With economy watchers banking on a revival in the investment cycle to lift the economy out of its Covid slump, investor interest has perked up in core sectors that power up industry, such as power, steel, metals and cement. India’s cement industry has always been a good proxy for the core economy, with steady volume growth and players enjoying considerable pricing power unlike other commodities. With cement industry leaders such as UltraTech Cement, Ambuja Cements, Dalmia Bharat and Birla Corporation correcting between 10% and 20% in the last 3 months, could there be an opportunity? We take a deep dive into the cement industry to assess its prospects.

(The companies mentioned in this article are for illustrative purposes only and are not our recommendations)

#1 Consolidation in capacities

According to the Cement Manufacturer’s Association, the total installed capacity in the Indian cement industry stands at approximately ~545 million tonnes per annum and India accounts for over 8% of the global installed capacity. The last few years have seen M&A activity in the cement industry, where several smaller players (some of which were debt ridden and on the verge of bankruptcy following aggressive capex) were acquired by the large players.

Some of the M&A activity in the cement industry

- Dalmia Bharat’s acquisition of Murli Industries and Kalyanpur Cements

- UltraTech’s acquisition of Binani Cement and Century Cement

- Sagar Cements’ acquisition of Jajpur Cements

- UltraTech’s acquisition of the cement business of Jaiprakash Associates

- Nuvoco Vistas’ acquisition of Emami Cements (giving it a strong presence in the Eastern region)

The result today is a consolidated cement industry with the top 5 players accounting for nearly half the capacity.

So stark is this concentration, that the leading players in the industry have faced accusations of cartelization and unreasonable price hikes. Unlike other commodities, the domestic cement industry has always been relatively insulated from the import threat and has thus enjoyed pricing power based mainly on domestic demand and supply trends.

#2 Promising demand outlook

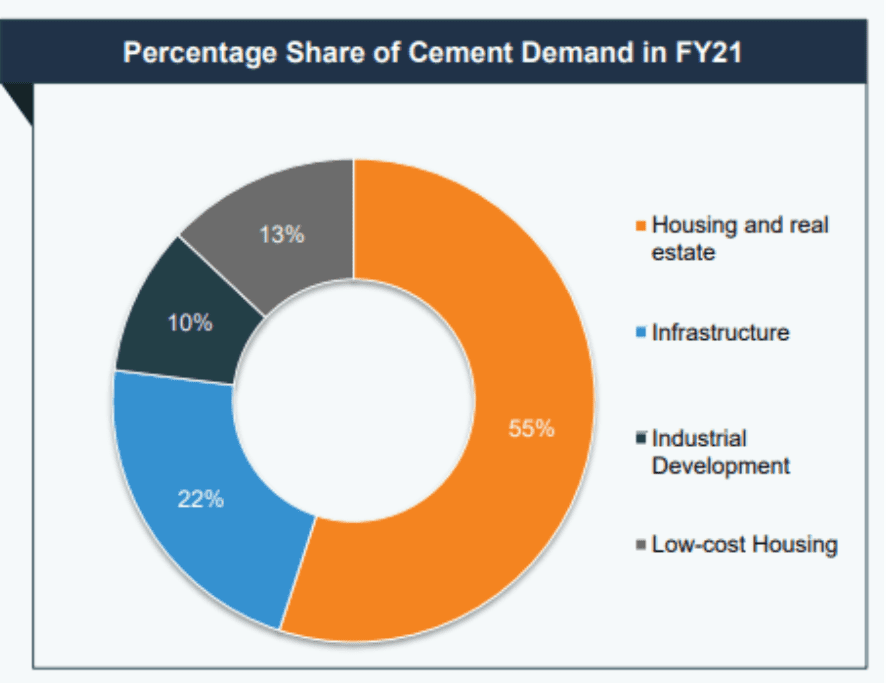

Multiple tailwinds are heralding a revival in India’s investment cycle as the economy limps back from Covid. The government is using its infrastructure buildout plan to crowd in private investments.

Source: IBEF

After a prolonged phase of slow sales and rising inventories India’s residential housing market seems to be turning a corner. With demand expected to perk up, leading cement makers are also confident of price increases, with some parts of the country already seeing an uptick.

