Overview

We live in a funny world. On one hand, we have people talking about SPACing their stonks with NFTs and on the other hand, we have people who need to visit the bank branch & fill out a form just to change their address.

Where technology continues to grow at a supersonic compounded rate, traditional banks have failed to keep up. This has led to the rise of a new class of banks collectively called “neobanks”.

Neo : (noun) /niːəʊ/, a new or revived form of

Neobanks are banks that are 100% virtual. They don’t have any physical branches.

But what makes these Neobanks interesting is that they simplify the whole banking process. Creating your account, transferring funds, tracking expenses and other banking activities are all seamlessly integrated into creating a far superior customer experience for the user when compared to traditional banks. Plus they’re cool.

Okay, but what are Neobanks?

Neobanks are fintech companies that provide a smoother banking experience. They are trying to solve problems in the banking sector using technology and design.

Every Neobank starts with 1 core problem statement that it solves for. It then uses its tech to solve that problem and build a nice app around that solution. They then later include other additional features in the app.

Let’s take this Neobank for example : NiyoX

NiyoX identifies a problem – High forex markup fees.

It then seeks to solve the FOREX problem by not charging markups on foreign transactions (0 mark up fees). It will then build a mobile app that will help you transact without any forex markup fees.

The final step is adding other bonus features like 0 charges for the card & providing investment solutions.

That’s how a neobank is born.

The business model of neobanks can range from transaction cuts and commission from the banks to fees paid by merchants when customers make purchases using their debit card. This phenomenon started in the UK with many challenger banks like Monzo, starling , etc mushrooming around 2015s and slowly has spread across the world.

There are also various Neobanks meant for businesses and SMEs like RazorpayX and Open. These Neobanks focus on solving problems like loans & lending to small businesses, account aggregation, accounting and reconciliation of accounts. (more on that below).

Most Neobanks nowadays, have a few common characteristics. They all have

- smooth user interface (well designed app)

- Zero maintenance and account opening fees

- High savings interest rates

Neobanks in India

Neobanks in India don’t have the license needed to be an independent bank. They instead partner up with already established and licensed banks to offer their services. This partnership helps both parties – the neobanks build that “trust” factor that comes with the traditional banks and helps the traditional banks to increase their customer base.

Anytime you make a transaction, you interact with the neobank interface but the actual transaction will happen on the bank’s systems. An example of this : NiyoX has a partnership with Equitas Small Finance Bank. Anytime you want to transfer money to someone, you will use the NiyoX app to do so but the actual transaction (the backend) will happen on Equitas’ system. So if there’s a problem with the transaction, you will most likely have to get it clarified by the Equitas team if the NiyoX support team is not capable of handling it.

Think of it like this : the base layer is the traditional bank that the neobank is partnered with and then there’s a nice layer covering that. What you see is the nice layer.

Neobanks outside India

For people in many other countries (including the USA and much of Europe) , transferring money between 2 bank accounts is not easy. They don’t have UPI, or anything close to it.

Neobanks like Venmo, Chime & Current simplify the process and provide additional benefits like a decent interest rate on their savings*. This part is important because unlike Indian banks that offer 4% to 6% interest, banks in the U.S.A. offer an interest rate of between 0.01% to 0.4% (for high savings accounts).

Europe has its fair share of neobanks as well – like Revolut, N26, Monzo and Starling. However, things have not been looking too well for these banks :

“From 2014 onwards, the challenger banks offered something simple, better, entirely online and free of the stodgy lineage of century-old banking brands for whom current account banking had become a largely loveless and loss-making exercise.

But the pandemic and the subsequent ‘new normal’ across Europe has pushed neobanks to the edge. With not a penny of profit yet between them, the pandemic was an opportunity for the startups to strengthen their relationship with users, and come out of the lockdown having proved their value over the big banks they sought to disrupt…

…Accenture’s neobank expert Tom Merry says there’s still a “trust factor” at play here. Six years in and neobanks are really still more a banking bolt-on for millennial pocket money, with deposit amounts in the low hundreds, not thousands of dollars. Whilst the neobanks may hold the key to the customer’s heart through “experience,” Merry says, many customers still see incumbent banks as safer and more secure.

Unique Features of Neobanks

Take a minute and think about how ridiculous it is to keep track of your expenses in an excel sheet (or even crazier – writing it down). This seems like a problem that should have been solved LONG AGO!

