The very term ‘high beta stocks’, sounds exciting and adrenaline packed – well at least as far as investing goes. But how should beta be interpreted, what are high beta stocks and should high beta stocks find a place in your portfolio? These are some of the questions that this article delves into.

What is “beta” in high beta stocks?

Before jumping into high beta stocks, let’s take a step back and understand what beta is. Beta is a statistical measure that measures the volatility of the price of a stock relative to the market which is represented by an index (such as the Nifty 500 or S&P 500). Essentially, it attempts to capture, in a number, how much the price of the stock will move in response to moves in the market. Since the beta is a measure of the volatility of the stock, it is used as an indicator of risk.

In other words, it aims at capturing how much higher than the market a stock can rally when the market moves up and how much more the stock can fall when markets correct. Higher the beta of a stock, the more it will rise when markets rally – and the steeper it will fall in corrections.

High beta stocks are more volatile and higher risk. Beta as a factor is most popularly associated with the capital asset pricing model (CAPM), which is used to price securities, where it acts as an indicator of the systematic risk. Here, beta forms a key input along with the risk free rate of return and risk premium, on the basis which the security in question is priced.

How is beta arrived at?

Beta is a formula. It is computed by dividing the covariance of the stock returns and index returns by the variance of the index. The covariance of the stock returns and index returns indicates how correlated the two are. The variance of the index captures how the index moves, relative to its own mean. Beta can also be computed in excel using the ‘SLOPE’ function.

Interpreting beta and what are high beta stocks

The beta of the index will always be 1, since it represents the base.

- A stock with a beta of 1 will be highly correlated to the index and will likely move in the same manner as, and keep pace with, the index.

- A stock beta value that is lower than 1 indicates that the stock is less volatile than the index and will bring a degree of stability to the portfolio that it is a part of. It can, in fact, lower overall portfolio volatility risk. Going a step further on the axis, a negative beta would indicate an inverse relationship with the index which means that the stock is likely to move in the opposite direction as the index.

- A beta that is greater than 1, or a high beta, will indicate that the stock is more volatile than the index and that the movements in the stock will be greater than in proportion to the index movement. A high-beta stock can therefore rally much higher than the index, but then falls much more steeply during corrections. High beta stocks are therefore stocks with volatility greater than the market or the index. Investing in high beta stocks call for a greater risk appetite. Portfolios with high beta stocks can deliver well on the upside.

Drawbacks of beta

Beta is most commonly criticized with respect to the following two aspects:

- It does not factor in the fundamentals of the company that it pertains to such as changes in the balance sheet of the company, its business model or any moat it might have.

- It is arrived at using historical data for a specified time period and is therefore only indicative of what could happen in the future and not set in stone. Further, beta too can keep changing as newer data points emerge with each day of data. The period and index in consideration also matters, and a change in period may change beta of a stock.

Nevertheless, beta is a valuable input in financial decision making as it standardizes the measure of volatility making it comparable across stocks.

How high beta stocks behave

High beta stocks are very sensitive to moves in the market. So when the index rises, the stock will likely rise but the rise will be more amplified. On the flip side, when the index falls, the stock will likely fall. Here again, the fall is likely to be more pronounced than in the index.

The steep falls and rises are often viewed as opportunities to time the market. To illustrate this point, take a look at the graph below that traces the percentage change in the closing price of Tata Motors – DVR (a high beta stock) and Zydus Wellness (a low beta stock) against the Nifty 50, during the tumultuous February – March 2020 period. While Zydus Wellness’ movements have mostly been muted in comparison and stayed around the +/- 5% range, Tata Motors DVR was prone to exaggerated versions of the ups and downs witnessed by the Nifty 50.

Typical high beta stocks

Usually, more small and mid-cap companies fall under the high beta stocks category. Certain sectors too, figure more prominently in the high beta stocks bucket. A quick filter of the top 50 companies by beta in the Nifty 500 shows a few sectors come up repeatedly like financial services, real estate, automobile, or cyclical sectors such as capital goods, metals, power and construction.

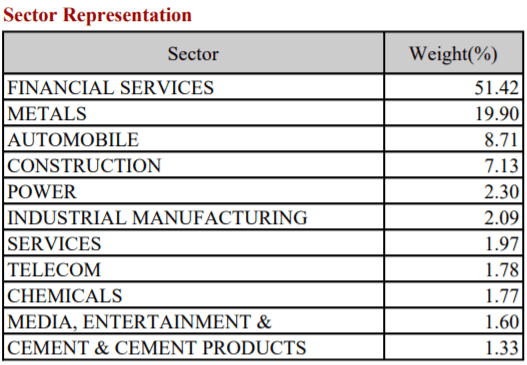

A look at the components of the Nifty High Beta 50 (one of NSE’s strategy indices, that aims to measure the performance of high beta stocks that are listed on NSE) also supports this. These sectors are usually more sensitive to changes in the external environment such as the general regulatory and economic climate or could be cyclical and therefore, prices of these stocks tend to be more volatile than the index.

Source: Nifty High Beta 50 factsheet

Equally important are the stocks that are at the bottom end of any list sorted in the order of beta or low beta stocks. Here, one can find companies in the pharmaceuticals, healthcare / diagnostics and FMCG sectors, all of which benefit to some extent from stable demand environment stemming from non-discretionary spending. These socks are less volatile than the index, even in scenarios such as a pandemic. Below is a list of 25 companies with the lowest beta in the Nifty 500.

Do high beta stocks always mean high returns?

High beta stocks are perceived to bring the possibility of earning greater than average returns or ‘beating the market’. While in an upswing, high beta stocks can perform better than the market, they also come with the flipside of sharper falls during a correction. A look at the price change percentage of the Nifty High Beta 50 (which picks stocks with highest beta relative to the Nifty 50), the Nifty 500 and the Nifty 50 across various durations throws up the numbers below.

While the high beta stocks have a significant edge during market rallies, soaring well above markets, the High Beta index also falls very sharply. As you will observe, these steep falls wipe out much of the gains, limiting average returns over the long term.

Further, a look at the share price returns of the top 50 stocks by beta in the Nifty 500 shows that only 21 of them have out-performed (stock price change alone) the Nifty 500 in the 3-year period (as of December 5, 2021).

This only highlights the point that you need to be deft with timing in high beta stocks, to capture the upside well and limit downsides. As always, look at stocks holistically keeping in mind sound fundamentals and other factors such as valuations and not just high beta stocks.

So what does one do with high beta stocks?

While high beta stocks may signal opportunities to capture upswings and make hefty gains, especially in rallying markets, it would require an active and vigilant approach and timely entry and profit booking. However, to whom timing the market is irrelevant, there can be no substitute to picking stocks with sound fundamentals and holding them. In such a process, beta too is a valuable input as an indicator of the volatility that the stock might bring to the portfolio. High beta stocks in a portfolio might need to be balanced out with more defensive low-beta picks. In any case, like all other metrics, beta cannot be used in isolation to form the basis of investment decisions.