During his colorful tenure as the governor of the RBI, Raghuram Rajan launched two new types of banks in India – Small Finance Banks (SFBs) and Payment Banks, and granted a handful of licenses for both these categories. Of these, SFBs, for the most part, have grown and flourished in the country.

The same cannot be said about payment banks. A few of those licenses issued were returned to the RBI eventually since the entities did not see a viable business model. The remaining marketplace is dominated by a single player (Paytm) with a few others trying hard to carve a niche for themselves.

One of these other payment banks is Fino Payment Bank (Fino Bank). And it arrives in the market today with an IPO – a public issue of Rs.1,200 crore comprising fresh issue of shares worth Rs.300 crore and offer for sale of shares worth Rs.900 crore by promoter, Fino Paytech, at a price band of Rs. 560-577 per share. The issue opens on October 29 and closes on November 2. The proceeds from the fresh issue will go towards augmenting the capital base of the bank.

The landscape of payments has changed dramatically since payment bank licenses were issued 5 years ago. How does Fino Bank plan to navigate its way today? Can they find a sustainable business model? Can they realize the original vision set for payment banks? Do they need to pivot?

And, is their IPO worth consideration? Let’s find out.

Payment Banks are a separate category of licenses issued to advance financial inclusion by offering banking and financial services to the unserved and underserved areas, helping the migrant labour force, low-income households, small entrepreneurs etc.

Payment banks can take deposits up to Rs. 2,00,000 and can issue debit cards. It can accept demand deposits in the form of savings and current accounts. 75% of the money should be invested in secure government securities while the remaining 25% is to be placed as time deposits with other scheduled commercial banks.Payments banks will be permitted to facilitate personal payments and receive cross border remittances on the current accounts. Payment banks cannot give loans, issue credit cards or set up subsidiaries to undertake non-banking financial activities.

Business

Background

Fino Bank, wholly owned by Fino Paytech, was granted license by RBI in 2016 to operate as a Payments Bank. Fino Paytech, founded in 2006, is an innovator and implementer of technology solutions for institutions like banks, micro-finance institutions, government entities and insurance companies. It was promoted by BPCL, PE giant Black Stone Group, ICICI Group, IFC and Intel Capital.

Fino Bank offers products and services to the unserved and underserved population. Its target customers include low-income individuals, domestic workers and migrant workers. In order to reach them in an efficient, scalable and cost-effective manner, it relies on its network comprising small merchants, where each merchant has access to the required technology (a Micro-ATM device and the app that powers their distribution services) to serve the banking and financial needs of its customers. Merchants form the backbone of its “Phygital” delivery model because it combines physical and digital channels. Customers use merchants to avail various products and services, including

- Savings accounts,

- Debit card transactions,

- Facilitating domestic remittances,

- Withdrawing and depositing cash via Micro-ATM or Aadhar enabled payment systems (AePS) and

- Cash management services (CMS).

Merchants also leverage the customer relationships to facilitate cross-selling of other financial products and services such as third-party gold loans, insurance, bill payments, recharges, etc

Since payments banks cannot offer loans, their principal source of income is the fee or commission income on the products and services offered. Fees on remittances and transactions form a major source of revenue where margins are thin. The key to their survival and success is continuous investment in technology while leveraging their network with more products and services

Structure and scale

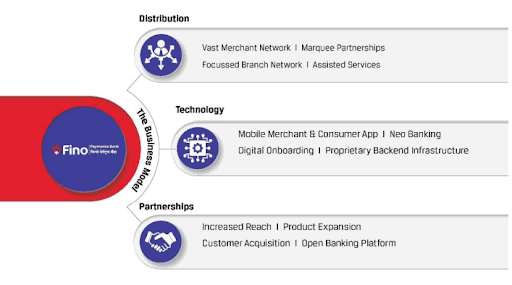

Fino Bank names its business model as DTP– Distribution, Technology and Partnerships.

On the distribution side the merchant on-boarding is capital light where the costs are borne by the merchants (premises, laptop/mobile phone, internet connectivity, micro-ATM & AePS devices fingerprint /IRIS scanners) depending on the type of partnership. At end-August 2021, the bank had a network of 7.7 lakh merchants. In addition, the ‘Fino Mitra’ app serves as a one-stop-shop solution for merchants by providing payments and banking related services such as account opening whereby merchants can on-board current/ savings account customers and navigate e-KYC requirements on behalf of the bank. Fino Payments Bank has its major presence in the States of UP, Bihar and MP which comprise 46% of its merchant network and 43% of its revenue for FY21 (excluding API partners).

