As far as investment products go, ULIPs (short for Unit Linked Insurance Products) have the reputation of being the ‘bad boys’. While investor wariness toward ULIPs in their earlier avatar was justified, they have evolved since their pre-2010 days following changes made by IRDAI. However, ULIPs have still not entirely managed to shake off their reputation. In this article, we pit the present day ULIP vs. mutual funds – and compare them on parameters such as their function, how they invest your money, liquidity, expenses and tax treatment and see how they stack up.

#1 What they do

Mutual funds as you probably already know are pooled investment vehicles. Professional money managers will manage the basket of instruments where the pooled funds are invested. Our explainer – What are mutual funds? – will give you a quick overview of the key features of mutual funds. This is purely an investment product and brings with it no risk cover. The money you invest is managed by an AMC. If you want life insurance in addition to your mutual fund investment, you would need to separately opt for a term plan.

ULIPs on the other hand combine investment and life (usually) insurance cover into a single product. The payments into the plan are called premium and these can vary in frequency depending on the plan from monthly, quarterly, half-yearly, annual to a single premium.

Every time you make a premium payment on your ULIP, a portion of it goes towards securing life insurance cover for you and the rest is invested. Except in the case of single premium policies, the premium payment term will usually not be less than 5 years.

While this combination of insurance and investment may seem like a positive, it may not be the most prudent way to plan your personal finances as there are more reasons to keep insurance and investment separate than to combine them. Further, if you do not require life insurance, the ULIP will be of no use to you.

#2 Where your money is invested

As far as mutual funds go, it can seem like an extravagant buffet where you can choose from a host of fund categories and funds to pick the best one to suit your goals, time frame and risk appetite. You can take a look at the various categories of funds on offer based on SEBI’s categorization of mutual funds. Each of these categories vary in terms of where and how they invest the money, the time frames that they are geared toward, the risk levels that they bring and the returns that you can expect.

If you are not happy with how your fund is performing or for any other reason at all, you are free to redeem your units (subject to exit loads where applicable) and move your money to a better fund or any other alternate investment. Importantly, you can redeem from the fund of an AMC and invest in an entirely different AMC. You don’t need to switch within plans of the same AMC.

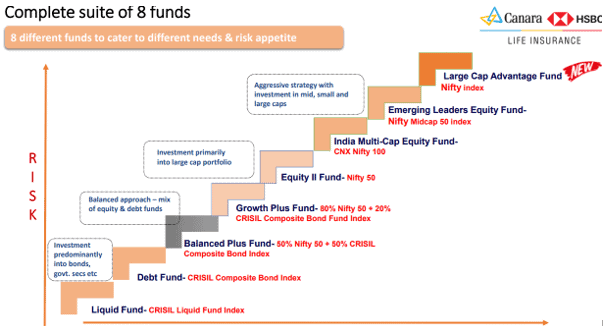

In the case of ULIPs, you also get the option to choose what funds your money is invested in. However, here you have a limited set of funds to choose from, much like a set menu, compared with the different strategy and style categories that mutual funds have. The example below shows the funds that an investor in the Invest 4G ULIP from Canara HSBC Life Insurance can choose from. These funds, like mutual funds, are professionally managed and publish NAVs on a daily basis.

While you will have some flexibility in moving your money across the funds that your life insurer offers, (switches in most cases are free of charge or free of charge subject to a maximum number of switches) your options as against a mutual fund investment are far more limited. You will likely not get options like index funds, ETFs, and sector or thematic funds in a ULIP. Nor will you specifically have a value or contra or a large & mid fund offered by every insurer.

This, coupled with the fact that ULIPs don’t come with portability (though they come with a free look period), means that, if you are not happy with how the funds you have are performing, you cannot freely move to another fund in the same category. You would have to surrender your ULIP to be able to move elsewhere and this means you also cut short your risk cover.

#3 Liquidity

Mutual funds in India are governed by SEBI. One of the biggest advantage that they bring to the table is liquidity. As an investor, you can buy and redeem units anytime you want to and the same will be processed at the applicable NAV (except some types of mutual funds such as ELSS that come with a lock-in period of 3 years). Even close-ended schemes like FMPs that are meant to be held till maturity can be traded on a stock exchange although liquidity may be severely limited. And then there are ETFs from mutual funds, that can be bought and sold on the exchanges, like the way stocks are traded.

