ICICI Pru Value Discovery Fund(G)

View the direct plan of this scheme

Rs 463.51 -2.59(-0.556 %) NAV as on 13 Jun 2025

Scheme Objective: To generate returns through a combination of dividend income and capital appreciation by investing primarily in a well-diversified portfolio of value stocks.

Performance (As on 13 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 2.25 % | 11.10 % | 24.59 % | 28.53 % | 20.21 % |

| NIFTY 500 | -1.94 % | 3.77 % | 19.50 % | 22.79 % | N/A |

Portfolio

Value funds invest in stocks with growth potential but are trading at price-earnings multiples that are below average or the market. Funds use a combination of valuation metrics, including price-to-earnings and price-to-book ratios. Returns come in when markets take note of the growth in these stocks and re-rate them higher, at which point the funds book profits. These funds can go through phases of poor performance and needs to be held right through these periods. The Nifty 500 or the BSE 500 can be used as benchmarks to measure performance.

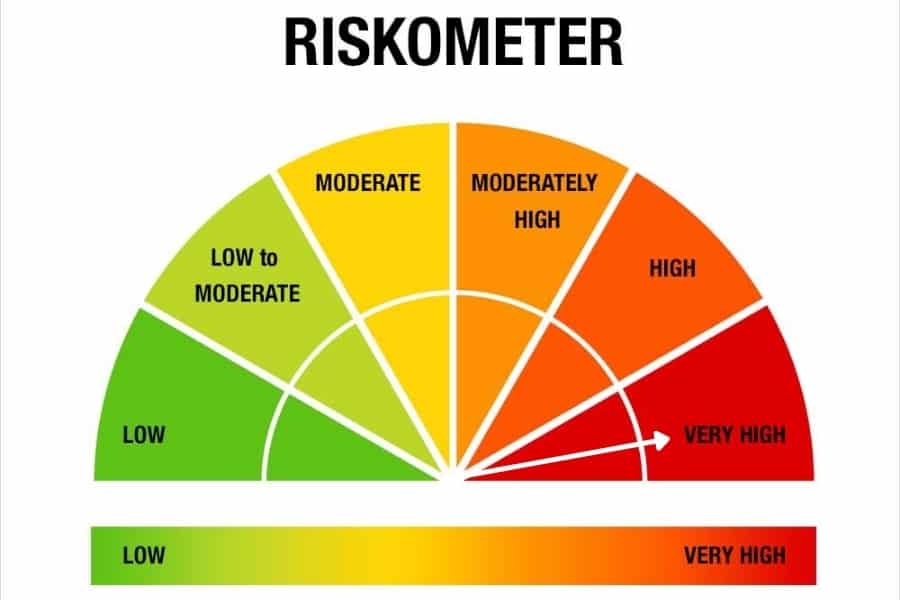

Value funds suit investors with high risk appetites. The minimum period for which these funds need to be held is 7 years.