2019 was a baffling year for Indian stock markets. Benchmark indices headed upward, notching up newer highs. But most stocks were anything but gainers. Corporate revenue and earnings growth came in poorer than expected. Economic growth struggled. Can 2020 be a year less mystifying?

We think that 2020 there will be better opportunities to be had for equity investors in 2020 than in 2019. Here’s why.

- Economic growth slowed to a crawl by the second quarter of 2019. However, we believe this could bottom out and begin to slowly recover in 2020 driven by a rural recovery, a pick-up in government infrastructure spending and easing of credit flow from banks/NBFCs.

- For corporate India, the selective economic revival can help bring about earnings and revenue visibility for a broader range of stocks outside the clutch of ‘quality’ names. Given that markets always bottom out ahead of the real economy, we think this can propel a broadbasing of the market gains beyond the Nifty and Sensex stocks. Such gains, however, are likely to be in pockets of stocks that are at relatively low valuations, are fundamentally strong and well-positioned to benefit from a cyclical recovery.

The best investing opportunities in equity markets are available only when there is uncertainty about growth or earnings. When the outlook is crystal clear, you can be sure that stock valuations have already factored it in. The pockets of low valuation in the Indian market today therefore offer an opportunity for long-term investors to build their portfolios to gain from the eventual recovery. Foreign institutional flows have also begun returning to markets. This support, absent for 2018 and part of 2019, can sustain markets along with domestic flows.

Bottoming out

That economic growth has suffered an extensive slowdown is well-known. Where and how it can recover is the question, especially with many high frequency indicators giving out a mixed picture. While recovery is not going to be V-shaped, we think the worst may be behind us on three counts.

One, the financial system is stabilising post the IL&FS/NBFC crisis. The weakness in the financial system limited both credit availability and transmission of the RBI’s rate cuts over 2019. That is likely to change in 2020 with pressure on lenders to transmit rate cuts. The RBI’s efforts to lower long-term lending rates can also help. The spread between government and AAA corporate bonds have begun shrinking, suggesting that high-quality borrowers are finding it easier to raise funds; RBI data shows that growth in loans to large corporates is starting to come off its lows in the last couple of months.

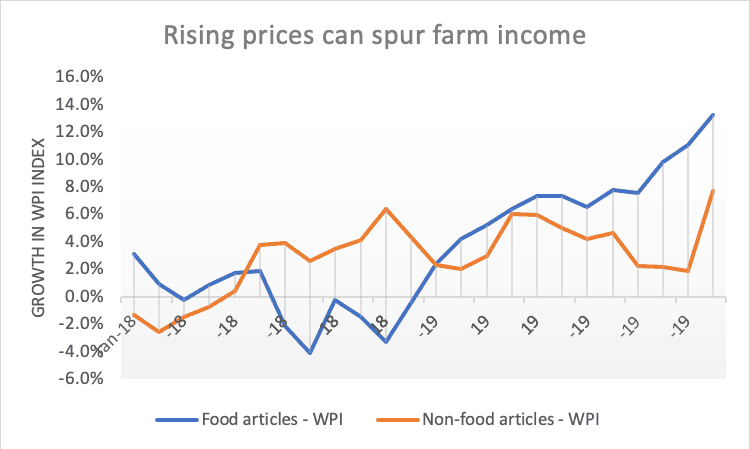

Two, several indicators are signalling a rural demand revival. In 2019, low food prices and slow rate of wage growth had hampered this sector. While pace of wage growth remains lower than earlier years, food prices have reversed sharply higher both at the retail and wholesale levels. Wholesale price increases have encompassed a range of fruits and vegetables, cereals, pulses, dairy products, and oilseeds in November and December. The rise in global food prices, signalled by the FAO Food Price Index is supportive of this trend.

Rural prosperity can also get a leg-up from the good monsoon of 2019 after two successive years of very poor spatial and temporal distribution of rains. Area under cultivation for this rabi season is 6.5% higher than the year before and targets for the 2019-20 kharif season are above that of 2018-19. Going by GVA data, agricultural activity has picked up in the first half of FY-20 after a fall in the final FY-19 quarter.

