Mirae Asset ELSS Tax Saver Fund-Reg(G)

View the direct plan of this scheme

Rs 49.494 0.17(0.345 %) NAV as on 27 Jun 2025

Scheme Objective: The investment objective of the scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments. The Scheme does not guarantee or assure any returns

Performance (As on 27 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 5.28 % | 7.63 % | 20.99 % | 23.97 % | 18.33 % |

| NIFTY 500 | 5.23 % | 4.80 % | 20.64 % | 22.48 % | N/A |

Portfolio

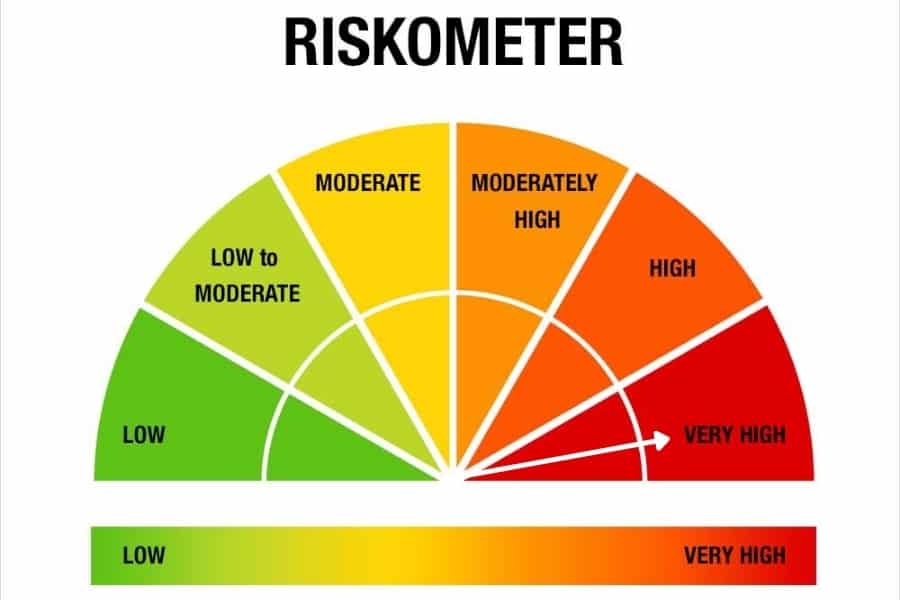

Tax-saving funds are equity funds that qualify for deductions under Section 80C of the Income Tax Act. These funds invest in stocks across market capitalisations, shifting allocations based on opportunities. These funds tend to be similar in terms of risk and return to multi-cap funds. While they can be volatile in the short term, holding for longer periods allow them to deliver well. Each investment in a tax-saving fund will be locked in for 3 years. Investments, however, can be held for periods longer than this as well, in order to earn optimal returns.

These funds suit investors looking to make tax-saving investments. conservative investors can choose funds with a large-cap orientation. Investments will be locked in for 3 years but should ideally be held for at least 5 years.