Nippon India Japan Equity Fund(G)

View the direct plan of this scheme

Rs 20.2681 0.0706(0.35 %) NAV as on 29 May 2025

Scheme Objective: The primary investment objective of Nippon India Japan Equity Fund is to provide long term capital appreciation to investors by primarily investing in equity and equity related securities of companies listed on the recognized stock exchanges of Japan and the secondary objective is to generate consistent returns by investing in debt and money market securities of India. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

Performance (As on 29 May 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 7.15 % | 14.38 % | 10.92 % | 7.92 % | 6.78 % |

| NIFTY 500 | 0.77 % | 7.55 % | 18.06 % | 23.91 % | N/A |

Portfolio

International or global funds are a wide variety. They can be built on certain markets, such as emerging markets, China, Japan, the US, Eurozone and so on. They can cover themes such as gold mining, commodities, consumption and others. International funds can offer good diversification from domestic markets and some can give currency benefits as well. However, they call for a thorough understanding of global markets, their correlation with our own domestic markets, and growth drivers. As they are primarily diversifiers, share of such funds in a portfolio should not be high. International funds are treated as debt funds for taxation purposes.

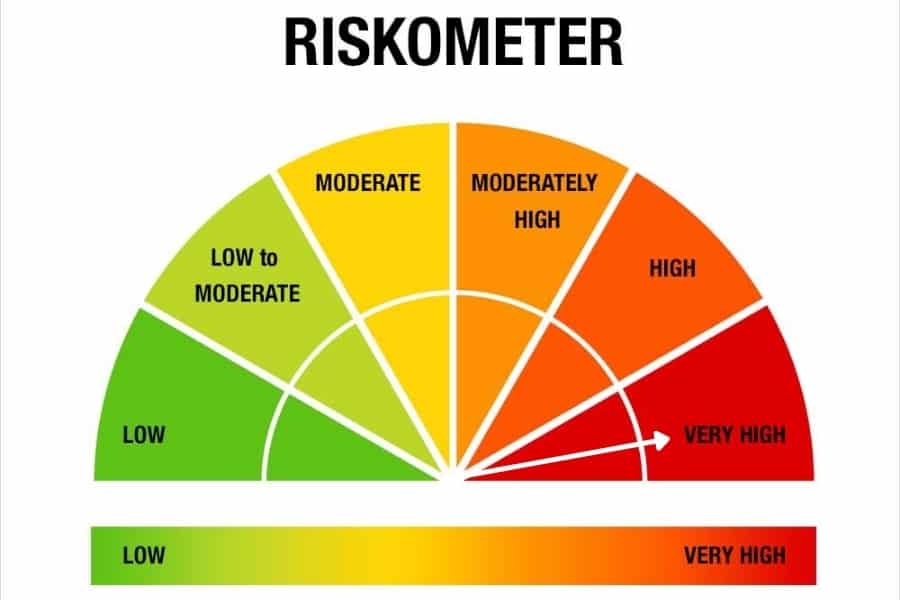

International funds suit high-risk investors looking for diversification and who have the ability to understand global markets and currency fluctuations. They are not suitable for investors who are unable to track performance and exit on time.