Investing in mutual funds can sometimes feel like an exam with a lot of multiple choice questions – regular plan or direct plan, growth option or IDCW. If you have already been investing in mutual funds, then you’re familiar with the growth or dividend option that you select for your investment. But if you’ve noticed, there’s no dividend option anymore. Now, you have the ‘IDCW’ option. So, old or new, as a mutual fund investor, chances are you’re wondering what is IDCW in mutual funds.

IDCW expands into Income Distribution cum Capital Withdrawal. With effect from April 2021, SEBI renamed the dividend option and called it ‘IDCW’ or Income Distribution cum Capital Withdrawal to make it more clear to investors what exactly the hitherto misunderstood dividend option in mutual funds was. The SEBI circular for the same can be found here.

So what is IDCW in mutual funds? This may sound like a tongue twister and have you wondering what the letters stand for at first. But what is reassuring is that it doesn’t really change how the investment works for the investor. What this new term does do is more accurately describe the distributions that mutual fund schemes make than the earlier term, ‘dividend’, and here’s why.

What happens in the growth option?

Mutual fund schemes make gains both in terms of dividends on stocks or interest received on the debt investments that the scheme holds and gains on the sale of these investments. The underlying portfolio remains the same under both options – the growth and IDCW (erstwhile dividend).However, in the growth option, gains made by the scheme are put back into the scheme, helping the money gain from compounding and adding to the NAV. You don’t receive any payout from the scheme other than at the time of your selling your investments in the scheme.

What is IDCW in mutual funds?

That’s not the case under the IDCW option, formerly known as dividend option. In this option periodically, ‘dividends’ are declared from the gains made by the mutual fund. Dividend payment frequencies can be daily, monthly, quarterly or annual. This dividend payment is required to be dispatched to unitholders within 15 days from the record date according to SEBI (Mutual Funds) Regulations, 1996 (Last amended on November 9, 2021).

So what is IDCW in mutual funds, i.e., dividends and how is it different from growth?

In a mutual fund, there is a dividend declared. However, this dividend is not extra profits that the fund is sitting on and giving you. Instead, in a mutual fund dividend, what actually happens is dividend is part of your own investment that the fund takes out and gives you – the dividend or IDCW will be deducted from your NAV. Therefore, your investment value drops to that extent. The dividend option, therefore, comes out of your own profits and roughly translates into you booking profits in your investments from time to time.

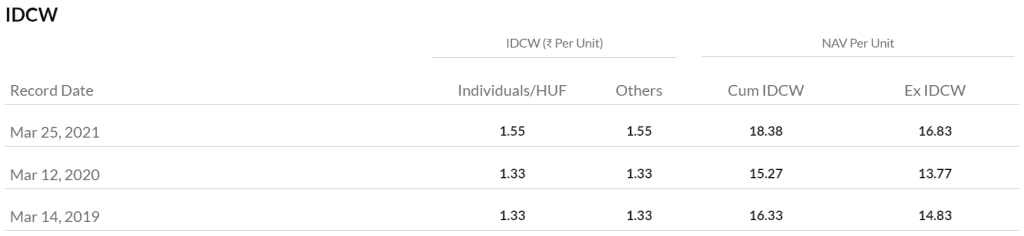

The example below, using Axis Bluechip Fund, shows how the dividend deducted from NAV impacts the NAV post dividend. Although the scheme has the same underlying portfolio of assets, the NAV under the growth option will be different from the NAV under the IDCW option.

Source: Axis Bluechip Fund Regular Growth

So, what is IDCW in a mutual fund, then? In dividend payouts, there can be both an income component and a capital component that gets distributed to the unitholder. By terming a payout as just ‘dividend’, SEBI observed that investors were not aware that it was part of their own investment (income and capital) that was being distributed. Therefore, as it was not evident under the earlier naming convention, SEBI changed it to IDCW or Income Distribution and Capital Withdrawal.

According to the SEBI circular “when units are sold, and sale price (NAV) is higher than face value of the unit, a portion of sale price that represents realized gains shall be credited to an Equalization Reserve Account and which can be used to pay dividend.” For a detailed illustration on how the payouts come out of the income and capital buckets, take a look at the FAQ and illustrations provided by AMFI.

Had these payouts not been declared, they would have contributed to the growth in the NAV. The dividend or IDCW in mutual funds is not fixed or based on the ‘profits’ a scheme makes but is at the discretion of the fund manager. Soon after the dividend is declared, the NAV of the fund will be reduced by the IDCW amount.

The table below compares Growth and IDCW in a mutual fund. Let’s assume you invested Rs 100,000 in the IDCW and Growth options in Axis Bluechip – Direct plan (to continue to example from above) made on 12 Jan 2015. The final value on Jan 10, 2022 includes the total dividend received since investment, in the IDCW option. As you will see, the IDCW option will reduce compounding. You will have to ensure that you reinvest this amount, in order to maintain returns.

