Fund type:

Debt

AUM (in crores):

₹ 18,156.15

Fund category:

Liquid

Fund manager(s):

Amit Somani, Abhishek Sonthalia, Harsh Dave

Benchmark:

CRISIL Liquid Debt Index

Minimum investment:

₹

5000

Launch date:

01 Sep 2004

Min. additional investment:

₹ 1000

Expense ratio:

0.31 %

Exit load:

0.007% for Day 1, 0.0065% on Day 2, 0.0060% on Day 3, 0.0055% on Day 4, 0.0050% on Day 5, 0.0045% on Day 6, NIL on or after 7D

Scheme Objective:

The investment objective is to generate reasonable returns with high liquidity to the unitholders.

Performance (As on 11 Jun 2025)

| 1 week returns | 3 month returns | 6 month returns |

1 year returns | 3 year returns | 5 year returns |

Returns since inception |

|---|

| Scheme | 0.15 % |

1.86 % | 3.60 % |

7.24 % |

6.89 % | 5.45 % |

7.02 % | >

| Nifty 1D Rate Index | 0.10 % |

1.49 % | 3.11 % |

6.49 % |

6.46 % | 5.20 % |

N/A |

Portfolio

Top 10 instruments

Type

Allocation (%)

Rating

** - PUNJAB NATIONAL BANK - CD - 16/06/2025

Certificate of Deposit

7%

CRISIL-A1+

** TREASURY BILL 91 DAYS (28/08/2025)

Treasury Bills

6.52%

Sov

** - INDIAN OIL CORP LTD - CP - 16/06/2025

Commercial Paper

5.49%

CRISIL-A1+

** TREASURY BILL 364 DAYS (12/06/2025)

Treasury Bills

5.22%

Sov

** - ICICI SECURITIES LTD - CP - 09/06/2025

Commercial Paper

4.81%

CRISIL-A1+

** - SMALL INDUST DEVLOP BANK OF INDIA - CP - 05/06/2025

Commercial Paper

4.13%

CRISIL-A1+

** - GODREJ CONSUMER PRODUCTS LTD - CP - 06/08/2025

Commercial Paper

4.09%

CRISIL-A1+

** - BANK OF BARODA - CD - 08/08/2025

Certificate of Deposit

4.08%

IND-A1+

** - PNB HOUSING FINANCE LTD - CP - 18/08/2025

Commercial Paper

4.08%

CRISIL-A1+

** TREASURY BILL 91 DAYS (19/06/2025)

Treasury Bills

3.62%

Sov

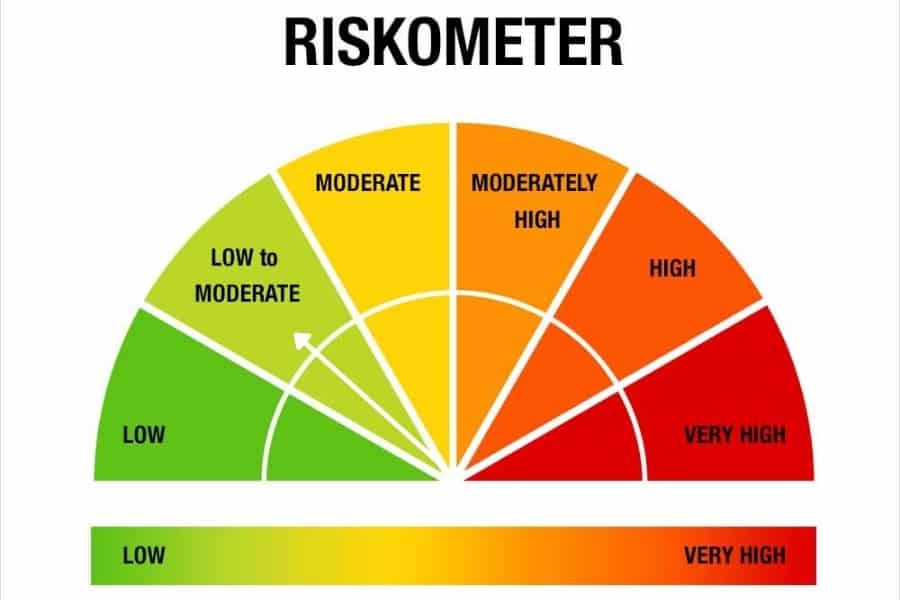

Liquid debt funds that invest in debt instruments whose maturities are less than 60 days. These instruments are typically government treasury bills, commercial paper, and bank certificates of deposits. Funds stick to papers that have the highest credit rating. Because of the nature of instruments, these funds are extremely low risk and generally do not deliver even 1-day losses.

These funds suit any investor with a very short term investment horizon of a few days to 6 months. These funds can also be used to maintain emergency money.