Glenmark Life Sciences (GLS) is a generic API (Active Pharmaceutical Ingredients) manufacturer and a subsidiary of Glenmark Pharmaceuticals. The Glenmark Life Sciences IPO is worth Rs. 1,514 crore, comprising fresh issue of Rs.1,060 crore and an offer for sale worth Rs.454 crore by Glenmark Pharmaceuticals. Should you invest in the IPO of this high-value, non-commoditized API player?

The offer

Glenmark Life Sciences (GLS) is a manufacturer of select high value, non-commoditized APIs. GLS came into existence in August 2018 when parent Glenmark Pharmaceuticals separated the API business through a slump sale. It has now decided to monetize its holding through a part-offer-for-sale. The API business was spun-off into the company on a slump sale basis for a consideration of Rs.1,162 crore. The remaining amount payable, including interest, stood at Rs.800 crore. Part of the issue proceeds will be used to pay this amount payable.

The remaining Rs 153 crore will be used for capex. Glenmark Pharma will hold 82.84% of the post issue share capital. The offer closes on July 29.

De-jargonizer

Here’s a quick explainer of the technical terms used in the pharma world and specific to Glenmark Life Sciences’ business.

- API or Active Pharmaceutical Ingredient is the key substance/ingredient in a drug, whether it is a tablet, capsule or injectable. It is the active component of a drug. APIs that are commonly used in low-value generic drugs are generally of a commoditized nature (volume driven) while those used in patented drugs and complex generics (those that are not easy to make) are of non-commoditized nature. The ones that are non-commoditized, therefore, offer better margins.

- CDMO or Contract Development and Manufacturing is a process where global companies outsource development of drugs and manufacturing. The cost of developing a new drug by innovation-led companies is exceedingly high. To put it in value, it costs, on an average, $2.6 billion to develop a single drug. Consequently, global companies have resorted to outsourcing the development part of R&D to lower the cost of pharmaceutical and clinical development. The CDMO value chain includes drug development, API and formulations (finished drug manufacturing) services.

Positives of the Glenmark Life Sciences IPO

#1 Strong parentage with thrust on R&D

Glenmark Life Sciences specializes in manufacture of non-commoditized APIs. 69% of its revenues come from regulated markets. The company is looking to scale up its API business in niche, newer areas such as oncology as well as to build its CDMO business.

There is stringent regulatory compliance like the USFDA in this business. It also requires experience and expertise to scale up business in specialty APIs and CDMO. These aspects remain critical for the evolution of GLS as a successful player in this space.

Glenmark Life Sciences' parent company is one of the top 10 Indian pharma companies by revenue and is a R&D focused company. It is known to spend 10-13% of its revenues, higher than the industry standard, in R&D for development of new molecules. Due to this, there is significant expertise available within the group in terms of regulatory compliance, manufacturing facilities and relationship with customers. This provides confidence on GLS’s ability to scale up in the specialty API and CDMO space.

