PrimeInvestor’s super new tool, Build your own portfolio is a simple yet powerful solution for your need to customise your portfolio the way you wish to, but without choosing the wrong funds nor going wrong on allocation!

There is an enormous number of funds available for you to invest in. There are a good number of categories these funds split up into, many of which share similarities. Then there’s fund performance itself.

Prime Funds, our recommended fund list, solves many of these questions because we look at overlaps, suitability, strategy, performance and the like to pick the most investment-worthy funds. We classify them into buckets that are easy to use in portfolio building – such as Moderate Equity, Aggressive Equity, Medium-term Debt, Long-term Debt and so on.

But for the novice investor, the question of how to allocate between these categories still remains. How much goes into equity as a whole? Or in Equity – Aggressive? Or how do you allocate between the debt categories? Our newest tool – the Build Your Own Portfolio – provides you this solution. It guides you into designing a portfolio for yourself using Prime Funds, based on your inputs. Here’s more.

How it works

The Build Your Own Portfolio is a tool that will help you build an asset-allocated and category-allocated portfolio that is the closest fit to your requirements. The Build Your Own Portfolio (let’s call it BYOP!) considers the following set of inputs that you need to provide:

- Timeframe: The single biggest input. The timeframe you have to invest is the primary factor that helps determine the extent of equity you can – and should – have in your portfolio. In debt, it holds the key to which category of debt funds are best suited.

- Risk: After timeframe, this is the factor that determines both the asset allocation and the category allocation. You need to assess your own risk profile for the purposes of this tool.

- Age: This third input is not the most important, but it helps to better tailor asset and category allocations to your requirements. If you are building a portfolio for someone else, be sure to input their age and not yours!

These are the main inputs. Apart from this, the tool asks you for two more:

- Gold: We generally do not include gold in portfolios unless an investor wishes to. We do not also give it for shorter time frames. So, if you do wish to add gold, select this option in the inputs field and if your time frame input allows it, it will be added.

- Thematic funds: Thematic funds are not everyone’s cup of tea. If the risk profile and timeframe inputs allow for it, you can choose to include these funds in your portfolio.

The BYOP algorithm that we have designed assigns weights and calculates scores for each of these inputs to arrive at:

#1 The asset allocation

This is the overall break-up between equity and debt (and gold, if you have opted for it). Every portfolio will have a debt component to it. The asset allocation is primarily based on loss probabilities in the given timeframe, with adjustments for risk and age. What do we mean by this?

The timeframe you have to hold your investment is the single biggest factor that is considered when arriving at how much equity to have in a portfolio, and takes precedence over the other factors. For example, if your timeframe is 1 or 2 years, holding pure equity in a portfolio is avoidable regardless of risk or age. Similarly, you could be a senior citizen, but that’s no reason not to have equity in your portfolio if your timeframe allows for it.

However, your risk level and age also matter to asset allocation – for example, if you are a conservative investor, suggesting a high equity allocation even in a long-term timeframe is not too suitable. The BYOP algorithm, therefore, considers these secondary factors as well to guide you towards the most-suited split between equity, debt and gold.

Quick note – though you may choose to include gold in the input field, you may still not find gold in your asset allocation if the timeframe does not allow for it. In our view, short-term investments in gold are a tactical call only and cannot be assigned as part of a portfolio. Gold is best used in a portfolio as a long-term hedge against equity volatility.

And another quick note – for the purposes of the BYOP, hybrid funds are considered to be part of equity allocation. These funds come in only if timeframes are short and risk levels entered are high.

#2 The category allocation

The categories considered in the BYOP are according to that of Prime Funds and not the SEBI categories. That is, don’t expect to see a break-up of large-cap, mid-cap, corporate bond, and so on. Instead, the BYOP will allocate to Equity Moderate, Equity Aggressive, Debt – Short Term, Debt – Long Term and so on.

This is because, for one, it sets the BYOP in line with Prime Funds to make fund selection easier. Two, it is also in keeping with our own approach of splitting funds based on risk (in equity) and minimum holding period (in debt) to accommodate category similarities.

In the category allocation, the risk profile plays a bigger role than in asset allocation. Why?

The range of risks and volatility in both debt funds and equity funds are very wide. And so, the portfolio of a low-risk investor with a 60% equity allocation will need to be different from a very high-risk investor with a similar equity allocation.

