When an equity fund is founded on the philosophy of value investing, seeks to reduce volatility through limited hedging and provides international flavour where such opportunities are not available locally, we call it an all-in-one fund. The fund we are talking of also has an expense ratio lower than the equity category average, considering its relatively small AUM size. This cost is especially low within the regular plan. Such tightly managed cost signals that the investor comes first.

This fund, part of our Prime Funds, is a must have for all long-term portfolios of 5-7 years and above. Willingness to hold through periods of underperformance when the market is high is a must for this fund. What makes this fund stand out from the rest of the multi-cap space and should you use it? Read on.

Strategy

Parag Parikh Flexi cap fund (PPFCP) is a value-tilted fund with a multi-cap strategy. It can invest across market cap and is sector agnostic, focusing primarily on picking good stocks at reasonable valuations. It invests 20-30% in international stocks. It does not hesitate to hedge its portfolio during volatility and up the game on market corrections.

PPFCP is a fund that believes in buying and holding stocks, but tweaking weights based on valuation and market conditions. The fund is reluctant to hold high equities in rallies that run on high valuation territory. As a result, underperformance in prolonged rallies is a characteristic that investors need to get used to, with this fund.

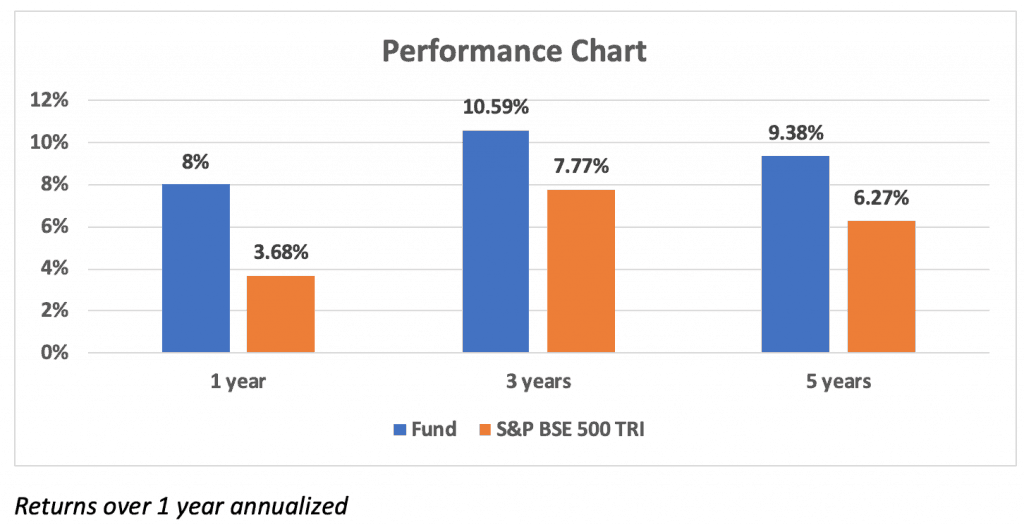

Performance

As a peer set to compare performance, we took the entire list of multi-cap, focused, value, contra and dividend yield funds. PPFCP stands out for its ability to contain declines. The downside capture ratio helps measure how much the fund falls when compared with the index in falling markets. We took the monthly rolling returns over 3 years to rigorously test the fund. This showed a downside capture of 26%, the lowest in the space. That means the fund declined only 26% as much as the index in a falling market! The category average for the same period was 86%.

We think this is the biggest strength of PPFCP; it is well proven in the Indian market that funds containing downsides tend to deliver better in the long term. The fund’s ability to beat peers overall is also high. When 3-year returns were rolled for 6 years, the fund beat peer average 76% of the times. Its Sharpe at 0.95 (rolling 1-year returns) is now the best in the category, thanks to lower volatility. Only Kotak Contra and Canara Robeco Equity Diversified come close to this.

That said, the fund does underperform in rallies that are narrow like 2019, or rallies that run on stretched valuations like 2017 because of its strategy to cut equity risks in overheated markets. It is also important to note that given its exposure to US markets, a correction there can impact the fund’s performance compared with peers.

