- SFB financials may look better than mainstream banks, but their lending operations are quite risky

- We identify three of them based on financials and disclosures

- SFB deposits are good as a diversifier and not as capital protection vehicles

Want a fund that will avoid expensive valuations and yet not leave you with the pain of the long wait for value to work? This fund does just that. Not only that, this fund can replace large-cap funds in your portfolio. Replacing pure large-cap funds with moderate-risk multi-cap funds is a strategy we have been suggesting for a while now. And this multi-cap fund avoids the high-valuation territory that most large-cap funds are prone to.

Fund Strategy

Invesco India Contra (Invesco Contra) is not a pure-breed value fund. But it satisfies a lay investor’s search for mispriced stocks.  It does this at two levels: one, it goes overweight (compared with the benchmark) to capture the opportunity in out-of-fancy sectors. At a stock level, it goes for stocks that are either trading below their fundamental value (clear value case) or are in a turnaround phase or are growth companies that the fund believes are temporarily de-rated. This part is meant to be value.

It does this at two levels: one, it goes overweight (compared with the benchmark) to capture the opportunity in out-of-fancy sectors. At a stock level, it goes for stocks that are either trading below their fundamental value (clear value case) or are in a turnaround phase or are growth companies that the fund believes are temporarily de-rated. This part is meant to be value.

But then, the fund also holds stocks that were bought as value and later become growth candidates. This last part buttresses the performance of the fund when value underperforms for prolonged periods. This can be 20-30% of the fund’s portfolio.

Suitability

Invesco Contra is multi-cap in its strategy and is suitable for moderate to high risk investors. The fund has marginally higher volatility than other contra or value funds given that it has up to 30% in growth stocks. It also has close to 30% in mid & small cap stocks. This share is not that much higher than the average for multi-caps, but is still above most other value/contra funds. It does not take cash calls, unlike peers. This also heightens volatility in falling markets.

If your time frame is at least 5-7 years and you are an above-average risk taker, then you can consider holding such this fund along with our earlier call on the Nifty Next 50 index. The fund is part of our Prime Funds list.

