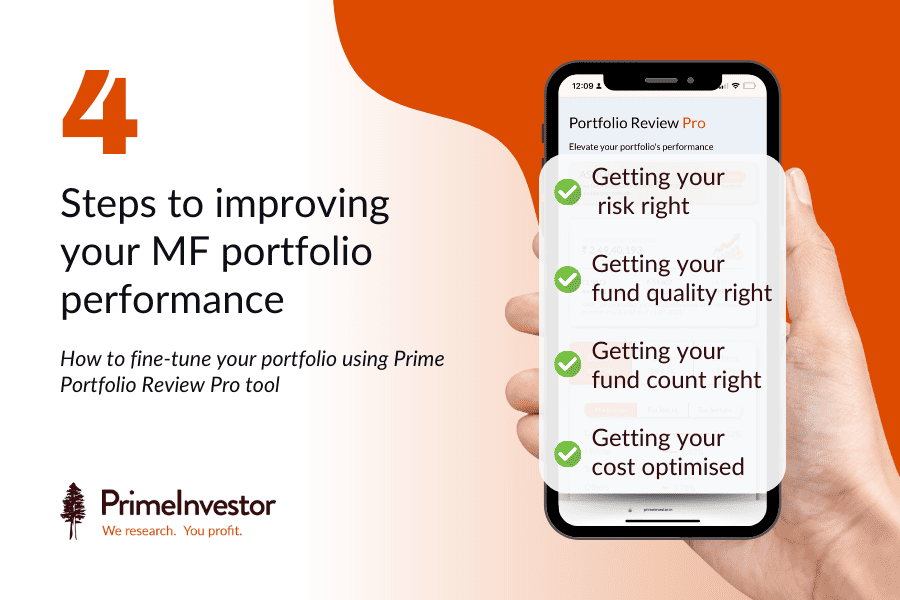

If you are worried about your MF portfolio performance, then your solution lies right here! The all-new tool from PrimeInvestor – Portfolio Review Pro – is aimed at giving you tips on fine-tuning your portfolio and help its deliver better with optimal risks. Some of you have asked us how you can go about implementing the changes that you may decide to make to your portfolio, post the review.

This Prime Portfolio Pro review guide (which is also available as a link in the tool) will help you put to effective use the observations in the Prime MF Portfolio Review Pro.

Get your fund quality right to boost portfolio performance

Whether your portfolio delivers or not is dependent on the quality of funds you hold. And we assess the quality of funds in our tool in the ‘Quality’ section. The Quality section gives the Prime Research team’s view (buy/hold/sell) on the funds you hold. These calls are based on each fund’s performance compared to its category, taking into account returns across timeframes, trends in returns, and other metrics.

- Funds with a Buy call can be further invested in.

- Funds with a Hold call can continue to be held, but try to avoid further investments. If you have SIPs in these funds, stop them and shift the SIP to Buy funds or Prime Funds. However, if there are only a few instalments (6-8) left to complete, then you can consider letting it complete.

- Funds with a Sell have seen poor performance relative to peers. You can exit in one go, phase it out based on your tax impact, exit at the time of rebalancing or when you need the money. Reinvest in funds with a Buy call or in Prime Funds.

- Funds with ‘No Opinion’ do not cross our gating criteria (in terms of track record or AUM), or are thematic/international. For new funds that are recently launched, you can choose to hold until they build up some record. For thematic/international funds, you can contact us for our research team’s views.

Do note that you can go for passive funds or active funds or a combination when adding to your portfolio. There are no cut-offs or rules on active-passive allocations.

Getting your fund count right

Suggestions on fund count and concentration are based on the ideal range given the portfolio size (corpus size). You don’t necessarily need to do this. It is entirely based on your conviction. However, if you have too many funds that are a sell or hold and hold a large number of funds in general, then it is a good reason to downsize your portfolio count.

The primary reason why one needs a right-sized portfolio is to ensure hassle free monitoring and review. Besides, sometimes too many funds may mean not being able to gain the most from better performers as the averages pull down the portfolio performance.

- If you need to reduce the number of funds, start with funds with a Sell call and then a Hold call. You can also exit funds which account for a very small part (<2-3%) of your portfolio.

- If you need to increase the number of funds or reduce concentration, go for funds that offer diversification or complement your existing funds. For example, in equity you can mix growth-style, momentum-driven, value-style, focused-style etc. In debt, you can mix different maturities. Use our MF portfolio overlap tool to check overlap in equity funds to ensure you have a diverse mix.

Getting your risk right for peak portfolio performance

The Portfolio Risk section provides insight on the equity-debt allocation in your portfolio, as well as the risk of your portfolio.

#1 Asset allocation risk

Suggestions on equity-debt allocation are made based on ideal ranges, determined by our research team, for a given timeframe and risk appetite. This is not a cookie cutter solution and may change based on you individual needs. Hence, we have given ranges rather than fixing a ratio.

When we give those ranges, the objective of such an ideal asset allocation is to contain the downside while optimising on returns. You can override the suggestions based on your individual need and philosophy. This tool is not meant to be advisory in nature.

