Rs 18,300 crore. This monumental sum is what One 97 Communications Limited, which owns the Paytm platform, aims to mop up in the largest-ever IPO in our markets. To put it in perspective, it is almost twice the size of the largest IPO this year (Zomato at Rs 9375 cr), and as much as the 3 IPOs that we covered recently (Nykaa, FinoBank and PolicyBazaar) combined.

What is Paytm planning to do with this money? While the better part goes to selling promoters and a clutch of investors (Rs 10,000 crore), a good part goes to the company itself. Of the fresh issue, the company aims to use Rs 4,300 crore in acquiring customers and merchants on its platform and improving technology, and Rs 2,000 crore in new business initiatives and acquisitions.

We will be discussing the Paytm IPO LIVE today at 7pm on Linkedin. Click here to attend the event.

The issue is priced in the band of Rs 2,080 to Rs 2,150, and post-issue, its total market capitalization is likely to be around Rs 1.39 lakh crore at the higher end of the band. That places it well within the top 50 stocks in terms of market capitalization. So, given its potential large-cap status and its leadership in the fast-growing digital payments space, is this a worthy bet? Here’s Paytm’s story in detail.

Many, many businesses

So, what does Paytm do, exactly? It dabbles in a wide variety of segments in the overall digital payments and financial services space. It enables consumers to transact online, pay their bills, transfer money, invest, and borrow. For merchants, it provides payment gateways, provides devices for store-keepers to collect payments, offers enterprise solutions, and gives them access to credit. The chart below shows the segments where Paytm currently is engaged in.

To elaborate, Paytm enables consumers to make payments (through cards, wallet, UPI, or bank) and allows merchants to collect those payments, online and offline (devices in stores). For this, Paytm could collect convenience fees, subscription fees, or commissions depending on the nature of payment and instrument used. Fees are usually a percentage of the transacted value.

On the services side, Paytm allows both consumers and merchants to access credit, essentially linking the lender (bank or NBFC) and the borrower and collecting a sourcing fee. It could also earn collection fees from the financial institutions if the monthly EMIs are paid through it.

On the investing side, Paytm allows its app users to trade in stocks or invest in mutual funds, for which it collects transaction fees. For insurance policies sold, it earns commission as it dons the mantle of an insurance broker.

Paytm executes all these either on its own (i.e., the company One97 Communications Limited, which is the one launching the IPO), or via associates and subsidiaries. For example, Paytm Money is a wholly-owned subsidiary. Paytm Payments Bank is an associate company (One97 holds 49%), and this entity owns the Paytm UPI, wallet, and banking; part of the financial services offerings goes through Paytm Payments Bank as well. Since Paytm processes these payments, it collects fees for routing the transactions from Paytm Payments Bank.

To sum up our view explained here:

Payments to merchants is the main revenue driver

In all the array of services, which one is Paytm’s bread-and-butter business? Paytm started out focusing on bill payments and phone recharges, being a payment gateway and a leader in mobile wallets. With the advent of UPI, though, the game is shifting away from wallets. Processing UPI payments involves no earnings. Therefore, consumers taking to UPI to make their payments is, in effect, whittling away at the role of Paytm Wallet and reducing the revenue benefit that may accrue to Paytm. In terms of overall UPI transactions, Paytm had only about 9.2% of transacted UPI value for September 2021, against Phone Pe’s 46% and Google Pay’s 37.7%, going by NPCI data.

What can substitute the consumer-to-consumer payment market is the consumer-to-merchant segment. In this segment, Paytm stands to earn from providing payment gateway services, of which UPI is an option among the various payment instruments that consumers can use. This is both in online payments as well as offline payments such as QR codes and POS devices in stores. According to the RHP and other reports, Paytm is a market leader in the payment-to-merchant segment including UPI.

An indicator of this market leadership is the share that Paytm has in the beneficiary UPI transactions - payments that are made into Paytm Payments Bank accounts and not from it. This important metric - share in beneficiary volumes - has moved from 14% (of the top 30 beneficiary banks) in September last year to 18% in September 2021, as per NPCI data.

When a merchant moves into the Paytm ecosystem, it is a big win for the company. Apart from allowing Paytm revenues through payment gateway charges, Paytm can add on services such as cloud, advertising, and merchant credit services. And on this metric, Paytm has recorded impressive gains in the last two years - the number of merchants registered on the Paytm platform has increased from 11.2 million at end-March 2019 to 21.1 million by March 2021.

