4 Reasons Why You Need PrimeInvestor

#1 You profit more from deep research

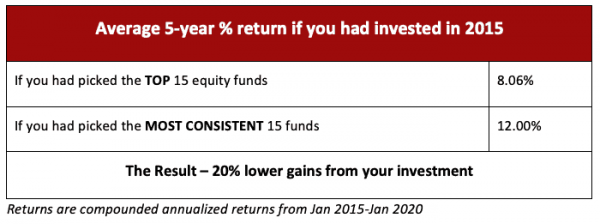

Popular products don’t pay off. Only well-researched ones do. Take mutual funds. It’s easy to pick what’s right! You just go for what the media says, or the top rated ones, or the ones with the highest 1/3/5 year return. But look what happens when you do that….

So the chances are your ‘top’ fund turned out to be second-rate. You don’t need a top fund. You need a GOOD fund.

PrimeInvestor gives you this. We research funds, strategies, stocks, and markets to make sure that we pick the funds with the best potential to perform. Of the 1000+ funds out there, we give you just 46 good ones.

#2 Go 'Direct' confidently and save on costs

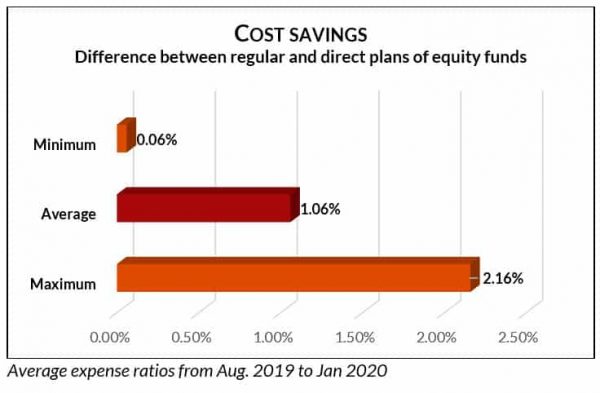

You don’t need a distributor. You don’t have to pay commissions. Let these cost savings compound over the years. Here’s how much cheaper direct plans in mutual funds are.

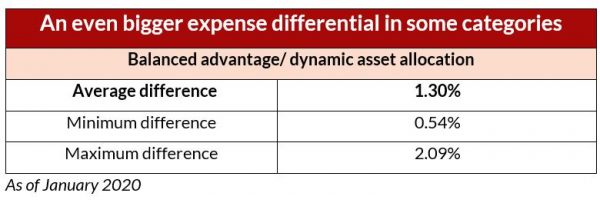

And it’s getting bigger! The difference between regular and direct MF was 0.75% just a few years ago and it is now 1.06%! What’s more, some categories are seeing even bigger differences:

It’s not just in mutual funds. Going direct in fixed deposits can sometimes give you higher interest rates. Direct insurance plans are also cheaper.

PrimeInvestor tells you which fund or deposit to invest in and we’ll explain why. You don’t need to do any homework. Save costs, invest right, and make more money.

#3 You don’t get hurt by the wrong advice

You don’t come first for your distributor or agent, more often than not. So you may get advised on products that earn your agent or distributor higher commissions. Or they may not be equipped or involved enough to truly understand the nuances of the investment they are recommending. The result? You get hurt.

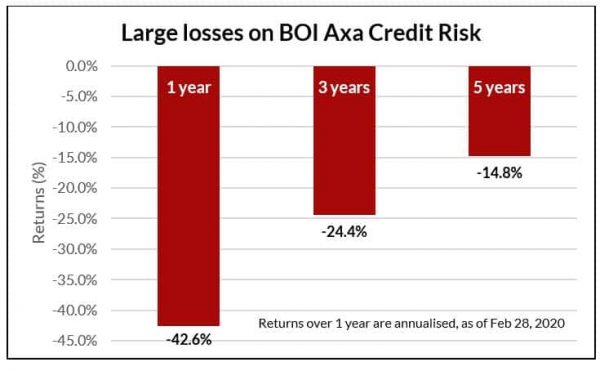

Here’s a case: BOI AXA Credit Risk saw its assets jump from Rs 672 crore to Rs 1012 crore between 2016 to 2018, primarily through inflows from various distributors. Why? Because it was sold as a double-digit returning debt fund to beat fixed deposits. The reality? It is a very high risk fund that was taking the wrong steps. By 2018, there was a crisis in the debt markets. That meant defaults on payments and losses. And BOI Axa Credit Risk? Look where returns are today:

Chances are that you would not even have known this product but for the wrong selling as a FD-beating safe option.

PrimeInvestor is different. PrimeInvestor is independent. We take no commission, no ads, no incentives. And being the only unbiased and research-driven entity, we can and do sound you off on bad products. We focus on researching products, markets, and developments. We understand investments. And we focus on you.

#4 You get to know about all the good products

Did you know there is a government guaranteed deposit scheme that gives you far higher returns than your bank FD? Or that the humble post office deposit delivers superior returns to bank deposits and even some bonds?

Mutual funds are not the only investments you should make. You need to tap the right opportunities across different products. Your distributor, agent, friend, or newspaper won’t be able to tell you about every product that’s good for you.

PrimeInvestor will sound you off on all products worth your money. And that’s because our work is centred on analysing personal finance products and what works for investors like you.

At PrimeInvestor, we’re uniquely positioned to give you sound, unbiased advice spanning the gamut of investment options – mutual funds, ETFs, stocks, fixed deposits, bonds, and more and all this at a highly affordable cost!