In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

Tanla Platforms has been around for years. But in less than a year now, Tanla Platforms went from a tiny market-cap of around Rs 500 crore to a mid-cap-level Rs 12,000 crore. That’s a whopping 2000% price rise. A Redditor might dismiss it as a stonk. But Tanla is in reality a two-decade-old company, and its business comes from services you and I use on a daily basis – namely, OTP verifications.

Tanla creates a platform (software) and sells access to enterprises. At the same time, the company integrates the platform with all the major telecom operators in the country. Be it bank transactions or Facebook verification or even flight delay notifications – most of those reach you through Tanla Platforms.

There are multiple angles for the sharp run up in the stock’s price. But a key reason is the dynamic shift in the way the business has aligned itself to the current trend in the Cpaas (Communication Platform As A Service) market. Cpaas, a $4 billion market globally in 2020, is expected to become a $26 Billion industry in 2025 or a 35% CAGR. Most importantly, Asia will be leading this growth.

Tanla Platforms development and stock drivers

Tanla Platforms has made acquisitions, launched new products, diversified revenue stream and more. In recent times, it’s a strong beneficiary from the market’s penchant for businesses that could ride the digitisation wave in a world shut down by the pandemic. Here’s how Tanla’s fortunes have moved and what the challenges could impact a further rally.

#1 Business background

The company’s major business in the past decade was secure SMS service, connecting enterprises to customers such as OTPs for transactions, login and so on. Tanla gets its revenues from two streams: one, telecom operators pay the company a fixed proportion of the amount they generate on each communication passed. Two, enterprises pay Tanla based on the number of communications that are done through their platform.

Back in 2015, the company became a market leader in mobile messaging, registering a 400% growth in domestic messaging A2P (Application to Person). This was driven by the regulatory changes necessitating banks, social networking websites and the Government to use A2P for sending OTP messages.

The stock was trading at less than Rs 5 per share in March 2014. By Dec 2015, it moved by 10x to Rs 50 per share backed by strong revenue growth of 136% – revenues grew to Rs 242 crore in FY-15 from Rs 105 crore in 2014.

In 2017, Tanla shifted focus to the mobile messaging business, exiting the mobile payments vertical it had until then. Then, TRAI regulations in July 2018 made commercial communications of voice and text to be provided using blockchain technology. Tanla was one of the early adopters of blockchain and cloud, setting it up to clock steady revenue growth. Revenue moved up to Rs 1000cr in FY-2019.

The mobile messaging business, however, is more volume-driven. Therefore, the high cost of servicing kept Tanla’s EBITDA margins below 10% despite steady topline expansion. As a proportion of sales, cost of servicing stayed at an average of 87% for the 3-year period between 2017 and 2019. The poor margin profile likely contributed to the stock’s flat performance in that period, when it ranged between Rs 35-45.

In order to improve margins, Tanla took a few steps. One, it looked for overseas clients. Overseas revenue accounted for 24% of FY-20 revenue. The company followed an inorganic expansion strategy, where it acquired two companies – Karix and Gamooga – in April 2019. Karix has a large global clientele.

#2 Product launches in the past year

Two, it launched products to capture the available opportunities. In Sept 2020, Tanla launched its fully blockchain enabled Cpaas platform Trubloq – the world’s first block chain enabled commercial communications stack.

What’s different in Trubloq was that it was enabled to meet multiple business and regulatory requirements. It increased trustworthiness of the ecosystem using blockchain and eliminating fraudulent transactions. Further, it kept up its data privacy and made sure all communications were directed through registered telemarketers. All this synced to a cloud-enabled system that rendered it more attractive.

The next big step was the launch of Wisely – a global edge-to-edge fully blockchain-based platform created in partnership with Microsoft’s Azure cloud. This made it seamless and fast; it was also a value-add as it provided real time analytics, operations & management using AI/ML and a lot more, in addition to the primary communication service. This was launched on 20th Jan 2021. Prior to this launch, the stock had jumped 3x from Rs.300 a share in Oct to Rs.900 in Dec 2020.

Tanla also got a leg up from the rapid shift to digitisation. The boom in ecommerce and the need for enterprises to reach their customers through Cpaas-like platforms became essential. Tanla reported all-time high quarterly numbers in the September and December 2020 quarters.