The evolution towards a merchant-led revenue growth instead of a consumer-based one also shows up in Paytm’s numbers. The data below shows the growth in revenues from Paytm’s business segments for the March 2020-March 2021 fiscal years.

As is clear from the data above, Paytm is losing its edge in consumer payments but has found traction in the merchant payment segment. Revenue from the consumer payment segment has declined over the past 3 fiscal years and accounts for a far smaller share of revenues. From about 64% of the revenues from the payments segment for the March 2019 fiscal, share has dropped to 44% by the June 2021 quarter.

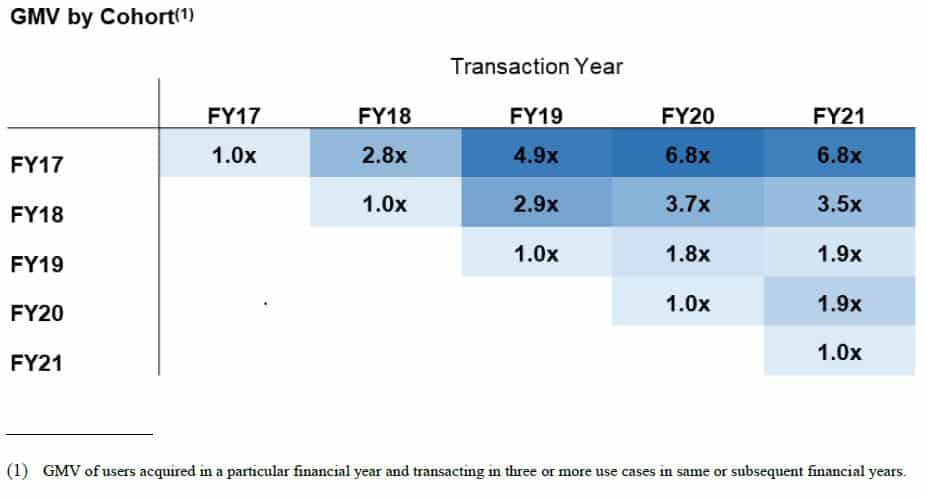

Further, going by data in the RHP, newer customers are transacting less on the platform than earlier. The image below shows the gross merchandise value (GMV or the total value of transactions made on the platform) of customers acquired in each year, and the rate of increase in transaction values (for at least 3 unique transactions) for the subsequent years. For example, customers who boarded in FY-17 spent 4.9 times as much two years later in FY-19. However, customers acquired in FY-19 spent only 1.9 times the amount two years later.

Source: Company RHP

The dominance of UPI and the lion’s share that both Phone Pe and Google Pay command mean that the consumer payments side has limited potential as a high-growth driver for Paytm. This apart, the heavy competition on bill payments, ticketing, and other e-commerce also narrows the scope for growth contribution.

On the other hand, the rising growth in cloud services and merchant payment gateway services offer scope as digital payments get more pervasive. The market for merchant payments is set to clock strong growth, which offers some visibility to Paytm’s topline expansion. The contribution of the top 5 merchants to the gross merchandise value dropped from 50% in March 2019 to 27% by March 2021, indicating an improving merchant base. Revenue share of the top 5 merchants similarly declined – it was 69% in March 2019, it is 35% in March 2021.

According to the RHP, digital payments are set to grow at a 30% CAGR until 2026, within which mobile payments to merchants is set to grow at an annual 50%. The penetration of merchants using QR codes for payments is expected to touch 69% from the 49% it is currently, while the transaction value of payment gateway aggregators is set to grow at an annual 26%. This suggests that a focus on the merchant segment can be an important part of Paytm’s growth, much as it might like to tout the consumer angle of its business.

Other businesses either cost centers or distractions

While payment services form the backbone of Paytm’s business and is likely to remain so, its branching out into financial services may offer additional growth channels. For instance, the number of loans disbursed under its customer credit service (the buy-now-pay-later bandwagon, besides other credit mechanisms) grew to about 28 lakh loans over the course of the past 2 years. The burst of interest in equities is also likely to spur both its broking effort as well as its mutual fund distribution.

However, Paytm’s task on this front is far from easy and it is not a given that success will be early or strong. For one, in the lending space, competition is rife and established players such as Bajaj Finance are making strong inroads into the buy-now-pay-later market. In broking, the company is not differentiated from other low-cost brokerages and faces the scale of larger entrenched players such as Zerodha.

In other wealth management aspects, such as mutual funds or gold distribution, margins are thin. All that Paytm earns are transaction charges on investments made. And like with stock brokerages, low-cost fund investment platforms are big competitors. On insurance, challenges are several – apart from online players already strongly established, the online space itself may be approaching saturation.