Source: CareEdge Research report

Rising demand backed by prices could help alleviate some of the margin pressures that are building up for cement industry players.

#3 Regional markets

Freight costs for shipping cement cross-country are high, therefore regional demand-supply equations play a significant role in deciding prices and despatches. The Northern, Central, Eastern, Western and Southern clusters have their own interplay of demand and supply forces.

In order to be strategically placed, players have located capacities in different regions, with each large player seeking to dominate one region. The IPO documents of Nuvoco Vistas show the distribution of capacities across regions with key players in each.

- North: Shree Cement 23%, UltraTech Cement 23%, Lafarge Holcim 16%

- South: UltraTech Cement 11%, The Ramco Cement 9%, Chettinad Cement 7%, India Cements 7%, Dalmia 7%

- East: Nuvoco Vistas 17%, Lafarge Holcim 16%, Dalmia Bharat 16%, UltraTech 15%, Shree 11%

- West: UltraTech 41%, Lafarge Holcim 21%

- Central: UltraTech 34%, Birla Corporation 13%, Jaypee Group 12%

What stands out is that:

- Only players like UltraTech Cement, ACC & Ambuja Cements (both part of the Holcim Group) have the advantage of having a meaningful presence across all geographies, while others are regionally focused.

- The Southern region which leads in terms of capacity is more fragmented than the other regions, leading to lower pricing power.

- The North, Western and Central regions have a greater degree of consolidation in capacity.

