Quant Momentum Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 14.9457 0.0542(0.364 %) NAV as on 04 Jul 2025

Scheme Objective: The primary investment objective of the scheme is to achieve long-term capital appreciation for its investors. This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments. The selection of these instruments will be based on a quantitative model meticulously designed to identify potential investment opportunities that exhibit the potential for significant capital appreciation over the specified investment horizon. There is no assurance that the investment objective of the Scheme will be realized.

Performance (As on 04 Jul 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 3.01 % | -5.59 % | N/A | N/A | 28.11 % |

| NIFTY 500 | 3.76 % | 2.83 % | 20.46 % | 22.03 % | N/A |

Portfolio

Thematic funds focus their entire portfolio on one particular theme, such as consumption, manufacturing, ESG and so on. These funds tend to cover multiple sectors that meet the theme and are more diversified than sector funds. If the theme is in market favour, returns from these funds can be much stronger than broader funds. However, returns can lag if markets donu2019t pick up the theme. These funds require well-timed entry at the low point and an exit at the high point in order to see returns. Please note that some international funds fall into this category. For such funds, taxation will be that of debt funds and not equity funds.

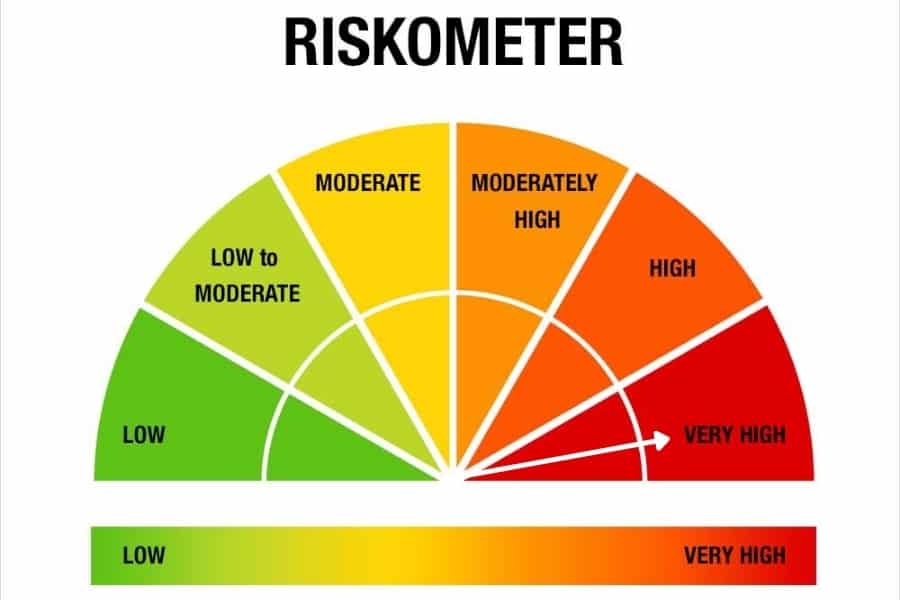

Thematic funds suit investors with very high risk appetites, and who have the knowledge and ability to track performance of various sectors and the broader market behaviour.