All this aside, a good part of the financial services segment is housed under Paytm Payments Bank, which is only an associate company for Paytm (it owns 49% in Paytm Payments Bank and the rest is held by One97 Communications promoter Vijay Shekhar Sharma) and not a subsidiary. Savings accounts, fixed deposits, FASTag, Paytm wallet, UPI, Aadhar-enabled payment system, current accounts and so on are held under Paytm Payments Bank. Paytm itself earns only the payment gateway or processing charge on these products.

In fact, about 30% of Paytm’s revenue is in fees collected from Paytm Payments Bank. Should Paytm Payments Bank make the leap into a small finance bank, the revenue model for Paytm (i.e., One 97 Communications) are likely to remain the same – it might at best piggyback on any strong growth that the SFB may notch up.

Of course, the company also has a tendency to jump into new businesses – which partly explains the bewildering array of all that it offers – which may click. Part of the issue proceeds is meant for new business initiatives. The flip side is that it may also compromise the management of existing businesses.

Profitability? What is that??

Paytm earns revenues on charges and commissions on its various services, as explained in the Business section. These charges are a percentage of the total transacted value, and depend on the nature of payment, the payment instrument, the merchant and so on. The payments services business is already a thin-margin one, and therefore is a volume-driven game.

Gross merchandise value has certainly grown at a healthy pace. The amount users spend in each transaction has also grown from Rs 6,959 in the December 2019 quarter to Rs 11,369 in the September 2021 quarter.

However, Paytm’s ability to make revenues off these transactions have been declining. For one, revenue growth has been flat in FY-20. It declined in FY-21 owing to the sharp hit to e-commerce ticketing services. The take rate, or the proportion of revenue to the GMV, dropped from 1.41% in FY-19 to 0.69% in FY-21 and has dropped even further to 0.61 in the June 2021 quarter, partly as the low-cost UPI payment mode found increasing takers.

Should Paytm keep a tight rein on costs, the shrinking margin may still hold up. Now, the contribution margin – or the profit after deducting expenses related to the revenues – has improved, as the data below shows.

In FY-21 and continuing into the June 2021 quarter, Paytm has been generating a positive contribution margin. Therefore, the shrinking take rate above may appear less of a risk. However, there are a few points to note here, which detract from the seemingly improving contribution margin:

- The contribution profit has improved primarily due to a precipitous drop in marketing and promotional expenses. Any step-up in marketing can push the contribution back into the loss-zone. Given that incentives such as cash-backs are a draw for customers to transact more, a sustained pull back can impact GMV and topline. Further, with new business lines, the company will have to pick up adspends.

- The other cost components directly related to providing Paytm’s various services have remained steady. For example, payment processing charges have held at 68-69% of revenues, while connectivity charges have held at 4-6%. It thus leaves little room for Paytm to improve contribution margins unless the company manages effective cost controls such as lower processing charges due to scale.

- The other large expense component is staff costs, which does not feature in contribution margins but accounts for 25-30% of revenues. Paytm holds large teams in sales and technology, and staff costs are likely to remain at similar levels.

On an EBITDA level, therefore, Paytm is currently loss-making and is likely to remain so. Assuming an annual GMV growth of about 40-44% - higher than what the company clocks currently – and a marginal improvement in take rate and higher marketing spends, the company may continue to clock EBITDA losses for the next 3-4 years. With depreciation as well to account for, profitability at the net level is still a long way off. This is also not including spends on any new business that Paytm enters or acquisitions it makes. Another potential risk factor is indirect tax litigations of Rs 3,735 crore where decisions are still pending.

Valuations – will it ever be reasonable?

Of course, the argument here is not on profits at all, but on growth. On this front, while Paytm’s GMV is certainly pacing well and the market potential in merchant payments is strong, revenue growth remains sedate. On an enterprise value to sales ratio (EV/sales), the Paytm IPO is priced at 49.8 times annualized FY-21 revenue at the upper end of the price band. This is higher, even if marginally, than Policybazaar’s IPO last week, and well above other digital business IPOs of Zomato (23 times) or Nykaa (21.8 times).

Even assuming a rapid revenue growth of 42% annually over the next 5 years until FY-26 – which Paytm has not clocked in the past 3 years, and is an approximation of the projected growth rate for the industry based on data provided in the RHP – the EV/sales ratio still works out to about 7 times. Current EV/sales ratio of global payment companies such as PayPal is at 12.4 times and Visa is at about 20 times.