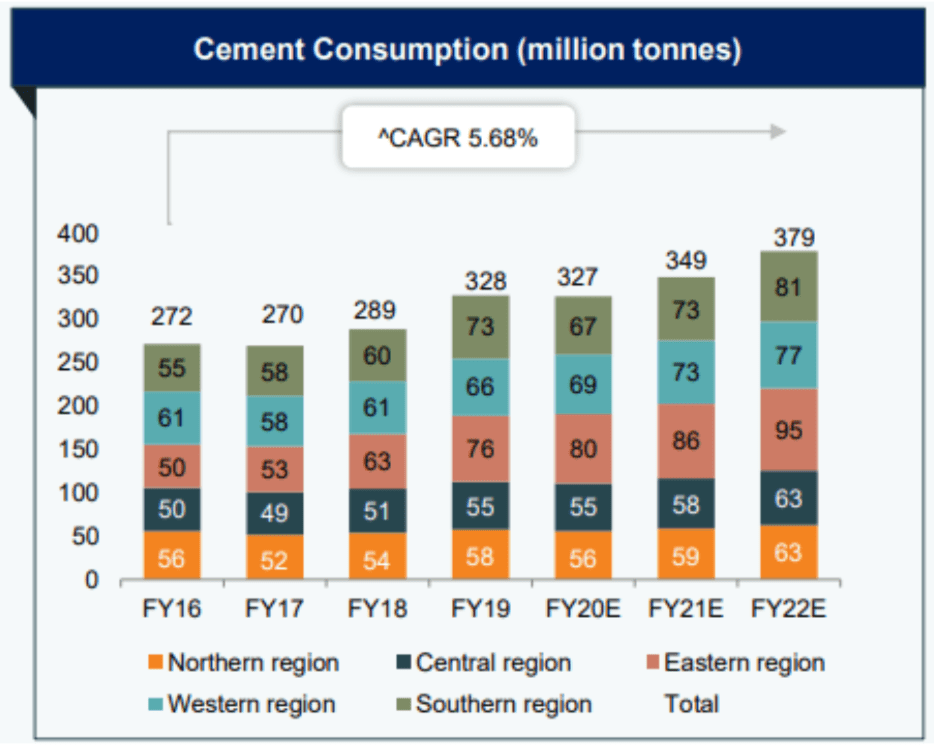

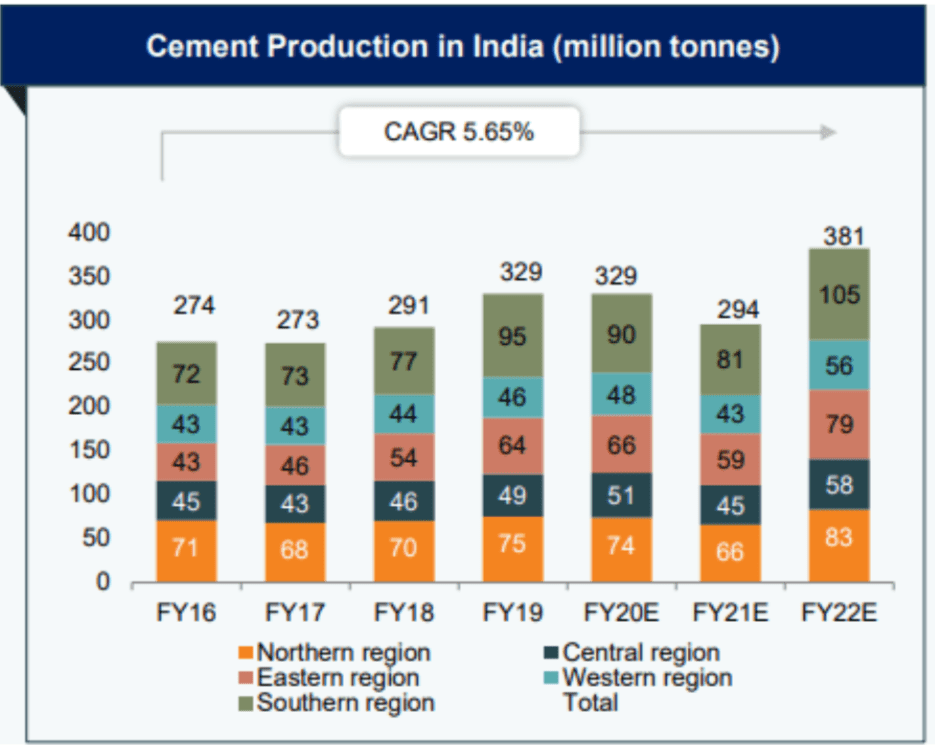

Region-wise demand

While the all-India demand outlook remains strong, the Eastern region is currently in the spotlight for acceleration in the housing and infrastructure sectors. Cement consumption in the East has raced ahead at a CAGR of over 11% between FY 16 and FY21 as against an all India average of 5.1% (1% in the North, 3% in the Central region, 3.6% in the Western region and 5.8% in the Southern region).

Source: IBEF Cement Sector Report - November 2021

This has fueled a spate of capacity expansions in the East which just a decade ago had only ~50 MT (million tonnes). Out of the 80MT of capex expected in three years, CRISIL estimates that 45-47 MT will be added in the Eastern and Central regions, supported by strong demand and utilisations of 72%. The South is expected to see additions of only 6-7 MT, given excess supply and lower utilisation levels of 54%.

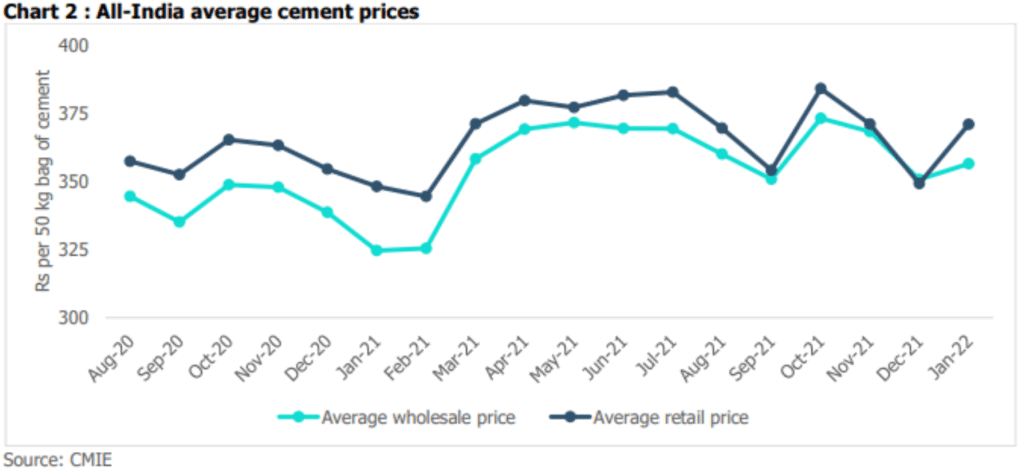

Utilisation rates and prices

Core industries data tells us that cement industry production in April 2021 to February 2022 was up 22.4%, but capacity utilisation rates hold a mirror to how the demand-supply equation is skewed.