#2 Focus on API and CDMO opportunities

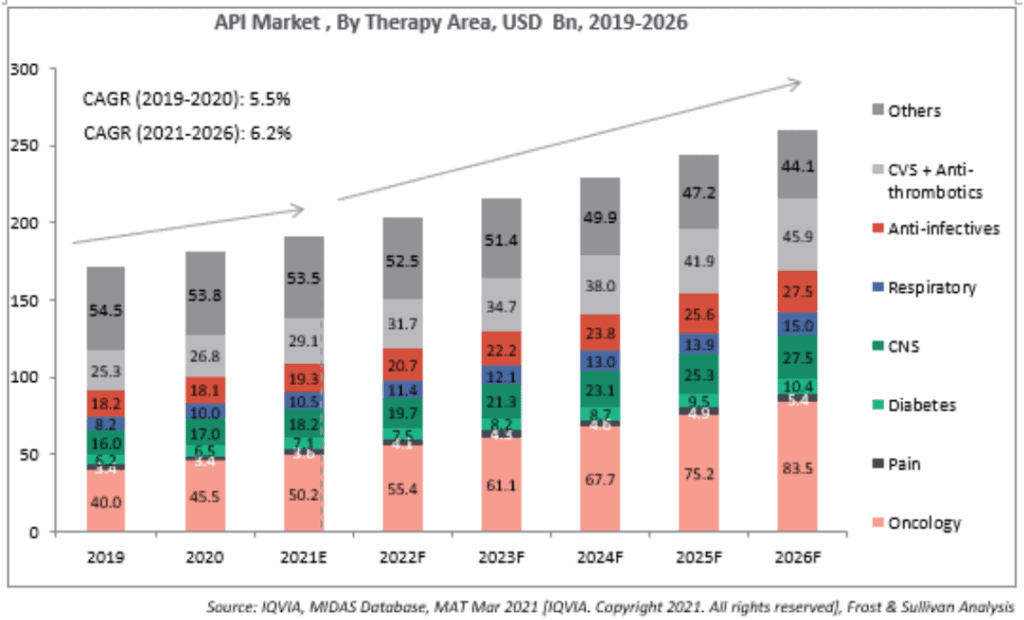

API market opportunity: The global API market is expected to grow at a CAGR of 6.2% from 2020 to reach about US$259.3 billion by 2026. In the API industry, India currently holds about 6% of the market share with an estimated size of about US$11 billion in 2020 according to a report by Frost & Sullivan. However, India is expected to have the highest growth rate of about 9.6% over the next five years owing to the government's thrust on API manufacturing. Consequently, India’s share in API Industry is expected to go up to 9.3% by 2026.

For the 120 molecules that Glenmark Life Sciences currently has in its portfolio, the market opportunity globally is expected to grow at 6.8% over the next five years to reach US$211 billion by 2026. This represents about 91% of the API market size. The market opportunity for Glenmark Life Sciences would be about a tenth of this, going by India’s expected share of the API market itself.

For FY21, 69% of Glenmark Life Sciences’ revenues came from regulated market end-products. Glenmark Life Sciences counts 16 of the world’s 20 major generic companies as its customers. This indicates that Glenmark Life Sciences is a serious global contender in the API space, boding well for its ability to ride on global growth in the API space.

Market size and estimated growth rate by key therapy areas

Source: RHP

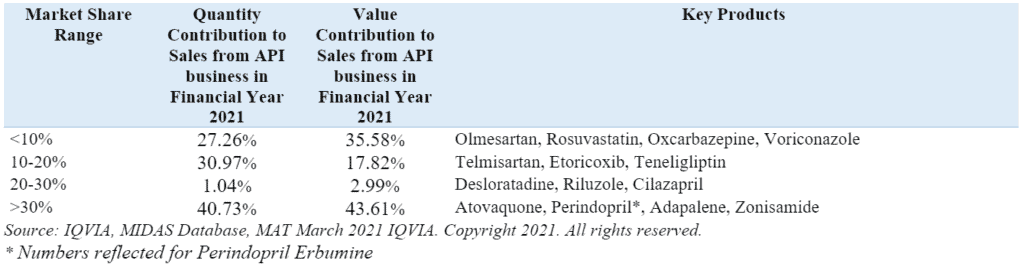

The API business accounted for 91% of revenues for Glenmark Life Sciences in FY21. GLS manufactures select high value, non-commoditized APIs in chronic therapeutic areas, including cardiovascular (CVS), central nervous system (CNS) and pain management and diabetes. That helps it earn better margins due to less competition. CVS accounted for 45.44% of sales in FY21. CNS contributed 10%. Pain management and diabetes 3-4% each. Other APIs accounted for 37% of the revenues.

The company develops, on an average, 8 to 10 molecules each year with R&D investment of 2-3% of its revenues. About 13.86% of its permanent workforce is for new product development, complex products, oncology product development, technology transfer, life cycle management and project management.

Oncology is a key focus area for the company for which it is building up team, manufacturing, and R&D capabilities. Parent Glenmark, Teva, Torrent, Aurobindo and Krka were among the top 10 customers by revenue contribution.