Performance

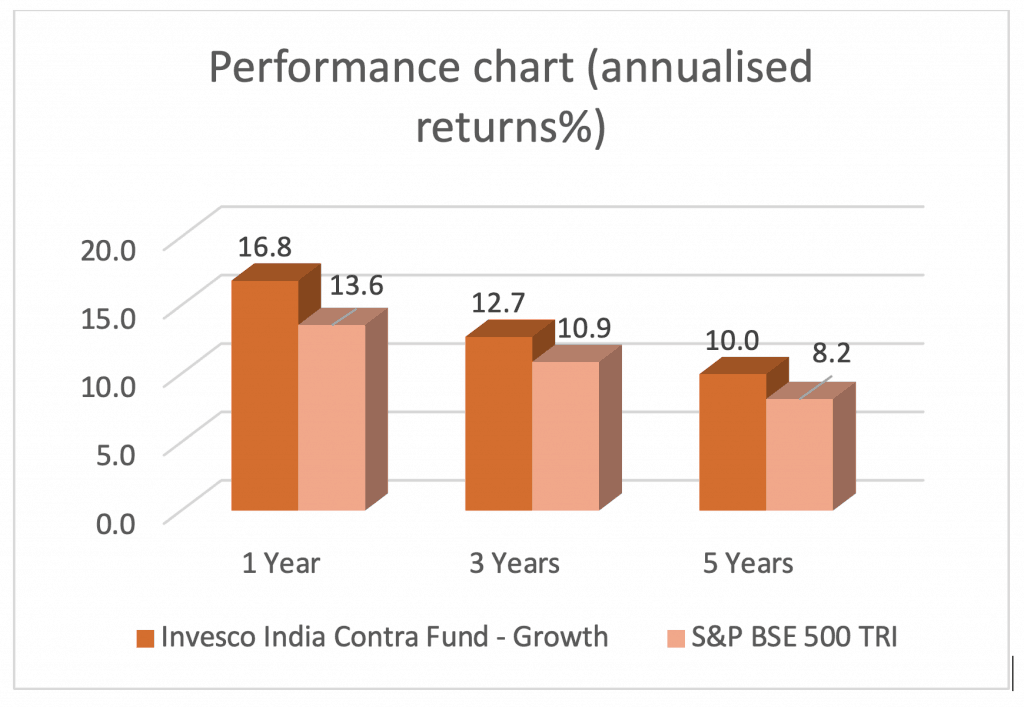

Returns as of Feb 14, 2020

Invesco India Contra managed to beat the Nifty 500 TRI (the benchmark we consider for multi caps) as well as category average (multi caps, contra value and dividend yield funds) 100% of the times when three-year returns were rolled daily for an 8-year period. Funds such as Kotak Multicap, Motilal Oswal Multicap 35, Edelweiss Multicap and SBI Magnum Multicap share this feat albeit with very different strategies.

In the above period the fund’s average annualized 3-year returns was 19.7% as opposed to 14.9% average for the above-mentioned categories. The worst 3-year returns over this period was 8% while the category fared at 4%.

Invesco Contra tends to show volatility over shorter time frames and has higher standard deviation. On rolling 1-year returns over the past 3 years the fund beat the benchmark 60% of the times. While this may seem low, peers on an average outperformed the index just 36% of the times. The fund’s downside probability too is not the best, for the same reason mentioned earlier.

Portfolio

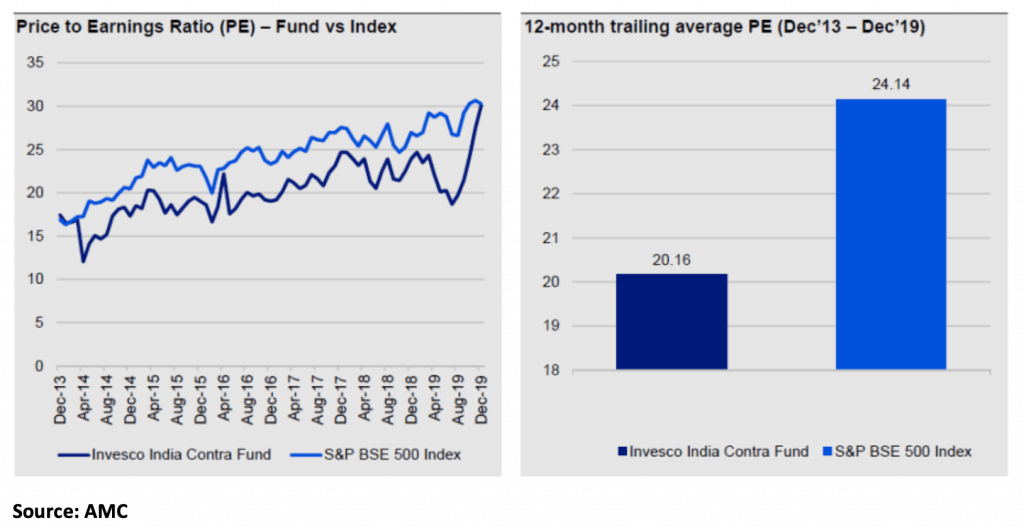

Invesco Contra’s portfolio in 2019 had far lower in valuations than its benchmark, the S&P BSE 500. Its portfolio was underperforming in 2019 for 2 reasons: one, value didn’t take off in the narrow rally of large-cap stocks seen in 2019.

Second, the mid and small cap segment continued to correct resulting in poor performance of the fund compared with peers with higher large-cap allocation. This saw funds like Kotak Contra (which has higher large-cap allocation) beat the fund.

In the last 6 months, this trend reversed with the fund gaining 15.5% as opposed to benchmark returns of 11.4%. Value funds delivered lesser, at 9.65% on an average. The graph above will also show you that this rally resulted in its PE moving up.