#3 Riding the digitisation wave

Around the September 2020 period, markets got another player in the cloud communications space through the IPO of Route Mobiles. This company, which offers services similar to Tanla and a few packaged solutions for enterprises, saw a very successful listing.

This shone the spotlight on the business and the prospects it held. The market’s fancy for businesses that could play on the shift to digitisation helped fuel both Route Mobiles and Tanla Platforms. It was around this point when Tanla really began to move – from trading at Rs 60 a share on 12th May 2020 it moved up 5x to Rs 300 a share on 29th Oct 2020.

But here’s an interesting point to note as far as Tanla’s ownership goes: it was the promoter share that saw significant expansion in the period prior to the run up. This was partly on account of a share buy-back program that was completed in July 2020 that saw retail investor participation. Promoter holding has moved from 32.4% in December 2019 to 41.2% by March 2021.

However, the fancy for the digitisation themes, Tanla’s deft product launches, and strong price rally spurred other institutional investors to accumulate stake in the company. Notable FPIs include US-based Smallcap World Fund and American Funds Insurance Series Global Small Cap. Other buyers in the stock included the company’s independent directors and Mobile Techsol Pvt Ltd, a company owned by Udaykumar Reddy, Tanla’s CEO.

Challenges to growth

But while the company’s business is strong and it has been quick in product launches, there are still some challenges. Chiefly, the business is inherently low margin with low moat.

#1 Low-margin business

Consider global players first. Twilio Inc is one the largest players in the Cpass industry with over 12 years of market experience, 220,000 active customers and an annual revenue of over $ 1.7 Billion. This company was able to grow revenue at about 54% CAGR over the last 5 years.

But it is still loss-making due to high spends on sales & marketing and R&D. The two expense heads together account for about 61% of the revenue. But margins for Twilio stayed above 50%, considering only the cost of service (gross margin). Tanla, on the other hand, has gross margins of only about 20%. The same holds for Route Mobiles as well.

Tanla has tried to improve profitability. In the nine months to December ’20 EBITDA margin (considering cost of service and other costs such as marketing, staff costs etc) stood at 16%. The primary contributor to these cost savings comes from cost of service. As a proportion of sales, cost of service stood at 78.2% whereas for the year-ago period, it was 84.3%.

It needs to be noted that financials are not strictly comparable due to the Karix acquisition. But to put margins in perspective, EBITDA margins in the previous years were around 10%. The thin margins compare similarly with its industry peer Route Mobiles whose 3-year average EBITDA margin stood at 10.5% and PAT 7.5%.

The company’s ROE has held below 10% levels also owing to low profitability. Should the current profitability improvement sustain, it could gradually help improve ROEs and allow the company to be a more profitable business.

Another factor that bears watching is the company’s receivables mix. In order to win clients, the company appears to have lengthened credit periods. The share of receivables to revenue stood at a high 30-33% for FY18-19. This was higher than peer Route Mobiles. This ratio dropped to 16% in FY-20 – but here again, it is difficult to compare movement in receivables due to acquisitions. The company has said that it has improved collection efficiency and cited this as a key reason for cutting debtors days by nearly half to 61 days.

#2 Low moat

Factors such as receivables cycles matter because there is minimal differentiation between companies offering Tanla’s bread-and-butter communication services business. Entry of new players is not prohibitively hard, allowing competition to come in if the industry shows more growth promise.

In other words, retaining customers can be a challenge. New or existing players can compete on a cost basis. This could hinder Tanla’s growth, and squeeze its already-thin profit margins or push the company back into giving longer credit periods. Tanla’s push to overseas markets and acquisitions there could offer some buffer, but this again needs to be watched.

Valuations

Tanla currently trades at a PE of 74 times on a consolidated basis – three times higher than its 3-year average PE. This is primarily due to the rapid stock price run with EPS growth lagging behind. Competitor Route Mobiles trades at a PE of 153 times, but that stock has also seen a similar rally post IPO.

To put it simply, Tanla appears to be on the brink of change. Markets may be willing to reward strong topline growth and push into newer technologies for now. But in the longer-term, much depends on Tanla’s ability to differentiate itself from competition, ability to innovate and product launches, and sustain improvement in profitability.

