Quant Active Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 688.2083 7.9603(1.17 %) NAV as on 25 Jun 2025

Scheme Objective: The primary investment objective of the scheme is to seek to generate capital appreciation & provide longterm growth opportunities by investing in a portfolio of Large Cap, Mid Cap and Small Cap companies. There is no assurance that the investment objective of the Scheme will be realized.

Performance (As on 25 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | -0.44 % | -9.23 % | 21.08 % | 29.54 % | 19.59 % |

| Nifty500 Multicap 50:25:25 | 3.08 % | 4.04 % | 23.61 % | N/A | N/A |

Portfolio

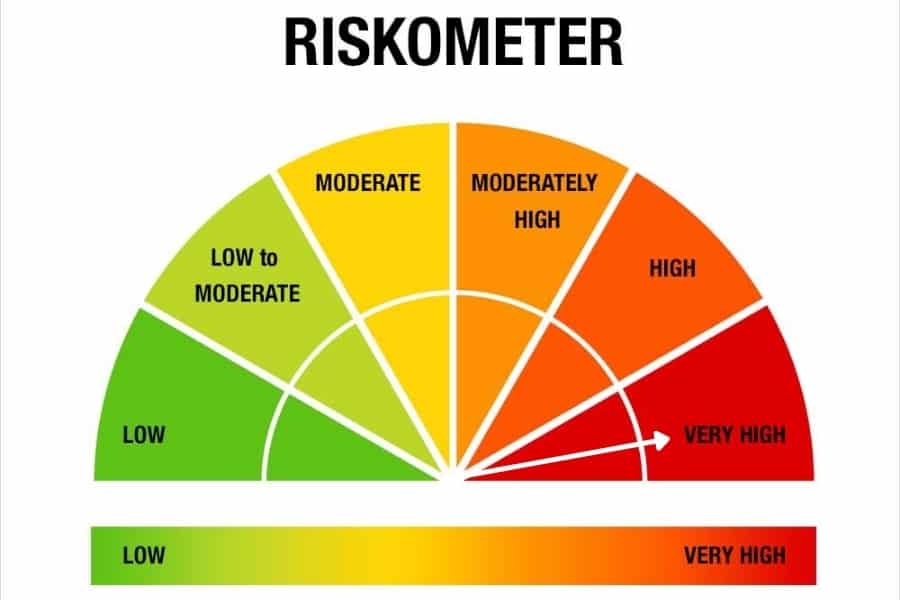

Multi-cap funds invest a minimum of 25% each in small-cap stocks, mid-cap stocks, and large-cap stocks. Across market cycles, thus, portfolio of at least half the funds will be in the higher-risk marketcap segments. This gives these funds a higher volatility profile and a tendency to fall more during market corrections compared to other fund categories that invest across market capitalisations. On the other hand, in rallying markets, these allocations could help drive returns.

Multi-cap funds suit investors with an appetite for high risk. Apart from their mandated mid-and-smallcap allocation, risk also comes from the fact that SEBI introduced this category only in 2020. How such funds deliver in different market cycles is unknown.