Invesco India Medium Duration Fund-Reg(G)

View the direct plan of this scheme

Rs 1243.8974 0.6509(0.052 %) NAV as on 23 May 2025

Scheme Objective: To generate income by investing in a portfolio of Debt and Money Market Instruments such that theMacaulay duration of the portfolio is between 3 years and 4 years.

Performance (As on 23 May 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.31 % | 3.94 % | 5.77 % | 9.66 % | 7.38 % | N/A | 5.83 % | >

Portfolio

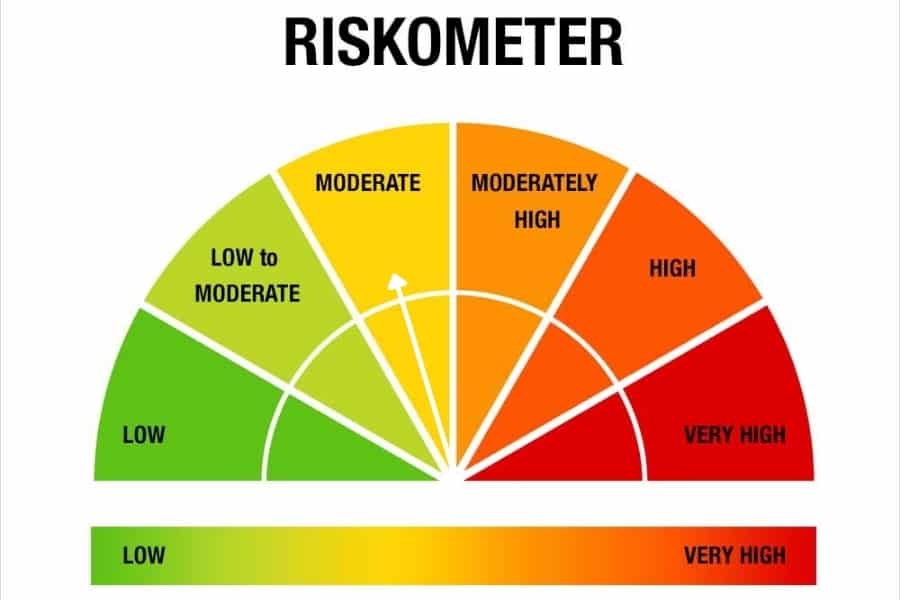

Medium duration debt funds invest in a variety of debt instruments such as corporate and bank bonds, PSU bonds, and other government papers. While funds earn returns mostly through accrual of interest on bonds held, they may also gain from bond price appreciation when interest rates fall. Average maturities for these funds range around 3-5 years. These funds can be volatile in the short term based on bond price changes. Funds can pick instruments across the credit rating spectrum and therefore, fund risk levels vary widely within the category.

These funds suit any investor with investment horizons above 3 years. Ensure that funds do not have a high share of low-rated debt if you have a low risk appetite.