The bank has increased its technology spend to Rs. 67 crore in FY21 from Rs.23 crore in FY20 and Rs.12 crore in FY19. It has a ‘Fino BPay’ app for retail customers, offering originating their savings bank accounts through the mobile app, which uses UPI for secure and fast personal banking and merchant payments. About 9% of the 7.6 lakh app downloads converted into savings account customers in FY-21.

Partnerships is a growth area that the bank is exploring. In this, Fino Bank aims to tie up with NBFCs for referral credit products where it will earn fees or commission.

Fino Bank also gains advantage from BPCL as one of its promoters where it provides services through 10,000+ BPCL outlets across the country.

While the bank has reported marginal profits in FY21, scalability at lower cost using technology will be critical for sustainability as the margins are very thin in its business segments. Its margins are ~0.5% to 0.6% of transaction value for various services offered while it has to share a sizable portion of it (~60%) with its partners.

Revenue streams

Micro-ATMs are handheld terminals (similar to a POS terminal) that typically require a card to be swiped by the customer, rely on mobile/internet connections. They are used in geographies where it is not practical for the relevant bank to locate a branch or facilitate doorstop mobile banking by BCs. Customers use micro-ATMs to deposit cash, withdraw cash, check account balances and request mini-statements. The micro-ATM has a maximum limit of Rs. 10,000.

Aadhaar Enabled Payment System (AePS) leverages Aadhaar online authentication and enables Aadhar enabled bank account to be operated in anytime-anywhere banking mode by the marginalised and financially excluded via micro-ATMs. If a customer has Aadhaar, they can deposit, withdraw, and check balance in their own account (without a debit card). And if another customer has an Aadhaar linked account, money transfer is possible between these two accounts.

Remittance is the largest revenue stream for Fino Bank followed by Micro-ATMs & AePS

#1 Remittances

Remittances are primarily done by the migrant population, and in this regard, Fino Bank has established itself well.

As per the Report of the Working Group on Migration, 2017 under the Ministry of Housing and Urban Poverty Alleviation, 17 districts account for the top 25% of India’s total male out-migration. Ten of these districts are in UP, six in Bihar and one in Odisha. So, remittances are expected to be a good business for the bank once the pandemic recedes. CRISIL projects the remittances market to touch Rs. 3.4 lakh crore by financial FY25, translating into a ~12-13% CAGR in remittances during FY20-25, notwithstanding the small blip in growth in FY21.

Fino Bank’s ability to expand into new geographies and the potential of these geographies in remittances also remains to be seen.

According to a CRISIL study, AePS transaction value is set to grow at 29% CAGR between FY21-25.

#2 Micro ATMs

The bank has identified CASA and Micro-ATMs as the areas of high growth potential. According to an RBI committee, the ATM density in India is very low at 21 ATMs per 100,000 adults in 2019. While the overall ATM access in India is low, they are also unevenly deployed across rural and urban areas. While ~65% of the population is in rural areas, only 20% of ATMs are deployed there. This leaves a good market opportunity for Micro-ATMs.

Fino Bank had 51% share of Micro-ATMs in India at the end of Q1FY22. Micro-ATM transactions are either conducted on its own merchant channel or on the API channel where it interfaces with third party financial services entities with whom the merchant is registered. Fino Bank has arrangements with 48 API Partners. For Micro-ATMs and AePS transactions, the bank charges 0.5% of transaction value or Rs. 15 whichever is lower.

Below is a break-up of major income streams for the bank and the transaction value

#3 Savings accounts

In CASA, its “Shubh Savings Account” forms ~70% of the total number of savings accounts and levies annual subscription fee of Rs. 450/- while it allows deposits/withdrawals up to Rs.25,000 per month. The annual fee appears to be a more recent addition to revenue streams. While this certainly allows the bank to eke some mileage out of its deposit base, the continued willingness of low-income earners to pay such fee, competition from other players, and the bank’s ability to raise fee needs to be watched.

#4 Other avenues

Apart from the NBFC partnerships explained above, Fino Bank is also awaiting approvals for offering mutual funds, digital gold, international remittances, recurring deposits, fixed deposits and pension fund products. While these have the potential to increase fee incomes, how well Fino Bank’s current customer base adopts these products remains to be seen. These revenue streams will also likely impact Fino Bank’s cost structure.

