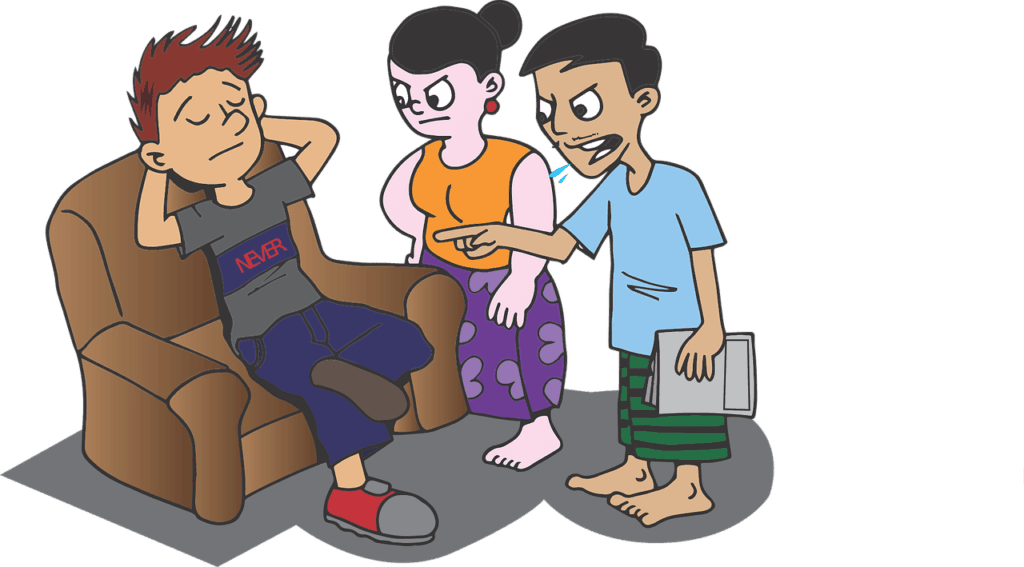

Several of the 50 year-plus investors I know are eager to initiate their millennial children into investing as soon as possible. In their eagerness, they help their children with the ‘first steps’. Sadly, those steps often constrain or cripple the millennial’s financial journey. It is terribly hard for me to tell the earnest parent how he (it’s mostly the father) has given advice that is not only outdated but simply wrong in today’s environment for two reasons: one, the millennials lead a very different working and personal life from their parents and therefore have different financial needs. Two, the range of financial products and options available today are dramatically different from what their parents had when they started their careers. I seldom get to tell them this but here’s a list of such advice and why they should not be repeated.

Buy an insurance policy first

With an average Indian, no investment journey begins without a policy and policy usually means LIC Pension Policy unless stated otherwise. A pension policy where one would get a handsome Rs 8000 per month after 25 years. Now, what exactly will the child do with just Rs 8000 a month, 25-35 years hence, even under a low inflation scenario? Even assuming it will just add to the rest of his income sources, what is the return? It may sum up to some measly returns of perhaps 4-5.5%! It is a different story entirely if you advise him to buy a pension policy soon after retirement. But tucking away his early earning years’ savings now in low earning products? That’s sad.

The insurance policy a millennial needs may be very different. A term policy, if and when they have dependents, yes. And there may be others. For example, an insurance that helps sail through job loss or on diagnosis of major medical illness and so on. Let your children figure what they need before you tie them down by gifting their first premium for their pension policy.

Have a ‘relationship’ with your bank

If parents approved of any relationship of their millennial kids, it must be with their bank ‘relationship manager (RM)’. Investing in products suggested by the RM is important from the father’s perspective because one needs to be in the good books of the RM. For what exactly? Unlike those days, the millennial is unlikely to visit a branch for the rest of his/her life. There will be no occasion requesting for cheque clearance or asking for change in denominations of 10s and 50s; nor is a higher education loan dependent on how much you invested through the RM. Your millennials do not have to blindly listen to the RM’s advice. It could mean tying oneself to products one didn’t know had a lock-in, products that would incur high costs if exited early or that are sold as high dividend products, not knowing the risks involved.

Anywhere between Rs 1.5-2.5 lakh per annum of a young earner’s income is locked into investment products that are of little relevance to his/her financial goals. Let your millennials explore their journey and find what suits them. They could go the traditional way to seek an advisor offline or through online channels or be a do-it-yourself investor by spending time on the web. But let them not invest for relationship’s sake.

Buy a house right away

“Real estate prices only go up, so I asked my son not to delay purchasing a house” said an investor known to me. After all, the logic goes, the son has no commitments and can well pay his EMI and finish them early. But let’s get a few facts right: one, if you plan to leave your house to your children (most of you will), they are not going to be homeless. Second, you have no idea in which state or country your children are going to settle in. Third, if your children pay an EMI now, that will leave little surplus by way of savings for the next 15-20 years. Exactly what are they supposed to do for the rest of their life’s goals and aspirations? Fourth, EMI is not equal to rent, please! You could have a spacious 1500 sq. ft house and pay a rent of one-third (or less) the cost of its EMI. Purchasing a house before settling into a career, before marriage or even before having kids (there is an ‘if’ component to all these in the millennial age) is not a good idea. And please remember many millennials give up their jobs just after a few years to do their heart’s calling – be a stand-up comedian, travel and photography or be an observer of people. Call it crazy or deep, fact is they may not even work like you did for the next 15-20 years after they take up a job. Let them decide what debt they want to take up.

And please don’t even think you are being a bad parent by not advising them. You will still have enough to advice on their spending habits (a new mobile every year!) and their not removing their headphone the whole time you’re talking to them!

This article first appeared in The Hindu dt. March 31, 2019