expertise to catch stocks at right inflection points.

- Domestic focused players offer prospects for steady returns with less volatility, but they seldom are at reasonable enough valuations to make returns beyond their growth rate.

The domestic pharma market

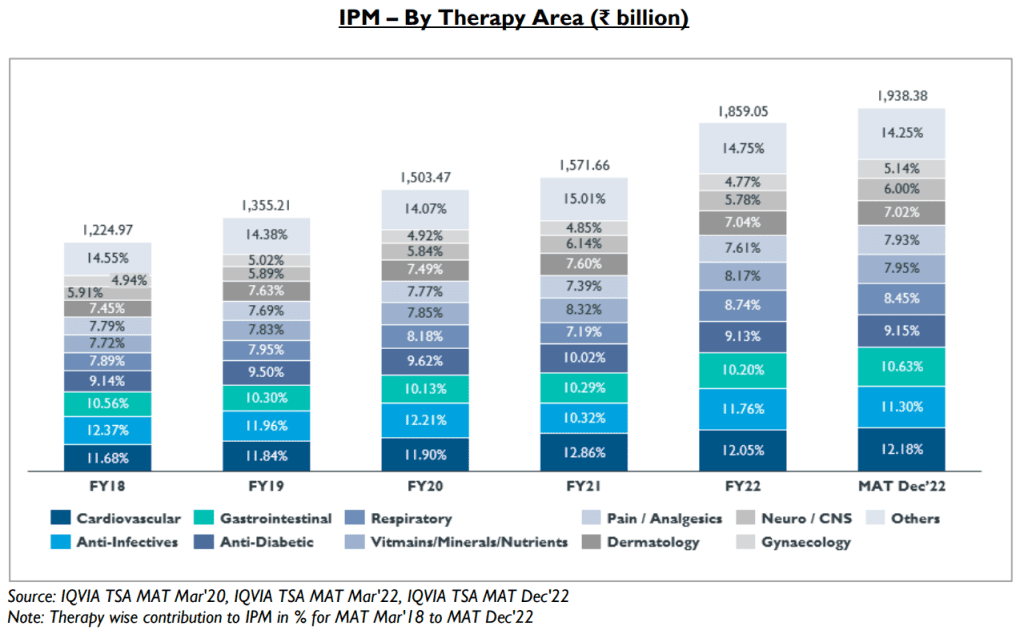

The size of the domestic pharmaceutical market was estimated at Rs.1939 billion ($23.6 billion) at the end of 2022 and is forecast to grow at a CAGR of 10-11% to reach Rs.3,000 – 3,100 billion ($38 billion) by 2027. This market covers a wide range of therapeutic areas, each a different size, as shown in the image below.

The domestic pharmaceutical market is primarily a branded generics market. In value terms, the market is ~97% branded generics and just 3% innovator drugs. Branded generics hold the advantage of low prices and higher availability, which will help retain dominance.

In this market, Indian generic players control 80-85% of the market with MNCs share at just 15-20%. The top 10 players are Cipla, Sun Pharma, Dr Reddys, Intas, Alkem, Lupin, Macleods, Mankind, Torrent and Zydus. These top 10 control close to 44% of the market. The next 10 players control 21%. For the market leaders, therefore, there is still growth to gain from market share expansion.

On the demand side, urbanisation, increasing income levels, Govt. schemes and affordability are expected to be the key drivers for pharmaceutical products in India. With rising life expectancy, urbanisation and affluence levels, the associated lifestyle changes ranging from sedentary behaviour, stress and poor diet are driving a prevalence of chronic diseases. The chronic segment – where Mankind Pharma has a presence - has grown at a relatively faster rate of ~12% CAGR compared to overall market (~10%) in the last 3 -4 years.

Key Strengths

#1 A leading player in domestic pharmaceutical market

Mankind Pharma is the 4th largest player (by value) in the domestic pharmaceutical market with a market share of 4.3%. It is present in both acute and chronic therapeutic areas; as mentioned earlier, the company’s products address a good 69% of the therapeutic areas.

It intends to remain a domestic focused player, where there are limited alternatives in the listed space. Other pharma players typically have an export-domestic mix that leave them vulnerable to higher competition in markets like the US and more risks of regulators such as the US FDA impacting manufacturing. Mankind, with its domestic market focus on OTC and prescription products, is positioned for steady growth with less earnings volatility unlike the export focused players.