Network expansion combined with products comprising loans, savings and investment is the strategy going forward to enhance operating leverage of its network. While the bank claims to have presence in 90% of the districts in India as at the end of September 2021, it is looking at even deeper penetration where there is more potential along with product expansion.

Weaknesses

#1 Limited opportunity to scale up

The big question is whether the payments bank business itself is a scalable one. Out of 11 payment bank licenses issued by RBI, 4 entities stepped out of it without even starting. . Those that remain operational include Airtel, IndiaPost, Fino, Paytm, NSDL and Reliance Jio. Of these, Paytm Payments Bank has the highest revenue and financial performance metrics and cannot be compared with any other in the ecosystem. Fino and Airtel stand in second and third positions while others are yet to scale up.

Among the various challenges faced by payment banks, among the bigger ones is their no-lending model that does not allow them to earn anything on their deposits base. They need to entirely rely only on repeated and varied transactions to grow revenues and topline. In a highly competitive space, this may mean a further squeeze on already thin margins.

At the same time, they have to build a huge scale at low cost in each of their business activities to stay profitable. Utilizing their vast network to push various savings, investment and lending products is an option available to earn additional fee or commission income, but which again involves higher costs; in Fino Bank’s case, it may require more effort in securing investments from its migrant customer base.

In any case, according to industry experts, the payment banks model was an experiment that did not work, and the RBI has, in some ways, accepted it by allowing payment banks to apply for SFB licensing after five years of operations. A recent working committee has recommended bringing it down to even 3 years.

An SFB can do everything a bank can do, with fewer restrictions. So, the logical question is why would a payment bank not convert to SFB when offered that choice rather than looking to survive on thin margins on every business they do?

The Fino Bank management has not denied that possibility.

#2 Competition heating up

While Fino Bank had 55% share of ATM at the end of FY21, it dropped to 51% at the end of Q1FY22. Competition is heating up with the entry of a large number of fin-tech players into the space while banks are also looking to expand in this space. The latest entrant into this space has been Kotak Mahindra Bank, this month. While Private Banks have ~68% share of PoS terminals (PSU banks hold another 25%), they have limited presence in Micro-ATMs. The space is attracting new fin-tech players also apart from Private and PSU banks.

Peer Comparison

Below are the 4 players who have scaled up the payments bank business. Reliance JIO and NSDL are yet to scale up.

Financial Performance

Fino Bank has a capital adequacy ratio of 54.8% at the end of 30th June, 2021 while the minimum requirement is 15%. IPO proceeds of Rs.300 crore will boost it further and is comfortably placed for growth. On the income side, Fino Bank shares ~60% of its core income with its partners, which is the major cost component.

Valuation

While earnings-based valuation best suits Fino Payments bank due to its asset light and fee or commission-based model, its limited profitability track-record makes it difficult to make projections. At the upper end of the price band, the bank is valued at Rs 4,800 crore - 235 times FY21 earnings and a price to book value of 10.5X on post-issue net worth. The bank would need to clock a high growth rate of 25-30% on income from services, while keeping fixed costs under control, to become profitable on a sustainable basis and justify this valuation.

As mentioned above, the growth story may change should the bank convert to an SFB However, Fino Bank will face a highly competitive environment and is an effort that will take a few years to develop. 12 other SFBs are already up and running, and are notching up strong growth. Fino Bank will have to start from scratch in building up a loan book amidst this competition, along with meeting other requirements such as capital. Given the entirely different business model and the time it would take for this to develop, to peg a valuation to any potential SFB changeover will not work at this time.

In summary, Fino Bank operates in a thin-margin business in a hyper-competitive market space. Hence, although it is asset-light and has achieved significant penetration in its target markets, revenue growth is unlikely to be dramatic. If it converts to a small-finance bank, a re-evaluation would be needed, but that will depend on how it positions itself and executes in a different field of players. At this time, given what we know, it would be prudent to give this IPO a miss.

And, if you are keen to invest in the payments space, you might as well wait a week to see if the Paytm IPO makes the cut!

Please note that this review does not take into consideration the possibility of listing gains.

1 thought on “IPO Review: Fino Payments Bank Ltd”

Jio’s payments bank has slowly started. In most of the JioMart stores, payment accounts are created free of cost. Knowing this, the promoters are exiting! Juicing part is already over.

Comments are closed.