As we step into 2025, you may be processing the lessons from a year that challenged both bulls and bears. You may have read Aarati Krishnan’s reflections on this a couple of days ago.

2024’s market movements – from steep returns to volatile swings – have created a complex landscape where most predictions went wrong. We got the broad trends right both in the equity and debt market, but as we admitted in our year ender, we expected a much deeper correction than what transpired.

But is 2025 going to be an easier year? Market commentary points to a few key challenges ahead:

- With the Indian economy hitting a real GDP growth low of 5.4% in the September 2024 quarter (over a year ago), questions are aplenty on whether the 6-5-7% projection for FY25 (Economic Survey) is feasible. Firms such as Goldman Sachs expect GDP growth to decelerate to 6.3% – 40 basis points below Bloomberg expectations. Lower inflation, less vigorous rate cuts, tight fiscal and current account deficits may all also contain growth.

- The above are not just theoretical numbers. High frequency indicators especially on private and public capex – such as production of automobile, steel, cement, coal as well as electricity consumption, rail freight – have all seen moderation since August 2024.

- Earnings growth for the Nifty 50 has been moderating post June 2024. Global investors’ pessimism, too, became palpable since the pullout in September 2024. Around that time, the MSCI India index (followed by foreign investors) too, saw the September quarter earnings fall well-below its 10-year average earnings growth.

- Rate cuts are expected but not steep. Hence the gains on the long duration debt plays may be over!

- There is also the uncertainty hanging over upcoming US President Donald Trump’s tariff policies, its impact in the Asian region and the indirect effect if any, on India.

However, several positives remain, say many others:

- Real estate inventories are trending near lows and that means there is still a lot of real estate activity whose ripple effect on the economy will continue.

- Defensives and export-led sectors have shown a clear pick up, potentially supporting corporate earnings growth.

- While bank credit growth has declined, report state that bank credit growth has converged with deposit growth, suggesting that the slowdown in credit growth may be bottoming.

- The correction in the large-cap segment has opened up entry points in terms of valuations for stocks that are otherwise fundamentally sound.

- Foreign brokerage firm Morgan Stanley defies many other estimates of moderation in growth and believes India’s economic growth is poised to accelerate, driven by several factors: increased government spending, a longer wedding season, and robust summer crop production. In a recent note, the brokerage firm stated that the factors which led to slower growth in the first half were temporary in nature.

Interest rate cuts may be shallow but the spreads for the AAA-rated bonds have turned attractive (as G-Secs are under 7% now), providing scope for capital appreciation even with shallow rate cuts or yields easing.

No, this is not our 2025 outlook 😊 These are just some of the contrasting market perspectives on how 2025 will shape up. We will publish our own outlook on debt and equity markets in a few days.

But what the above tells us is that there can be different sets of market views, both of which are reasonable and probable. And markets can run contrary to what we predict and that outlooks can be revised as events unfold. If such is the nature of the markets, then isn’t it necessary for you to be prepared for any eventuality?

At PrimeInvestor, we think the best response to market complexity is this – getting back to basics. And what better way for you than with PrimeInvestor? So, here’s how to keep your financial life in shape in 2025 and beyond,, come what may!

Mutual fund solutions

We believe the core of your portfolio of mutual funds should be market agnostic. That means you don’t try to rejig this part of your portfolio constantly to suit market needs. By this, we mean that you should not try to change your risk profile (increasing or decreasing mid and small cap or reducing or increasing equity) to suit changing market conditions. Rather, you stick to your allocation in your core portfolio and rebalance (bringing back to original allocation) then when they go out of sync.

How do you build and maintain this core? Here are the ways:

#1 Prime Funds

Our equity, debt and hybrid fund recommendations in Prime Funds (barring the thematic/sector strategy ones and high-risk turnaround categories) are meant to act as your core.

So, how do you build market resilience with Prime Funds? After all, they are market linked! Here’s how:

- You get a healthy dose of funds with different strategies – Value or Growth or Growth at reasonable price. That means you do not have to change your funds to cash in on whichever style is performing, since there’s always a part of your portfolio that works.