When you exit a fund, apart from the capital gain or loss that your investment may have incurred, you may have to bear an exit load depending on the fund and how soon you redeem your units. Shorter duration funds have no exit load or have it for a few months while most equity funds have it for a year or less. The exit load, if applicable, is usually calculated as a percentage of the redemption amount and deducted from the proceeds before it is paid out to you.

ULIPs on the other hand, fall under the purview of the IRDAI and are governed by the IRDAI (ULIP) Regulations 2019. These plans come with a lock-in period which the regulations define to be “the period of five consecutive completed years from the date of commencement of the policy, during which period the proceeds of the discontinued policies cannot be paid by the insurer to the policyholder or to the insured, as the case may be, except in the case of death or upon the happening of any other contingency covered under the policy.”

The lock-in period has been put in place because ULIPs are intended for wealth-creation which usually happens only in the long-term. However, a mandated lock-in period of 5 years means your funds are inaccessible, should you have a requirement that does not qualify for a payout under the ULIP.

If before the end of the lock-in period, you choose to stop paying premiums and you don’t opt to revive the policy within the time allowed, your life cover will cease and the fund value (after deducting discontinuation charges) will be moved to a discontinuance fund account and will only be paid out at the end of the lock-in period.

Further, what will be paid out to you is after deduction of fund management charges for the duration till pay out. After the lock-in period has passed, the policy can be surrendered without charges for the same. However, with several charges being front loaded in a ULIP, you don’t give these expenses a chance to get spread out over the long term.

#4 Tax treatment

As far as taxation of mutual funds goes, it is pretty straightforward. They are taxed at the time of redemption. Gains from equity funds held for less than a year (short term capital gains) are taxed at 15% and long term capital gains over a limit of Rs. 1 lakh are taxed at 10% with no indexation benefits.

For debt funds on the other hand, the holding period cut-off is 3 years for classification as long or short term capital gains. Short term capital gains are added to the income and taxed at the applicable rates whereas long term capital gains are taxed at 20% after indexation. IDCW payouts are always added to the income and taxed at the applicable rates.

Please note that taxation of debt funds have undergone a change. Indexation benefits will not be available for investments made from April 1, 2023 onwards. You can read all about this change in our article ‘Tax changes in mutual funds: How to manage your investments now‘.

Here is where ULIPs have an edge. Or at least, used to have an edge until recent amendments to the Income Tax Act. The favourable tax treatment that ULIPs are eligible for is by virtue of the life insurance component and consists of two parts.

First, premium payments to a ULIP are eligible for deduction under section 80C of the Income Tax Act. This benefit is only available to a category of mutual funds called ELSS or Tax Saving funds. In any case, the total deduction across all eligible items under section 80C cannot exceed Rs. 1,50,000.

Second, payouts from ULIPs fall under the purview of section 10(10D) of the Income Tax Act (Incomes which do not form a part of total income). While earlier, all ULIP payouts were not included in computing total income for tax purposes (as long as premium does not exceed 10% of capital sum assured) and this meant that ULIPs were getting the dual benefit of exemption at the time of premium payment and at the time of payout, this was recently changed as follows:

- With effect from February 1, 2021, this blanket exemption was modified to be available only to ULIPs issued before February 1, 2021.

- For ULIPs issued after the above date, the exemption would only be available if the premium for such policy is under Rs 2,50,000 per year.

- The section also says that if premium is being paid for more than one ULIP, then the exemption will be only available for the policies where the aggregate premium does not exceed Rs. 2,50,000 for any of the previous years during the term of any of those policies. (None of this is applicable if the payout is on account of the death of the insured). This circular, explains with examples how the changes will impact taxability of ULIP payouts.

- In addition, the gains on the high premium ULIPs (over Rs. 2,50,000 issued after February 1, 2021) will be taxed in accordance with this notification which treats the gains more like gains on equity mutual funds.

What this means is that the full effect of the tax benefits is only available to:

- ULIPs issued before February 1, 2021 and

- ULIPs with premium / aggregate premium below Rs. 2,50,000

For high-premium ULIPs, the only meaningful advantage in terms of tax treatment is with respect to section 80C which is anyway capped at Rs. 1,50,000.