Market share, volume and value contribution of key APIs manufactured by the company in the global market in FY21

Source: RHP

CDMO market opportunity: The cost of developing a new drug by innovation-led companies is around US$2.6 billion on an average. While innovator drugs have higher demand and pricing power, it involves high R&D costs. Consequently, global companies have resorted to outsourcing the development part of R&D to lower the cost of pharmaceutical and clinical development and India is among the preferred countries for this purpose.

The CDMO value chain includes drug development, API and formulations services. The global CDMO market is expected to grow at a CAGR of about 5.2% between 2021 to 2026 to reach US$169 billion. The Asia-Pacific region is expected to show a strong CAGR (2021-2026) of 8.5%.

In the last three years, Glenmark Life Sciences has started working with innovator pharmaceutical companies in CDMO. The segment is still small for the company, contributing to 8% of revenues in FY21. But it may be able to tap this opportunity meaningfully as the parent already has a long-standing track record in R&D.

A planned new greenfield plant with flexible volume capabilities, manufacturing efficiency and automation will aid the CDMO business in the next 5 years. Since it is expensive and time-consuming for pharmaceutical companies to switch CDMO partners once a manufacturing process is established, it is a long term and sticky relationship as well.

Given the size and nature of the market and a strong parentage, Glenmark Life Sciences appears well placed to tap opportunities in the non-commoditized APIs as well as CDMO in future.

#3 Major capacity expansion over next 3 to 4 years

Glenmark Life Sciences has four manufacturing facilities with an aggregate annual total installed capacity of 726.6 KL at the end of FY21. Three facilities are USFDA-approved. These facilities have been inspected in FY18 and FY19 and have not received any warning letters or import alerts.

The company is looking to increase production capacities at its Ankleshwar facility in FY22 and Dahej facility in FY22 and FY23 by an aggregate annual total installed capacity of 200 KL to expand generic API production and grow its oncology product pipeline. The USFDA approved plants are already running at 85-88% capacity.

It is also planning a new greenfield manufacturing facility with an aggregate capacity of 800KL, expected to be completed by the end of FY23. This facility will be able to manufacture both API and intermediates and will house several multi-purpose manufacturing blocks with mid to high-volume capacity. This will aid growth of API business and provide a platform for the CDMO business as well.

These capex plans will almost double manufacturing capacity and add capabilities in the CDMO business. This offers strong visibility on growth. With a healthy margin profile of 30+% and only 2-3% of revenue going to R&D, the company should be able to fund the capex with internal accruals as well.

#4 De-leveraging at parent is a healthy signal

Glenmark Pharmaceuticals is known to invest heavily in R&D; as much as 10-13% of revenues have gone towards R&D in the recent past. Consequently, despite being a recognized player in formulations, the company has carried high debt and volatility in earnings expectations from its R&D pipeline, which reflects in its stock price as well.

At the end of FY21, Glenmark Pharmaceuticals’ debt to equity ratio stood at a healthy 0.55. This IPO is part of its initiative to pare debt while retaining healthy investments in R&D. The company is also looking to monetize its R&D assets. This is a good sign for GLS given that it presently derives ~40% of its revenues from its parent company.

#5 Scope for stable growth and cash flow profile

Glenmark Life Sciences has been investing 2-3% of its revenues in R&D and is expected to continue in this range given the nature of its business and the focus on CDMO in future. The business, though, is also capital intensive with significant investment required in fixed assets and working capital.

It is important, therefore, that Glenmark Life Sciences maintains healthy cash and debt levels to fund expansion plans. Unlike its parent that suffered from high debt and R&D expenses earlier, Glenmark Life Sciences has a healthy margin profile, measured R&D spend and focus on high-value API and CDMO.

Glenmark Life Sciences’ growth, margin as well as cash flow profile can therefore be expected to be more stable than the parent company. We therefore think it can command better valuation than its parent which is currently trading at 19 times (parent was derated post 2015 for concerns mentioned earlier).