10 thoughts on “Stock Review : Tanla Solutions – what explains the quick rise and what’s in store?”

Tanla is much above Route mobile in terms of current numbers and future numbers. IPO and related noise has made Route mobile price to soar. Tanla will catch up in another year.

Good just learnt about Tanla interesting but crazy valuations .

The latest PE is only around 30, with huge scope for increase in net profit.

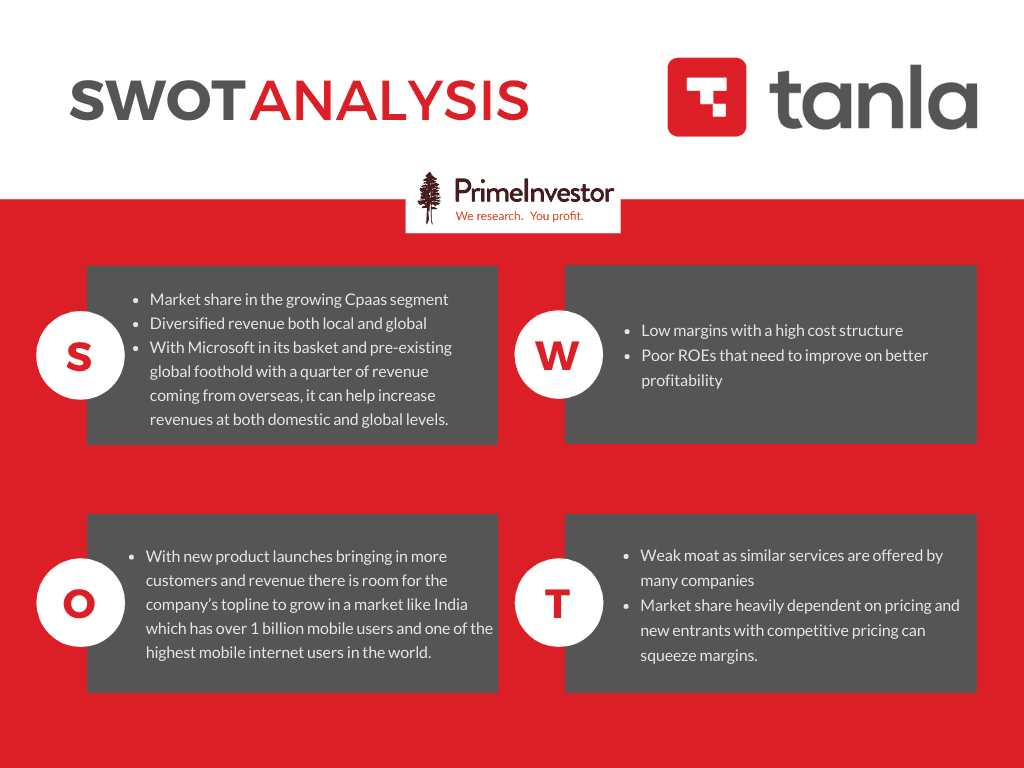

An interesting company and very good analysis. This graphical SWOT analysis is awesome. Can you please also analyze Affle’s business?

Thanks! Affle India ltd is an end-to-end marketing solutions platform. We’ll take a call later on whether to review the stock in full detail.

If there are more details about TruBloq is available, would be helpful to understand the differentiation. Reads more like a buzz word. Also is Karix the major revenue contributor?

TRUBLOQ is a software product and has multiple functions. It enables businesses to register and hold the data of their customers to whom they can reach through messaging and voice. It serves as user consent management tool, Content provider, Regulatory audits governance and complaint management system .Yes, the acquisition of karix did add a major revenue stream into Tanla’s business.

Thanks Anush Raj. But I am not able to find how is TruBloq leveraging blockchain and call it as a differentiator. Blockchain, in my limited understanding, is a P2P network. Is TruBloq similar to TrueCaller then, which curates information from users for filtering spam messages. This is being cited as a future revenue generator. More information would be helpful to understand.

Can you please also share inputs on Karix’ financials as well? Thanks.

Is it possible to add a comparison with direct competitor Route in financial aspects as well as ability to grow their business

We’ve added a comparison with Route in some financial and valuation aspects. Route and Tanla have both grown their topline sales at 41% and 44% CAGR in the last 3 year period.

Comments are closed.