Are you an NRI juggling the desire to invest in India with the frustration of endless paperwork? You’re not alone! While India offers compelling investment opportunities, the maze of compliance requirements and tax complications can quickly dampen your enthusiasm. Funds domiciled in GIFT City could offer a way out. Let’s take a look at how they work.

What is GIFT City?

GIFT City (Gujarat International Finance Tec-City) is a planned business district in Gujarat designed to be a global financial and technology hub. It is situated on the banks of the Sabarmati River, between Ahmedabad and Gandhinagar in Gujarat. It is divided into different zones – a Special Economic Zone (SEZ) and a Domestic Tariff Area (DTA) and includes an International Financial Services Center (IFSC) that forms a part of the SEZ.

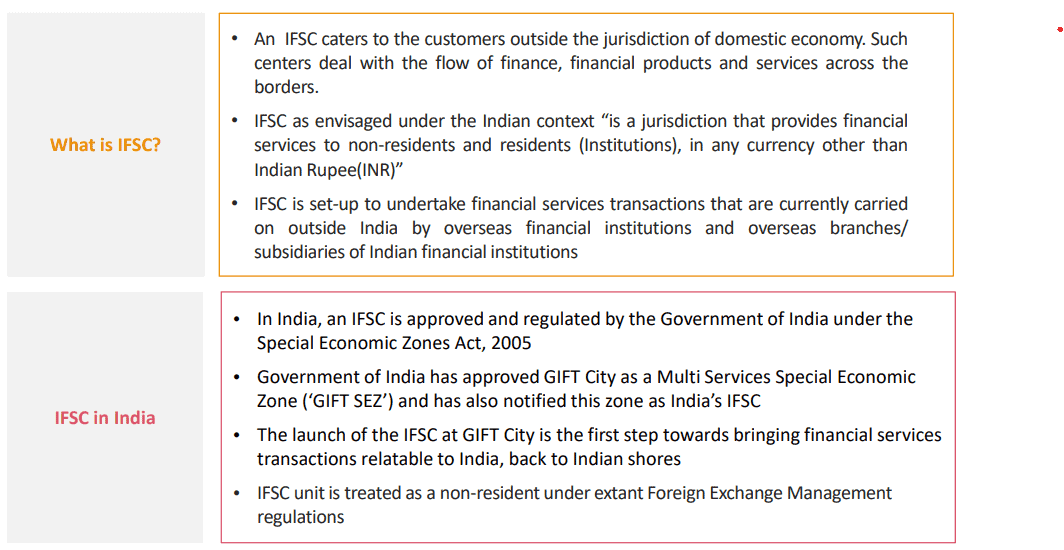

What is GIFT City IFSC?

GIFT City IFSC is India’s first IFSC. An IFSC is a jurisdiction that provides financial services to non-residents and residents (institutions) in currencies other than the Indian Rupee and onshore financial services that are currently carried on outside India. The IFSC is treated as a non-resident for the purposes of FEMA regulations.

IFSCs are regulated by the International Financial Services Authority Regulator or the IFSCA which is a unified regulatory body vested with the powers of the IRDAI, RBI, SEBI and PFRDI all rolled into one.

The GIFT City IFSC is endowed with several tax incentives and benefits to facilitate the flow of finance, financial products and services across borders.

The IFSC ecosystem consists of banks, stock exchanges, brokers and intermediaries, insurers, asset management entities and more. Through these entities products such as bank accounts, bank deposits, AIFs, PMS, life insurance are made available as offshore products and never in INR.

Source: GIFT City Brochure

GIFT City Funds

Indian AMCs and fund management firms are part of the ecosystem at GIFT City and one of the investment avenues that they offer are popularly referred to as GIFT City funds. The key features of GIFT City funds are:

- They are set up as Alternate Investment Funds. A full list of AIFs registered in GIFT City can be found here ).

- They are targeted primarily at NRIs, foreign nationals and corporates.

