For the first quarter of FY-22 listed steel stocks have generated profits that are already three-fourth that of the full year ending FY-21. The sector has thus stood out for its June quarter earnings, the 2nd wave of Covid lockdown and drop in consumption notwithstanding. Higher prices and export opportunities buttressed earnings despite a drop in domestic sales.

A 33% jump in exports saved the day for this sector even as it witnessed a 15% drop in domestic consumption

Below is the comparison of financial performance of the steel sector for Q1FY22 against the full year of FY21. We did not do the usual comparison with a year ago numbers as most companies were staring at losses a year ago. Steel prices have doubled since.

Given below is data with more insights on the performance of individual companies. You will see that Tata Steel has surpassed its full year (FY-21) profits in a single quarter (June 21). The others have clocked more than half of previous year’s earnings or are already nearing the full year earnings of the previous year.

Now, just to place the steel companies’ enormous jump in PAT in relation to other large companies, let us look at a few examples: Tata Steel’s quarterly profit of Rs. 9,768 crore is the second largest by an Indian Company in the first quarter of FY22, next only to Reliance Industries. The second largest domestic steel maker by capacity, JSW Steel, has reported net profit of Rs. 5,900 crore – placing it in the 5th spot in terms of quarterly earnings, after Reliance Industries, TCS, HDFC Bank and SBI.

The data below will tell you that all the large steel players have seen stupendous growth in the past four quarters.

No doubt, the sector has turned attractive, and this is clearly reflected in the price movement of stocks. Many steel stocks (see table further below) have seen tripling in their prices in the course of the past one year. But what led to this change of fortunes and where do the stocks in this space stack up now? This article will explore these questions. Also check the links to our earlier recommendations in this space - in both mutual funds and stocks.

De-jargonizer

Steel Products Classification: Steel Products are classified majorly into Hot Rolled Coils (HRC), wire rods, TMT bars and round bars. HRC prices are generally taken as the benchmark for steel prices, which are used for a wide range of applications such as, automobiles, electrical appliances, construction materials, containers, agricultural equipment, steel pipes, etc.

Industry shift

#1 Demand goes up – Covid stimulus packages

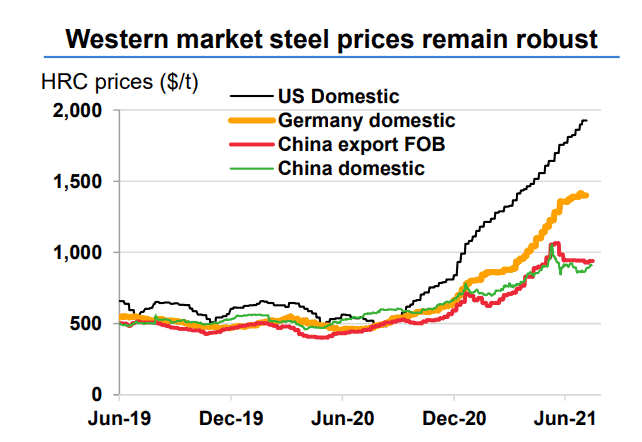

Global steel prices have seen a spectacular run since the second half of FY21, especially in the US and Europe. The HRC (hot rolled coil) prices in the US have spiked up from around $550 per tonne to around $1,800 per tonne while prices in Europe have spiked up from $500 per tonne to $1,400 per tonne as shown in the chart below. This stupendous rally was primarily driven by the shift in supply-demand dynamics following the first wave of COVID. The pandemic led to a $2-trillion stimulus package announced by the US and a $900 billion economic stimulus for European Union nations. Much of these went into transportation infrastructure, vehicle electrification besides power grid projects leading to better prospects for steel demand.

#2 Supply goes down – The China factor

On the supply side, China, a dominant player in this space, resorted to a slew of measures from production cuts to curb exports and allowing imports duty on raw materials. It’s first decision was to cut its steel output to reduce carbon emissions. As part of this plan, China introduced production curbs in Tangshan, its highly polluted steel city, which immediately pushed up prices of steel in China. Anticipating a fall in production because of the curbs, China announced plans to reduce steel exports and focus on feeding domestic demand. On May 21, China removed VAT rebates on the export of 146 steel products (including HRC) and increased export duty on other steel items. At the same time, China also encouraged steel imports by eliminating import duty on raw material, including pig iron, crude steel and recycled steel.