In IDCW in a mutual fund, there’s one key point to note - there is no legal requirement on the frequency of this IDCW payment. The quantum of IDCW payment can and does change, based on the distribution the fund manager intends to make. Dividend declaration is at the discretion of the fund house and the fund manager. A fund can completely skip paying dividends altogether, even if it has a ‘monthly’ or ‘quarterly’ etc. dividend payment option.

What happens to the IDCW in mutual funds?

The IDCW in mutual funds can be paid out into your bank account, reinvested or transferred. Accordingly, dividend reinvestment and dividend transfer plans have also been rechristened to be known as ‘Reinvestment of Income Distribution cum Capital Withdrawal option’ and ‘Transfer of Income Distribution cum Capital Withdrawal plan’. In the case of re-investment, it will result in an increase in the number of units held.

What IDCW in mutual funds is not

- IDCW in a mutual fund is not additional return: One of the common misconceptions associated with IDCW, especially when it is referred to as ‘dividend’, is this - like dividends on stocks, it provides a return to the holder in addition to the capital appreciation on the investment. But that’s not true. In a mutual fund it is the unitholder’s money or a part of the NAV that is getting distributed to him. As shown in the example above, when the fund declares IDCW, the NAV gets reduced by this amount.

- IDCW in a mutual fund is not dividend from stocks the fund holds: The other mistaken assumption about mutual fund dividends is that it is a distribution of the dividends received by the fund from the stocks it holds. Not true. Dividends received by a mutual fund by virtue of the stocks it holds will result in an increase in an NAV and will not be directly passed on to the unit holders. The unit holders will benefit via an increase in the NAV of their units.

- IDCW in a mutual fund is not related to dividend yield theme: Dividend yield funds are funds that use a stock’s dividend yield as a valuation metric to pick stocks that are undervalued. A dividend yield fund is not a fund that will pay out steady dividends to you. In fact, dividend yield funds themselves come with growth or IDCW options.

- IDCW in a mutual fund is not the same as SWP: SWPs or Systematic Withdrawal Plans allow you to make periodic withdrawals of fixed sums from your mutual fund holding, providing you with a regular flow of funds. IDCW in a mutual fund is not the same as this – as mentioned above, the IDCW is not guaranteed and the quantum is not uniform. Our earlier article on SWPs, what they are and why they score over the IDCW option can be found here.

How is IDCW in mutual funds taxed?

Until Budget 2020, dividends declared by mutual funds were subject to DDT or dividend distribution tax, where the fund house deducts the tax on your behalf and transfers the dividend net of tax to you. While the amount was not taxed in your hands, you still bore the impact indirectly as the payout of the DDT would have the effect of reducing the NAV.

However, Budget 2020 made dividends or IDCW in mutual funds as they are now known, taxable at the hands of the unitholder based on the income tax slab rate applicable to him / her. For example, if you are in the 30% tax bracket, you will have to pay tax at 30% on the IDCW amount regardless of how long you have been investing in the fund. This robs you of the tax efficiency that funds otherwise offer.

Therefore, it would make more sense to opt for the growth option and let the capital gains alone be taxed – for equity-oriented funds, you will have long-term capital gains up to Rs 1 lakh exempt from tax in equity oriented funds, and pay a far lower 10% tax on the remaining. You pay 15% for short term capital gains. For all other funds, you pay 20% on long-term capital gains after taking advantage of cost indexation to reduce capital gains. STCG alone is taxed at slab rates. This is more advantageous as against paying tax on the entire IDCW (dividend) amount, which includes both income and capital components.

What is IDCW in a mutual fund useful for?

To put it in very clear terms, the IDCW in a mutual fund is not really an attractive option.

- In general, the IDCW option is picked by investors seeking some periodic inflow of funds. Because the IDCW happens at the discretion of the fund manager, there is no assurance that the it will be declared at the intervals or in the quantum that the funds are needed. To be able to truly get the quantum of funds you need, when you need it, an SWP would do the job more effectively. Remember, an IDCW is not an additional return.

- On the taxation front as well IDCW payouts are on a weak wicket as they are taxed at the hands of the unit holder based on the applicable tax bracket making the growth option with SWP if needed, relatively more attractive.

- When compared against the growth option too, the IDCW option does not fare very well because it means that your money is being returned to you instead of remaining invested in other attractive opportunities and being given the chance to compound.

Due to the above, it would be prudent to compare the IDCW option against the growth option (with an SWP) on whether it meets your requirements (both timing and quantum) and ticks the boxes on taxation and wealth creation before opting for an IDCW in mutual funds.