Source: IBEF Cement Sector Report - November 2021

CRISIL places the all-India cement capacity utilisation rates at a little over 60%. While the North, Central and Western regions have maintained utilisation rates higher than the all-India average, the Southern region has been battling low rates of capacity utilisation. This region has also had greater price volatility as against other regions.

After price hikes had to be rolled back in the December quarter following unexpectedly weak demand, prices started to pick up in the March quarter, especially in the Eastern region. However, as players rush to ramp up capacities here, price-based competition cannot be ruled out. Prices in the Northern, Central and Western regions which are characterised by greater consolidation, better capacity utilisation rates and a more measured growth in consumption seem more sustainable.

#4 Key players deleveraging

Cement is a capital intensive sector and in past capex cycles, players have ended up taking on excessive debt to fund capacity expansion. This time around though, leading players appear to be cautious about debt or even in deleveraging mode, as they add capacities through the organic and inorganic routes.

- ACC and Ambuja are already at low to zero debt levels.

- UltraTech Cement’s net debt came down from Rs. 6,717 crore to Rs. 6,147 core in March 21 to December 21, and is on track to be ‘debt free’ by the time the expansion programme is completed.

- Dalmia Bharat became net debt free in December 2021

CRISIL estimates that 6 out of the top 10 cement makers will be net-debt free by fiscal 2024.

#5 Margins under pressure

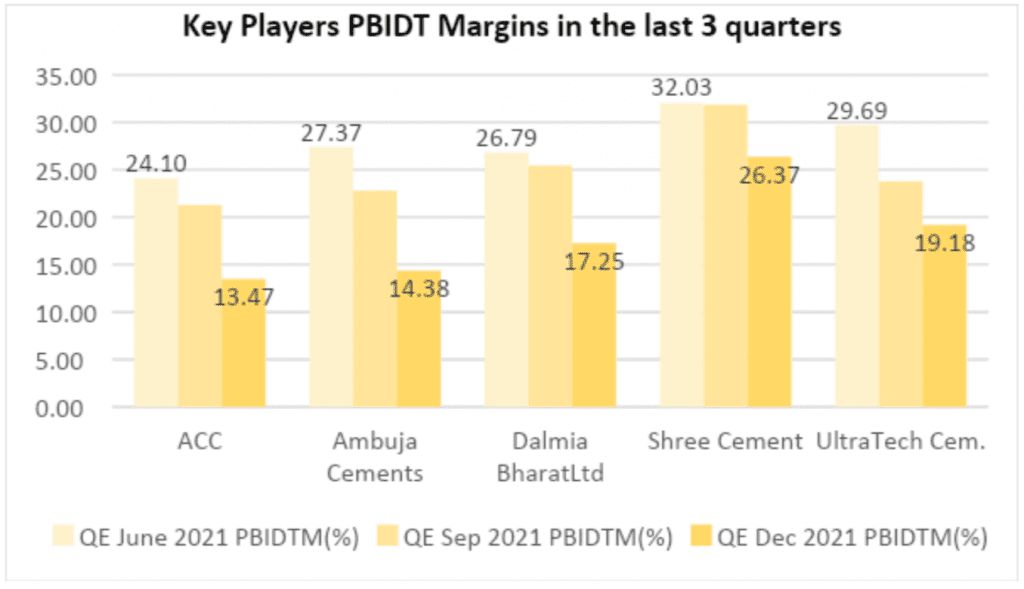

While EBIDTA margins were on a favourable trend in the last three to five years, they’ve been under pressure from the December quarter. Even a player like Shree Cements, which has historically been leading the pack in managing costs and sustaining margins, faced the heat from rising material and fuel prices.

