Given rate adjustments by other banks and NBFCs recently, a significant rate cut may soon be in the offing in this deposit as well. Investors and seniors looking for deposit options should lock into this FD before rates are revised.

These are hard times for fixed deposit investors, with all the entities that offer relative safety of capital busy slashing their deposit rates. As we write, leading banks such as SBI and HDFC Bank have already reduced their rates on 1 to 5-year fixed deposits to 5.7% and 6.15% per annum respectively. Small savings schemes, after recent resets, now offer just 5.5% for 1 to 3-year deposits and 6.7% for the 5-year deposit.

But one reputed entity that offers safety with relatively good rates is India’s largest home finance company – Housing Development Finance Ltd (HDFC). HDFC has not revised its interest rates on smaller retail deposits since December 24, 2019. Given rate adjustments by other banks and NBFCs recently, a rate revision may soon be in the offing when there will be significant cuts. Investors and seniors seeing deposit options should lock into this FD before rates are revised.

Which tenures?

While HDFC offers fixed deposits for 12 to 84-month tenures, with interest rates at a two-decade low it is best for FD investors to stay only with its less than 3-year FDs currently. By sticking with short tenures even for your long-term savings, you will be able to benefit from any reversal in the interest rate cycle that comes up in the next two years. Such a reversal is quite likely once the COVID crisis abates, the economy resumes activity and financial market conditions normalise. This process is unlikely to take beyond a year or two. Locking into 3 year plus deposits today will force you to lock into record low returns.

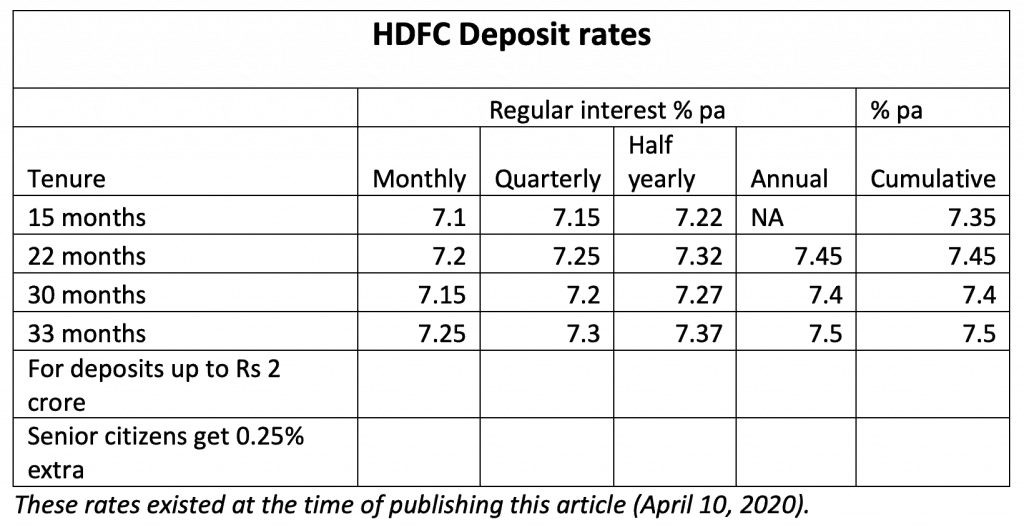

Keeping this in mind, we recommend that retail investors stick with four specific tenures from HDFC Ltd.

For regular income investors, the 15-month deposit offering 7.22% (only monthly, quarterly and half yearly interest are available in this tenure), the 22-month deposit offering 7.45% (for annual pay-out), the 30-month deposit offering 7.4% (for annual pay-out) and the 33-month deposit offering 7.5% (for annual pay-out). Do note that rates are lower of you choose more frequent pay-outs.

Those seeking cumulative options can go for the 15-month deposit offering 7.35%, 22-month deposit offering 7.45% or the 33-month deposit offering 7.5%. These are rates applicable for deposits less than Rs 2 crore.

Senior citizens will receive 0.25% more on the same deposits. If you opt for the monthly payout in the above, you’ll have to deposit a minimum of Rs 40,000. For quarterly, half yearly or annual pay outs or the cumulative option, the minimum deposit is Rs 20,000.

