With more retail investors wanting to get in on the action happening in the stock markets, SIP in stocks have been gaining popularity as it allows investors to buy stocks in reasonable quantities with time, even if they cannot spare a large sum in one go. What is an SIP in stocks, how does it work, how does an SIP in stocks stack up against a lump sum investment? Should you make an SIP in stocks your preferred route to investing in equity?

What is SIP in stocks?

SIPs in mutual funds, have over time, proved their ability to minimize the risk of making ill-timed investments and have helped investors bring discipline and the power of compounding to the process of wealth building. SIP in stocks seeks to extend this approach to investing in equity as well. Known by different names by different brokers, SIP in stocks, makes purchases of stocks of a predetermined amount / quantity at regular intervals (for e.g. daily / fortnightly / monthly). By opting for an SIP in stocks, you will be investing directly in equity and will therefore need a demat and a trading account. Brokerage charges too will apply on the transactions.

What makes SIP in stocks so popular?

Many of the benefits of investing in mutual funds through the SIP route are what draw retail investors to SIP in stocks.

- First, SIP in stocks makes stock investing more accessible because it requires a regular but much smaller financial commitment as against a lump sum investment.

- Second, because it gets automated and you don’t have to initiate it every time after you do the initial set up, it runs on auto pilot and brings about a discipline to the process with minimal effort.

- In addition to the above, investors also believe that SIP in stocks reduces the risks inherent to equity investing, especially the risk associated with volatility, by not needing to time investments. By entering the market at various price points, it is believed that the price is averaged out (rupee cost averaging) much like an SIP in mutual funds.

- Compared to the mutual fund route to investing in equity, directly accessing stocks through an SIP in stocks is considered a big plus as it saves on the fund management costs.

How does an SIP in stocks measure up in terms of returns?

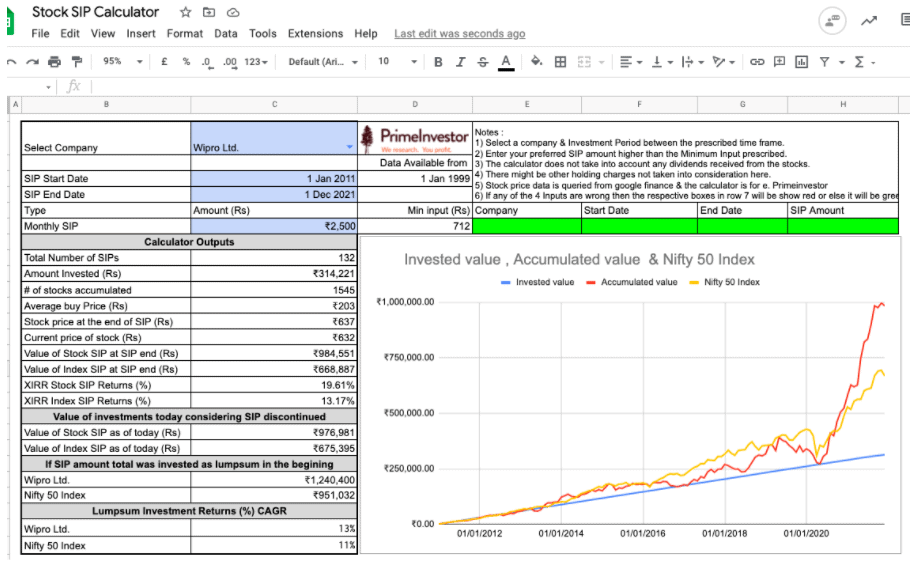

If you would like to quickly see how an SIP in stocks fares in terms of returns, compared to a lump sum investment, based on past data, our Stock SIP Calculator will come in handy. The calculator is powered by Google Finance and therefore, it works only on Google sheets. Below are the instructions to use the stock SIP calculator.

Step 1: Clicking on the link (above), will ask you to sign in to any Google account following which, a pop-up will ask if you would like to make a copy of the calculator to your Google drive. Click on ‘Make a copy’.