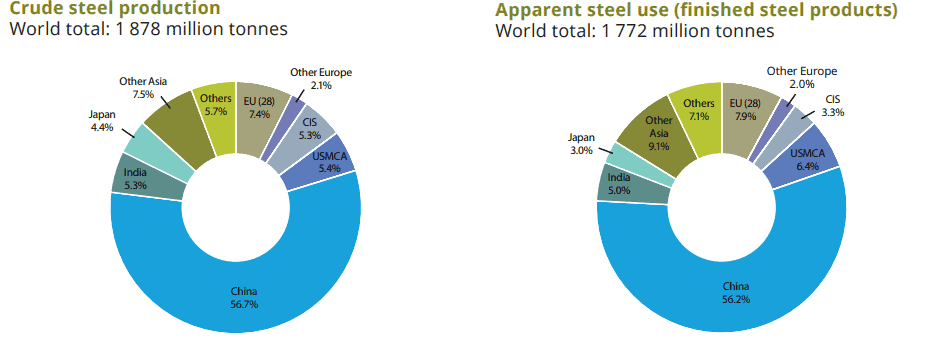

These moves assume importance for global steel price as China is the largest producer as well as consumer of steel in the world (see graph below).

Thus, while the stimulus from US and Europe acted as a key demand driver, export curbs by China put pressure on global supply, pushing up steel prices.

Source: World steel association steel production and use geographical distribution in 2020. Apparent steel use (ASU) is defined as production plus net imports minus net exports and commonly used to measure steel demand

#3 Domestic scenario - prices at discount

Despite this global shift, in the local market, domestic steel prices have been trading at a discount as high as 15-20% to international prices over the last few months. Lack of domestic demand recovery is a key reason. But this also means that domestic players have enough margin of safety in terms of price and capacities to capitalize on a scenario of demand recovery.

But domestic players have been preparing themselves for an upswing by consolidating and de-leveraging. That is discussed below.

Consolidation and valuation

A key structural change that happened in the domestic steel sector was consolidation. Top 5 companies now control 60% of the domestic steel making capacity. This market share may go up further as on-going projects come onstream. Incumbents like Tata Steel and JSW Steel seized the opportunity in the downturn to consolidate through acquisitions.

While Tata Steel acquired Bhushan Steel and few smaller assets, JSW acquired Bhushan Power and Steel. Arcelor Mittal in association with Nippon Steel of Japan took over the ownership of Essar Steel’s 10 million TPA (tonnes per annum) capacity, while Vedanta absorbed 1.5 million TPA from Electrosteel. Tata Steel and JSW have domestic capacities of 20 million TPA and 18 million TPA respectively; more than doubling their capacities over the last decade. SAIL with a capacity of 21 million TPA is already considered large.

This consolidation could pave the way for a strong pricing environment, prudent capacity expansion and high market shares.

The market has taken note of these changes positively and re-rated steel stocks that were otherwise languishing at low valuations. Below is a comparison on valuation of large and mid-sized steel Companies from our Stock Screener based on various parameters

De-jargonizer

Valuation of steel stocks: When it comes to valuation, steel stocks are valued at replacement cost (cost per ton) at the bottom of the cycle and Enterprise Value (EV)/EBIDTA past the recovery cycle. The EV/EBIDTA ratio depends on the longevity of the cycle. Since EV is Market Cap (Equity Value) + Debt, it takes into account overall value for the company based on its replacement cost as well as earnings potential. It can also be referred to as the “take-over valuation” or “acquirer’s valuation” of a company. Consequently, in the case of companies with high debt, reduction in debt in will also lead to increase in Market Cap (Equity Value).

How to use our Stock Screener

- Choose the “sector” first if you are looking for stocks from a particular sector

- Filter further based on the “Market Cap” filter if you want companies above a certain market cap.

- Use the “Add filter” option to add various filters on “Growth”, “Quality” and “Valuation”

- Save the screen for future use as you need to just “run it” to get the latest data at any point of time. Can also “export to excel” and use for further analysis

The above companies have different strengths and therefore their rerating in the market happened for different reasons – apart from the common thrust from the commodity upcycle. If you take Tata Steel, there have been two key developments in financials. One, the increasing contribution of domestic business (given that the company’s overseas subsidiary has been an overhang for long) and two, significant reduction in debt. While the company’s domestic contribution (at 42% now) is expected to move to 50% in another 5 years, it has reduced its debt by a fourth in FY-21. This led to the company’s stock price rallying rapidly in the past year. But companies like SAIL, which did not have the kind of debt overhang like Tata Steel or others like JSW Steel with superior margin profile and better domestic focus, remained more resilient than Tata Steel in the downturn and therefore did not see any sharp bounce back like Tata Steel. In other cases, based on capacity addition plans or consolidation, stock markets have re-rated the companies.