- You have funds that contain downside better together with ones that go behind returns. that is, our Equity – Moderate that helps your portfolio contain downsides and Equity – Aggressive that delivers returns without going overboard on risk

- You have funds that sail with the market (passive funds) and at times funds that passively beat the market (factor investing). We have also advocated having both passive funds and active funds in your portfolio to balance out the risks of any underperformance.

- We have debt funds to play interest rate hikes as well as those to play interest rate falls.

The result: A market-agnostic portfolio through strategic diversification.

In other words, if you had a mix of these funds – call them strategy mix in equity and duration/credit mix in debt, your portfolio needs to be less scared about correcting or soaring markets! Yes, they may fall or rise but in a more contained manner. Wild upside swings or falls are much more reduced. 2024’s last quarter correction was a testament to this!

If you’re wondering how to identify these mix of strategies as mentioned above, all you need to do is take 30 seconds to read the tool tip (question mark) under the column ‘Strategy’ for each Prime Fund.

Now, does this mean that you do not change your core at all? Not so. You may need to replace a poor performer with a better one. That is the way of active management. So, for those of you who complain that this results in churn (we don’t really change funds at the drop of a hat for those who think otherwise 😊), passive funds would be ideal.

Outside this core, to pick up market-driven opportunities, we have the tactical part of Prime Funds. Here, we have given theme/sector calls that have delivered exceptionally well are the ones that you need to book profits on, or exit based on your quantum of exposure. Choosing Prime Funds and using our Buy/Hold/Sell calls to assess your holdings is a better way than looking merely at Prime Ratings to pick funds that suit you.

#2 Prime Portfolios

Prime Funds filters you a list of about 50 funds from over 1500 funds. But if this is still too big a list for you to mix and match and allocate right, then we have our ready-made portfolios called Prime Portfolios. With Prime Portfolios you get to choose ready-made portfolios suiting your time frame or goal. With 17 unique portfolios, they pretty much cover every need of yours, without the hassle of deciding how much to invest in each.

Each Prime Portfolio has the mix of strategies that we spoke of in our earlier point. That means you don’t need to worry about holding the right mix! We track these portfolios every quarter along with Prime Funds, and we’ll alert you to any changes needed in the portfolio We do all the work for you!

#3 Portfolio Review Pro

If the above two solutions help you build portfolios, there can be no better way to maintain it than with Portfolio Review Pro.

Many of you may be using this tool simply to know which funds to buy/hold/sell. However, this tool’s utility goes well beyond meeting this need.

- It tells you whether you are taking on higher risk that you set out to. Your risks may be elevated simply because your portfolio allocation to risky asset class (equity) has bloated. A simple rebalancing will often solve the problem and in some cases reducing or upping risk may be warranted for your specific goal that you mention.

- Your risk may also arise from concentration in some funds.

- Your portfolio may be sub-optimal due to holding too many funds.

- It highlights opportunities to reduce costs by switching from regular to direct plan.

If you act on the above cues – either by rebalancing or weeding out underperformers and adding it to the good ones, or simply reducing funds you hold – your portfolio would be on its path to building wealth efficiently.

More importantly, by focusing on basic allocations, fund quality, and portfolio structure, it does away with you changing your portfolio to suit market conditions. Your rejigging or rebalancing of the portfolio would serve to take excesses out.

But in this tool we take the horse to the water. You need to take onus for what to do next 😊

Stock investing solutions

When it comes to stock investing, we cannot deny the need for markets to drive decisions. However, can we reduce the impact of changing market dynamics on your portfolio? Yes, we can!

This is why with Prime Stocks we do not claim to be single-strategy players. We do not go all out on value investing nor do we hunt only for high-growth plays. We do not claim to be experts of small cap investing that generate multi baggers nor are we blue-chip recommending analysts. And this is precisely why we are not impacted by market extremes.

First, our research team combines fundamental analysis with valuation metrics to identify companies poised for growth. The focus remains on:

- Companies with strong governance frameworks

- Sustainable competitive advantages

- Robust balance sheets

- Reasonable valuations

When we do the above we follow the second rule of what Pulak Prasad mentions in his book, What I learned about investing from Darwin: Buy high quality at fair price.