#5 Expenses

As far as mutual fund investments go, your expenses are quite transparent and come under just two heads:

- One is the exit load which may be applicable in some funds depending on when you redeem your units or not at all.

- The other is what is covered by the ‘mutual fund expense ratio or total expense ratio (TER)’ which is adjusted every day from the fund’s NAV before it is declared. The expense ratio covers the whole gamut of expenses from fund management expenses to custodial expenses and marketing expenses. In the case of regular plans, the expense ratio will be higher on account of the commission paid to mutual fund distributors.

To get an idea of mutual fund expense ratios and how much (or little) it has eaten into your NAV, take a look at our tool – Mutual Fund Expense Ratios (Direct vs. Regular) – that helps you compare expense ratios by fund category. These expense ratios are also subject to limits imposed by SEBI on a slab basis and you can find these details and more in the above page. - The returns you see on your NAV is the actual returns after all expenses. Hence, what you actually earn is very clear unlike ULIPs, where one needs to calculate one’s individual return.

This brings us to the very sensitive topic of charges in ULIPs. Before 2010, the ULIP space was rife with hidden charges and there was no uniformity across players.

Now however, on account of measures taken by IRDAI, there is a more focus on uniformity and transparency with respect to charges in ULIPs. Further, the charges are also subject to maximum limits that are periodically reviewed.

Below is a look at the main charges one would encounter in a ULIP.

From the above table, the only item that can be meaningfully compared with mutual funds is the fund management charge which is capped at 135 basis points.

However, what would also be a useful comparison for you to make is to compare the mortality charge against the premium for a pure term plan.

While the situation regarding ULIP charges has evolved, and the standardised terms and limits bring a certain level of comfort to the investor, it is still not as straightforward as the charges in the case of an investment in mutual funds.

One would need to do a careful reading of the product information to be able to get a grip on how exactly the charges work for the specific ULIP being evaluated. Further, features such as return of mortality charge and return of premium allocation charge add to the complication.

It is also worth noting that the charges are subject to GST.

#6 Returns

For mutual funds, since they are purely investment products and the number of cost line items are limited, arriving at returns is not a challenge. Our article, ‘Understanding mutual fund returns’ will tell you how you should compute and evaluate the returns on your mutual funds. This can then be compared with peers in the same category, the average for the category and also against benchmarks among other things.

The 1,3,5 year returns that you see on websites or factsheets are the actual returns you would get if you held those over that period, pre-tax. There are no other charges that you need to deduct to arrive at your return. It is one of the most transparent products in terms of showcasing returns.

With ULIPs, returns can be a bit tricky to make sense of.

In the early stages when you are prospecting, you will get an illustration of benefits which will be based on an assumed rate of return (usually 4% and 8%). What will be more important for you to consider is the net yield which is basically the returns at the assumed rate of return minus the reduction in yield (charges).

Do ensure that mortality charges have been considered in arriving at the net yield.

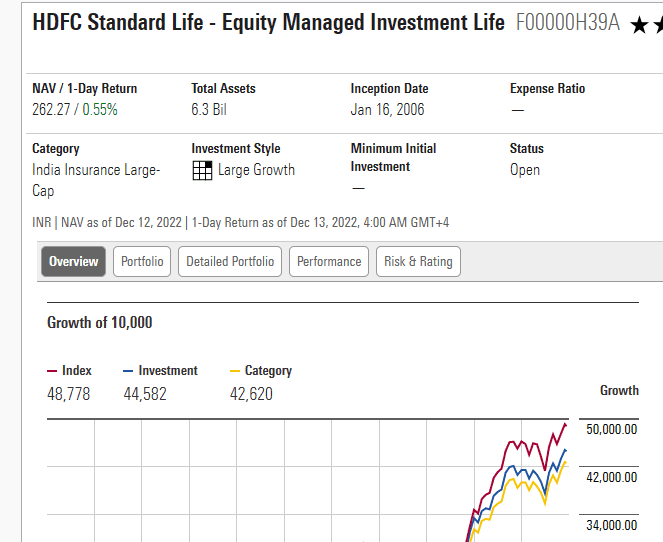

The investment portion of ULIP premiums are invested in the underlying segregated funds based on the options you choose. In accordance with regulations, the NAV of these funds is published daily and can be found on the website of the insurer or on sites such as Morningstar.in.

