A good way to gauge the state of personal finance books that are India-centric would be to visit the ‘Book’ section of Amazon’s India website.

If you go to the American Amazon.com, you will find the ‘Business and Money’ section, under which you will find ‘Personal Finance’. Boom, done – you have access to a treasure trove on all topics PF.

If you go to the Indian Amazon.in, you will find a ‘Business and Economics’ section, and under that, you will find ‘Analysis and Strategy’, ‘Economics’, and ‘Industries’. If you, by power of logical reasoning and elimination, go into the first category, you will find, along-side books about American personal finance and self-help (Dale Carnegie!), a smattering of books by Indian authors to help Indian investors.

A handful, at best.

No doubt, this is an emerging section, but the current state of limited selection is properly captured by just browsing through these aisles.

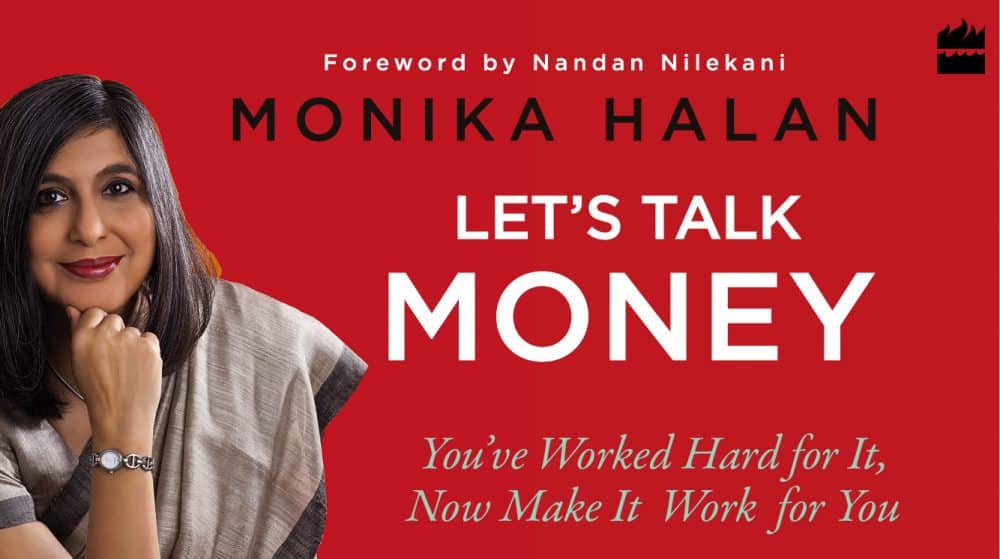

Monika Halan’s ‘Let’s talk money’ is, especially in this context, a much-needed publication that addresses a sore need in the Indian market.

Three things distinguish this book for me:

- It is broad – it is not narrowly scoped as in for a specific goal or about a specific product set (there are many books about picking stocks and trading)

- It is at the right level – the book talks to people who are generally aware about finances, but is not really clued into what is what about various products. This way it addresses, in my opinion, a very large segment of the Indian investor population.

- It is comprehensive – it talks about everything that such an investor should know – from bank accounts to insurance to investments to wills.

In essence, this book talks to, as I see it, the most important segment of the Indian populace – the aspiring investors. These are the people who have legitimate aspirations about money, wealth, and future finances. They are not greedy, nor are they the most timid when it comes to taking risks. But they don’t know the first thing about stock markets (or have the wrong ideas), are confused about insurances, and due to ignorance or inertia, are staying with low-return products that are hurting their financial lives. This book will set them straight.

For the range of topics it covers, the book is pretty small – running to a little over 200 pages. But that’s not because it lacks depth of coverage – it is simply a testament to the author’s ability to say much using few words. A talent honed over years/decades of writing pithy columns with strict word limits – something regular readers of Monika would be well aware of.