A discounted cash flow analysis over the next 10 years, assuming healthy growth rates, an improved take rate, and lower marketing expenses still shows that the current asking price for Paytm appears to fully price in the growth.

Therefore, it’s best to wait and watch the company to see if it gets a grip on where its growth will come from and what its focus will be before making a beeline for the high-growth digital play it offers.

Please note that this review does not take into consideration the possibility of listing gains.

10 thoughts on “IPO Review : One 97 Communications (Paytm)”

Mirae Asset Large Cap Fund has 20 % allocation in >7 years prime portfolio. From the news I think this fund invested 185.1 Crores in the IPO, even though Paytm is not really a large cap. Should I trust the fund manager with my money because of their inability to read business fundamentals and following media hype?

Mirae Asset Large Cap has beaten the Nifty 100 nearly all the time on a long-term basis. Average 5-year returns are about 26% against the 20% of other largecaps. It’s quite all right to be investing in the fund.

Fund managers do not get every stock call correct. Nor is every stock in a fund portfolio perfect on business fundamentals. Business analysis, beyond the numbers, is subjective. You also do not know the reasoning for the fund manager picking the stock – it could even be for something as simple as listing gains, whether or not it materialises. It could also be taking a measured chance in a market that’s lifted several IPOs – the allocation to Paytm would be very small at less than 1%.

The bottomline is – every fund will have stocks that underperform markets; stocks other than Paytm can well correct 20-30%. The key is to be able to minimise losses through wrong calls and make up for it with the right ones. Mirae does well at this. – thanks, Bhavana

Very good review. I think Paytm has gone into everything and has lost its niche. It’s valuation is quite high.

Hi Bhavana,

First of all I must say this article is very well written. You have covered most of the areas from which the company gets the revenue and the areas where the company is trying to focus in terms of future growth prospects.

I have couple of questions for you:

1. Does the merchant payment services model works similar to the consumer payment services where in one merchant makes payment to another merchant using UPI or any other payment gateway ?

2. When it comes to cloud services, what exactly does Paytm do ? Do they compete with the likes of TCS,Infy etc to implement cloud services or they are the alternative of AWS/Azure?

Thanks,

Partho

Thanks! The merchant payment model is providing payment gateway services, the QR code scanners in-store, and POS devices in-store. They charge a processing fee/subscription fee etc. In cloud, it is more billing management, payment systems, vendor management services, customer engagement etc. for small/medium enterprises. – regards, Bhavana

Very comprehensive review, and you have clearly pointing where company strength is ie Merchants /

Cloud , and where likely to lose out / remain same in ie consumer payments . And clearly covered growth aspect, i felt you are light on reason to miss the IPO . Ie take rate going down less than 1%/ Mgmt / super app sucess . Have 3 questions on this regard more to get your thoughts if the 1) company continues to grow , steers towards merchants / cloud does that offer healthy take rate above 1% or OM ? Essentially which services offers more margin / take rate and is the company already have lion share …

2) payTM modelled after alipay , a superapp. Even paypal wanted to acquire Pinterest ( though dropped) and square acquiring afterpay … do you see pay TM

suceeding as super app ? Or with commerce /

Other intiatives not taking off , with merchants payments it is currently very transaction vs it is not sucessful with high sticky/ consumer engagement options

3 ) it is clear the current mgmt priortized growth at all costs , how would you rate or view their management capabilities

Thanks…to elaborate, the take rate is the only way the company is going to make money, so if it drops, higher spending by consumers is really not going to help. Second is the profitability itself – as mentioned, the only reason for contribution profit going up is marketing costs going down. Third, valuations. Even assuming very aggressive growth, the IPO price is still far too expensive. To answer the points raised:

1. No, take rate will not improve significantly. Paytm provides payment gateway services to merchants, and both because of increasing competition and UPI being used extensively, it won’t be able to extract higher fees. Cloud services may offer better fees, but how successful the company will be at this, how much merchants take to it, is hard to say. It will have to be a much larger share of revenues for it to make any meaningful change to the overall take rate.

2. No, far too high competition and there’s little differentiation that Paytm brings in, in its current apps.

3. The company seems to be able to identify where opportunities can be, but they also seem to jump for as many of them as possible. They have lofty missions, but at the end of the day, it needs to translate into profits. That ability we’re yet to see.

Thanks,

Bhavana

After Reading the article,Am confused

conclusion wait and watch or subscribe to ipo?

As mentioned in the highlighted box and at the conclusion, it is best to wait and watch to see how the company does before investing. – thanks, Bhavana

Thanks 👍

Comments are closed.