The initial public offer of SBI Cards and Payments is slated to be huge, aiming to mop up over Rs 10,000 crore. A subsidiary of State Bank of India, the company issues and runs SBI’s credit cards business. SBI Cards is the second largest credit card player in India after HDFC Bank. The IPO is primarily an offer for sale by SBI and PE investor CA Rover Holdings, with Rs 500 crore being a fresh issue of shares.

SBI Cards, a systemically important NBFC, represents a unique franchise because NBFCs in India are not allowed to issue credit cards and banks have this business as one of the many in their fold. We have therefore evaluated this offer on the premise that this is a retail lending business housed in an NBFC.

SBI Cards: Positives

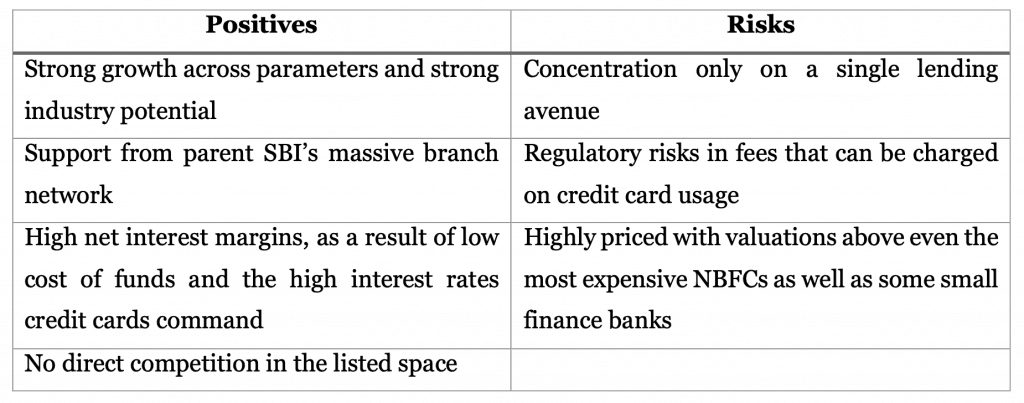

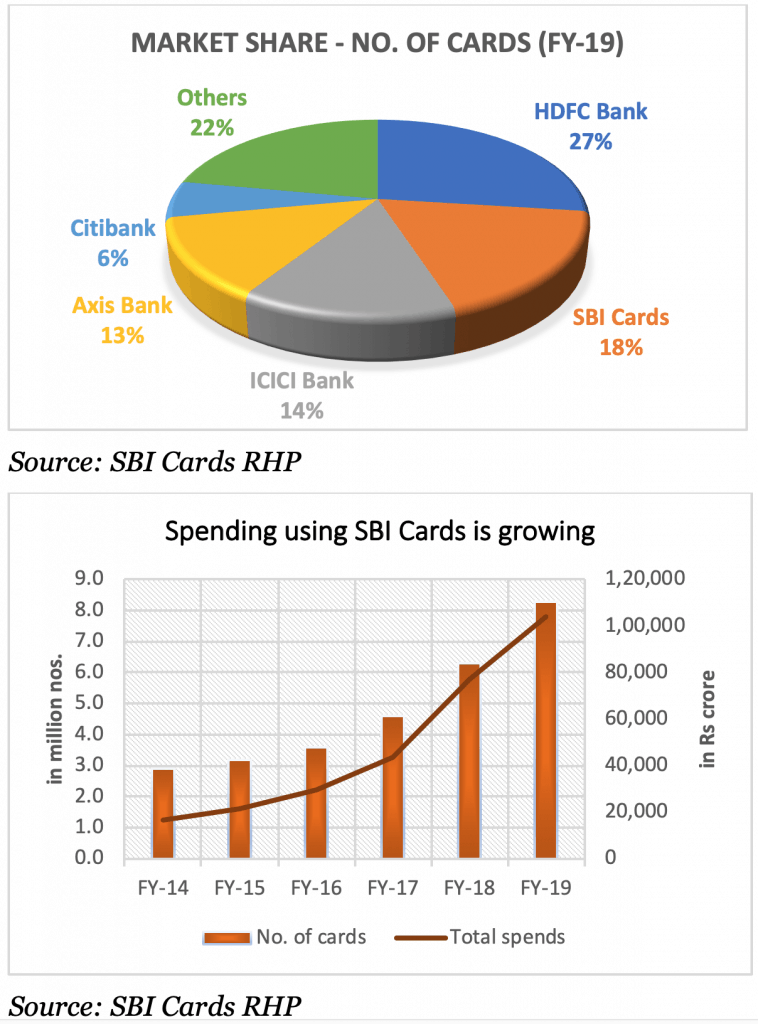

Direct consumption play: SBI Cards’ NBFC business is a direct play on India’s booming consumption economy. First, the company has a 18% share in credit cards by volume, the biggest after HDFC Bank’s 27% share. ICICI Bank and Axis Bank each have a 13%-14% share. However, SBI Cards has clocked the fastest growth among these – between FY-16 and FY-19, its credit cards issued jumped from 3.6 million to 8.3 million, a CAGR of 32%.