Does the stock run up provide less leeway for further upside in these companies ? Not necessarily, for 2 reasons already discussed. One, there is still room for price rise in the domestic market given the discount in price to the global market. Two, as data shows, sales are yet to recover. That means improved demand from an economic recovery can provide volume thrust and add heft to profits.

Valuation up move, notwithstanding, institutional investors continue to show interest in this space as data below will tell you.

Continued interest by MFs and FPIs

Following is the data of increase in holdings by Mutual Funds (MF) and Foreign Investors (FII) in steel stocks during the latest quarter (ending June 21) from our stock screener.

(You can use our premium screens to check MF and FII stake increase “stock-wise” or “sector-wise” and get the entire list)

Across mutual funds, commodity and infrastructure related sector funds besides small-cap funds have seen increased exposure to the above stocks. Besides, funds that use derivatives (arbitrage, equity savings, balanced advantage/dynamic asset allocation categories) also actively took positions in these stocks.

As for FPIs, besides the stocks mentioned above, increased exposure can be seen. FIIs have increased stake in other smaller steel companies also such as Kalyani Steel, Kirloskar Ferrous, Tata Metaliks, and Sarda Energy.

Our earlier recommendations

Fresh investors in this space should be aware that they are entering into these companies mid-way in their valuation cycle, but can derive comfort from strong earnings and debt reduction.

- We had given a mutual fund call a few quarters ago to play this space: You can check our commodity fund as part of the thematic segment in our Prime Funds.

- We also gave a stock recommendation to play this turnaround and an emerging special situation in a smaller steel company. This is part of our Prime Stocks.

Both of the recommendations hold good. But make sure that your exposure is limited as the sector is prone to volatility. They should not form part of your core holdings, especially in mutual funds.

Lessons from the steel cycle

Investments in steel stocks or commodity stocks in general can be tricky because they appear very cheap at the top of a cycle and expensive at the bottom of the cycle. But the top and bottom are characterized by a chain of events that can serve as a guide to judge the cycle.

For example, at the bottom of a cycle:

- Companies make losses

- their utilization levels drop

- companies with high cost struggle

- debt servicing becomes difficult

- some companies go bankrupt

National Company Law Tribunal (NCLT) resolution of Bhushan steel, Bhushan steel & power and Essar Steel are examples from the previous cycle. Other mid & small sized steel companies such as Adhunik Metaliks, Uttam Galva, Electrosteel, also went through NCLT resolution.

A recovery cycle, on the other hand, is characterized by

- Capacity expansion

- Debt reduction

- strong prices

- earnings growth

- Payouts/returns to investors

Currently you will find both Indian and global companies going through this stage of debt reduction and delivering returns to investors in whatever form possible. Arcelor Mittal, the global Steel giant, for example, announced a buy-back plan of $2.2 billion. Locally, Tata Steel is focusing on debt-reduction and strong earnings growth. This has given a significant leg up to stock price in the past 11 months.

But here’s the caution: at the peak of a cycle, even if prices may hold firm, expansions/acquisitions followed by any economic catastrophe can put an end to the cycle. Many end up with debt post large acquisitions or expansions and a downturn hits them hard. An example to point out would be Tata Steel’s acquisition of European Steel Co Corus in 2007 at the peak of the Steel cycle. Had Tata Steel not acquired Corus in 2007, its share capital would have been half of what is now (expansion in equity to fund acquisition resulted in earnings dilution) while its debt would have been only one third (Standalone debt of Rs.28,000 crore Vs Consolidated debt of Rs. 88,000 crore at the end of FY21) of what is now. You can imagine the price at which the stock would be trading had it avoided that costly mistake at the peak of the previous cycle.

3 thoughts on “Steel Stocks – Hot and Shining!”

Very timely and insightful post,Sir. It gives us conviction to remain invested in your recommended fund i.e ICICI Pru. Comm. atleast in the foreseeable future although recently it has become quite volatile.

“expansions/acquisitions followed by any economic catastrophe can put an end to the cycle”. Do you mean that peaking of cycle is also quite unpredictable.

Welcome your query sir

What we meant was even when all conditions for the commodity is favourable (demand supply, price), it could end up negatively if an economic crisis or pandemic situation comes out of the blue. In normal conditions..the hints we gave will play out between cycles and offer clues on cycle turning.

Thank you

So true about Tata Steel’s Corus acquisation in 2007. Shareholders lost immensely.

Comments are closed.