SBI Small Cap Fund-Reg(G)

View the direct plan of this scheme

Rs 170.0419 1.3168(0.78 %) NAV as on 24 Jun 2025

Scheme Objective: To provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well diversified basket of equity stocks of small cap companies.

Performance (As on 24 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | -4.09 % | -3.12 % | 21.00 % | 28.26 % | 19.64 % |

| Nifty Smallcap 100 | -1.49 % | 1.29 % | 30.01 % | 31.61 % | N/A |

Portfolio

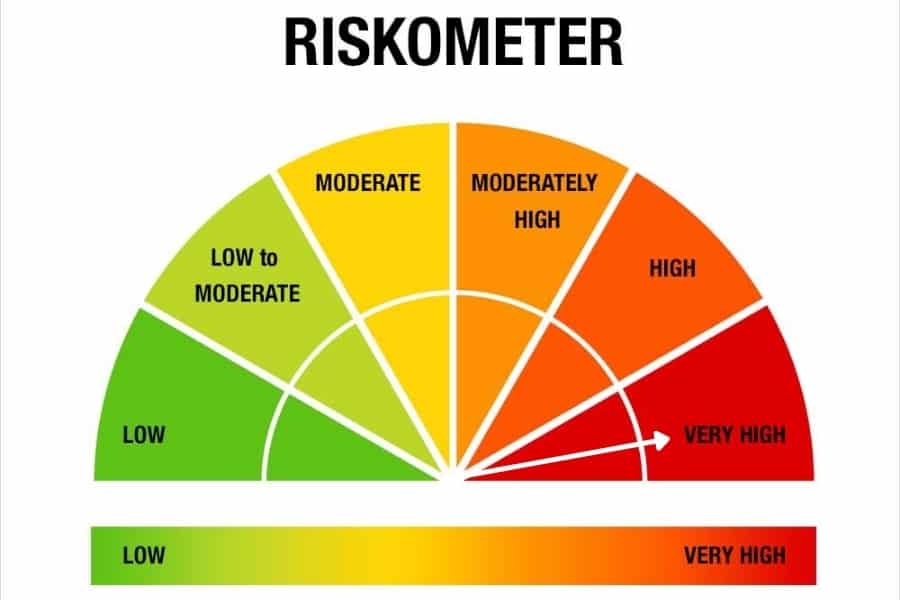

Small-cap funds invest in stocks beyond the 251st in terms of market capitalisation. These funds have very high risk-return potential, as small companies soar and deliver multi-fold returns during rising markets. However, these stocks fall sharply and are the last to recover from steep market falls. The Nifty Smallcap 100 or the BSE Smallcap can be used as benchmarks to measure performance.

Smallcap funds suit investors with high risk appetites. The minimum period for which these funds need to be held is 5 years.