Portfolio

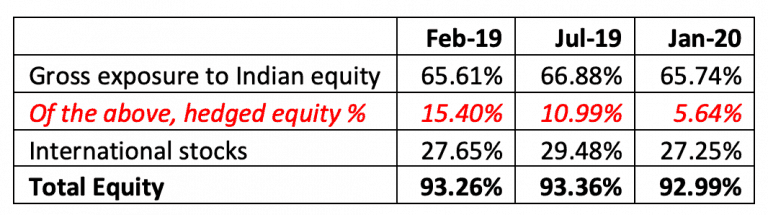

The second standout feature of PPFCP is its deft moves in hedging equity using derivatives and through overseas exposure. For example, the fund hedged as much as 15% using stock derivatives in February 2019. By July 2019, once the froth in the local market was contained by a swift correction, it reduced its hedging steadily to 5.6% as of January 2020. But all the while, it kept its US-stock at close to 28%.

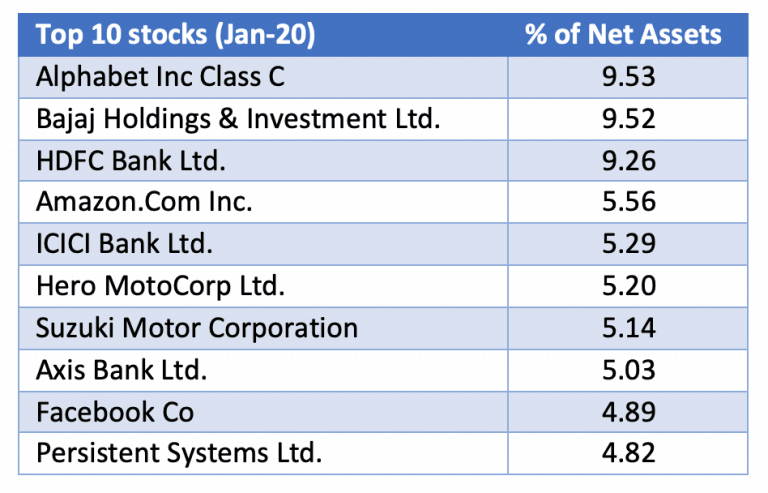

With Indian stocks, the fund does appear value conscious. Other than stocks like HDFC or Lupin, its Indian stock holdings have a P/E lower than 20 times. The value argument, though, is hard to make with its international holdings.

For example, while ADR/GDR options of Suzuki Motor or Nestle SA may be better value buys compared with their more expensive counterparts in India, other stocks such as Alphabet or Facebook cannot be called value. But the plus point of these stocks is that they provide exposure to segments unavailable in India. Also, this ensures that there is some ‘growth’ in the portfolio. Its moves in international stocks have also been well-timed. For example, the fund completely exited 3M Company in December 2019. The stock fell 14% since after earnings did not beat street expectations and management raised concerns over environment liabilities.

Apart from using derivatives to hedge its Indian stocks, PPFCP also used currency derivatives to hedge (80-100% of its foreign exposure) against any volatility in foreign currency. Sometimes, it also gains from this strategy.

Suitability

If you decide to hold PPFCP, the following points are noteworthy:

- The fund needs a longer time frame of 5-7 years and is therefore suitable only for long-term portfolios.

- It can be used along with other multi-cap funds, thanks to its unique strategy, or with index funds (see our Prime Funds for other multi-cap or index fund options).

- The fund may be the odd one in your portfolio, underperforming in a rally at times, or underperforming when Indian market is doing well, due to its international exposure. This cannot be avoided in this all-in-one fund.

The fund is managed by Rajeev Thakkar and had assets of Rs 2784 crore as of January 2020. It has exit load up to 730 days.

Related Article : Review of Motilal Oswal S&P 500 Index Fund

20 thoughts on “Prime Recommendation: Parag Parikh Flexi Cap Fund”

Isn’t the exit load timeline too long?

Isn’t that the idea of an equity fund that is signalling you need to stay long? 🙂 Vidya

Greetings!