Second, the company’s credit card spends grew at a much faster pace than card volumes at 52% annually. Of the total spending by the top 5 card players, SBI Card’s share has jumped to 23% in FY-19 from 16% in FY-16. Market leader HDFC Bank has lost share in spends while ICICI Bank and Axis Bank have only maintained share.

Third, the market is under-penetrated and SBI Cards has the ability to widen reach by piggybacking on its parent SBI’s massive country-wide bank network into newer Tier II and Tier III markets. Organised retail and e-commerce are simultaneously reaching out to these areas which can spur spending. SBI Cards is also a leader in co-branding with established brands in retail outlets, travel, fuel, e-commerce, and entertainment, which drives customer acquisition.

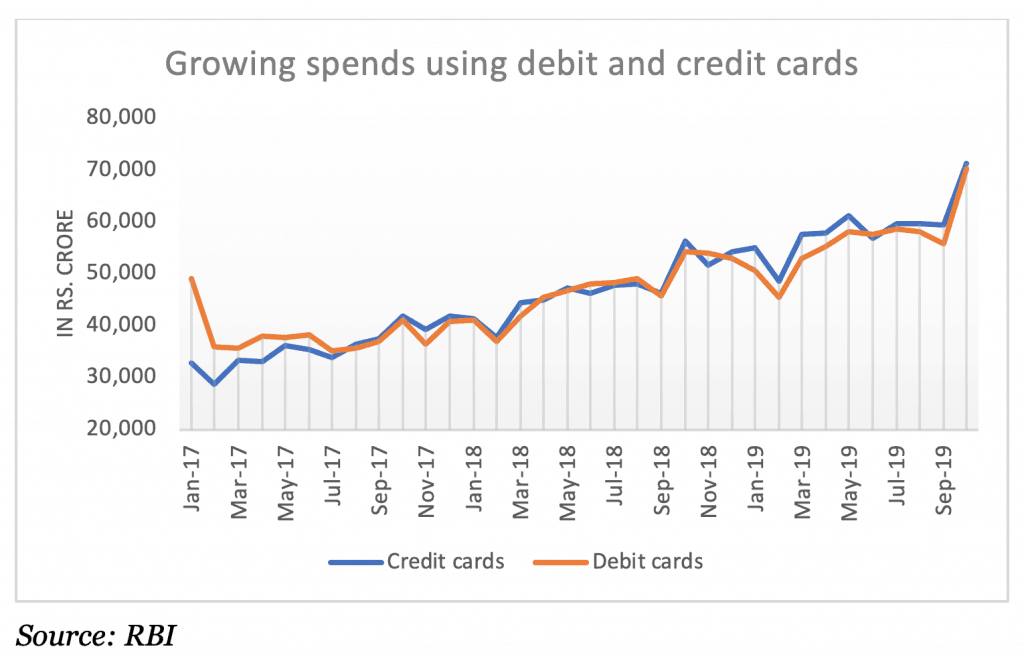

Company aside, the industry itself faces a large addressable market. Card usage in India has historically been dominated by debit cards and for ATM withdrawals, but this is now changing. Credit card swiping at point-of-sales terminals has more than doubled from Rs 24,840 crore a month in 2016 to Rs 54,477 crore now, going by RBI data.

Retail lending focus: Having burnt their fingers at wholesale lending, most lenders in India are now turning to retail lending which offers low loan book concentration with high yields. SBI Cards is firmly rooted in this segment with a loan book that is virtually entirely retail with limited corporate clients. This brings low client concentration with single borrower exposure as on December 2019 standing just 2.8%.

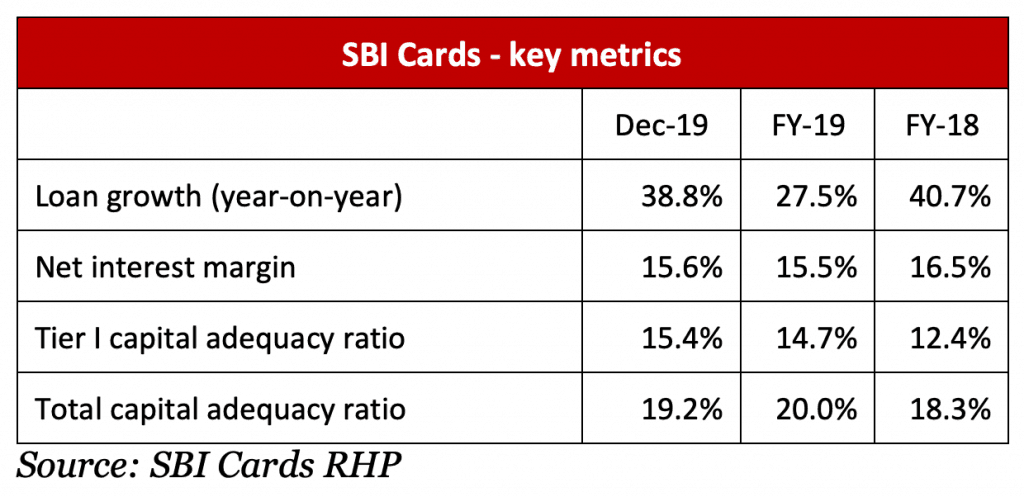

SBI Card’s loan growth has been impressive from an annual 34% between FY-17 and FY-19, to 38.8% in the first nine months of FY-20 over the year-ago period. Loans are split into EMI-based loans where cardholders convert purchases into EMIs and revolving credit on unpaid card balances. EMI loans account for about 32% of the total, and are generally more manageable and less susceptible to default than revolving credit.

