SBI Contra Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 413.8867 -0.293(-0.071 %) NAV as on 23 Jun 2025

Scheme Objective: To provide the investors maximum growth opportunity through equity investments in stocks of growth oriented sectors of the economy. There are five sub-funds dedicated to specific investment themes viz. Information Technology,Pharmaceuticals, FMCG, Contrarian (investment in stocks currently out of favour) and Emerging Businesses.

Performance (As on 23 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 1.18 % | 2.59 % | 27.18 % | 33.49 % | 16.88 % |

| NIFTY 500 | 3.17 % | 3.70 % | 20.14 % | 22.15 % | N/A |

Portfolio

Contra funds invest in stocks that are out of current market preference. Criteria these funds have to choose contrarian stocks include low valuations, out-of-favour sectors, or companies in turnaround phases. These funds can take a few years to deliver, as markets need to see potential in the low-value stocks and re-rate them higher. The Nifty 500 or the BSE 500 can be used as benchmarks to measure performance.

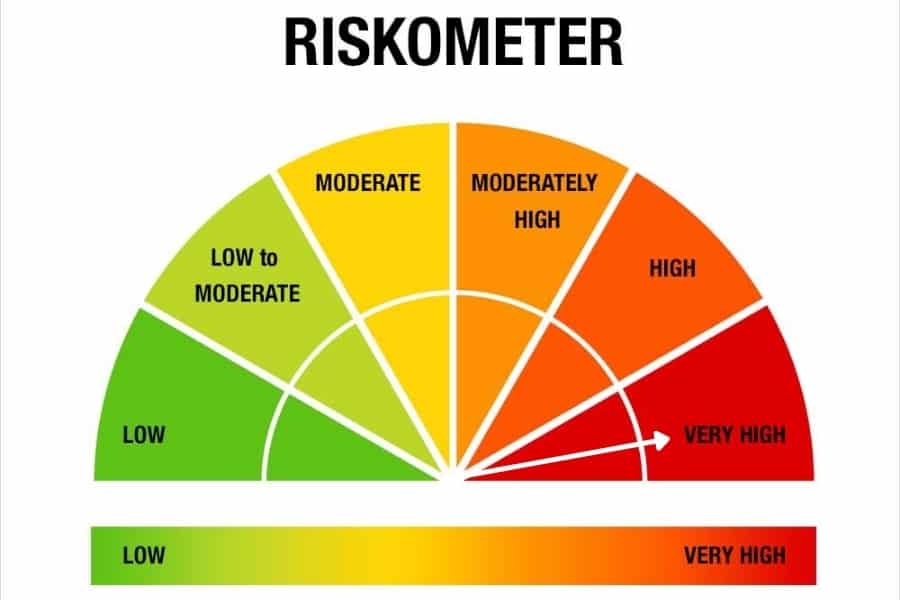

Contra funds suit investors with high risk appetites. The minimum period for which these funds need to be held is 7 years.