In the last 6 months, this trend reversed with the fund gaining 15.5% as opposed to benchmark returns of 11.4%. Value funds delivered lesser, at 9.65% on an average. The graph above will also show you that this rally resulted in its PE moving up.

Invesco Contra’s value-turned growth picks include HDFC Bank, ICICI Bank and Reliance Industries. Others such as Bharti Airtel or Axis Bank, having been picked in lows in September/October 2018, remain relatively attractive in valuations. Invesco Contra has displayed astute value picking traits, be it in the above-mentioned large caps or midcaps such as Apollo Hospital Enterprises, entered in September 2017 (61% stock returns since) or Coromandel International picked in December 2018 (42% stock returns since).

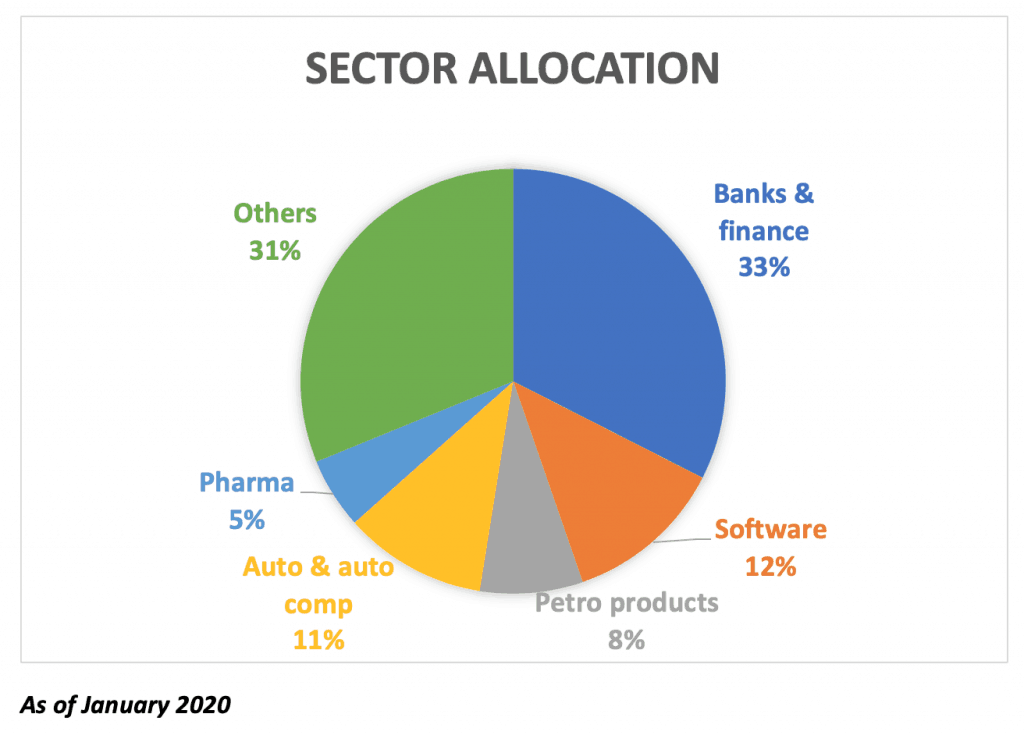

What stokes our interest in the fund at this juncture is the cyclical tilt in its portfolio in terms of energy, automobiles, consumer discretionary and construction besides de-rated pockets of IT and healthcare. This mix ensures that it does not miss on an economic recovery while at the same time, has enough opportunities even if recovery gets delayed. In the financial services space, while the fund may appear overweight overall, it has cut down pockets of banking and instead hiked in financial services. This may also serve it well as there are signs of recovery in quality financials.

Taher Badshah and Amit Ganatra manage this fund. Its AUM as of January 2020 was Rs 4751 crore.