As seasoned observers of Indian investor mindsets will tell you, the typical person in India needs advice both on what to do and what not to do. Say yes to the right products and say a resounding no to the much larger set of wrong products. “Let’s talk money” deals with both – it tells you to avoid ULIPs and endowment plans while encouraging the use of term plans; tells you to keep away from trading in the stock market, but emphasizes the vital importance of equity investing; demonstrates the shortcomings of deposit products but tells you where they would be the ideal thing to use. Everything when used the right way and in the right portion, will come together to make a healthy mix of protection and investment to take you through your earning years and beyond with as little money troubles as possible.

The book though, starts off with the basics – savings, budgeting, and organizing your money. Monika recommends that you put money in different ‘money boxes’ for different purposes – income, expenses, and investments. She lays out a neat plan that anyone starting off in their investing career will do well to adhere to and follow. Everything flows from there – step by step, into how to protect your money and your family, how to take care of the unexpected, how to invest, how to plan for retirement, and how to plan for the beyond.

It’s an easy flow of themes and topics – made easier by the use of copious amounts of anecdotes – both from the author’s own life and from all that she has heard from friends, colleagues, and an army of readers through her career of helming personal finances pages of publications.

Most importantly, what came clear to me through the reading of the book was an earnestness – a sincere desire that the author has that you – the reader – understands what she is trying to communicate. She uses anecdotes, experiences, analogies (plenty of these), and multiple angles to a topic – all to make sure that the reader does not leave a section without a proper understanding of the subject at hand.

This earnestness comes out of passion – and having known Monika for more than a decade now, I am not the least bit surprised about it – for educating the common Indian investor and putting them on the path of prudent financial life.

For this sincerity, for its plain-speaking tone, for the breadth of its coverage, for its simple but effective style of writing, and for its absolutely sound and practical advice, I heartily recommend this book.

One suggestion that I would make is that Monika do a companion workbook to ‘Let’s talk money’. A book that would have illustrations, sample worksheets (for saving, budgeting, allocating), simple plans, and easy to deploy portfolios. And, as in vogue these days, a website to go-with would be awesome. These will enhance the book’s utility much more and help realize its full potential.

(I do notice that she has a simple, but active blog)

I should also mention one more thing – the foreword written for this book by Nandan Nilekani is one of the more well-written forewords I’ve read. Nandan shows a surprising (to me) level of understanding about the mindset and plight of the common Indian investor in this lucid essay. Do not skip.

As I mentioned in my review of Subra’s book on retirement, the readers of this blog are probably not the target audience for this book (although they can still learn a thing or two, as I did, by reading it). But this inexpensive, relatively small book will be an ideal gift to the aspiring innocents among us, and definitely to the folks heading fast in the wrong direction in their financial life.

The personal finance marketplace in India can definitely use more such publications. But I can concede that these are not easy books to write or books that can be written by anyone. Only a person with knowledge, experience, and an elan for writing, such as Monika can author these. The way we will see more such books in the virtual shelves would be if more such people emerge (hard), or people with such qualifications (I can think of a couple 🙂 ) start writing such books, or if Monika herself writes more. Any which way, a deserving market awaits.

Link to book in Amazon (not an affiliate link)

4 thoughts on “Monika talks money”

Thanks Srikanth for the book recommendation – it is definitely good and as you suggested a good gift for people who are starting their careers.

BTW, Primeinvestor is a treasure trove as well – Recently I have joined as a Prime member and going through old articles and lot of interesting information. Appreciate your work to share financial knowledge with everyone!

Monika Halan’s TV show along with Vivek Law was one of the earliest one’s in business channels on TV…about 10 years back and one of the first of its kind…when there were hardly and shows on personal finance….they were extremely simple and useful…she has used all her experiences in this book, which has to be used as a text book and referred to now and then !!!!

This is a great review of the book. Enjoyed reading it. Would recommend.

Thanks 🙂 Please share in social media for others to read the review and the book!

Comments are closed.