Now you should see a page that looks like this.

Step 2: Select Company

Here you can choose any of the 1700+ companies in the dropdown for which the calculator can perform the calculation. If no company has been selected or an incorrect name has been input, an error message will be displayed.

Step 3: Enter the Start Date

This is the date from which you would have begun the SIP. Do note that the SIP is assumed to happen at the start of the month for all periods. If you enter a date before the 5th of a month, the stock price at the beginning of the same month will be considered. In case you enter a date after the 5th of the month then the stock price at the beginning of the next month will be considered.

(The historical data availability for different stocks are based on their respective IPO dates and for how long Google Finance has the data. Please refer to cell D4 to check the date from which historical data is available. In case the user inputs a date earlier than this, the tool will show an error.)

Step 4: Enter the End Date

This is the date at which the SIP would have ended. Since this is a calculator to compute past SIP returns, the latest date that can be entered is today. The calculator will not assume any prices to compute future returns.

Step 5: Enter the Monthly SIP amount

This is the maximum amount you would have invested in the selected stocks each month. This and the price of the stock determines the number of shares you would have purchased. For example, if you are considering investing Rs.2,500 in Wipro Ltd. every month (the stock price is around Rs.712) the maximum amount of stocks that can be purchased is 3. The amount of Rs.2,136 (Rs. 712 * 3) only will be considered as investment. The total sum of all investments made can be found in cell C11.

At this point, the calculator might take a few seconds to process as it needs to download historical price information and then compute the returns for the stock. To assess relative performance, we have done the following:

- Included the Nifty 50 Index SIP. You can see both the value and XIRR returns for the same period and the same value of investments in the Nifty 50.

- Included a simple lump sum comparison against SIP.

This assumes that the total sum of all SIPs done during the period is invested at the beginning of the period in the stock / Index and allowed to compound till the end of the period.

Note: Use the Stock SIP Calculator as an information source only. There is no guarantee that a stock that has given impressive returns in the past will continue to do so in the future. Do your due diligence or consult your advisor before making any investment decisions.

The case against an SIP in stocks

So should we simply set a mandate to buy a particular stock or set of stocks every month and forget about it like we do for our mutual fund SIPs? Despite the advantages (convenience and requiring a lower financial commitment) is a SIP in stocks worth it? We think not. Our earlier article, ‘SIPs in stocks: should you go for it?’ gives you four big reasons why a SIP in stocks may not be the best way to accumulate equity in your portfolio. Below are the ways in which we think a SIP in stocks could trip you up.