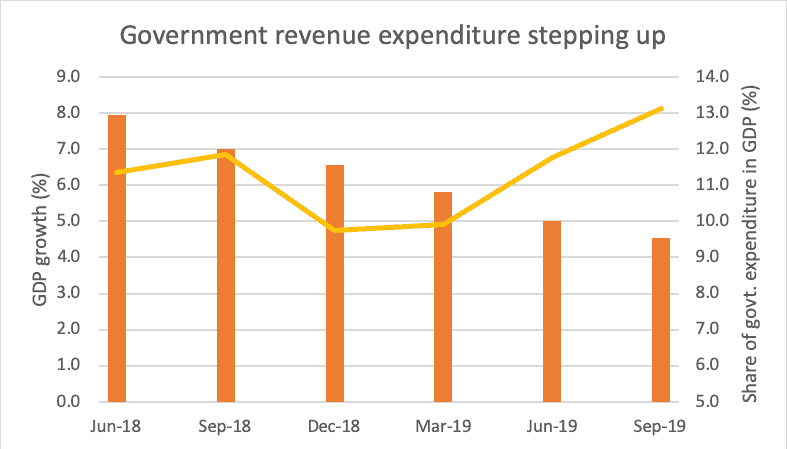

Three, keen to check the runaway deficit, the government has been frugal with its capital spending, even as it has kept up revenue spending in the ongoing Q4 of FY20. Going ahead, spending constraint could ease and measures could see the government step up capital spending. Among these, from a medium to long-term perspective, is the recently-announced National Infrastructure Pipeline. Its enormous Rs 102 trillion outlay, even if partially met, can have a broad-based impact on investments in the infrastructure and agricultural sectors. The impact of enhanced capital spending can show up in GDP growth in the coming quarters. Given the lack of corporate investment demand, a push necessarily needs to come from the government, notwithstanding the limited fiscal room the government has.

If the upcoming budget provides tax breaks for individual tax payers, it can drive consumption demand too, in addition to the pickup from the rural revival. Consumer demand was also hit by the NBFC crisis; if NBFC funding troubles ease, it could revive consumer durable and housing demand. Going by bank credit disbursement, while overall personal lending slowed, consumers appear to have taken on credit card and other personal loan debt. This suggests that spending on smaller-ticket items may sustain.

Overall, the above trends point to a tentative turnaround in 2020 in two of the four legs of economic growth – consumption and government investments, even as private investments and exports remain weak.

Corporate India

Poor earnings growth at much of India Inc has been a key impediment to broad markets pushing higher, for much of 2019. Growth in aggregate revenue and earnings for the Nifty 500 companies has slipped over the September and June quarters, mirroring the economic slowdown. Aggregate revenues grew just 1.44% in the September 2019 quarter, down from the 10.9% in the March 2019 quarter. Adjusted net profits, too, were flat.

However, there are some segments that bucked the trend. Huge here, of course, is the banking segment where bad loan pressures are easing. Excluding banks, in fact, aggregate revenues fell 1% for the September 2019 quarter. Given that the financial system can benefit both from a consumption increase and an investment demand revival, the sector holds promise. Other sectors where both revenues and earnings have held up include agri-based companies, healthcare, and pharmaceuticals. This apart, some sectors clocked an earnings growth even if toplines remained subdued. Corporate tax cuts can drive earnings growth for a few quarters, but will dissipate over time. For a recovery to sustain, both revenue and earnings need to pick up.

Apart from sectors bucking the trend, cyclical sectors can see improved visibility in revenues and earnings if the growth slump bottoms out. The reasonable valuations they trade at can also be supportive. This opportunity, though, is likely to lie only in pockets.

For one thing, a private investment cycle revival is necessary to lift all cyclicals and this is yet some time away. For private capex to revive, signs of a demand revival first need to be visible. For another, while sector prospects may be present, individual companies or promoters may not have the financial wherewithal to participate in the revival.

Markets and institutional flows

Stock markets outside the Nifty 50 have already begun to turn around from August/September 2019 – the announcement of the first stimulus package of the corporate tax rate cut. In the Nifty 100, for example, stocks such as DLF, NMDC, Bharti Airtel, Siemens, and Tata Steel are up over 30% from those lows.

Over 2018 and 2019, Nifty 100 and the Nifty 50 gains had been driven by a handful of stocks with strong earnings visibility. Recently, though, this trend looks to be less polarising. Consider the Nifty 100 Equal Weight index, which assigns equal weight to all stocks in the index and therefore limits the influence of each individual stock. This index began beating the Nifty 100 index on a rolling 1-month basis from around the end of September. However, for the polarised market to reverse, a sustained move away from index heavyweights into the other stocks is required.

Overall, while the economic recovery in 2020 is likely to be weak and earnings revival likely to materialise only in select pockets, it is the reasonable valuations in several pockets of the market that make the case for accumulating equity exposures in the coming months.

And 2020 may offer good opportunities on this score – 327, or nearly 7 in every 10 stocks of the Nifty 500 today trade below the market PE of 30.5 times. A similar number are trading below their average 2017 PE-multiples. And a good 40% are also lower than the 17.6 Nifty PE consensus estimates for FY-21.

A sentiment boost may broaden market rally. Foreign inflows can be one such boost. On this front, there already appears to be a revival. Net foreign inflows into equity came in at Rs 101,000 crore for the 2019 calendar, against a net outflow of Rs 33,014 crore the calendar before. Domestic flows have remained strong, especially through the mutual fund SIP book; monthly SIP inflows have climbed every month in the 2019-20 fiscal compared to the year ago period.

To put it in a nutshell,

- While no big bang recovery can be expected, there are signs of the economy bottoming out. A rural revival helped by rising food prices and a government push such as the NIP may help two of the four legs of the economy look up.

- There may not be a broad-based rally across stocks and sectors. It is instead, likely in pockets – in sectors that can be first in line for a growth and those where valuations are below historical averages.

- 2020 may be a year of consolidation, where there may be positive news to drive stocks but without all-out euphoria that can trigger a resumption of a big bull market. Changes on the policy front can alter market direction.