For risk levels at the lower end of the spectrum, allocation to categories such as Equity Moderate and Debt Short-term would be higher. Thematic funds may be included in high-risk long-term portfolios, but not in lower-risk ones.

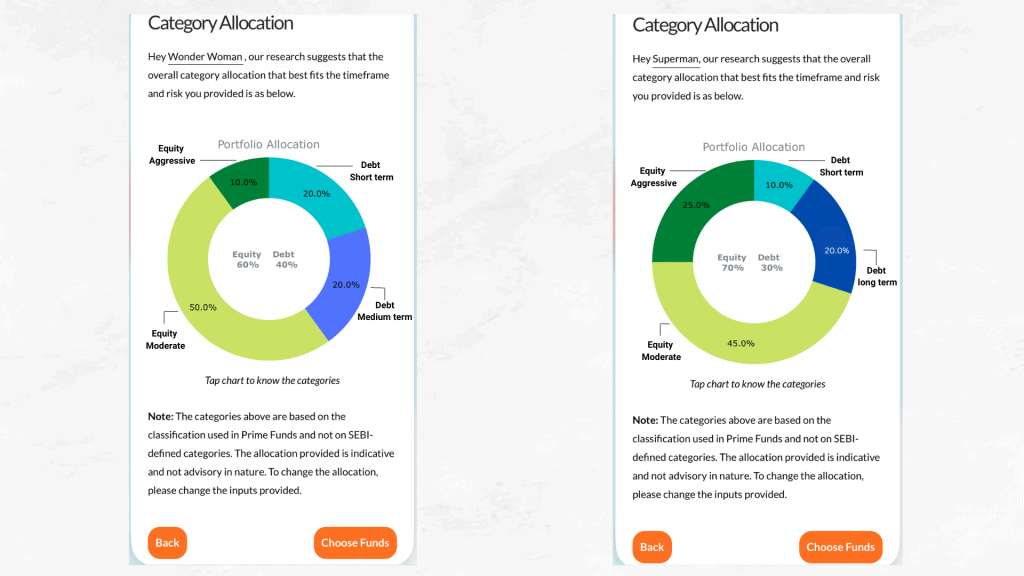

Consider the examples below. For both, we considered an age of 33 and a timeframe of 5-7 years.

In Example 1:

- The risk level is low to moderate.

- The equity-debt split is 60-40.

- In equity, Equity Moderate accounts for 50% of the portfolio with just 10% in the Equity Aggressive category.

- In the debt, 20% goes to Debt Short Term and 20% goes to Debt Long Term.

In Example 2:

- The risk level is very high.

- The equity-debt split is 70-30.

- But here, a good 25% goes to Equity Aggressive, even as the Equity Moderate holds at similar levels of 45% as Example 1.

- Similarly, the Debt Short-term allocation drops to 10% to accommodate the higher equity, even as the Debt Long Term holds at 20%.

You cannot modify the asset allocation and the category allocations in the BYOP for the following reasons:

- One, it would defeat the purpose of providing the most suitable allocations.

- Two, we’d like to be a responsible guide and not allow you to modify allocations to the extent that it creates a wholly unsuitable portfolio!

- Three, you can modify the return potential of the portfolio choosing different funds, instead of tinkering around with asset and category allocations.

- Four, if you already knew what allocation you need, the purpose of this tool is limited😊

If you still want a different allocation, try modifying the risk level or timeframe.

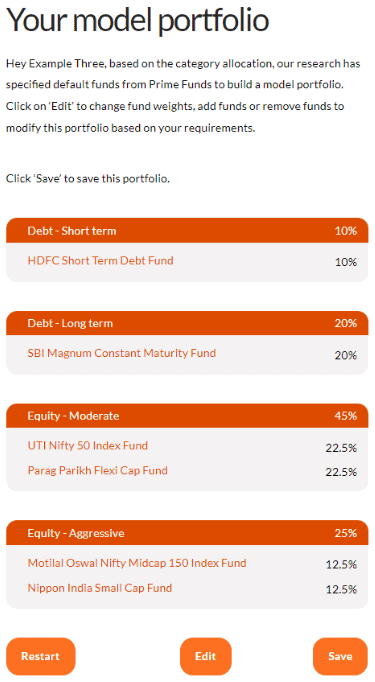

#3 The funds

Based on the asset and category allocations, BYOP assigns a default set of funds along with weights for each (including thematic funds). (Please note that the portfolio is not a model portfolio nor the recommended portfolio and should not be construed as advice. The default funds are simply from the Prime Funds for the given asset and category allocation).