How does the recent Multicap guidelines by SEBI impact PPLTE ?

Hello sir,

As of now, we do not know what action the AMC is going to take. One, AMCs are trying to either get a relaxation on the rules or get a new category introduced. This apart, the fund can change categories, and there are categories such as value which it can move into without having to change any aspect of its strategy or portfolio. So, we need to wait for more clarity.

Thanks,

Bhavana

AS A GENERAL INVESTOR ALL ARE LOOKIN AFTER RETURNS THEY GAINED IN LAST YEAR , FUND HAS BECOM EFAVOURATE IN INVESTOR FURTINTY , WILL THIS FUND WILL BE ABLE TO DELIVER SUCH KIND OF ALPHA IN YEARS TO COME .. IF YES … HOW …?

LOOKING IN TO THE ELECTION SCENARIO AT SHOULD WE PUT MORE IN TO THIS FUND …?

It is part of a recommended list for a reason. if that reason goes away, we will alert our subscribers. thanks, Vidya

Hi ,

One query on PPFAS portfolio , they have Currency Derivatives 28-SEP-20 which is a significant 20% . What does Currency Derivatives mean ? Does it make the fund more riskier ?

No. Since the fund takes international stock exposure, it is exposed to currency risks (rupee-dollar equation). Hence the hedging helps, especially when rupee is gaining. thanks, Vidya

I have joined as an active trial user but am unable to access your recommendation on Parag Parikh long term equity fund although your site says that subscribers and active trial users can access it. Kindly look into the matter.

Some articles are only for subscribers. However, since you have asked, we have opened it for trial members. Please check now. thanks, Vidya

Hi, dont you update the portfolios of the funds? PPFAS has ITC now for quite some time now.

Hello sir,

Do you mean in this article? No, we don’t sync portfolio details with blog articles. For the latest top portfolio holdings, please visit the individual fund page, here.

Thanks,

Bhavana

Hi Vidya,

I am keen to invest in a fund with exposure to U.S. tech stocks (Microsoft, Alphabet, Amazon, Netflix etc) for a long duration- maybe with a 10 years horizon-but, frankly, do not have the comfort level of investing in Parag Parikh Long Term Equity fund (PPLTE), mainly due to the unknown pedigree of the AMC and its small AUM size.

Would appreciate if you could recommend any other prime fund with a similar investment mandate as PPLTE.

Thanks

Rohan

Rohan, if are a subscriber, use https://www.primeinvestor.in/best-mutual-funds and find international options in strategic/thematic and read the why this option and you will know which one fits your need. Or please write to us from your subscribed id: https://www.primeinvestor.in/contact-us/

Some points: PPLTE is not an international fund. it has 25-30% in intl. stocks and rest local. SO it may not fit you if you want just US stocks. Second, PPFAS started off as among the top performing PMS firms in the country under the late Parag Parikh a classic and one of the most successful value investors in the country (who ironically passed away in an accident after attending the annual Berkshire Hathaway meet) . They moved to MFs only when PMS limits which were earlier at Rs 5 lakh was moved to 25 lakh. So their ‘pedigree’ is not in question 🙂

Thanks Vidya

Please review IDFC Sterling Value fund

It is part of our picks for 2020 outside of Prime funds. We covered it as a dark horse bet in January https://www.primeinvestor.in/prime-strategies-equity-markets-2020-opportunity-to-capture-the-lows/ We will do detailed review at an appropriate time.

Vidya

Please can you advise what to do with Tata equity PE fund? Last 2 years my investment is in the red. I am also invested in ICICI Value Discovery fund.

Regards

Meenakshi Ray.

Our review tool will give our view on both the funds (buy/hold/sell). Please take a look if you are a subscriber: https://www.primeinvestor.in/portfolio-review/ thanks, Vidya

Except for Kotak Standard multi cap which large or multi cap can complement to PPLTE strategy i.e. pure growth style which will work when PPLTE may under perform.

Everything in our Prime funds moderate list (other than the contra fund there) and aggressive fund list will complement it as the mix of its strategy is unique. Vidya

Comments are closed.