- Being set up in IFSC, they are able to invest in an array of instruments including global financial securities.

- AIFs come with a minimum investment amount of USD 1,50,000.

- AIFs may also have a cap on the number of investors they are allowed to have.

- The funds also follow varying investment strategies. Some act as feeder funds, feeding into their own mutual fund schemes, others invest in equity with or without hedging, others invest in global investments etc.

- These funds can be accessed directly from the AMC or via banks operating in GIFT City that offer investment services or via intermediaries such as financial advisors / distributors.

Advantages of investing in GIFT City Funds

Gift City Funds offer the promise of doing away with some of the key hurdles NRIs / OCIs would face in investing in mutual funds in India.

#1 Fewer hoops to jump through

In order to invest in GIFT City funds, there is no need to open a bank account or to remit funds back and forth. It can be done directly from one’s account abroad. Further, since the AIF is considered an offshore investment, none of the many requirements such as PAN card, Aadhar card and signatures are required. Instead, these AIFs come with a more concise and NRI-friendly list of requirements (such as proof of identity, proof of residency, bank proof etc.) and when one needs to repatriate on redemption, the FEMA rules do not apply – meaning you can freely remit back to your country of residence without any problems.

#2 Do away with conversion

Since GIFT City funds are available in currencies other than the INR (usually USD) the need to convert to INR and then back again when one wants to redeem and repatriate the proceeds is completely eliminated. This in effect limits any dent to returns on account of rupee depreciation.

# 3 Friendly tax treatment

Perhaps the biggest advantage of investing via GIFT City is the favourable and less complicated tax treatment. Income from AIFs is taxed at the fund level and not taxable in India as far as the investor is concerned. The investor will only need to fulfil his / her tax obligations as per country of domicile. Further there is no TDS, and no GST on fund management fees.

Overall, GIFT City funds score over mutual funds in terms of ease of investing for NRIs, doing away with conversion and above all tax treatment. You can read more about how mutual fund investments are taxed here.

That’s not all, for an NRI, capital gains on redemption is normally subject to TDS. This doesn’t arise in the case of GIFT City funds.

Another pain point that these funds could potentially address is this. If in a particular year, you book profits on a large chunk of your investments, you get hit by the tax provision which says that an individual who is a citizen of India and has total income (from other than foreign sources) in excess of Rs 15 lakh during a financial year, shall be deemed to be resident in India in that year, if he is not a tax resident of any other country. Investing through the GIFT route sidesteps this provision.

While GIFT City funds solve many problems, they’re not perfect:

- The high minimum investment threshold limits access to wealthy NRIs

- Concentrating significant funds in one strategy limits diversification benefits

- Performance data isn’t as robust as established mutual funds

- The regulatory landscape is still evolving

Bottom line: GIFT City funds make sense if they address your specific pain points with Indian mutual funds and align with your investment strategy. Always evaluate the asset management company’s track record and fund manager expertise before diving in.

4 thoughts on “GIFT City Funds: The Tax-Efficient Gateway for NRI Investors”

I have explored this some time back. One major item where regulation is not clear (or not favorable) is: If an NRI becomes Resident , it appears that the funds have to redeemed which is mandatory. This doesn’t help NRIs who will soon become Resident. In case of banks they allow to keep funds as RFC. This point should be addressed by Indian Government in favor of NRE as long as they follow the norms..

Great article.. always wanted precise and reliable details on this.. can you guide if similar options are available for Indians which can work in place of LRS also? Is PPFAS setting up one?

Hello and thank you for your comment.

As regards similar options for Indians – as we understand there are also similar AIFs that pool money from resident Indian investors to invest outside India. Here the investment would fall under the purview of the LRS.

Recent news articles do indicate that PPFAS is setting one up.

Thanks,

Pavithra

Would be great to get an article/recommendations on this matter i.e. resident Indians trying to easily and safely invest abroad. I know there are trillions of blogs/influencer shorts/videos are on this but that’s so much noise. So much uncertainty.