Both funds and weights are based on rules set by the research team. You can go with this default, if it suits you. Else, you can change the funds and the weights. You can add funds, remove funds, increase weights and reduce weights. Your fund choices are limited to Prime Funds only.

Clicking on Edit will allow you to change funds and/or weights, and you will have to do this for each category that you wish to modify.

A few pointers on how to modify the funds list is below – but always bear in mind your risk level and timeframe when choosing funds as the variety is wide!

- Add funds if your investment amount is high. This goes even if you’re otherwise fine with the default portfolio. When your investment amount is high, it is prudent to increase the number of funds in your portfolio. This article on how many funds to hold can come in handy.

- To increase return potential, within the category and asset limits, choose the more aggressive funds in the category. For example, you can add more midcap or small-cap funds in the Equity Aggressive instead of focused funds or large-and-midcap funds. Similarly, for long-term timeframes, adding a credit risk fund in the debt allocation can help improve returns.

- To reduce risk levels, especially if you’re more on the conservative side, you can do the opposite – replace the midcap or smallcap funds with more multi-cap or flexicap funds. You can even increase weights to the passive options. In debt, you can avoid constant maturity funds and credit funds and instead choose only the corporate bond and short-duration funds.

- In thematic funds, avoid spreading allocations too thin – this will reduce the benefit of the potentially higher returns that themes can bring in. About 2-3 funds should do.

- Bring in a mix of fund strategies. This will ensure better diversification and a more balanced portfolio that can work in different markets. For example, mix active and passive funds. Combine duration-based debt funds along with accrual-based funds, or mix credit risk with corporate bond/short duration funds. Blend value-based funds along with growth-oriented or momentum-based, or tactical funds. Add international funds. If you’re using this tool on a desktop, you will also see quick parameters of each fund including strategy if you hover over the fund name. Fund strategy details can also be found under Why This Fund in Prime Funds.

FAQs on Build Your Own Portfolio

#1 Will you alert me on changes to be made in my portfolio?

NO. We do not track nor maintain these portfolios as they are your customised portfolios that you build for yourself. We have not designed them nor are they our recommended or model portfolios. This is not an advised product and the portfolios you create are not advisory in nature. This tool simply enables you to choose funds, categories and allocation appropriate to your time frame and risk. We do not build them for you!

We suggest you review your portfolio periodically using the Prime MF Review Tool and look out for our quarterly Prime Funds updates to know if there’s any action needed on your part. Please also note that we do not provide our view on whether your portfolio is good or not, so please don’t send us your portfolios for review😊

#2 What if I want to bring in funds outside Prime Funds?

The BYOP is designed to use Prime Funds only. If you want to include funds you already have or from outside Prime Funds, the best you can do is to take note of the category/asset allocations and build your portfolio separately. The same holds if you want to include different products in a portfolio – say, ETFs, fixed deposits, PF and so on.

#3 I want to change the asset and category allocations in the tool. How can I do this?

The tool does not allow you to change asset and category allocations, for reasons explained above. If your desired allocations are entirely different, and you know the allocation you’re looking for, you can simply choose the Prime Funds accordingly. The Build Your Own Portfolio tool is meant only for those who need help in arriving at allocations.

#4 Why don’t you have an option to choose active or passive funds?

In our view, active and passive funds both find a place in the same portfolio as each have their own strengths. There is no need to be all-active only or all-passive only. The way we categorise Prime Funds is also in keeping with this. You simply need to choose the best option given your requirement. This article we did earlier on where passive can work better, and where active still holds strong can explain more.

#5 What kind of portfolios does Build Your Own Portfolio offer?

The tool will give you only buy-and-hold portfolios – that is, timeframe-based portfolios for a particular goal. It will not help if you have any specialised requirements, such as setting up an income stream, or to save taxes, or optimise taxes, or use products such as ETFs. For these, head over to Prime Portfolios, our readymade portfolios.

You can try out the Build Your Own Portfolio tool here. Let us know your feedback!