Source: Data from Capitaline database

Key components of cost for cement makers are raw materials, power & fuel and freight. A look at the cost break up of major players for FY/CY21 shows power and fuel to be a big component.

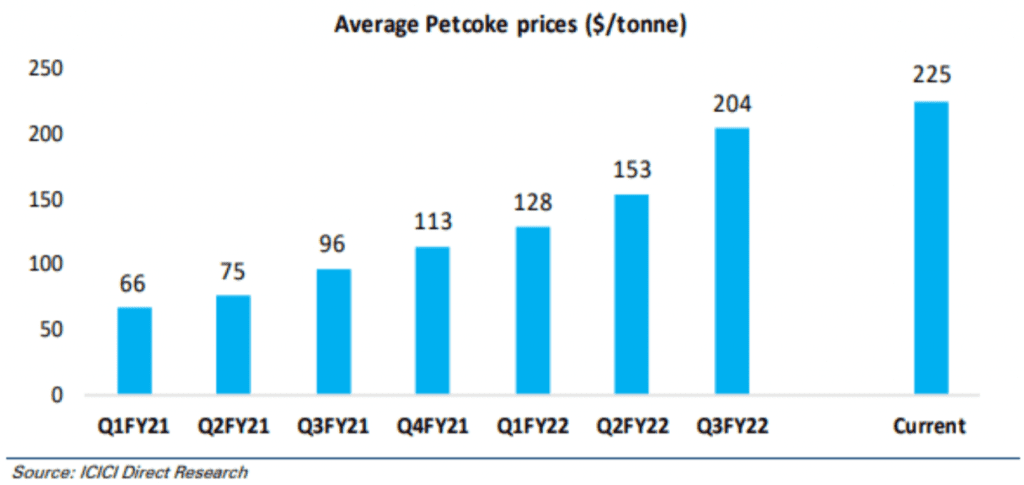

Soaring prices of international coal, pet coke and diesel in recent times, thus threaten margins. Heating is a key part of the cement making process and companies use a mix of domestic coal, imported coal and pet coke. While imported coal is the more economical and preferred fuel, prices of both imported coal and pet coke have jumped, first due to concerns over a global shortage and then following the Russian invasion of Ukraine. Based on affordability, companies have been switching between coal and pet coke to keep the fuel bill in check.

Source: ICICI Direct Cement Sector Update – March 13, 2022

Here is how coal and pet coke prices impacted the earnings of some of the key players. CARE Ratings estimates that the average fuel cost for the industry has increased by Rs.250-300 per tonne in H2FY22. UltraTech Cement’s energy cost went up by 39% YoY in the December quarter. As a percentage of revenue, power and fuel costs went from 20% in December 2020 to 25% in the December 2021 quarter. Shree Cements saw power and fuel rise from 18% of net revenue to 25%. Ambuja Cements clocked energy costs that were over 50% higher at Rs 1,572 per tonne against Rs. 996 per tonne in the December 2020 quarter.

Limestone is the key raw material to make cement, heated and treated to make clinker. The clinker is then ground with gypsum to make Ordinary Portland Cement or OPC. Limestone is a natural resource which has to be mined and the MMDR Amendment Act 2015, governs the auction of mineral blocks. Successful bidders pay an annual amount to States for long term leases.

While India has abundant reserves of limestone, these are concentrated in a few States such as Madhya Pradesh, Rajasthan, Andhra Pradesh, Chattisgarh, Karnataka and Gujarat (Indian Minerals Yearbook). The availability of the right quality and quantity of estimated limestone reserves to match capacities, with leases with a long enough time horizon, provide visibility on growth and revenues.

Limestone is a natural resource and preserving the reserves in their captive mines is a key priority for cement makers. This makes ‘blended’ products attractive.