Mankind Pharma’s strategy has focused on building presence in the domestic market. It has scaled up several brands; 21 brands are among the 300 highest selling brands in their respective therapeutic areas. The key therapeutic areas that contribute to its sales are anti-infectives (14%), cardiovascular (13%), gastrointestinal (11%), vitamins/nutrients (9%), respiratory (9%), anti-diabetic (8%) and gynecology (8%). Moxikind, Telmikind and Neurokind are some of the major family of drugs in these therapeutic areas.

Gynaecology, though, is dominated by consumer health products where it is a major player. This is another area where Mankind is set apart from other domestic listed pharma players. Its brands such as Manforce, PregaNews, Unwanted 72 in the condoms, pregnancy detection and emergency contraceptives command a leading market share. The potential of this business doesn’t require much explanation at a time when India has surpassed China in terms of population with favourable demographics! A detailed list of Mankind’s key products and their sales value are listed out in Pages 205-215 of the RHP.

#2 Balancing affordability with margins

As mentioned in the industry section above, India is largely a branded generics market where affordability rules strong. Mankind Pharma has evolved as an affordable branded generics player that supplies quality products.

The company claims that 80% of the doctors in the country prescribe its formulations. Having started with tier 2 – 4 cities in its early growth phase, Mankind derives a healthy 47% of its sales from those markets. This compares with an industry mix of one third from tier 2 – 4 cities. Major players including MNCs derive two thirds of their sales form metro and tier 1 markets. This helps Mankind make inroads into markets where competition is limited, and where its affordability can hold it in good stead.

Despite its focus on tier 2 – 4 cities and being pocket-friendly, Mankind has a history of operating at close to 20+% EBIDTA margins over a long period of time (as per available data from other sources). This could be attributed to its inhouse manufacturing at scale along with a healthy mix of consumer products in its portfolio.

Mankind also has many products or family of products with a sizable revenue base of Rs.300-500 crores. This apart, it has a lower proportion of products under price control, at just 13% of its overall sales, which helps keep regulation-driven margin pressure under control. Being an affordable player and still making healthy margins is a strong competitive advantage.

#3 Focus on growth through brand building in new therapeutic areas

Mankind has been growing at 15-18% CAGR over the last 10 years and intends to grow at 1.2 to 1.4X industry growth rate (10-11%) through market penetration and entering new therapeutic areas. One of its strategies is to drive deeper penetration into metro and tier 1 cities where its proportion of revenue is low versus other industry players.

The second strategy is to expand its product portfolio in chronic therapeutic areas and increase the segment’s market share from the ~34% of its portfolio that it currently has. As mentioned earlier, the chronic segment has clocked faster growth within the domestic pharma industry, compared to other areas; the segment’s share by value has jumped from 34.7% to 37.5% over the past 3-year period. Major chronic therapy areas such as cardiovascular and antidiabetic are expected to grow at 11-13% CAGR over the next five years.

Mankind Pharma is exploring both organic and inorganic routes. Its acquisition of Panacea biotech’s domestic formulation business for Rs. 1,808 crores in FY22 comprising antidiabetic, oncology and transplant products seems to be a major step in this direction. It has also made a minor acquisition from Dr. Reddys in the dermatology and respiratory space.

This apart, partnerships and co-marketing agreements between Indian and foreign companies are expected to increase over the next 5 years, reflecting benefits for both originator and local partners. Last year, Mankind launched NEPTAZ in a collaborative agreement with Novartis in the cardiovascular segment, whose patent expired in January 2023. To put this opportunity in perspective, Novartis has a domestic arm with annual sales of Rs.400 crores and still opted for a collaboration.

Key Risks

#1 High base effect of Covid on earnings growth

Mankind has seen significant growth in sales and margin in FY22, partly driven by Covid-related drugs, which has set a high base for growth going forward. FY22 has seen sales growing at 25% compared to its historical average of 16-18%. Margins also expanded to 26% from its historical average of around 20%.

