Cost inflation index benefit makes the post-tax return of debt funds far superior to fixed deposits.

Please note that debt fund taxation has undergone a change. Indexation benefit will not be available for investments made from April 1, 2023 onwards. You can read about this in our article, ‘Tax changes in mutual funds: How to manage your investments now‘.

If there’s one major advantage with debt funds compared to fixed deposits, it’s their taxation. Indexation benefit in debt funds helps you drastically cut down on tax outgo, improving your post-tax returns. Here’s what you should know about indexation in debt funds.

The terms

In debt funds, capital gain is the difference between the NAV at which you bought the fund and the NAV at which you sold it. When the holding period is three years or longer, it is termed as long-term capital gains. Holding period of less than three years is short-term capital gains. Tax is applied at 20% on long-term capital gains, and at your tax slab rate for short-term capital gains.

Indexation is the process by which you increase the purchase cost. Since rising inflation eats into your money power, the taxman allows you to factor in this inflation into your costs to make the figure more realistic and in tune with today’s levels. By increasing the purchase cost, the capital gain for tax purposes shrinks. And therefore, the actual tax you pay reduces significantly. You undertake this indexation using the cost inflation index, which the tax authorities release every year.

Given that the capital gains index has been expanding at a good pace (see table), courtesy inflation, using the index will likely ensure that you pay very little tax or nil tax on your gains.

How it works

Let us take an example of a debt fund that you bought for Rs 10,000 in February 2016. If the fund returned 8% annually on an average for the next three years, you sell it for Rs 12,600, your long-term capital gain would normally be Rs 2,600.

If you were to simply apply the tax rate of 20% on this amount, it would work out to Rs 520. But if you apply the cost inflation index, the cost rises to Rs 11,023. The capital gain for tax purpose would then be Rs 1,023 and the tax Rs 204. That’s less than half the tax you would have paid without indexation!

So know that taxation on debt funds is not an onerous clause nor a huge drag on your returns and should not be considered a detriment to investing in them. This tax rule of indexation applies for gold funds, international equity funds, and any debt-oriented hybrid fund. So – remember to factor in indexation before you pay your tax and when you look at the attractiveness of debt funds.

Comparison with FD

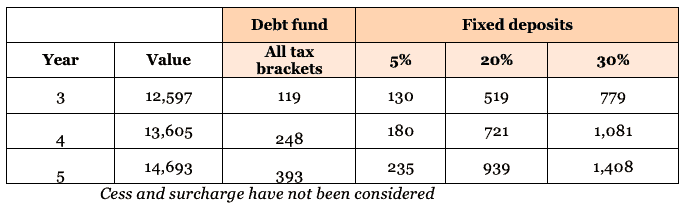

Now see tables below to know how this indexation makes a debt fund a superior post-tax product compared with most fixed deposits. Let’s assume you invested Rs 10,000 in the debt fund and FD five years ago, in Feb 2014 and both earn the same return.

As you can see, in the higher tax brackets, the tax outgo is much more in the FD than in the debt fund. That’s because you pay tax on the FD’s interest earned at your income tax slab rate. Your post tax return would be much lower in the FD as a result.

However, if you are in the lowest 5% slab rate or you are not a tax payer, then you may benefit from investing in FDs even on a post-tax bases. You need to ensure in this case that the FD’s returns are superior to debt funds.