Features

Should you need cash for an emergency, HDFC allows premature withdrawal after the expiry of three months at the discretion of the company. Deposits broken within 6 months will earn 4 %. Those broken after 6 months but before maturity date will receive interest at a rate 1% lower than the prevailing rate for deposits of that tenure. If there’s no deposit of that tenure, the rate will be 2% lower than the minimum FD rate from HDFC. There’s also a loan facility available for upto 75% of the deposit value at interest rates that are 2% higher than the deposit rate.

About HDFC

HDFC, incorporated in 1977, has a track record of over four decades in financing home mortgages and related activities in India. It is the rare deposit-taking entity to have enjoyed a AAA rating for its deposits from two rating agencies consistently for 25 years. Strong subsidiaries such as HDFC bank, HDFC Life, HDFC AMC, HDFC Ergo General Insurance, many of which are in market leading positions, further add to its size and balance sheet strength.

As of December 31 2019, HDFC had a gross loan book of Rs 5.05 lakh crore, made up of 76% mortgage loans, 5% corporate loans, 11% construction finance and 8% lease rental discounting. 90% of the loans were to individuals. With individual housing loans making up the bulk of HDFC’s book, its lending business has been quite resilient to ups and downs in the economic cycle in the past. Improving home loan affordability (the average loan to income ratio is less than 4 times) and a conservative loan to value ratio of 70% has helped HDFC keep its bad loans within a tight band, despite the NBFC crisis of the last couple of years.

As a long-standing mortgage financier, HDFC has built up a diversified funding base made up of ECBs, market borrowings, term loans and public deposits with retail deposits accounting for about a third of its funding. This diversified fund base has helped it retain Net Interest Margins within a tight band of 3.2-3.3%. As of December 31 2019, HDFC reported a moderate gross NPA ratio (Non-Performing Assets ratio) of 1.36%, 0.75% on individual loans and 2.91% on wholesale loans.

The moratorium announced by the central bank could lead to interrupted loan repayments and delayed cash flows. The deferment also creates moral hazard where borrowers may skip repayments even after the moratorium period ends. HDFC’s increasing focus on affordable home loans to low and middle-income groups in the last couple of years raises this risk.

Over the current and next couple of quarters though, HDFC’s financials could see temporary stress as the lock-down interrupts household incomes and clouds job prospects. The moratorium announced by the central bank could lead to interrupted loan repayments and delayed cash flows. The deferment also creates moral hazard where borrowers may skip repayments even after the moratorium period ends. HDFC’s increasing focus on affordable home loans to low and middle-income groups in the last couple of years raises this risk. The mortgage business is particularly prone to asset liability mismatches.

However, HDFC is much better placed than most other NBFCs/HFCs to weather this turbulent phase. For one, as a premium borrower in the Indian debt market with a strong reputation and deposit franchise, it is likely to continue to enjoy access to funding from multiple sources even if at slightly higher costs than before. Two, given that individual housing loans are often secured against mortgages on self-occupied homes, this is one category of loans that is not just secured but also actively disincentives default, as very few loan-takers would like to risk losing the roof over their heads.

Suitability

Despite its rock-solid track record, HDFC is a non-bank that does carry business risks related to leveraged lending. Investors must therefore consider HDFC deposits as a diversifier for their regular income/fixed income needs, after exhausting safer options such as bank deposits (with SBI, HDFC Bank) and the post office Senior Citizens Savings Scheme. Excessive exposure to a single deposit-taking company is best avoided.

9 thoughts on “Prime Recommendation: Lock into these rates before they are cut”

Why not Rbi bonds which offer 7.75% for a 8 year period.. if cumulative yield becomes close to 7.9 Ma’am

Regards

Praveen

Yes, they are a better option if you are willing to lock in for 7 years. We have already written about these bonds in an earlier post hence didn’t cover them here.

hi what about NRIS will these deposits be charged as per normal account

I already have a hdfc account but an nri one

This is a deposit from the housing finance company HDFC, not the bank. NRI deposits may be difficult in this.

What about Sundaram finance please?

Hello Sir, Please check our list of recommended deposits for the full list https://www.primeinvestor.in/best-fixed-deposits Thanks, Vidya

Yes absolutely. It features in our list of Prime Deposits

Are these deposits available for NRE investments?

Hello Sir, Since this is an NBFC, it is not allowed. Thanks

Comments are closed.