Crypto goes up; crypto goes down. But stable coins were supposed to be, well, stable. But have the events of the past few days peeled the curtains off that and exposed the truth? Our resident crypto expert Anush Raj takes you around the table of stable coins and explains how they work. This is a developing story, and hence the numbers in the article below are as of publication.

PS: And, no, this does not mean we are going to start ‘researching’ and ‘recommending’ crypto assets 🙂

Crypto assets (or should we say ‘Virtual digital assets’?), as we all know, are a highly volatile asset class. In a world where – 40% moves on a daily basis are kind of normal, the people in the crypto space thought they needed some form of stability at least in some of these coins to protect the earnings they made from betting on random alt-coins. Since moving from crypto to fiat currency (Rupee or USD) is not a quick process and also if that specific crypto is not listed in the exchange you have KYC at, then it becomes even more difficult. All these make way for stable coins coming into the system.

Stable coins

They are simple crypto tokens that essentially mimic a stable currency like the Dollar, Euro, Pound, etc. According to coinmarketcap.com, there are about 10+ stablecoins that have a market cap of over $700 Million USD. Leading the pack are USDT (Tether USD) and USDC (USD Coin) with a market cap of $83 Billion USD and $48 Billion USD respectively.

Though these stable coins were in the market since 2015 their market cap was pretty low during the previous run in 2017-18 where people often used fiat as an exit for their crypto gains which eventually led to a massive sell-off taking down major cryptos like BTC & ETH down to about -92%. However, things happened slightly differently in the 2020-21 run up. Though there have been two cycles of bear markets with the second one currently in progress, major cryptos have not fallen to grave depths like before. Mostly holding up from the support of our new stable-coins friends.

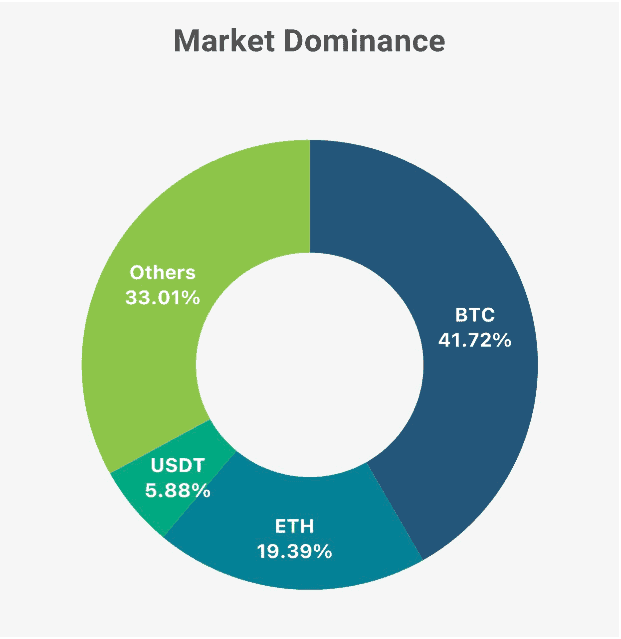

Adding cryptos like BTC and various other stable coins to the table above would simply skew the data. Hence I am taking the second largest crypto in the space today ETH as a comparison against the bellwether stable-coin USDT. It's clearly evident that the stable coin market has immensely grown the past few years and USDT holds a 5.88% market dominance as of 11th May 2022.

Now that we know there is a stable coin in the crypto world let us try to understand how a bunch of decentralised folks manage to keep a token price stable.

Types of Stable coin

Broadly there are 4 different types of stable coins in the market today.

Fiat currency backed stable coins

They are pretty simple and straightforward - for each token issued, the value of the token is backed by a fiat equivalent peg. Tether, one of the largest issuers of such tokens, uses this method. Where each 1 $USDT is backed by 1 $USD in fiat reserves. You can read more about their reserve holding here.

How ever it is worth mentioning that just like every other company out there this company too had some corporate governance issue with some legal cases in the past which stated that the company had issued more tokens than they could based on their reserves at that point in time. However these stable coin issuers also provide regular audit reports to restore confidence in its investors; here is one such from Circle, the company that issues USDC tokens.

Commodity based stable coins

They use precious metals like gold as backing. In some cases they are even backed by other commodities like oil etc. However the most common stable coins and the highly liquid ones are based on gold. They are PAXG (Paxos Gold) and XAUT (Tether Gold). The difference here is that unlike usual stable coins that are pegged to a dollar here the price of the token is pegged to the price of 1 ounce of gold.

Crypto backed stable coins

Here too the understanding is easy like the previous one just that instead of fiat or commodity as collateral, these stable coins use cryptos usd as backing. As we all know crypto being a very volatile asset usually these crypto backed stable coins are overcollateralized to offset any possible de-pegging (the situation where the stable coin is no longer tracking the underlying asset and has a wide variation) during high market volatility conditions. These kind of systems are usually not from a centralised issuer. Rather it is controlled by using smart contracts by a DAO (Decentralised Autonomous Organisation).

One of the best user examples in this type of stablecoins is the DAI created by the MakersDAO. The smart contracts that are in place will make sure that 1 DAI = 1 USD how does it do that ? Simple if you want some DAI you need to deposit ETH into the smartcontract assume the price of ETH is $2000 and a collateralization ratio of 150% is in place ( this changes based on the crypto ) now Once the deposit is over you get 1 CDP ( collateralized debt position ) which is essentially the ticket to claim your ETH back from the contract.