#1 Odds of choosing the right stock

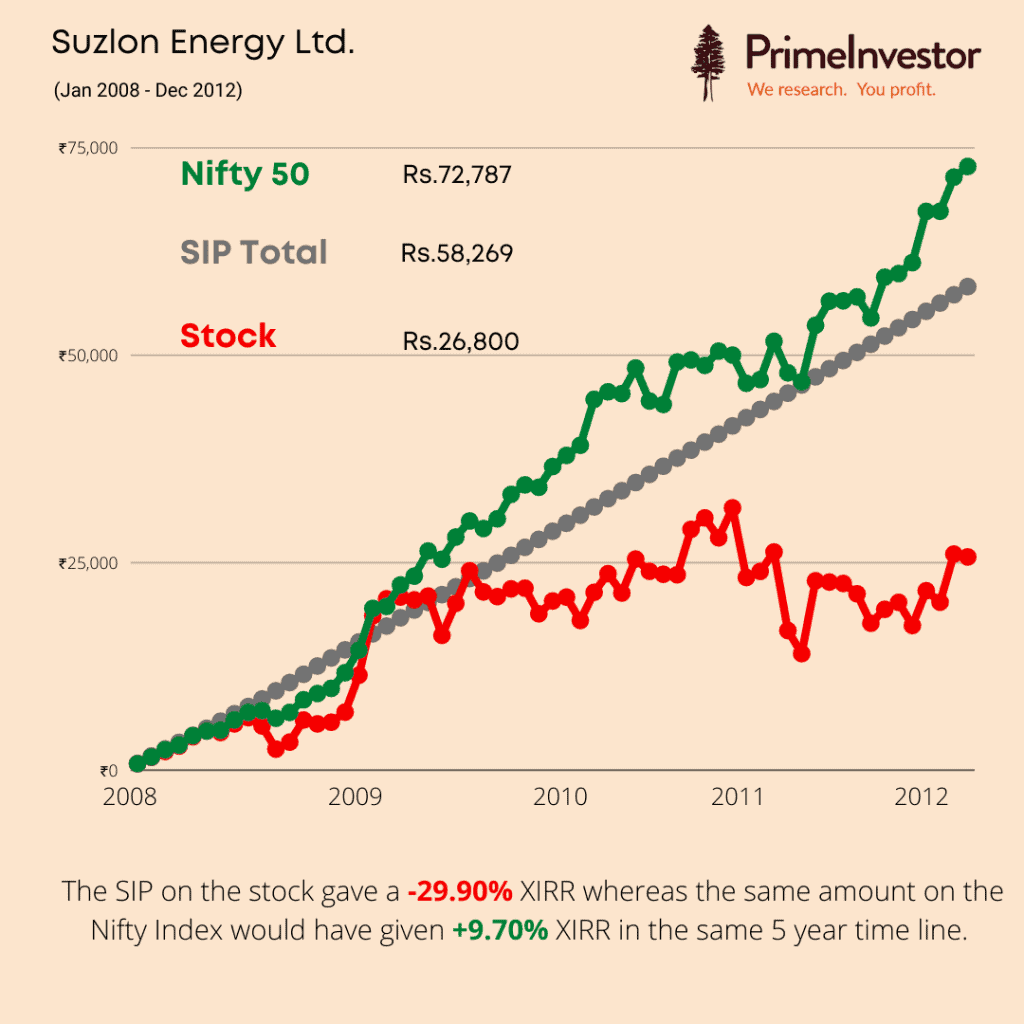

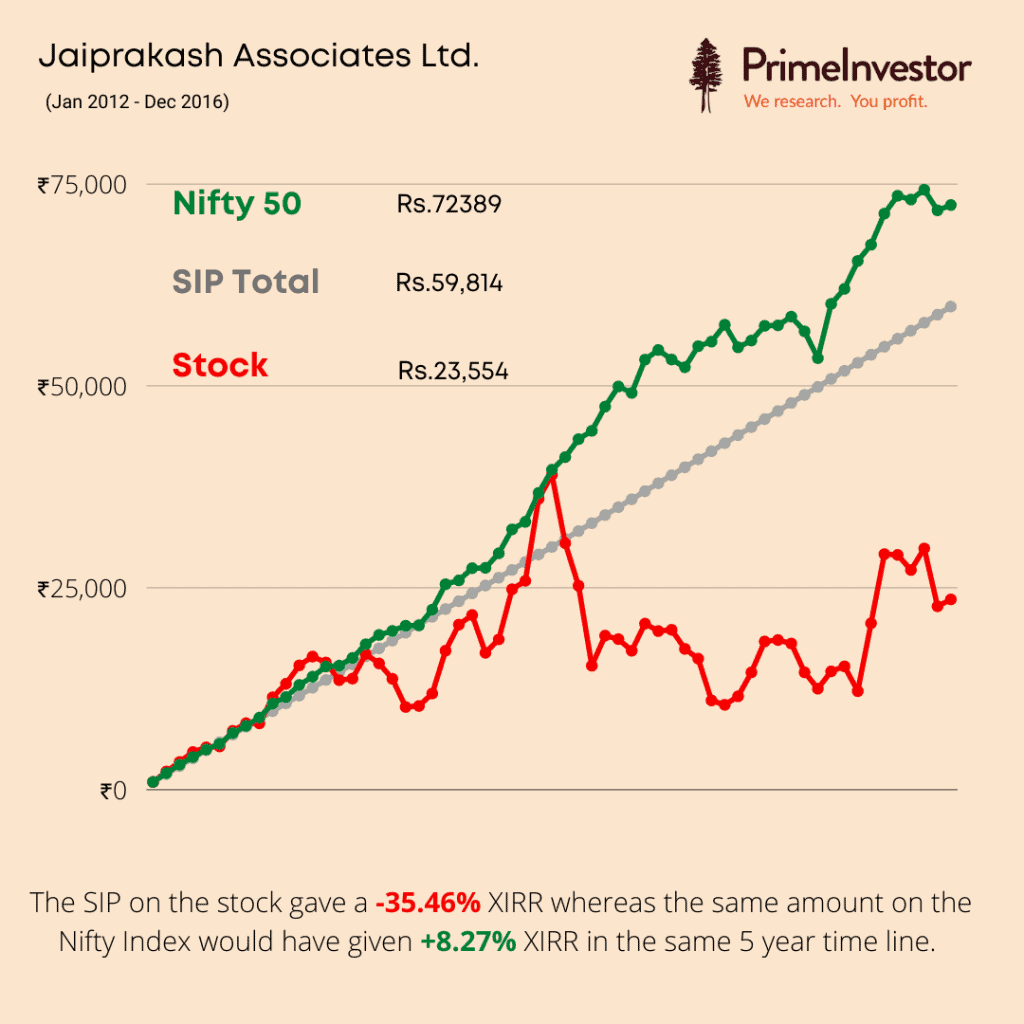

A great deal of success in stock investing depends on what stock you choose to invest in. Many brokers try and help improve the odds here by providing research and by recommending candidates for an SIP in stocks. Let’s assume you took a safe bet from one of the well-known Nifty 50 stocks. Here is an SIP performance result comparison with the Nifty 50 index for a 5 year period.

The assumption here is that you would have bought at least 1 stock every month for the entire 5-year period. If you were lucky enough to pick one of the outperformers like Bajaj Auto Ltd. or BPCL, you would have had a handsome 40%+ CAGR return in the 5-year period.

These historical numbers are mouth-watering enough to make you want you to go pick a stock from the Nifty-50 right away. But hold on – the data shows that there is less than a 50% probability that you will end up picking stocks that outperform the market. What’s more, close to 1/5th of the stocks not only underperformed the market but also resulted in capital erosion like the two candidates in the graphs below.

Making an incorrect choice and sticking with the wrong stocks like these might cause considerable dent by eroding a lot of your capital.

#2 Knowing when to enter

Even if you do the right research and analysis and pick a good growth stock, timing your entry and exit is still important to maximise the long term returns in equity investing especially in a portfolio that is not diversified. The entry has to be timed so that the value in the stock is not already factored into the price. Further, market corrections may present opportunities to buy. In order to be able to do this effectively, you will need to put in a considerable amount of time and effort which is negated in an SIP in stocks where equity investing pretty much runs on its own, once you set it up.