SBI Card’s delinquencies have been well under check with Gross NPAs at 2.47% in December 2019, a level it has more or less remained at since FY-17. Strong provision coverage of nearly 67 per cent has led to net NPAs being at 0.83 per cent, a comfortable level.

High net interest margins: A key indicator of profitability in a lending business is the Net Interest Margin (NIM). As credit card debt is among the most expensive there is, SBI Cards scores high on this parameter with NIMs of 15-16%.

Average yields for SBI Cards ranged between 21.3% to 22.2% since FY-17 while cost of funds ranged between 7.2% to 8.1% over the years, thanks to the strong parentage and AAA and A1+ credit rating. While cost of funds may rise should rates increase, NIMs may continue to remain strong given the high lending rates. Interest income grew 33% for the first nine months of FY20 (9MFY20) over the year ago period and at a similar pace in the earlier fiscal years.

Interest income accounts for 51% of the revenue for 9MFY20, with most of the remaining from SBI Cards’ share of the interchange fee charged from the merchant and payment network for facilitating credit card transactions. Fee income grew 40% in 9MFY-20 over the year-ago period. Fee income allows SBI Cards to earn revenue from a customer’s entire spend on credit cards – interest income, on the other hand, is earned only on that portion which converts into lending.

SBI Cards: Risks

Consumption slowdown: The credit cards business is a direct play on consumer confidence and income prospects in the economy which if weak can lead to slower growth and higher delinquencies. Here, the lack of available track record for SBI Cards across an entire economic cycle for say 5 to 10 years makes an assessment of its vulnerabilities difficult. While SBI Cards and other credit card players have seen growth in spending, the pace of growth slackened in FY-19 in line with the consumer slowdown.

SBI Cards’ focus on a single lending product, while aiding its scorching growth, can render it more vulnerable to trouble in its target segment compared to banks or NBFCs which cater to multiple borrower segments.

SBI Cards splits its book into three buckets (“stages”) based on its assessment of borrower credit risk. These classifications show that the share of Stage 2 and 3 loans in its gross exposure stood at 10.63% for December 2019, up from the 9.11% in FY-17. These are loans where SBI Cards sees heightened credit risk with some evidence of impairment, though the problem hasn’t reached the bad loan stage. SBI Cards additionally is targeting new-to-credit and young customers, which pose their own risks.

SBI Cards’ focus on a single lending product, while aiding its scorching growth, can render it more vulnerable to trouble in its target segment compared to banks or NBFCs which cater to multiple borrower segments.

Regulatory moves: In its eagerness to promote digital transactions, the Government has been rolling out margin-hurting moves for payment ecosystem players. A recent move was the removal of interchange charges on use of RuPay cards. This apart, if innovations in other popular digital payment modes such as UPI allow credit to be offered to users, it could pose a risk to plastic cards. Inroads by other NBFCs into offering their own credit cards either if the RBI allows it or via co-branding with other banks could pose competition especially in Tier II and Tier III markets.

SBI Cards: Valuations

While the business positives of SBI Cards presently outweigh its risks and its IPO can command a scarcity premium by being the only listed credit card provider, expensive valuation is a sticking point with this offer. Going by the post-offer numbers, at the upper end of the price band of Rs 755, the price-to-book value of the offer works out to 13.4 times. Post-issue annualised FY-20 PE multiple works out to 45.5 times. Most NBFCs in contrast trade at 1 to 5 times their book value. Bajaj Finance, a retail NBFC with an impressive track record of delivering growth while weathering economic cycles, currently trades at about 9-10 times book.

In terms of their growth metric and loan book orientation, small finance banks offer a close comparison to the SBI Cards business. Here AU Small Finance Bank trades at about 10.7 times book. With several other small finance banks lined up for listing, these could offer high-growth alternatives to SBI Cards.

Data source: SBI Cards’ filing with SEBI

[Editor’s note: We published an article a few days back on how IPOs have done in the Indian market. If you have not already, please read that essay by Aarati Krishnan to get context today’s IPO]

3 thoughts on “IPO review: SBI Cards and Payment Services”

Good note. Valuation concerns are highlighted well.

Thanks, sir 🙂

Regards,

Bhavana

All aspects covered in the post..On a side note Equitas quotes at less than 2 times book! So yes SBI Cards does seem expensive…

Comments are closed.