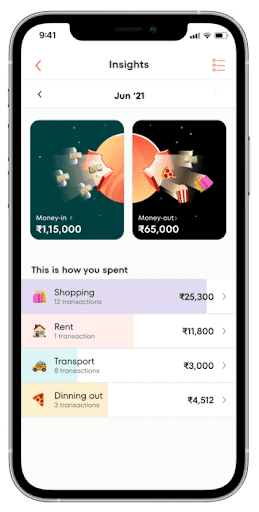

That’s the first unique feature of neobanks – Spend analysis.

All your transactions are updated in real time and you get to see a detailed analysis of all your spends explained to you in a detailed but ‘fun’ (read : aesthetically pleasing) manner.

Image source : Jupiter

Neobanks also have a superior user interface & user experience. All these apps are designed to make it feel as personalised as possible with a focused customer centric approach.

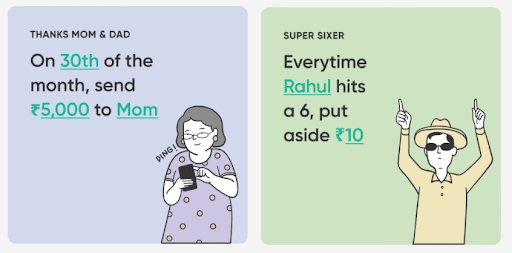

(An example of the an innovative feature that lets you save money based on predefined rules)

Image source : Fi

Examples of ‘goals’ from fi – these are 100% customisable

Neobanks also offer personalised ‘rewards’ that can be unlocked by using the account (regularly). Instead of random coupons like the ones on PayTM and GPay, with neobanks you can choose the rewards you get. Each neobank has a different way of doing this. Most of them do it by issuing coins or tokens as a reward and then giving you the option to pick your reward by redeeming those coins.

Image source : Walrus

Zero or Low costs. All Neobanks have very low cost. Most of them have ₹0 account opening fees, ₹0 annual maintenance charge, ₹0 debit card issuance fees, ₹0 markup on forex / international transactions and ₹0 fee on transactions.

They do, however, charge for things like cheque books (if you want it), cheque bounces and other physical stuff…

Ease of onboarding. Getting a neobank account is basically downloading an app and filling in the basic personal details. The whole process gets done in 3 minutes.

High interest rates. Less fixed cost (completely digital) + partnering with SFBs = high interest rates (3.5% to 7%).

Like this one for example : Freo + Equitas Savings bank = 7% savings rate

Image Source : Freo

Safety of neobanks in India

All neobanks take stringent safety measures to protect the users money. These include safety of all your data as well. Here are some technical terms that will reassure you of their safety : 256bit encrypted HTTPS protocol, 2FA, RBAC, Biometric verification.

When it comes to protection of money, we have to note that the underlying money is actually in a real bank. So, your money is safe – or at least as safe as it would be while doing netbanking with one of the underlying banks that neobanks use. Worst case scenario – if there’s a hack or something goes terribly wrong, your money is insured by the DICGC for upto ₹5 lakhs.

Types of neobanks in India

Every neobank has a different target audience that depends on the core problem that they solve. Primarily, there are 3 audiences that Neobanks cater to. Teenagers, Gen Y + Gen Z and Businesses.

Neobanks for teenagers

If a teenager wants a bank account in a traditional bank, they will have to open a joint account with their parent / guardian.

Opening an account with a neobank is easier. They download the app. Fill in all the details and the account is ready in under 3 minutes (this is true for neobanks across the board). It’s a prepaid account that is usually ‘topped up’ every month by the parents.

One neat feature in neobanks for teenagers (apart from personalised rewards, an improved UI and a smoother banking experience) is ‘tasks’. Parents can set a ‘task’ and a ₹ amount beside it. Once the task is completed, the money is transferred. Most neobanks (for teenagers) also have creative features where they help build the financial literacy of the user through practical guides and in-app gamified challenges.

Here are some neobanks for teenagers in India today :

There are many more and I’m sure there will continue to be new ones that pop up. These are just a few of the neobanks for teenagers that are talked about (and have a good SEO team!).

Neobanks for millennials & Gen Z

Neobanks were originally started with Gen Z as the ideal target market. These are the people that are looking for a better banking experience. You’ve probably remember the ppt ads on social media for Fi money. Fi is a neobank.

There are many such types of neobanks in this space. Most of them share similar features. Zero or low costs, ease of onboarding (which is basically downloading an app & filling the details) and superior UI & UX. Some neobanks go further and offer services like no forex markup for international payments and credit cards with instant rewards, extended credit limit & overdraft and cashbacks.