Concerns of the Glenmark Life Sciences IPO

#1 Current high dependence on parent

Sales to parent Glenmark Pharma account for ~40% of sales in FY21. While this provides a strong and sticky customer, any regulatory or business impact on the parent can hurt Glenmark Life Sciences. The management does expect contribution from the parent to decrease over the next 3 to 4 years, as the company adds more customers and therapeutic areas, but that remains to be seen.

#2 Dependence on China for raw materials

Glenmark Life Sciences sources a significant portion of inputs from vendors in China; imports from China stood at 39.59% in FY2. While the management has indicated that the company has de-risked the supply chain by adding domestic/multiple sources as well for each product, they continue to source from China due to the better value obtained. Disruptions on this front could hurt production.

#3 Regulatory risk

Almost 69% of Glenmark Life Sciences’ revenue comes from products sold in regulated markets. Warnings or import alerts by the USFDA on the company’s plants or its key customers’ facilities related to APIs supplied can significantly impact revenues in the short term. Such concerns may abate as the company grows with diversified customers and products and supplies to the parent reduces.

Peer comparison

Valuations

At the upper end of the Rs.695-720 price band, Glenmark Life Sciences will be valued at a PE of 25 times FY21 earnings on post-issue capital. Excluding the interest cost on the amount payable to the parent, the P/E is at 20 times. This appears attractive, relative to peers, considering its focus on non-commoditized API and CDMO and the expansion plans.

The fact that the IPO is rightly-sized to meet its financial needs in the short term and that the parent will continue to hold 82.84% of the post-issue capital provides confidence (do note that Glenmark Pharma will have to pare this stake to 75% over the next 3 years to comply with minimum public shareholding norms). The reasonable valuations combine well with the company’s strong API business, expansion plans into the sticky, high-margin CDMO space, capacity additions, comfortable financials and parent support. Therefore, from a long-term perspective, you can consider subscribing to the Glenmark Life Sciences IPO.

Please note that this review does not take into consideration the possibility of listing gains.

13 thoughts on “IPO Review: Glenmark Life Sciences – Should you invest?”

Thanks for the review.

I applied for the IPO and didn’t get any allotment. Now, it is available at around 596. Can I buy Glenmark now (maybe 50% initially and the rest in batches).

Thanks for your query sir

The listing has been lackluster. The stock opened at 750/- and closed at 746/-, a tad above issue price of 720/-

The price of 596/- you mentioned is that of parent Glenmark Pharma. Kindly search GLS for Glenmark Life Sciences.

Our investment argument stand un-changed.

Thanks Sir for correcting.

Sure, will go with the recommendation.

Regards,

Vikas

Hi , unable to use Loveprime code for discount

Dear Sir,

Pl do write to [email protected] regarding this

Thanks

Is this a case of unlocking value of an entity by spinning off entity & listing them? Similar to what Adani group has been doing

Appreciate your query sir

This is a spin-off and listing of API business. Demergers and spin-offs have been done by many Cos and is common

The idea is to invest in spun-off company if the business is good

Need not draw any parallel with Adani group stocks. Of course the group has done spin-offs and listing in recent past

Thank you

Can I book initial public issue – R?

Dear Sir, kindly check with banker on this before proceeding

In general, “R” represents “Resident”

I have Three Questions.

What is the model between parent and GLS? How much margin can be expected from this model?

What is the CAPEX size planned?

Is there a dividend distribution policy?

Appreciate your queries sir

The Co came in to existence only in FY19 pursuant to spin-off of business division from parent

The parent Co is into finished drugs (formulations) while GLS is into active ingredient in a drug (API)

On margins, the Co has 30+% margins and with the complexity of the ingredients it manufactures, it goes up

On Capex, the Co has not given any number. But going by capacity addition plans over next 3-4 Yrs, which is similar to existing capacity,

it can be to the extent of Rs.700 crore, excluding the capex of Rs.153 crore announced for FY22

On dividends, it is at the discretion of the board. Being a new Co with major capex plans ahead, the possibility of meaningful dividends in near future will be less.

Hope this address your queries. Thank you

Appreciate it. Thank you for the responses.

Thanks for the detailed review

Comments are closed.