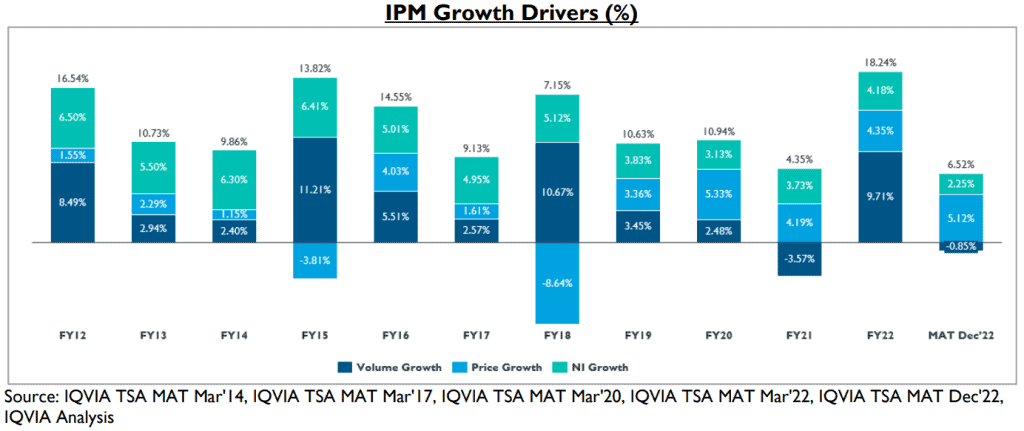

The graph below shows the growth drivers for the market as a whole. As can be seen, the spike from Covid has tapered off; volumes in the April-December 2022 period have contracted, driving a fall in growth. For sustained margins and growth, healthy volumes are essential.

For Mankind Pharma, EBIDTA margin has already moderated to 22% in 9M FY23; IPO valuations appear to have factored this in. Even so, there are still risks to earnings growth from this high base – one, volume growth needs to pick up. Two, Mankind’s ability to scale up its presence in chronic therapies through collaborations or acquisitions will influence how much it can grow faster than the industry. Three, the current high base has been driven in part by one-off circumstances that will be hard to sustain.

For Mankind, revenues in the April-December 2022 period grew 11% over the year-ago period (after accounting for the Panacea business acquisition), while PAT has shrunk 19% during this period.

#3 Panacea Biotech’s business acquisition

As mentioned earlier, Mankind acquired the domestic formulations business (with the sales team and production facility) of Panacea Biotech in FY22 worth Rs.1,808 crores. As per the details available, the acquired business had sales worth only Rs.220 crores in FY22. The bulk of the consideration (Rs. 1,543 crores) is amortized for a life of 15 years. The manner in which Mankind uses this acquisition to its market growth, and its ability to rapidly scale it up will be key for it to maintain its superior RoCE as this is a major acquisition.

Our call

Mankind Pharma is going for an IPO after its business has attained a large size. Earnings growth has also got a favourable boost over the last 2 years due to Covid. The issue is priced at 32 times FY23 annualised earnings and could be 27-29 times 1 year forward earnings based on how earnings growth plays out in FY24.

Viewed in isolation and on the basis of Mankind’s healthy balance sheet, cash flows, and strong market presence, the IPO is not prohibitively priced. However, the following factors render the valuations more expensive:

- The pharma sector itself has gone through a rough patch, with large players seeing significant correction. We even recently issued a buy call on a major pharma stock that’s available at attractive valuations. Mankind’s IPO is priced at par with, or at richer valuations than larger players. The IPO would thus require compounding from a higher base.

- Mankind’s valuations also need to be viewed in terms of earnings growth from here. For reasons explained above, there are risks to Mankind clocking the high growth it has seen over the past couple of years. A revert to the industry growth rate, or even marginally industry-plus, would render current valuations expensive.

Therefore, while we like the company’s business profile, we’d prefer to keep this on our watchlist for better entry points or for more clarity on sustainable margins.

The other aspect to consider is the wide range within the pharma space (see box above), with variations between each company – there are those in the higher-end of the value chain involved in drug discovery, those making pure ingredients and so on. A basket approach of using Mankind Pharma along with other pharma stocks may thus work better than using this stock alone for pharma exposure. We have recommendations in both funds and ETFs to play the pharma theme.

Please note that this review does not take into consideration the possibility of listing gains.

2 thoughts on “Mankind Pharma IPO: Invest or avoid?”

If we eliminate Covid attributed sales, What would be expected Sales?

Also, Domestic price on certain drugs is allowed to increase effective from Apr 2023. How this would help Mankind?

Welcome your query sir,

As you can see from the report (Key risks part), sales grew 11% while PAT contracted 19% in 9MFY23 Vs 9MFY22 despite some contribution from Panacea acquisition.

So, the best guess to make is that any excesses in sales and margins due to Covid will fully reflect in FY23 and growth wwill resume from FY24.

Their historical growth rate has been 16-18% and that is likely to continue on both sales and profit from FY24

Hope this clarifies. Otherwise, there are no clear numbers available on Covid related drug sales

On price controls, drugs under price control forms only 13% of sales for Mankind. So, there should not be any material uptick to earnings

Thank you

Comments are closed.