Some Neobanks in India today :

Neobanks for businesses

Small/medium sized businesses don’t have it easy when it comes to their banking experience. The interface of traditional banks is clunky and their archaic infrastructure & policies make it difficult to form a reliable relationship. You’ve probably heard of a few businesses that were denied loans even after having an account with the bank for 15+ years.

Thankfully, now they too can now use neobanking services.

Neobanks in India help improve the banking experience for businesses & SMEs. They do this by helping the business with loans, manage accounting, reconciliation, payment collections, invoicing, payroll, displaying statements, tax payments and aggregating all this data in real time.

From the earlier example, if you wanted a loan from a neobank, there’s no need to submit every single document from your DoB to your last 3 years accounts statements. Every neobank in this category has pre-approved limits that you can borrow – no questions asked.

If you have a business, neobanks can help you manage all your different banks (current & savings accounts in one place).

One neat feature of neobanks for businesses is the option to create a virtual card. So let’s say I have 5 different departments in the company. I can create 5 virtual cards, fill up the account with that month’s budget for that dept. and handover the card. The neobank takes care of the rest.

Some neobanks in this space are

Our Take

Are Neobanks really ‘neo’?

The main objective of neobanks is to provide a smoother banking experience. However UPI platforms like PayTM, Gpay and phonepe have already been doing this for 4 years now. Sure, these UPI platforms don’t have the fancy UI designs and other features like ‘tasks’ and ‘goals’ that neobanks offer, but they still do a good job of providing a smooth user experience for basic things like transfers and bill payments.

In countries that don’t have UPI (and rely on wallets), neobanks are definitely a huge value add. In India, however, UPI shot the wheels off neobanks before it could take off.

Neobanks would have to continue innovating and bringing new, creative ways to improve the banking experience to consider becoming mainstream in India. Else, neobanks would most probably face the same predicament they faced in Europe.

Are Neobanks extra useful?

Hmmm, not really. They provide almost the same functionality of other UPI apps like Gpay and PayTM.

Where they shine is the user experience side of it. Neobanks succeed in providing a superior experience of banking. With features like ‘tasks’ and ‘goals’, they make the banking journey a lot more personal…and fun.

Neobanks are not a need to have. They are a nice to have.

Note : G-pay & Paytm need you to have a bank account already. Neobanks can help with opening an account swiftly and connect it to these apps. It is a differentiator in that sense. Not that they’re more useful.

Downsides to neobanks

No physical branch

Neobanks don’t have physical branches. Any complaints will have to be raised online. However, they do have 24*7 customer support. If you’re the type of person who likes to go to the bank to resolve issues, please think twice before trying out a neobank.

Limited backend support

Neobanks provide the fancy layers on top of the regular traditional bank account. The backend of all transactions is with the regular traditional bank (the partner bank). This means, if there’s a problem with your transaction, the issue will have to be escalated to the partner bank. In these cases, neobanks are limited in the action they can take since they are only the middlemen. Also traditional banks are not known for providing a quick and peaceful resolution to the client’s problems.

Will Neobanks disrupt traditional banks?

With all this personalisation, higher interest rates & a fully virtual model, are neobanks in India going to ‘disrupt’ the traditional banking system?

No.

I’m going to let 2 fintech experts in India tell you why.

“You can’t disrupt banking by being dependent on the bank” – Srikanth Meenakshi

“While banks and fintechs keep wondering about who’s disrupting each other, money as a concept is getting disrupted and no one is prepared for it.” – Kunal Shah

Closing remarks

If you have a teenager in your family, consider giving them a neobank debit card. It’s a Prepaid Debit Card for online payments for teenagers. These neobanks are built around empowering teenagers with financial knowledge and independence.They also have videos of financial literacy and games to realise this. This will – hopefully – inculcate some good habits of saving and investing early on.

If you’re a working professional, try out a neobank for some fun. They don’t offer too much – functionality wise – when compared to apps like GPay and PayTM but they’re fun. If you’re going to travel a lot, neobanks like NiyoX and Jupiter can become handy. If you just want to dabble in it and see what the hype is all about, choose any neobank like Fi, put in anything upto ₹5 lakhs (to be on the safer side) and have fun with it.

If you run a business, and you realise that you’re peeved about the current traditional banking infrastructure, neobanks may serve as a useful alternative.

If you have an account with a neobank or if you’ve opened one after reading this article, please share your neobanking experience in the comments section. We would love to read them.