#3 Knowing when to call it quits

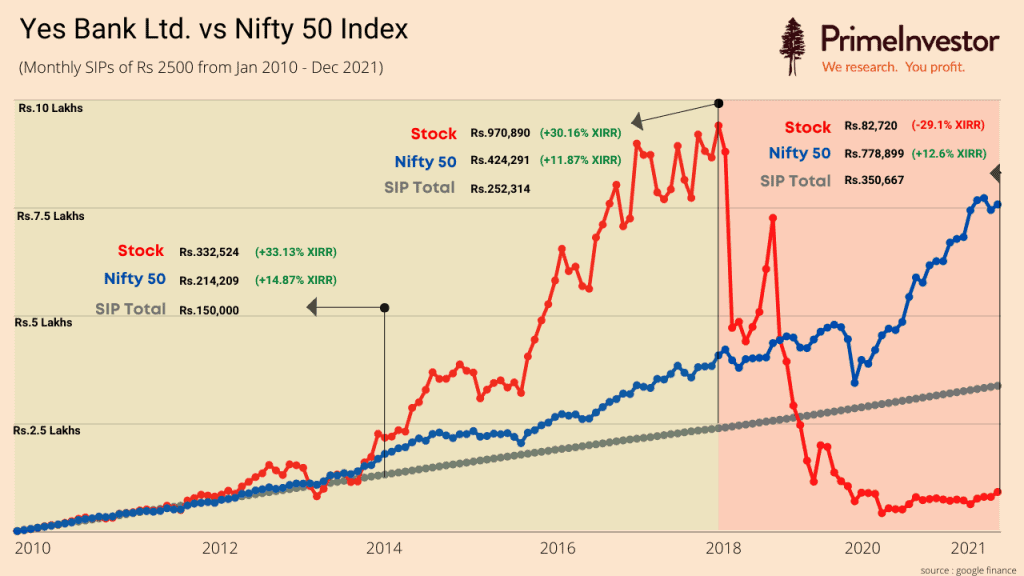

Equally important, is being clued in to changes in the fundamentals of the stock and knowing when to exit. Let’s take a classic example - Yes Bank Ltd. This was a high growth company until mid-2018. If you had started a stock SIP of Rs 2,500 in Yes Bank on 1-Jan-2010, the SIP report card as of 1-Sep-2018 would have looked like this:

*Total amount invested: Rs 2,52,314

*Market value: Rs 9,70,890

*XIRR: 30.16%

Impressive indeed!

After a month, trouble started for Yes Bank. There were questions about the quality of its loan book and the stock corrected by more than 46% in just one month and the report card of stock SIP started to look like this:

- Total amount invested: Rs 2,57,106

- Market value: Rs 4,86,489

- XIRR: 14.18%

Almost half of the value was eroded in just a month. At this point in time, an investor would have had two options:

- See if the fundamental rationale to invest in Yes Bank still holds true, if not, exit the stock

- Ignore market movement and continue the SIP

We have all been told what not to do in corrections. Do not stop SIPs and do not redeem investments. This may hold for a widely diversified basket of stocks like that of a mutual fund but not for a single or small portfolio of stocks. With an automated SIP in stocks, it is easy to lose track of rapid changes in the fundamentals of the company that could cost you dearly. Take a look at what would have happened if you had continued with the SIP in Yes Bank till today (1-Dec-2021).

- Total amount invested: Rs 3,50,667

- Market value: Rs 82,720

- XIRR: -29.06%

Nothing short of a bloodbath. The stock corrected another 94% after 1-Oct-2018

(An SIP for the same amount and duration in Nifty 50 would have been worth Rs 7,73,939 at an XIRR of 12.63%)

Had corrective action not been taken, more good money would have been thrown into accumulating a stock that one should distance oneself from. The financial hit from such a move would have been exacerbated by the concentration risk that one would be taking on by virtue of the portfolio not being as diversified as it would be in a mutual fund.

SIP in stocks - key learnings

- All the common wisdom about SIP investments is for a fairly diversified investment vehicle like mutual funds. The less diversified an investment is, the more important timing and exit strategy becomes.

- SIP helps us to not get swayed by herd mentality during negative market sentiments. However, a stock falls because of reasons other than broad market sentiments. A fundamental change with a company will reflect in the stock price. This cannot be ignored and one cannot soldier on with an SIP in a stock where the case for investment no longer holds true.

- Stock investments are not meant for setting up on autopilot or to buy and forget. Whenever anything fundamental about the company changes, the investment thesis needs to be reevaluated to see if it is still a buy, hold or sell.

- The cost of holding on to a bad stock is much higher than the cost of holding on to a bad (diversified) mutual fund.

- Diversification and vigilance too are key to success in stock investing and the fund management fees in mutual funds are compensation for this.

Article video ↓