You can tell when a platform marketplace is getting too crowded when useless, misleading ‘features’ get added on to the software in the quest for ‘differentiation’. I ran into a prime example of just such a thing when someone sent me a screenshot of a page from the Paytm Money app.

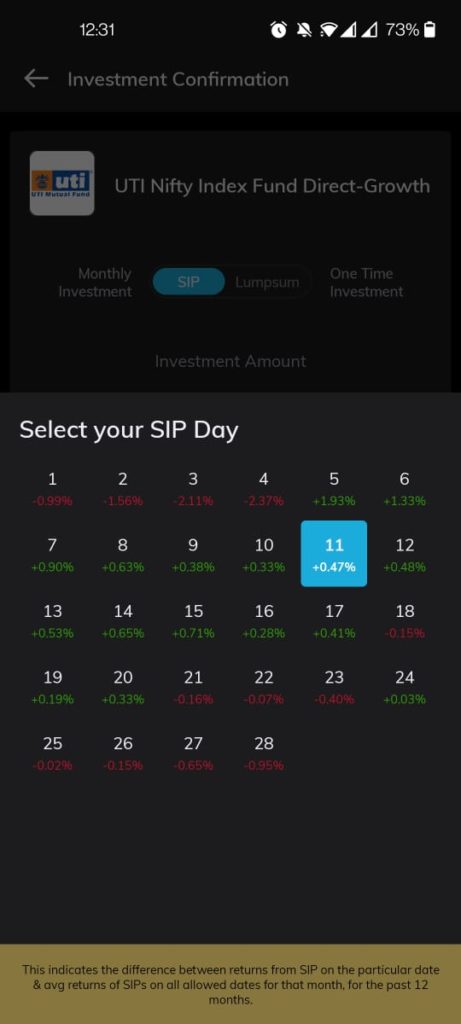

This page/screen is part of the SIP setup flow of the app. When an investor chooses a fund to set up a SIP, the app shows a calendar to choose a monthly date. So far, so good, and expected.

What is not quite expected is the extra ‘information’ provided in the calendar. Each date is accompanied by a percentage figure (see image). This number purports to show how a SIP on that date has performed relative to the other SIP dates.

That is, each date is accompanied by a percentage that tells you (per the explanation in the bottom of the screen) the outperformance (or underperformance) of an SIP done on that date compared to the average SIP performance for that fund over the past 1 year.

Wow! Right? Now, an investor can choose, for EACH fund they are investing in, the exact date that could maximize their returns!

But, of course, this is BS. For one, the sample size is ridiculously small – 12 data points for each date, and two, using the recent one-year performance for an equity fund for making long-term investment decisions is just plain wrong.

Mercifully, as useless and frivolous this feature is, it is unlikely to cause much harm to investors. As our recent researched article shows, it does not quite matter which date you choose for your equity fund SIP – the returns differential is minimal and entirely up to chance. So, just because you choose a ‘high-return’ date based on this data, it won’t dent your returns significantly.

But that doesn’t make for a good marketing tagline, does it? 🙂

4 thoughts on “Frivolous features”

This is an equally frivolous article! Please reserve these for your twitter or other social media posts. Not worthy of an “article” tag. Can we get some meaningful macro coverage instead?

Anonymous huh? 😀 Read the less frivolous ones please. There are plenty.

Paytm money found to be good app for going through the fund world. Especially features like funds managed by same manager etc can be easily filtered. But for investment and tracking purpose, its not the best one out there.

It is one type of investment gimmicks played by Paytm while introducing.

Comments are closed.