Second, we see whether this rubber meets the road. A company with great fundamentals but moving into a sectoral downturn may only result in opportunity loss. Being able to match the above with the shifting sector trends is something that we try to identify every year during our outlook and constantly revisit it based on market dynamics.

When we gave our picks in IT and pharma this year, we were not simply playing the defensive, we were eying the export plays for 2025, as domestic growth moderation became visible in late 2024. Even as we entered auto and capital goods in a timely manner in 2022-2023, we were happy to book out in 2024 on early signs of moderation in growth in pockets of these sectors.

When we follow this, we somewhat ensure we follow the first rule that Pulak Prasad mentions: Avoid big risks.

Prime Stocks is also categorised as Compounders, High Growth, Tactical and Dividend Earners, thus allowing you to either mix stocks with different characteristics in your portfolio or simply choose the ones that most appeals to your risk appetite or portfolio need.

Our Prime Stocks will not promise you multi baggers at all times, but they ensure the winners really count in your portfolio.

Leveraging PrimeInvestor’s Research Ecosystem

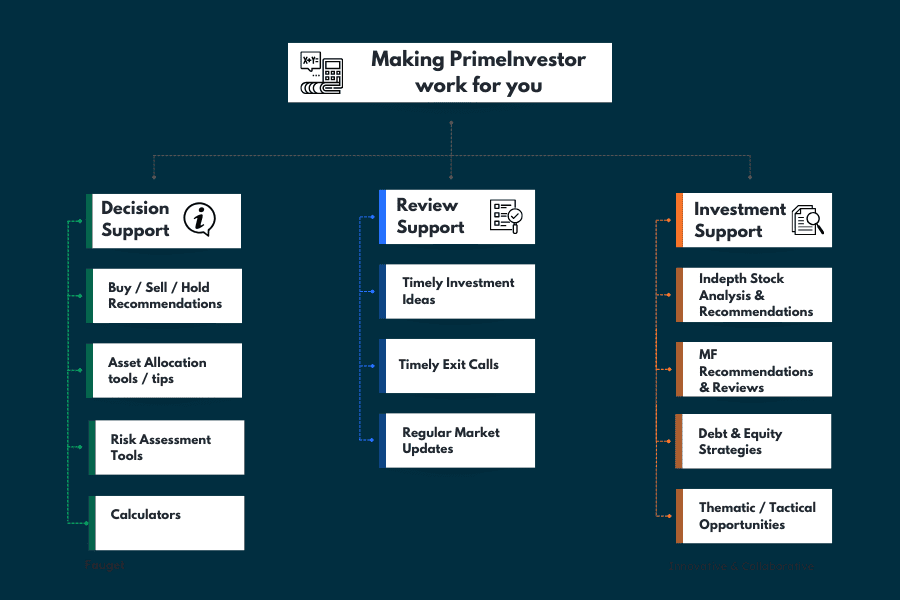

PrimeInvestor acts as your investment, decision, and review support guide as the visual below tells you.

As you may be aware, we have a whole lot of offerings and tools to help you navigate any kind of market (see tables below). Skip the crystal ball gazing and let our toolkit do the heavy lifting. Because reading your actual returns beats reading tea leaves any day!

In an environment where quality research makes the difference between average and superior returns, let PrimeInvestor be your guide to navigating the financial markets of 2025.

2 thoughts on “How PrimeInvestor can shape your financial life in 2025”

> We have debt funds to play interest rate hikes as well as those to play interest rate falls

How well placed Liquid Funds are to play this game of rate hikes and falls? If yes, to what extent? Or for that one must pick other debt funds like Gilt et cetera and Liquid Funds are not appropriate for this at all – due to their short securities?

Liquid funds’ returns swell only when rates move up since their portfolio comprises of held to maturity papers. For rate falls – gilt and medium duration funds work. But sometimes withotu rate cuts, yields start falling..so gilt fund returns may often prempt actual rate cuts like it happened last year with gilts. Vidya

Comments are closed.