But if you decide to act, here’s how you can go about rebalancing your asset allocation:

- For timeframes of less than 1-2 years, equity allocation needs to be zero to very low regardless of your age or risk level. Any equity should come only from low-risk hybrid funds such as equity savings or conservative hybrid.

- For timeframes of 3 years and higher, ensure that you hold debt funds to curtail equity risk and truly diversify. Balanced advantage funds equity savings or multi-asset funds can be part-substitutes but do not substitute debt fully with hybrid funds.

- When you decide to reduce equity and move to debt, unless you are entering long duration funds, you can make the investments as lump sum.

- When you are cutting down on debt and upping equity, if the amount is large (say over 10% of your portfolio or more), make the same in tranches rather than in one go, to avoid ill-timing the market. Also make sure your tax implication is not way too high. Else, do it across financial years than in one go.

#2 Portfolio risk

Once you know whether your portfolio asset allocation is in sync with your time frame and risk, the tool moves on to the portfolio risk of your holdings. The tool calculates Portfolio risk by looking at your allocation to different fund categories in context of the time frame you have mentioned for your portfolio and tries to match it with the category’s suitability for that timeframe. Here’s how you can approach it:

- When you look at the results of this dimension, compare your portfolio risk to your own risk level (that you have mentioned) to know if your portfolio suits you.

- Additionally, look at the Risk column in your review. Then use the guide below.

- The first 3 columns in the guide – our risk indicator of the fund, portfolio risk vs. your risk and asset allocation action are the 3 combinations you can have from the tool.

- The fourth column in the table below will tell you what to do in each of those scenarios.

Additional tips

- When you need to increase or decrease your equity or debt allocation, you can either rebalance (reduce one and increase the other) or bring in fresh sums if you have the surplus.

- You can go for passive funds or active funds or a combination when adding to your portfolio. There are no cut-offs or rules on active-passive allocations. You can use existing funds if you have enough ‘buy’ funds or go for ones from Prime Funds.

Getting your cost optimised

Our tool does not aim to just tell you to move to direct plans and save costs. We know that other costs such as tax or exit load can hurt you. So we take a more nuanced approach.

There are some funds where the regular plan is by far more expensive than the direct plan. Our research team arrives at this by looking at the differential in the expense ratios of the direct and regular plans of a fund and comparing this to the average for the category.

- Where the differential is higher than the category average, you will be able to make good cost savings by opting for the direct plan. For these funds, make fresh investments only through the direct plan. If these funds have a Sell call, exit these funds first.

- Where the differential is below the average, you can continue to hold such regular plans (provided they have ticked our quality box) and if convenient, carry on investing. However, run a check once in a while to ensure that the fund expense remains reasonable.

- You can also choose to exit the regular plan and reinvest in direct, but be aware that this will entail capital gains tax.

Read more about the new Portfolio Review Pro tool here or listen to our podcast here.

If you are not a PrimeInvestor, register for free to check the health of your portfolio!

GET YOUR PORTFOLIO REVIEWED FOR FREE TODAY!

Important disclaimers

PrimeInvestor Financial Research Pvt Ltd (with brand name PrimeInvestor) is an independent research entity offering research services on personal finance products to customers.

We are a SEBI registered Research Analyst (Registration: INH200008653).

The recommendations of funds, if any, given in the tool, are our view on the individual mutual fund schemes based on qualitative and quantitative parameters specific to the scheme. They are not a view on your portfolio.

The suggestions given in the tool are based on common asset allocation and holding practices for a given timeframe and risk and not specific advice on your portfolio. They should therefore not be construed as portfolio advice.

The user must make his/her own investment decisions based on his/her specific investment objective, existing holdings and financial position and using such independent advisors as he believes necessary for the purpose.

Mutual funds and subject to market risks. Please read all scheme information and related documents before investing. Past performance of funds is not an indication of future returns.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Please read our disclosures and disclaimers here: https://www.primeinvestor.in/disclosures-and-disclaimers/

3 thoughts on “4 steps to improving your MF portfolio performance”

I have a question about the action to be taken for a ‘Sell’ fund.

Depending on the corpus, phasing out in batches to limit the cap gain to 1 lakh a year might take quite some time.

Also, for an equity fund, the time I need the money is going to be more than at least a couple years away. I don’t think a Primeinvestor subscriber will have short term funds invested in equity.

Switching at rebalancing is relatively better, provided it is annual. But there will be a tax hit too.

When I need the money, I will anyways redeem from even a ‘Buy’ or a Prime fund. This does not sound like a good benchmark for when to redeem a Sell fund.

So, if the fund has performed poorly, should I get out of it irrespective of the tax hit and my target time or not?

If I don’t need the money now, I should redeem and invest in a Buy fund, not keep it in a Sell fund.

For sell funds, if you do not mind the tax impact, you can sell any amount you want and exit in one go. – thanks, Bhavana

Understood.

My emphasis is on the sell when the goal is near part. Is it advisable to hold a ‘sell’ equity fund for more than a couple years? Would you say sell regardless of the tax hit because the fund performance has started dwindling or can hold for some time?

Comments are closed.