Along with this CDP you get 1320 DAI which you are free to use as long as ETH stays at $2000 or above, if were to go down below a certain limit lets say 25% slippage and price of ETH becomes $1500 then your hands are forced - you either have to pay back the 1320 DAI along with the CDP you have which you got earlier and claim back the 1ETH that you deposited if not the ETH you have deposited will be auctioned and your CDP will be invalidated and you can keep the 1320 DAI. You can read more details about the DAI stable coin here.

Algorithm based stable coins

These are a complex version of cryptobacked stable coins. Here too the stable coin is backed by a crypto token. But unlike ETH or BTC the protocol native token or as they would call it “governance tokens”, the peg of 1 dollar is maintained by increasing and decreasing the supply of these governance tokens and the arbitrageurs take care of the rest.

To understand how algorithmic stablecoins work, let's take UST (Terra USD) stable coin from the terra protocol as an example . Terra aimed to maintain the stability of UST to 1$ USD by using its governance token LUNA - it was deeply dependent on arbitrageurs who buy and sell the volatile crypto LUNA to keep the UST as a stable coin. Just like how you had to deposit ETH to get DAI you have to burn (it's a process of extinguishing the tokens) some LUNA to get UST.

Every time LUNA is burnt there is a drop in supply which makes the price of LUNA go up. This process works in reverse too where you burn some UST to get LUNA. Imagine a case where UST price slips to $0.95 then you can buy some and sell it for $1 of LUNA. By this the peg difference is adjusted and UST goes back to $1.00.

Are these stable coins really stable?

It took a while for people to get back to restoring hope on stable coins after seeing multiple audit reports and court hearings on Tether. However the space moved fast with many transparent stable coins like USDC and DAI coming out. It was believed until the 10th of May 2022 that stable coins were really stable.

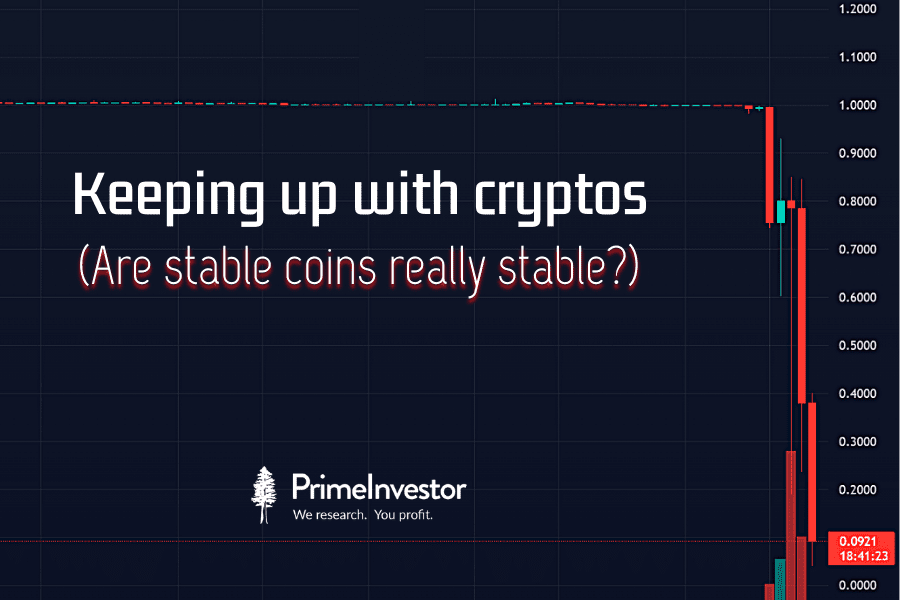

But the view changed when the $18 billion market cap stable coin UST de-pegged from the dollar and fell to $0.30 at the time of writing though it was able to recover some of it its peg still stands at $0.47 even after 48 hours of the crash. Even if UST goes back to its peg of $1 the investors in LUNA are sitting on top of huge losses. How much loss? well the image below can give a clear idea.

A death spiral like this in one of the prominent $41 Billion USD market cap crypto affects border market sentiment badly which is dragging down the overall market with it.

Conclusion

Stable coins pegged to fiat or real monetary assets have tried to stay with their peg unless there is a very large amount of buys or sells where a temporary slippage might happen and the coin re-pegs immediately however the case might not be the same in algorithm based stable coins as they are vulnerable to attacks and chances of market manipulation.

When market correction happens just like how stock market investors move to cash here in the crypto space people are moving to stables.

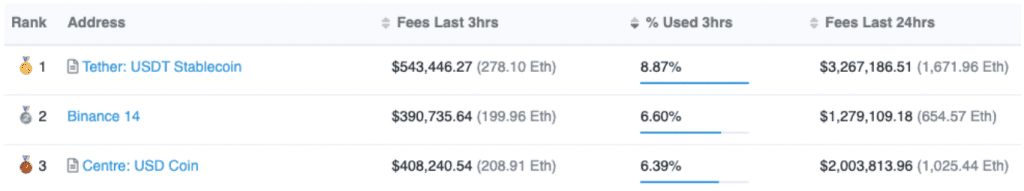

The image shows that the highest gas fees paid on the Ethereum blockchain mainnet transactions were paid by the users of the USDT stable coin in the last 24 hours as of 12th May 2022 5PM IST.

1 thought on “Keeping up with the cryptos – Are stable coins really stable?”

Test Comment

Comments are closed.