In addition to OPC, there are several other varieties of cement such as, Portland Pozzalana Cement (PPC), Portland Slag Cement (PSC) etc. (You can take a look here to see the different types of cement being manufactured and their various uses). These variants have varying proportions of the inputs. In PPC for instance, a portion of the limestone is replaced with fly ash which is a by-product of thermal power plants and in PSC, a portion of the limestone is replaced with slag, a by-product of steel plants. These blended products, apart from reducing limestone usage, require less energy in the manufacturing process and reduce the fuel bill.

Gypsum and iron ore are the other raw materials. Raw material costs have stayed range bound between 15% and 20% of net sales in the last three financial years. But in the second half of FY 22, fly ash and gypsum prices too went up. In the December 2021 quarter, Ambuja Cements reported an 8% increase in raw material costs per tonne and UltraTech Cements a 7% increase.

Cement manufacture involves transporting bulky materials - clinker to the grinding units and finished cement to the final market. Accounting for 20% to 25% of revenue, freight is a big chunk of the costs of cement manufacturers. While diesel price inflation has escalated freight costs, key players have maintained it as a percentage of revenue, by optimising the rail:road mix. Some, like Ambuja Cements, even managed to reduce freight costs per tonne in the December 2021 quarter.

Cost controls

While concerns surrounding power and fuel costs are not over yet, the favourable demand outlook offers some solace that some of the rise in costs can be passed on to customers. Apart from price hikes, players are also undertaking other measures to shield their margins. One, they’ve been investing in Waste Heat Recovery Systems (WHRS). Shree Cements, which has led in terms of margins, has had the highest WHRS capacity relative to cement capacity.

Two, they’re relying more on captive power plants and alternate / renewable sources of energy such as wind and solar and High Efficiency Low Emission (HELE) technologies, which help bring power and fuel costs down. Three, increasing focus on blended cements cuts down power requirements. Four, they’re achieving a more favourable mix of retail and bulk buyers. While the retail (trade) route requires the cement maker to invest in distribution networks (dealers and retailers), it translates into better margins.

Investor takeaways

The demand outlook for the cement industry appears strong and cement prices seem to be looking up. The market correction has reduced stock valuations and the consolidated nature of the industry means that an investor already has a ‘shortlist’ to work with.

Below is a valuation snapshot of the major cement makers in India as on April 2, 2022.

Here are the points to keep in mind while narrowing down on a cement stock to own:

Regional exposure: The five regions across the country are in different stages in the journey to consolidation, pricing discipline and capacity utilisation rates. While a pan-India player like UltraTech offers a diversified presence across the regions, players focused on one or two regions face the impact of regional dynamics. The Eastern region is seeing a lot of action in terms of new entrants and capacity expansion. This could result in over-supply and price based competition before it stabilises. The Southern region is grappling with excess capacity. The North, Central and Western regions display pricing discipline which would be valuable in protecting margins.

Product portfolio: A portfolio with strong brands, premium and blended products and a robust distribution network will stand a cement maker in good stead to benefit from the demand uptick and support higher realisations.

Balance sheet health: As leading players embark on capacity expansions to keep up with anticipated demand expansion, capacity utilisation rates and balance sheet health would be sharply in focus. ‘Debt free’ or ‘low debt’ status and healthy cash flows would be key differentiators.

Valuation: An EV / tonne below $100 is generally considered undervalued, whereas $200 – $225 is considered expensive. However, like all valuation ratios, this too would have to be viewed in the context of other parameters such as the company’s presence across regions, balance sheet health, replacement cost, historical averages and value relative to that of peers. Cement industry leaders may command premium valuations.

Other factors: Having access to sufficient limestone reserves with long leases, access to other raw materials such as fly ash and slag to make blended products would be a plus. A cocktail of unusual circumstances has led to steep rises in the prices of the fuels cement makers use. It seems unlikely to sustain long-term but does not seem to be easing up in the short term either. Agility in containing costs (for instance accessing domestic coal when international coal prices are steep) and preserving margins will be a key differentiator in the short to medium term.

2 thoughts on “Cement Industry: 5 things to know before you choose a stock”

JSW Cement is not considered in the top 14 companies?

Thanks for your comment Sir. We identified the top players by market capitalisation and since JSW cement is not yet a listed player, it does not figure on the list.

Comments are closed.