While this information tells you how the fund has performed, the performance of your ULIP will not necessarily be the same due to the following factors:

- The mortality charge that keeps getting reduced from your asset value (by extinguishing equivalent units) is unique for you.

- Other charges that are levied by extinguishing units too will impact your investment.

- Charges such as premium allocation charge that are reduced from the premium, will have the impact of reducing the investment amount you start with.

While the performance of the underlying funds may well match that of a similar mutual fund, and the fund management charge too could be at par with expense ratios of direct plans of mutual fund schemes, the other variable factors have a bearing on the returns in a ULIP making it hard to make a meaningful comparison with a mutual fund. Often times, only when you own a ULIP will you even know what it actually delivered and then make a comparison.

Further, the limitations on options and inability to move to a better performing fund under the same category, weighs down the ULIP in terms of getting the best returns for your investment.

Key Takeaways

ULIPs have certainly come a long way since their original avatar. Thanks to regulatory initiatives, transparency, which was a key concern earlier is less so now. However, the following need to be borne in mind.

- The combined insurance and investment structure may not be of any use to you if you already have sufficient term cover (our Term Insurance Calculator could help here) or don’t require life insurance. Our article ‘Who doesn’t need life insurance’ will help you decide if you are someone who doesn’t require life insurance.

- If you do require life insurance, check if the ULIP will provide you with sufficient cover, without eating up a major portion of your premium. There is no ‘maximum’ for the mortality charge as this is unique to you. Your mortality charge could be high also if you are not ‘young’ or fall under a category that would warrant higher risk premium. In these cases, you will need to compare the same against the premium for a pure term plan to see if you are getting your money’s worth.

- ULIPs score low on flexibility compared to mutual funds on account of the 5-year lock-in and the inability to port. This means that you should be prepared to not have access to these funds for 5 years at least. Further, you could be losing out on better opportunities should the funds of your insurer underperform meaning, you are limiting the returns on your investments.

- Latest regulations mean that the most attractive ULIPs from a tax standpoint are those issued before February 1, 2021 and low premium ULIPS / ULIPS with premiums aggregating to Rs. 2,50,000. If your ULIP does not meet these criteria, the main tax benefit is by virtue of section 80C. This too would be of no significance, if you have already used up your Rs. 1,50,000 limit with other eligible investments.

- The biggest challenge surrounding ULIPs is getting a grip on all the charges and factoring these into the returns expectations. Due to the nature in which some of the charges are levied (extinguishing units) further complicated by the return of some of the charges during the lifetime of the ULIP, despite the best efforts of the regulators, evaluating ULIP returns is not straightforward.

At PrimeInvestor, we prefer mutual funds to ULIPs and prefer having a separate term cover for life, if you need one. This stance is further strengthened by the advent of more passive mutual funds (index funds and ETFs) whose cost structure and simplicity makes it a far better choice even within mutual funds, without the need to actively manage your portfolio.

5 thoughts on “ULIP vs. Mutual Fund – where should you invest?”

Yes I’ll always vote for mutual funds over ULIPs.

Actually I wanted to comment on your article on who doesn’t need insurance. You have taken the example of a home maker and said that she doesn’t need insurance as the family may not suffer financially if something happens to her. But this is not correct. I know of a family where the lady passed away due to covid leaving the husband and 2 school going kids. Now this father has to keep a full time cook and maid to look after his kids when they return from school. He’s shelling out an extra 20k for all this. If the lady were insured adequately, this would have been taken care of. There is a whole load of invisible income earned by a home maker.

I really don’t know if any insurer in india who says that we do not offer policies to home makers. They are more than willing to sell policies. Please check and let us know which company has this rule? I am posting as a comment here because the other post has no comment option.

With term insurance, there is a min income earning criteria with proof (salary slip), failing which term policies are not provided. thanks, Vidya

Insurer (e.g. Aegon life) provide term insurance to the wife if the husband is already covered by the company. No income proofs are required.

Comments are closed.